How do you distribute stock certificates to investors?

As one of the corporation's founders, you have to decide whether to issue paper or electronic shares of stock, and what percentage of the company the investor receives in stock. Learn more about both paper and electronic distribution of shares.

Ready to start your business? Plans start at $0 + filing fees.

Excellent

by Ronna L. DeLoe, Esq.

Ronna L. DeLoe is a freelance writer and a published author who has written hundreds of legal articles. She does...

Contents

Updated on: January 31, 2023 · 3 min read

- Issuing stock certificates

- Disadvantages of issuing stock certificates

- Determining the amount of stock an investor gets

- Small companies and electronic shares

- Large corporations and the direct registration system

If you are an owner of a corporation, one of the decisions you must make is whether to issue paper stock certificates or whether you can show investment in the corporation in another way. While some people still want to have something tangible, such as stock certificate paper, public companies have moved to a different system of issuing their stock. Private companies may still issue stock certificates, but many of these companies also are switching over to either electronic or digital shares.

Issuing stock certificates

A stock certificate is a piece of paper that shows that the investor owns shares in the company. Stock certificate paper is a paper record that shows the investor owns the shares and how many shares the investor owns. It also contains the name of the company, the official signature from an officer of the company or someone in a similar capacity, and an official company seal. The company then mails the certificates to the investors.

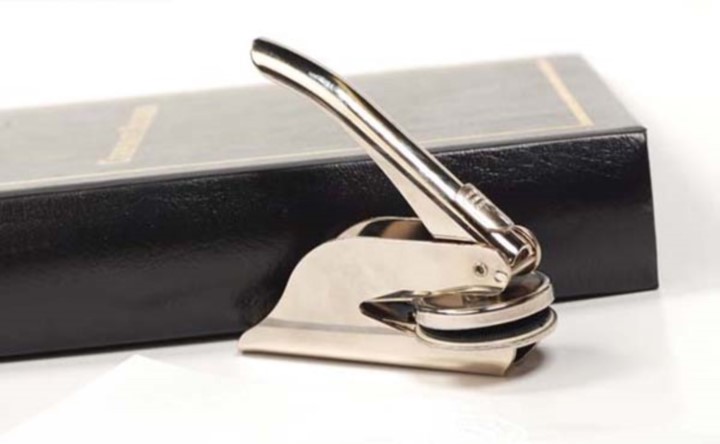

Corporations rarely issue stock certificates anymore. Many companies encourage their investors to turn in their stock certificates, replacing them with newer indications of stock ownership. If, however, you do want your company to issue stock certificates, you can get corporate business supplies online by using a corporate kit. A corporate kit usually contains a handsome binder, a ledger, some stock certificates, and a corporate seal.

Disadvantages of issuing stock certificates

While some of your investors may want stock certificates, issuing and distributing them burdens your company because:

- There is tedious clerical work involved in distributing paper certificates.

- You have to ensure the company mails the certificates to the investors who own them.

- You have to ensure the investors sign the certificates.

- You have to keep track of the shares at all times in a ledger book or on a computer.

- Paper stock could be stolen or lost, requiring replacement.

- Investors have to obtain certificates from the company's transfer agent, or from their broker, usually for a fee.

Check with a legal or financial advisor to see if your state still requires you to issue stock certificates to your investors. Make sure your company complies with all applicable laws.

Determining the amount of stock an investor gets

Investors often receive stock in proportion to the amount they have invested in the corporation. For example, if your corporation is worth one million dollars, and an investor puts $200,000 into the company, the investor could be entitled to receive one-fifth, or 20%, of the corporation's shares. However, check with a financial advisor to decide if you really want to give up that much control of the company.

Small companies and electronic shares

Most publicly traded companies no longer offer stock certificates. These are usually large corporations that now issue electronic or digital shares. Electronic shares are easy to trade because the broker doesn't have to wait to receive the stock certificate from the investor.

Conversely, most small and medium-sized companies don't offer electronic shares, in part, because the officers don't want investors to be able to trade their stock that easily. Nevertheless, it's a lot easier for your company to keep track of electronic shares of stock. Your company can do this by emailing investors to show how many shares they own, so long as the company keeps track of this information in a ledger book or on a computer system.

Make sure you check with legal counsel or an online legal service before your company issues electronic stock. The company may need to amend its bylaws to show that the company is issuing stock electronically.

Large corporations and the direct registration system

Large corporations use the Direct Registration System (DRS) to register and transfer stock. Instead of issuing tangible shares of stock in paper form, these corporations keep track of how many shares of stock an investor gets by recording it in a ledger book, a computer, or both. The ledger books list the investors' names, which is evidence of the investors' stock ownership.

Small and medium corporations can usually use this system for issuing their stock. In addition to keeping track of the stock shares in a ledger, the company must inform investors about their stock by sending a notice to them that provides the amount of shares they own and other pertinent stock information. The company can send the notice to investors either by email or by mail.

No matter which type of stock your company issues, check with a legal or financial advisor to determine what percentage of the company you want the investors to have.

You may also like

Starting a Business

Starting a BusinessWhat does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

Starting Your LLC

Starting Your LLCHow to get an LLC and start a limited liability company

Considering an LLC for your business? The application process isn't complicated, but to apply for an LLC, you'll have to do some homework first.

March 21, 2024 · 11min read