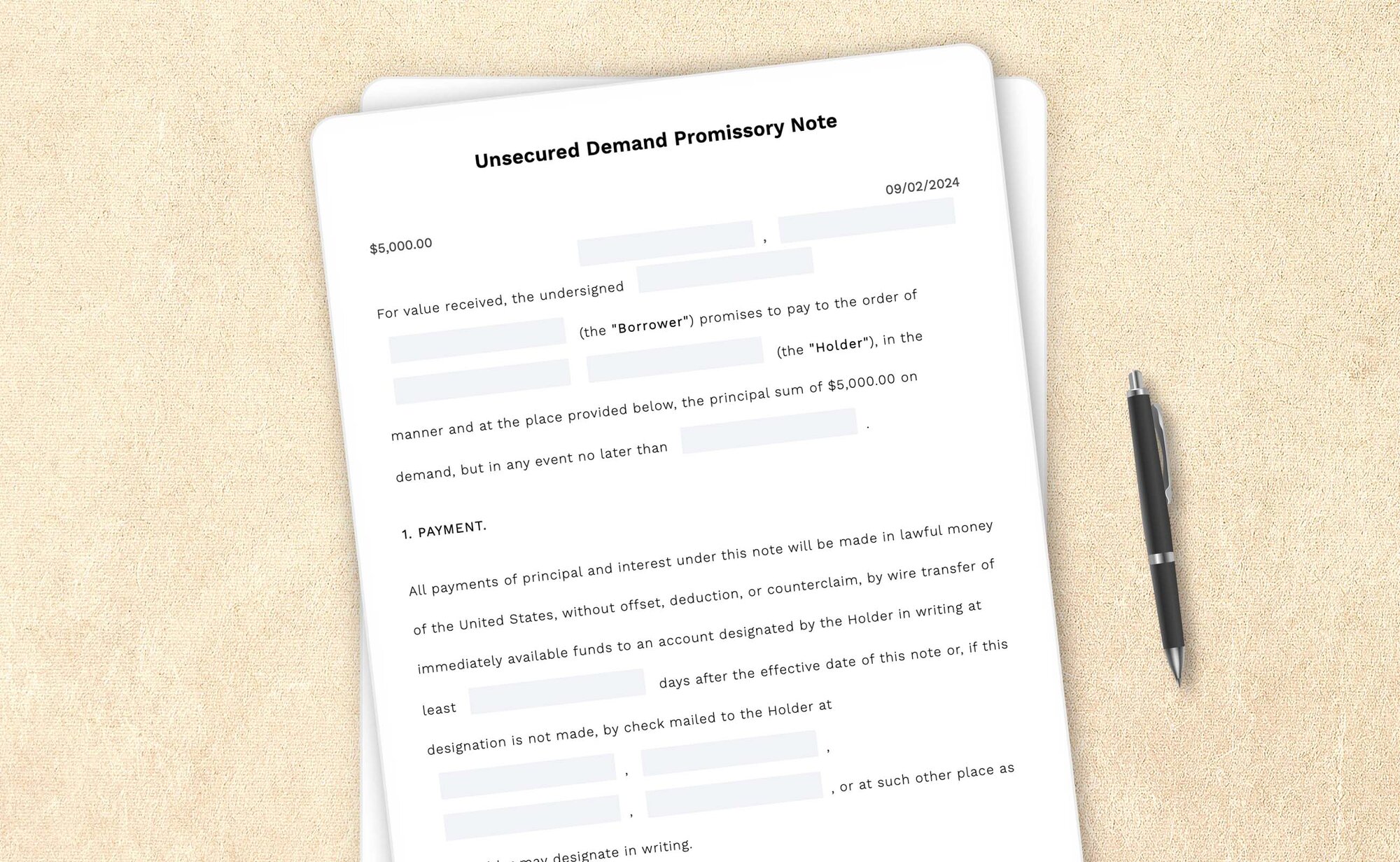

For value received, the undersigned

1. PAYMENT.

All payments of principal and interest under this note will be made in lawful money of the United States, without offset, deduction, or counterclaim, by wire transfer of immediately available funds to an account designated by the Holder in writing at least

2. INTEREST.

Interest on the unpaid principal balance of this note is payable from the date of this note until this note is paid in full, at the rate of

3. PREPAYMENT.

The Borrower may prepay this note, in whole or in part, at any time before demand, without penalty or premium. Any partial prepayment will be credited first to accrued interest, then to principal.

4. EVENTS OF DEFAULT.

Each of the following constitutes an "Event of Default" under this note:

- (a) the Borrower's failure to make a payment in full to the Holder within

business day(s) following the date of the Holder's demand for payment; - (b) the filing of any voluntary or involuntary petition in bankruptcy by or regarding the Borrower or the initiation of any proceeding under bankruptcy or insolvency laws against the Borrower;

- (c) an assignment made by the Borrower for the benefit of creditors; or

(d) the appointment of a receiver, custodian, trustee, or similar party to take possession of the Borrower's assets or property. (d) the appointment of a receiver, custodian, trustee, or similar party to take possession of the Borrower's assets or property; or (e) the death of the Borrower.

5. ACCELERATION; REMEDIES ON DEFAULT.

If any Event of Default occurs, all principal and other amounts owed under this note will become immediately due without any action by the Holder, the Borrower, or any other person. The Holder, in addition to any rights and remedies available to the Holder under this note, may, in its sole discretion, pursue any legal or equitable remedies available to it under applicable law or in equity.

6. WAIVER OF PRESENTMENT; DEMAND.

The Borrower hereby waives presentment, demand, notice of dishonor, notice of default or delinquency, notice of protest and nonpayment, notice of costs, expenses or losses and interest on those, notice of interest on interest and late charges, and diligence in taking any action to collect any sums owing under this note, including (to the extent permitted by law) waiving the pleading of any statute of limitations as a defense to any demand against the undersigned. Acceptance by the Holder or any other holder of this note of any payment differing from the designated lump-sum payment listed above does not relieve the undersigned of the obligation to honor the requirements of this note.

7. GOVERNING LAW.

- (a) Choice of Law. The laws of the state of

govern this agreement (without giving effect to its conflicts of law principles). - (b) Choice of Forum. Both parties consent to the personal jurisdiction of the state and federal courts in

County, .

8. COLLECTION COSTS AND ATTORNEYS' FEES.

The Borrower shall pay all expenses of the collection of indebtedness evidenced by this note, including reasonable attorneys' fees and court costs in addition to other amounts due.

9. ASSIGNMENT AND DELEGATION.

- (a) No Assignment. The Borrower may not assign any of its rights under this note. All voluntary assignments of rights are limited by this subsection.

- (b) No Delegation. The Borrower may not delegate any performance under this note.

- (c) Enforceability of an Assignment or Delegation. If a purported assignment or purported delegation is made in violation of this section, it is void.

10. SEVERABILITY.

If any one or more of the provisions contained in this note is, for any reason, held to be invalid, illegal, or unenforceable in any respect, that invalidity, illegality, or unenforceability will not affect any other provisions of this note, but this note will be construed as if those invalid, illegal, or unenforceable provisions had never been contained in it, unless the deletion of those provisions would result in such a material change so as to cause completion of the transactions contemplated by this note to be unreasonable.

11. NOTICES.

- (a) Writing; Permitted Delivery Methods. Each party giving or making any notice, request, demand, or other communication required or permitted by this note shall give that notice in writing and use one of the following types of delivery, each of which is a writing for purposes of this note: personal delivery, mail (registered or certified mail, postage prepaid, return-receipt requested), nationally recognized overnight courier (fees prepaid), or email.

- (b) Addresses. A party shall address notices under this section to a party at the following addresses:

- If to the Borrower:

, - If to the Holder:

, , - (c) Effectiveness. A notice is effective only if the party giving notice complies with subsections (a) and (b) and if the recipient receives the notice.

12. WAIVER.

No waiver of a breach, failure of any condition, or any right or remedy contained in or granted by the provisions of this note will be effective unless it is in writing and signed by the party waiving the breach, failure, right, or remedy. No waiver of any breach, failure, right, or remedy will be deemed a waiver of any other breach, failure, right, or remedy, whether or not similar, and no waiver will constitute a continuing waiver, unless the writing so specifies.

13. HEADINGS.

The descriptive headings of the sections and subsections of this note are for convenience only, and do not affect this note's construction or interpretation.

[SIGNATURE PAGE FOLLOWS]

Each party is signing this note on the date stated opposite that party's signature.

| Date:__________________________________ | By:____________________________________________________________ |

| Name: |

| Date:__________________________________ | By:____________________________________________________________ |

| Name: |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Unsecured demand promissory note: How-to guide

Successful businesses are built on big ideas and long-range goals, but reaching those goals seems impossible without sufficient capital. In such scenarios, individuals or companies borrow money from financial institutions or their family and friends.

Business promissory notes may benefit a company looking to borrow money from less formal sources. Commercial lenders may be reluctant to loan money to businesses without defined income streams.

A written unsecured note can minimize confusion and clearly set the parties’ expectations and fulfillment obligations. It establishes the loan terms and deal structures and promotes a reliable business arrangement.

What is an unsecured demand promissory note?

An unsecured demand promissory note is a type of loan where the lender provides money to the borrower without taking any secured interest in the borrower’s property. The borrower must pay it back immediately when the lender requests it. If the borrower fails to repay the loan, the lender has the right to take legal action against them.

On the contrary, in a secured promissory note, the lender takes a secured interest in the borrower’s property. If the borrower defaults on the loan, the lender can seize that property immediately.

Best practices while drafting an unsecured promissory note

1. Setting a reasonable interest rate

Choosing a fair interest rate on the principal sum while extending a loan to someone is essential. This reduces the likelihood of default and helps foster a more amicable relationship between the parties involved.

2. Reviewing and revising the note

Give both parties time to review the promissory note before signing it. Carefully check that all deal points are included, and don't assume anything not expressly stated in the document.

3. Signing the note

When signing this legal document, always ensure that only one original copy is signed and given to the lender. The lender can create a copy of the note with the label "Copy" and give it to the borrower. The lender should keep the original document until the note is fully paid. Once the note is paid, the lender will return the original document to the borrower.

Depending on the agreement's terms, you should have a witness or notary present to reduce the chances of someone challenging the validity of a signature.

If your loan agreement is complicated, contact an attorney to help draft a document that meets your needs.

Key elements in unsecured promissory notes (demand)

It's crucial to have specific details in your loan agreement, such as the amount borrowed and applicable interest rates. A well-written agreement should accurately reflect the parties' intentions. Therefore, it's important to clarify the terms and conditions of your loan and put them in writing.

An unsecured promissory note includes the following sections to help you understand the terms.

1. Introduction

This section identifies the document as a promissory note. Write the effective date of the note and the details about the parties involved.

One party is called the “borrower,” who borrows the money and will pay it back to the “payee.” Note that the payee may or may not be the same entity as the lender. Under some loan agreements, the lender requires the borrower to make payments to a third party.

2. Payment

In this section, the parties agree that the borrowed amount will be repaid immediately whenever the payee demands it.

3. Interest

This section mentions the lump sum amount and a legally valid interest rate. The payee can add details of where and how the money must be repaid.

4. Prepayment

This section explains that the borrower can pay the lender before the payment schedule ends or before it is specifically demanded and that there are no additional fees for doing so.

5. Events of default

In this clause, list the situations in which the person receiving the loan can declare that the borrower has defaulted on the loan. Additionally, add the specific date within which the borrower must repay the loan amount after being notified of the demand.

6. Acceleration; remedies on default

This section mentions the actions that the payee can take when an event of default occurs, such as when the borrower won’t repay the unpaid debt before the due date.

7. Waiver of presentment; demand

This clause allows the payee to take action without further notice or explanation when an event of default occurs.

8. Governing law

This section allows the parties involved to choose which state law to use while interpreting the note.

9. Collection costs and attorney’s fees

In this section, the borrower agrees to pay for all expenses incurred in collecting the debts or spending reasonable attorneys fees under the note.

10. Successors and assigns

This section establishes that the rights and obligations of the parties will be transferred to their heirs or successors in the event of death or business transfer.

11. Severability

This clause safeguards the terms of the note as a whole, even if one part is later invalidated.

12. Notice

In this section, provide the borrower’s and the payee’s mailing addresses where any official or legal correspondence should be sent.

13. No implied waiver

This section clarifies that if the payee overlooks or allows the borrower to violate an obligation under the note, it doesn't mean that the payee gives up their future rights to demand the borrower to fulfill those obligations.

14. Entire agreement

This clause ensures that the signed note is the official document of the parties' agreement. However, it doesn't completely prevent any claims of other enforceable promises and offers some level of protection against such claims.

15. Headings

This section states that the headings in each section are only meant to help organize the document and aren’t operational parts of the note.

Frequently asked questions

What does an unsecured demand promissory note mean?

A promissory note is a written promise to pay back a loan. Unsecured means that the loan isn’t guaranteed by security or collateral. The ‘demand’ part means the loan must be paid back when the lender requests it.

This agreement spells out the terms of an unsecured loan so that both the borrower and the lender understand their responsibilities. It clarifies to both parties how and when the borrower will pay the money back to the lender.

Are unsecured promissory notes enforceable?

Yes, they are. Here's the information you'll need handy to enforce your unsecured demand promissory note:

- Who it's coming from: Determine if a business or individual is sending the document and have the name and contact information ready

- Who it's going to: Know who this document is going to and have the individual or business name and contact information ready. If it's a business, know the business type (LLC, corporation, etc.)

- Which state will govern it: Specify a state to determine the applicable law

- Subject matter: Have a summary of the general nature of the loan ready (e.g., the loan amount and the interest rate, if any)

- Dates: Understand the effective dates of the loan