Dear

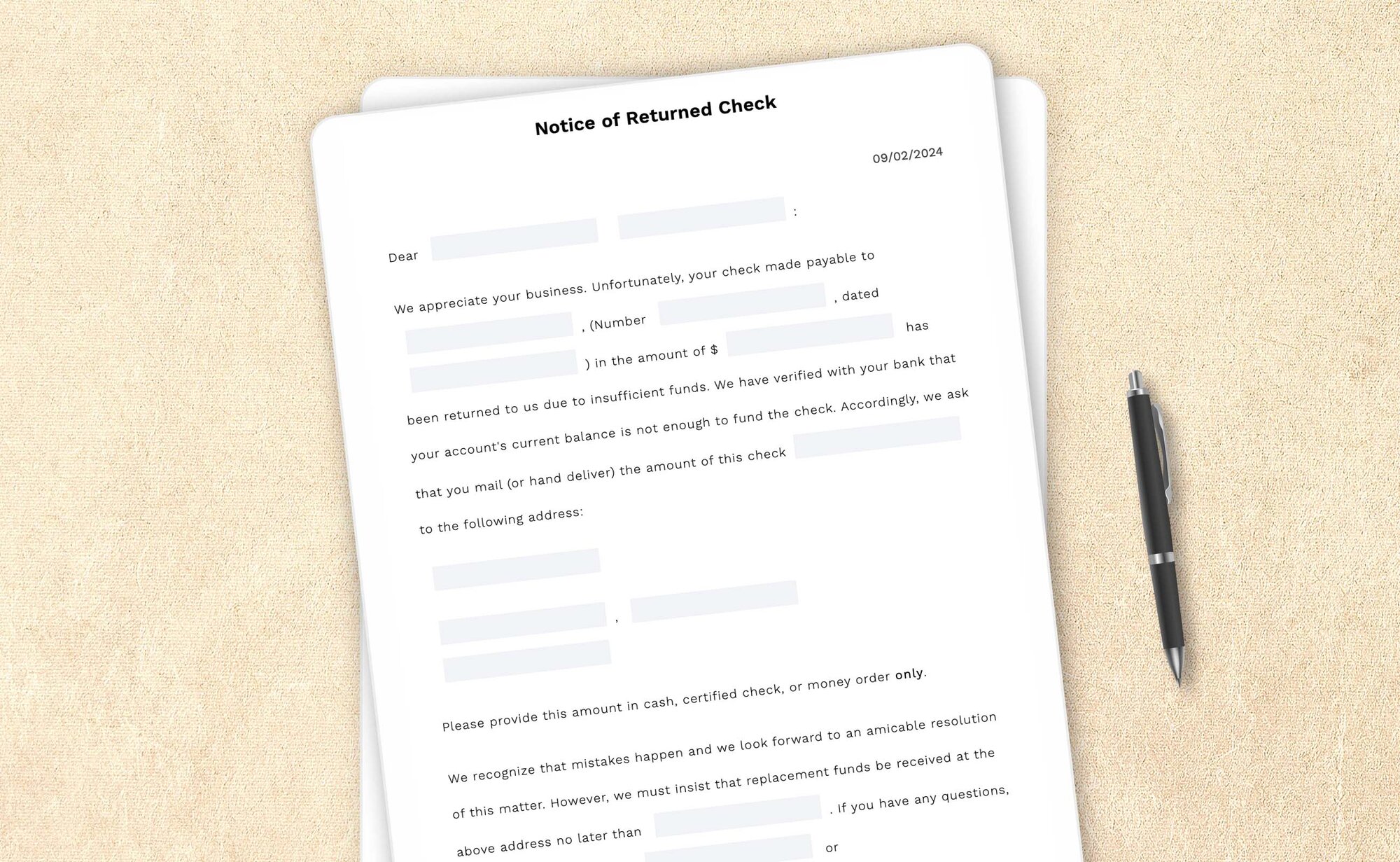

We appreciate your business. Unfortunately, your check made payable to

Please provide this amount in cash, certified check, or money order only.

We recognize that mistakes happen and we look forward to an amicable resolution of this matter. However, we must insist that replacement funds be received at the above address no later than

| Sincerely, | |||||||||||||||||||||

_______________________________ |

|||||||||||||||||||||

[PAGE BREAK HERE]

DEMAND FOR FINAL NOTICE

RE: Final Notice

Dear

We have attempted several times to resolve the matter of your past due account. Unfortunately, we still have not received payment of the outstanding amount, which is now significantly in arrears. Your account is overdue in the amount of $

This is your final notice. Unless we receive your payment for $

We strongly urge you to take this opportunity to avoid expensive and time-consuming collection efforts and litigation. If you have any questions about your account, please call or email me at

| Sincerely, | |||||||||||||||||||||

_______________________________ |

|||||||||||||||||||||

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Returned check notice: How-to guide

Handling returned checks can be an unavoidable aspect of business operations. Whether due to insufficient funds, closed accounts, or other reasons, receiving a returned check can disrupt cash flow and create administrative hassles. Be it a small business owner, a landlord, or a creditor, effectively communicating with the check issuer about the returned check is crucial to recovering the owed amount while maintaining professionalism and adhering to legal requirements.

However, businesses can efficiently address these situations with a well-structured returned check notice. Sending a returned check notice helps you communicate with your customer in a straightforward manner when their certified check is returned.

From outlining the necessary information to providing clear instructions for resolution, this article aims to streamline the process of addressing returned checks, minimizing confusion for both businesses and customers alike.

What should you do when your customer’s check bounces?

1. Reminder notice

Generally, it is best to send a polite reminder because the chances of a returned check might be because of a simple mistake. For instance, the customer (payer) might have given the wrong bank account number, there might be a mismatch in the signature on the check, or even the date entered might be wrong. If a check gets bounced because of simple mistakes, a nasty notice may get you paid, but it can spoil the business relationship that you had with your customer.

2. Returned check fee

Many states limit the fees that can be charged on a returned check. These returned check fees are sometimes called “bounced check” fees, “insufficient funds” fees, or non-sufficient funds fees (NSF fees). Before asking for a returned check fee, you should check the maximum amount your state allows you to charge a customer.

3. Hire a collection agency or take legal action

If a customer just won’t pay, don’t be hesitant to contact a collection agency or lawyer. Collection agencies may work for a fee or take a percentage of the recovered money. If the matter ends up in court, the nature of your recovery will vary from state to state.

Essential actions to be taken while sending a notice of returned check

1. Follow-up notices

When a customer defaults on check payments, the lender can initially send a basic reminder notice of pay. However, when the customer doesn’t pay even after that, the lender can send a second letter as a final warning before taking other stringent measures.

2. Details about the returned check and fees involved

In your correspondence to the customer, you should include the details of the bounced check:

- Check number

- When was the check drawn (date when it was signed)

- Account holder’s name and account number

- Details of the bank

Also, mention the return check fee (if applicable) in the letter. If you don’t want to collect a returned check fee, you can avoid mentioning the charges. If your state allows you to charge the customer, check the maximum eligible amount and inform the customer accordingly.

3. Address of the receiver

Provide an address to which payment can be sent or hand-delivered. If the customer wishes to send a money order or a revised check, they can do that at the given address.

4. Mention deadline

Write in a date by which you must receive payment. Provide your customer sufficient time to submit a replacement check. If the deadline you established has passed, you can opt to either send a second letter or to pursue alternative means of retrieving your money (e.g., collection agencies or attorneys)

5. Contact respective bank

Before mailing any letters, contact the bank that issued the check. Verify whether the customer’s account still has a shortage of funds. An overdraft may have been unintentional, and the customer may already have remedied the situation.

6. Use registered mail

Consider sending your notice by registered mail. Although not strictly required, it'll provide a record of your actions if legal action is required later.

Frequently asked questions

What's a returned check notice?

A returned check means a check that gets bounced from the bank due to a lack of funds or a mistake in the check. When this happens, you can notify the customer by sending a notice of returned check, and ask them to pay on a set time.

To fill out a notice, you’ll need the following information:

- Who the customer is: Keep the information of the person ready who wrote the check

- How much do they owe you: Find out how much the check was for and whether there are any additional fees