Transfer your property with confidence

Transfer your property with confidence

We help make it simple to update your property ownership records. Pricing starts at $249 + fees.

Choose the plan that meets your needs

Standard

Start My Transfer

Includes:

Express

Start My Transfer

Includes Standard package, plus:

When do you need a new deed?

To transfer property to family or business

To fund your living trust

To add or remove a name from the title

Why use LegalZoom for property deed transfers?

Guided support

Fast processing

What you need to know about property deeds

What is a property deed?

When do you need a property deed?

Types of property deeds

Quitclaim deed

Grant deed

Warranty deed

Property title vs. deed: What’s the difference?

How to transfer your property deed with LegalZoom in 3 steps

Important considerations in a property deed

Grantor and grantee: who’s involved?

Ownership structure: sole vs. co-ownership

Property interests: what’s being transferred?

Property deed examples

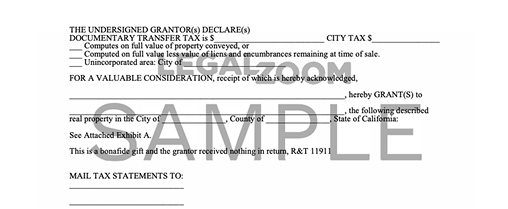

What does a property deed look like?

Property deed sample

Some helpful articles to get you started

What Is a Grant Deed and How Does It Work?

What Is a Warranty Deed? Types and Uses

What to Do When a Quitclaim Deed Is Challenged

Michigan Requirements for Quitclaim Deeds

Frequently asked questions

Can I use your service to transfer property when money is being exchanged?

No. Our deed service can only be used when money is not being exchanged. If you're selling a property, we recommend that you contact an attorney, escrow company or title company to complete your transaction.

What's the difference between a quitclaim deed and a warranty deed?

A quitclaim deed transfers whatever interest you have in the property and makes no guarantees. It's often used for adding or removing someone's name on the title, transfers between family members, or transfers into a living trust and by divorcing couples.

A warranty deed provides greater protection to the new owner because the current owner makes a promise that he or she legally owns the property and has clear title to the real estate. Warranty deeds are commonly used when selling real estate.

What if I have vacant land I want to transfer?

No problem. If the property is vacant land or if no street address is assigned, then you'll just need to enter as much information as possible about the location of the property (such as mile marker, street intersection, map or lot number, assessor's identification number, etc.) in your questionnaire.

How do I get a property deed?

A property deed is typically provided at closing when you purchase real estate. If you need a copy, contact your County Recorder’s Office, where the deed is recorded. If it's unrelated to a sale, then you can find deeds online or you use LegalZoom's property deed transfer product.

How do I transfer a property deed from a deceased relative?

If you inherited property, the process depends on whether the deceased had a will or trust. You may need to file a new deed, probate court documents, or an affidavit of heirship to update ownership.

Can a quitclaim deed transfer property from a trust?

A quitclaim deed can be used to transfer property into or out of a trust, but its validity depends on state laws and the terms of the trust agreement. Need guidance? LegalZoom's network of independent attorneys can help.

How do I transfer a property deed from a deceased relative in California?

In California, transferring property after an owner’s passing can involve several legal steps, depending on how the property was owned. If it was not held by a trust, jointly with the right of survivorship, or covered by a transfer on death deed, it may need to go through probate court before ownership can be updated.

Because property transfers can be complex, it’s best to consult an attorney to determine the proper process for your situation. They can better help you understand whether you need to file a new deed, an affidavit of death, or a court order.

LegalZoom can assist with the deed preparation process, but it's best to speak with an attorney can help ensure you take the necessary legal steps.

How do you transfer a deed on an inherited property?

Transferring ownership of an inherited property depends on how the property was passed down—through a will, trust, or intestate succession (when a person dies without leaving a valid will) and what you intend to do with it. The process may involve recording a new deed, filing legal documents, or completing probate requirements.

Because property transfers can be complex and vary based on your situation, it’s best to consult an attorney to determine the right approach. LegalZoom can offer attorney consultations to help you navigate the process.

Where do I go to transfer a property deed?

Property deed transfers are handled by the County Recorder’s Office where the property is located. Some counties allow e-filing, while others require in-person or mail submissions. If you need assistance preparing your deed, LegalZoom can help.

How do I transfer a property deed to a family member?

A quitclaim deed or grant deed is typically used for family transfers. The deed must be prepared, signed, notarized, and recorded with the County Recorder’s Office. LegalZoom makes it easy to create and file your deed.

How much does it cost to transfer a property deed?

The cost varies by state and county but typically includes recording fees, transfer taxes, and legal document preparation costs. Fees can range from $50 to several hundred dollars.

How do I get a copy of a property deed online?

Many counties provide online access to public property records. Visit your County Recorder’s website to search for and request a copy of your deed.

Does a spouse have the right to property after signing a quitclaim deed?

They can. In most cases, signing a quitclaim deed means a spouse releases their ownership rights to the property. However, mortgage obligations and certain marital property laws may still apply. If you're unsure, LegalZoom's attorney network can provide guidance.

How do I find deed restrictions on a property?

You can find deed restriction records with the County Recorder’s Office and may also be listed in Homeowners Association (HOA) agreements or subdivision covenants. Check property records or contact your county office.

Can a property deed be overturned?

Yes, in limited circumstances. A property deed may be challenged in court due to fraud, undue influence, errors, or lack of capacity when it was signed. A legal proceeding may be required to revoke or correct the deed. If you need help understanding your legal options, consider consulting an attorney through LegalZoom's independent network.

What does "c/o" mean on a property deed?

The abbreviation "c/o" stands for "care of" and is often used in mailing addresses on property records to indicate a recipient responsible for receiving documents on behalf of the owner.

How do I update a property deed?

To update a property deed, such as after a name change due to marriage or to correct an error, you must file a new deed with the corrected information and record it with the County Recorder’s Office. LegalZoom can help you create and file the updated deed.

How do I transfer a land deed?

The process for transferring a land deed typically follows the same steps as any real estate transfer: a new deed must be prepared, signed, notarized, and recorded with the County Recorder’s Office. LegalZoom can help you get started.

How do I transfer the deed of a house?

To transfer a a deed for a house, you’ll need to draft a new property deed, have it signed and notarized, and submit it to the County Recorder’s Office for official recording. LegalZoom simplifies this process with easy-to-use deed preparation services.

How we’ve helped our customers

Simple and easy process for your deed transfer highly recommend.

—Norbert P., property deed customer

K+

property deeds created

The deed transfer was done accurately and fast.

—Pablo D., property deed customer

+

years

of customers’ trust