| BY REGISTERED MAIL |

Dear

This letter relates to the promissory note dated

| Sincerely, |

| ________________________________________________________ |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Notice of default on installment promissory note: How-to guide

Borrowers sometimes may default on loan payments. Even with precautions taken, it's inevitable that some borrowers might miss loan payments. While lenders can't stop these defaults completely, they can still take action to address the situation.

In the case of a default, the lender should first read the promissory note to determine the necessary procedures and steps. Often, the first step is to send a notice of default on the promissory note to the borrower, giving them a chance to address the issue. Through the notice, a lender can notify the borrower, request a quick remedy, or speed up the payment of the entire loan.

Steps to consider when a borrower defaults on an installment promissory note

1. Reviewing the promissory note

Review the terms of your promissory note. It should include information about the steps a lender must take after default and about the consequences that can or will result for the borrower. If there are specific procedures you must follow according to your agreement, ensure you have followed them.

2. Setting a deadline

It is essential to include a deadline in the terms and conditions of the note to ensure that you receive payment on time. If the note doesn’t specify a deadline, it is recommended that you set a date that'll work for your arrangement. A week or two should be enough time for the borrower to pay the amounts due. It'll help both parties stay on track and avoid confusion or misunderstandings.

3. Sending a polite notice of default

A polite notice of default is recommended when the borrower doesn't receive a payment on time. It is plausible that the delay was due to a simple mistake. While a harsh notice might prompt payment, it could harm your personal or business relationship with the borrower.

4. Sending the notice

It is recommended that you send your notice by registered mail to preserve a record of your actions in case of future court action.

5. Steps to take after the deadline

If the borrower has missed the deadline and the installment payment is still pending, you can follow the instructions in the note.

6. Seeking help from a legal professional

If your agreement involves complex terms, contact a legal professional to help draft a document that meets your requirements.

7. Demanding payment and clarifying outcomes

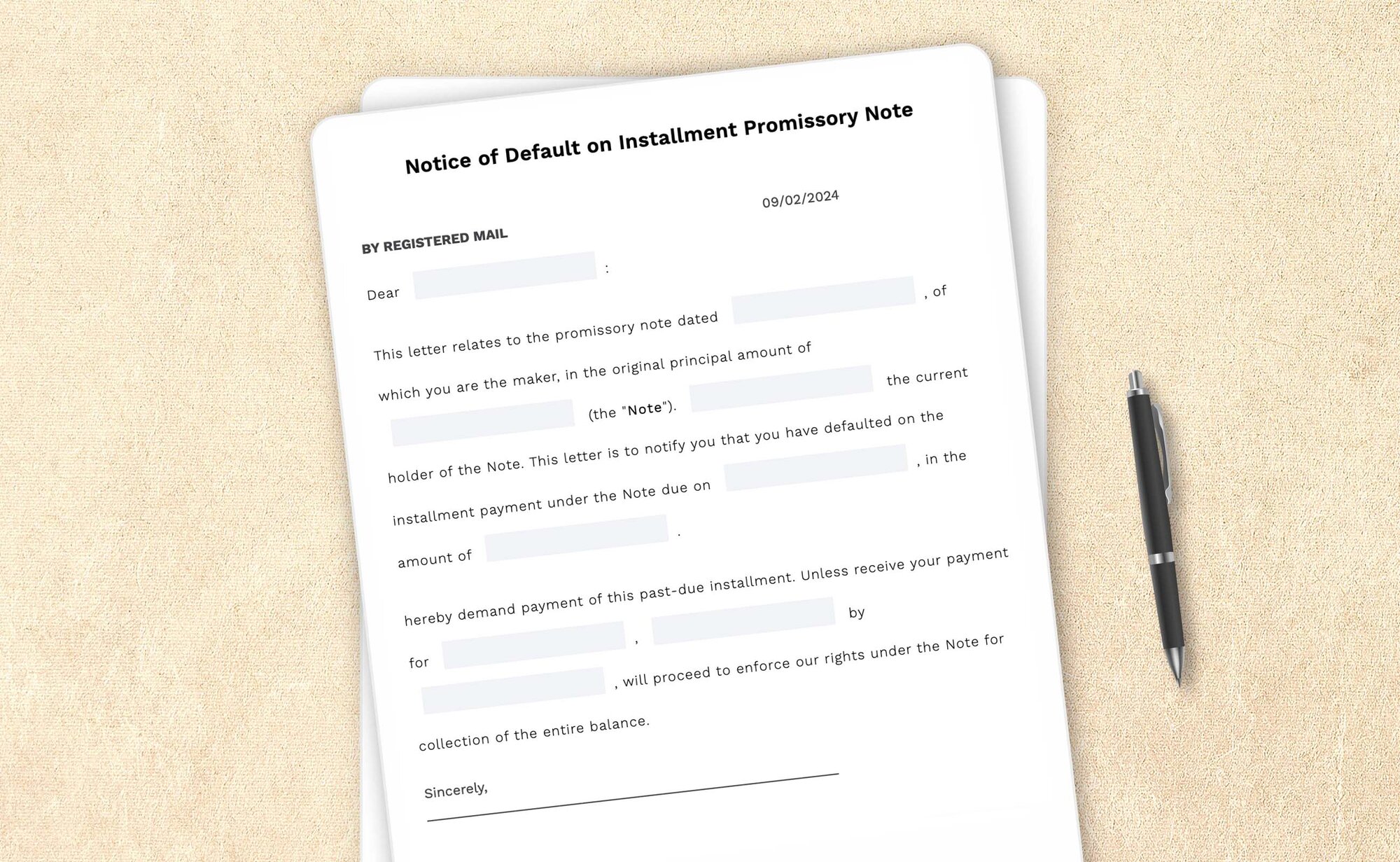

The notice template attached to this page demands that the borrower make the late payment by the given date. The notice also clarifies that the entire loan amount will be due immediately if the borrower fails to take the necessary action. It is crafted to help lenders receive their payments while maintaining a professional and firm tone. As a lender, you know your borrowers better than anyone else, and you may want to adjust the correspondence to best suit your personal and business needs.

Frequently asked questions

What's a notice of default on an installment promissory note?

Suppose one of your borrowers has missed a payment on the loan you provided. In that case, you can send a “notice of default on an installment promissory note” to encourage your borrower to repay within a given deadline. This notice will inform the borrowers that you'll take necessary action if they fail to pay. Usually, this is enough to get everything back on track.

What information is needed to complete a notice of default on an installment promissory note?

Here's the information needed to complete your notice of default on the installment promissory note:

- Who it's going to (the borrower): Make sure to have the name and contact information of the borrower (individual or business) to whom this document is going

- Date: The date on which the original promissory note was issued