Avoid probate court with a living trust

Have questions? Call (866) 679-1568 for a free discovery call.

Living trusts at an affordable price

Basic Trust

$399

Includes:

Living trust

Pour-over will

Healthcare directive

Financial power of attorney

HIPAA authorization

Certificate of trust

Schedule of assets

Bill of transfer

30 days of free revisions

Printing & shipping of one set of documents

Premium Trust

$549

Everything in a Basic Trust, plus:

Attorney review of your documents

Unlimited 30 min calls with an attorney for 1 year*

Attorney advice for your family

1 year of free revisions

Have questions? Call (866) 679-1568 for a free discovery call.

If an attorney from our network advises you to set up a last will instead of a living trust or vice versa, please call us to change your order. See LZ Guarantee for exact terms.

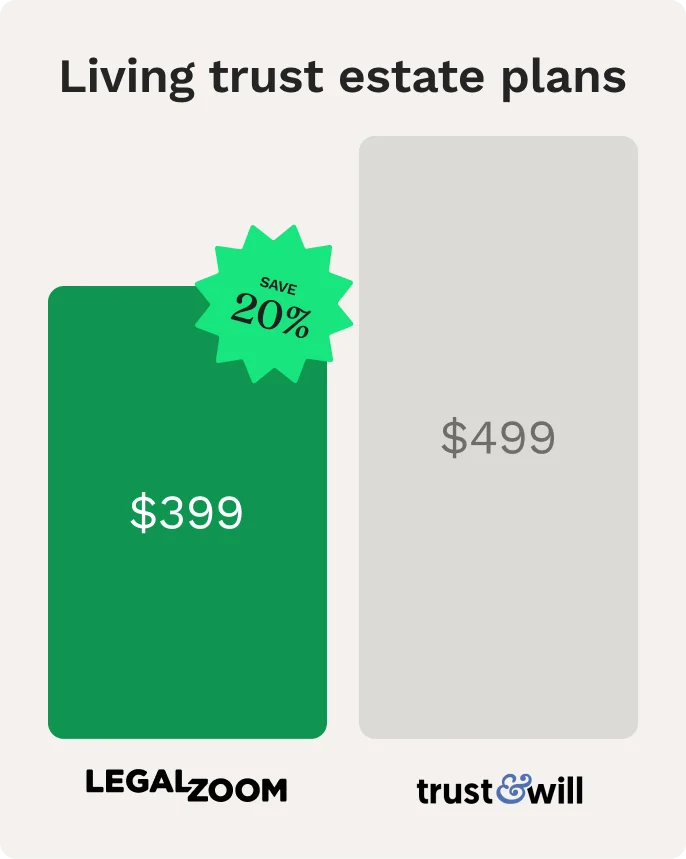

Comprehensive estate plans at a lower cost than Trust&Will.

Give your loved ones peace of mind with LegalZoom, the #1 online estate plan provider. We have served 2.1 million customers over two decades, establishing our trusted name in estate plan services. See why thousands have given us 5-star reviews on TrustPilot.

Documents included

- Living trust

- Pour-over will

- Advance healthcare directive

- Financial power of attorney

- HIPAA authorization

- Certificate of trust

- Schedule of assets

- Trust funding guide

- Executor Guide

- Living trust

- Pour-over will

- Advance healthcare directive

- Financial power of attorney

- HIPAA authorization

- Certificate of trust

- Schedule of assets

- Trust funding guide

Printing & shipping of

first set of documents

Printing & shipping of first set of documents

Living Trust Estate Plan

Printing & shipping of additional copies

Why choose LegalZoom to set up your living trust

Why choose LegalZoom to set up your living trust

Easy and convenient

Answer a short, guided questionnaire from your phone or laptop—no trips to a lawyer’s office and no paperwork surprises.

Attorney support

Add a review or unlimited 30-minute calls with an attorney for 1 year* with highly rated, state-licensed attorneys.

Accepted in all 50 states

Accepted in all 50 states

Your documents are drafted by experienced attorneys and recognised nationwide, so you can move or buy property anywhere with confidence.

Why create a living trust?

Living trusts are a way to distribute your assets and provide for your beneficiaries while keeping loved ones out of probate court. Since trusts don’t need to be filed in probate court, they offer more privacy. Revocable living trusts allow you to change your terms if you change your mind.

Why create a living trust?

Living trusts are a way to distribute your assets and provide for your beneficiaries while keeping loved ones out of probate court. Since trusts don’t need to be filed in probate court, they offer more privacy. Revocable living trusts allow you to change your terms if you change your mind.

Put your wishes in

writing

Keep family out of probate court

Spare your loved ones from the expenses and delays that may result from the probate process. Avoid multistate probate if you own real estate in another state.

Protect your privacy

Spare your family from tough decisions by documenting your medical preferences and powers of attorney.

Keep your personal matters—and assets—private with a trust. Probate court records are public records, which means that anyone can access your will.

Avoid bank delays

Clarify who should receive what to help avoid confusion and reduce the chance of conflict.

Help ensure your assets are accessible to your loved ones with less interruption after your death. With a living trust, a trustee can typically access assets and handle affairs more quickly than with a will.

Start a trust

Once you sign and transfer your assets to the trust it’s considered effective and can be managed by you as the trustee. You can use the trust assets in the same way you did before creating the living trust. When you can no longer act as trustee, the successor trustee that you name takes over and uses the trust assets for your lifetime benefit. After you pass away, the successor trustee distributes your assets to your beneficiaries without going through probate court.

What are the disadvantages of a living trust?

Having a living trust as part of your estate plan has many advantages—but it does take more effort to set up.

Here are some reasons you might not want a living trust:

Having a living trust as part of your estate plan has many advantages—but it does take more effort to set up.

Here are some reasons you might not want a living trust:

What are the disadvantages of a living trust?

Having a living trust as part of your estate plan has many advantages—but it does take more effort to set up.

Here are some reasons you might not want a living trust:

Having a living trust as part of your estate plan has many advantages—but it does take more effort to set up.

Here are some reasons you might not want a living trust:

Put your wishes in

writing

Costs more to set up than a will

It’s more expensive to set up a living trust—including revocable living trusts and irrevocable trusts—than a last will.

Needs funding and title transfers

Spare your family from tough decisions by documenting your medical preferences and powers of attorney.

If you die without funding your living trust, your estate will be subject to the probate process. For assets where you own the title—like real estate—you must legally transfer ownership to the trust.

Requires more paperwork

Clarify who should receive what to help avoid confusion and reduce the chance of conflict.

It takes more time and paperwork to set up and fund a living trust than a will. Living trusts also require more ongoing maintenance since they need to be updated as your assets change.

Start a trust

Frequently asked questions

What’s the difference between a last will & testament and living trust?

A last will is quicker and easier to set up, but it needs to go through the court probate process after your death. Probate court can be time consuming and expensive, depending on your state.

A living trust allows your loved ones to avoid the potential hassle of probate court. But trusts require you to change the title to most of your assets, which means more paperwork and ongoing maintenance.

What is probate?

Probate is the legal process through which the court oversees how an estate and assets will be distributed. While there are many benefits to having oversight of the process by the probate court, it can be time consuming and expensive depending on your state.

If you create a last will, your assets will be distributed to your named beneficiaries as part of the probate process. If you create a trust, your assets will be distributed to your beneficiaries without going through the probate process.

In many states, probate may not be required if the estate is of minimal value.

Can I transfer property into and out of the trust while I'm alive?

Yes. If you have an individual living trust, you can transfer assets and property, including real estate, whenever you like. Likely, you’ll be your own trustee while you’re still alive. After your death, it will transfer to your successor trustee, appointed by you. Joint trusts require your co-trustor's consent for co-owned property.

What is a revocable trust?

A revocable living trust can be changed by the person(s) that created the trust. You can change a revocable living trust by amending it or revoking it. An irrevocable living trust, on the other hand, cannot be amended or revoked.

Do I still need a will if I have a living trust?

Yes, you should have a last will for property that may not have been transferred to your trust. Our living trust includes a pour-over will to help ensure that all of your assets are distributed to your beneficiaries. The will lets you name guardians for your minor children.

Will a living trust remain legal if I move to another state?

Yes, a living trust is valid in all 50 states, no matter where it's created and signed. You should consider talking to a living trust attorney licensed in the new state to make sure it’s up to date. If you buy real estate or acquire assets in your new state, be sure to transfer it into your living trust.

Do I need a lawyer to prepare my living trust?

No, it’s not legally required for a living trust attorney to prepare your trust. That said, every person has different needs and you may want to ask an attorney for help, especially if your estate is large or complicated or you have a child with special needs. Some of our living trust packages include attorney advice—unlimited 30-minute calls on new legal matters.

What is Assist?

Assist is our legal guidance subscription service, which gives you unlimited 30-minute calls on new personal legal matters to vetted attorneys in our network. It is included in our Premium estate plan packages, including Trust Estate Plan Premium, where it also includes comprehensive estate plan review.

Can I put my 401k in a living trust?

No, you cannot transfer your 401k and certain other kinds of retirement accounts into living trusts. Speak with a living trust attorney for more information about what assets you can include.

Aren’t living trusts just for the wealthy?

No, despite the higher living trust cost, they’re a good choice for many people. People of all income levels can set up a living trust to manage their finances, assets, and estate in case they become disabled, or to provide for beneficiaries while avoiding the probate process.

At what net worth should I have a living trust?

Living trusts can be a good choice for people of any net worth. But there are some instances where a living trust may be favored over a will. For example, if you have children with special needs or own assets that may exceed the estate tax limits set by the state and federal government, then a living trust might be preferred. A living trust attorney can advise you on these matters and help you decide what's best for you.

What are the disadvantages of putting your house in a trust?

The advantages and disadvantages of putting your house in a trust are similar to reasons to have—or not have—a living trust in general. For example, if you put your house in a living trust, you’ll need to transfer the title to the trust, which can be time-consuming. But once the house is titled in the name of the living trust, it can pass to your beneficiaries without going through probate after your death. A living trust attorney can also advise you on these matters.

Is it expensive to set up a living trust?

A living trust is more expensive and requires more work to establish than a last will, but we offer both DIY solutions and affordable living trust attorney guidance options to suit many budgets. In fact, some of our living trust packages include attorney support with 30-minute calls on new topics to attorneys in our network for a monthly cost that’s less than an hour with an attorney from a traditional firm.

Can a living trust help save on estate taxes?

It can help reduce estate taxes, depending on how it’s set up. Speak with an estate planning attorney for more guidance.

What happens after I order my estate plan?

You’ll be all set to start building your estate plan using our online questionnaire. Before you begin, if you purchased a plan with Assist, we recommend scheduling a call with an estate plan attorney from our network to answer any questions you may have about the process.

Once you’ve submitted your answers, we’ll prepare your paperwork and it will typically be available for download within 2-3 business days so you can review and sign.

The explanation about the [pros and cons] of having a living trust instead of a will was great and made the process simple.

— Ryan S., living trust customer

I'm stunned at the precision and ... quality of the end product ... There's a reason why they're No. 1...

— Teddy F., living trust customer

The process was fast, easy, and met my needs. The final product I received in the mail was spectacular! It exceeded my expectations!

— Barbara F., living trust customer

Questions?

Sat–Sun 7 am–4 pm PT