Passing wealth from one generation to the next can be both a financial milestone and a deeply personal act. But the expectations surrounding inheritances don’t always match reality, especially when viewed through the eyes of different generations.

To better understand these differences, we surveyed 1,000 Americans aged 18–44 and 1,000 Americans aged 45 and older with children. The results reveal where expectations align, where they diverge, and how factors like financial confidence, homeownership, and economic conditions shape the way people think about what they’ll receive—and what they’ll leave behind.

We’ll explore the inheritance “expectation gap,” take a closer look at younger and older Americans separately, and highlight where better communication and planning can help bridge the divide.

The Inheritance Expectation Gap

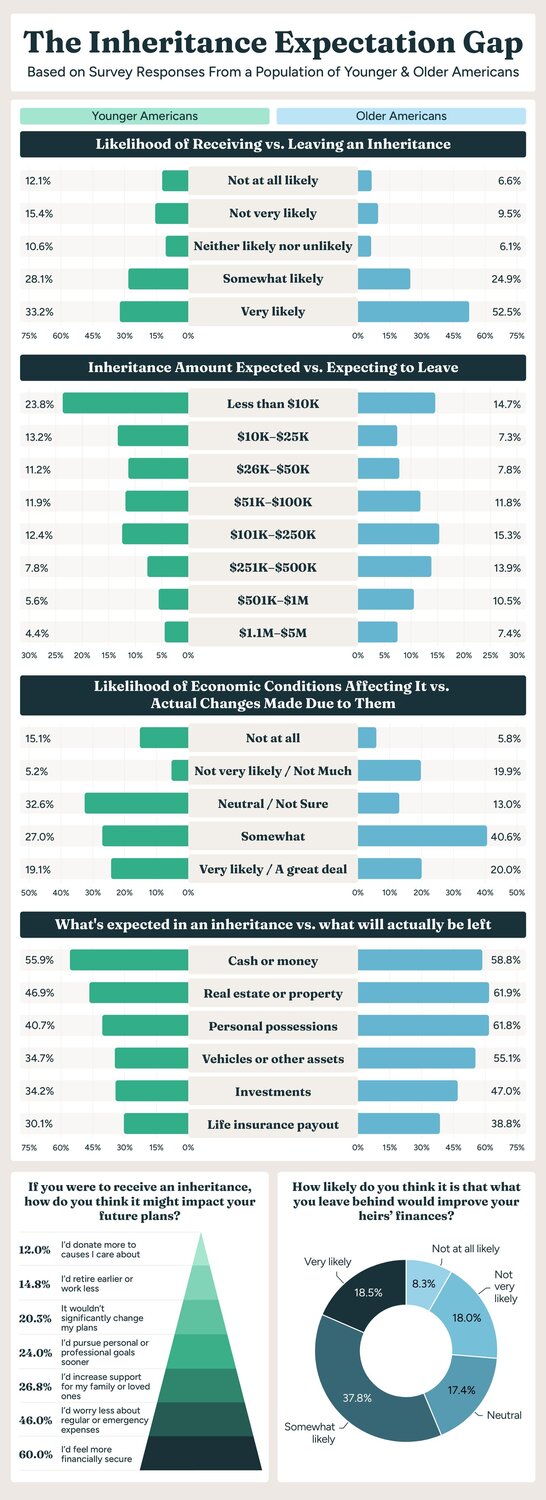

When it comes to passing wealth from one generation to the next, perception doesn’t always match reality. Our survey reveals a divide in how much young Americans expect to receive in an inheritance and how much older ones plan to leave behind.

Let’s take a closer look at some of the key differences.

Likelihood of Receiving vs. Leaving an Inheritance

- 60% of younger Americans think it’s at least somewhat likely they’ll receive an inheritance in their lifetime.

- In contrast, 77% of older Americans say they’re likely to leave one, with more than half (53%) saying they’re very likely to do so.

Amount Expected vs. Amount Planned to Leave

- Younger Americans’ expectations: 24% believe an inheritance would be less than $10,000, followed by $10K–$25K (13%), $101K–$250K (12%), $51K–$100K (12%), and $26K–$50K (11%).

- Older Americans’ plans: 15% expect to leave less than $10,000, another 15% expect to leave $101K–$250K. Most (about 60%) anticipate leaving more than $50K overall.

This expectation gap shows that younger generations are underestimating both the likelihood of receiving an inheritance and the size of it. Growing up in a time of wage stagnation and rising living costs may be shaping their outlook, making large inheritances feel less attainable. Older Americans, many of whom bought property before home prices surged and have had more time to build wealth, may be more confident about what they can pass on.

When asking about the types of inheritance people expect to receive and leave behind, we noticed some expectation differences, too.

What’s Expected vs. What Will Be Left Behind

- Younger Americans expect: money (56%), property (47%), personal possessions (41%), vehicles/valuable assets (35%), investments (34%). Ten percent expect nothing.

- Older Americans plan to leave: real estate/property (62%), personal possessions (62%), money (59%), vehicles/valuable assets (55%), investments (47%).

As with overall inheritance size, older Americans anticipate leaving more across most categories compared to what younger ones expect to receive. The most notable differences are in property and personal possessions, where expectations fall short of what older generations plan to leave.

For younger Americans, these assets could provide both financial value and emotional connection.

Expected Impact vs. Planned Impact

- Younger Americans say an inheritance would make them feel more financially secure (60%), help them worry less about emergencies (46%), allow them to support their families more (27%), or pursue a personal/professional goal sooner (24%).

- More than half of older Americans say their heirs’ futures will significantly improve from an inheritance, with 1 in 5 very confident it will.

What’s passed down directly shapes these impacts. For younger Americans, an inheritance could be the difference between financial strain and stability. For older generations, that potential is a driving reason behind making estate plans and ensuring their wishes are clear.

That alignment in intention doesn’t necessarily mean inheritances are guaranteed. Today’s economic conditions are playing a not-insignificant role in estate planning.

Economic Conditions: Perceived Impact vs. Actual Changes

- 1 in 4 younger Americans think current economic conditions will very likely affect their chances of receiving an inheritance, while 20% believe it’s unlikely.

- Over 60% of older Americans say factors like inflation and the housing market will impact what they’re able to leave, with 20% saying it will affect them “a great deal.”

For some older Americans, rising costs may require using more of their assets during retirement, while market shifts can influence the value of investments and property. For younger Americans, these pressures translate into uncertainty about whether an inheritance will arrive, and if it does, how much it might be worth.

The data shows a consistent pattern: younger Americans expect less, while older Americans plan to leave more, though economic realities could shift those plans. Understanding this gap matters because it affects financial planning on both sides.

Next, we’ll look more closely at what younger Americans expect to inherit and if they’re prepared for it.

The Inheritance Expectations of Younger Americans

Younger Americans may feel as though they’re years away from writing their last will and testaments, but many are already forming opinions about what they might inherit and what they hope to leave behind. Our survey of 18- to 44-year-olds highlights a generation balancing financial uncertainty with a strong desire to provide for the next.

Confidence in Current Finances

- Only 7% of younger Americans feel very confident in their financial situation, while 43% report some level of not confident.

This lack of confidence may help explain why expectations for inheritances are often modest. For many, current financial pressures make windfalls feel distant or uncertain.

Inheriting a Home: More Concern Than Readiness

- If a home were left to them today, 42% of younger Americans say they wouldn’t feel financially prepared to keep and maintain it.

- Top concerns include property taxes (20%), maintenance costs (20%), existing debt tied to the property (12%), and legal complexities (11%).

These concerns suggest that an inheritance, while valuable, can also bring unexpected expenses that require careful planning and consideration.

How an Inheritance Could Shape Financial Decisions

If they were expecting to receive an inheritance, younger Americans say it would most influence:

- Saving for retirement (37%)

- Buying a home (33%)

- Taking on debt (17%)

- Starting a business (16%)

- Having children (16%)

Several of these experiences require long-term financial security and flexibility, indicating that inheritances are often seen less as spending money and more as a way to strengthen financial foundations.

Knowledge Gaps in Inheritance Taxes

- Over half of younger Americans say they’re not confident in their understanding of how inheritance taxes could affect what they receive.

This uncertainty reinforces the importance of clear communication and planning with family members. And professional guidance when necessary.

Planning to Pass Something On

Even with lower confidence in their current finances, younger Americans see value in leaving something for the next generation:

- Nearly 7 in 10 say passing on an inheritance is important to them.

- About 70% say they’re likely to leave an inheritance for their family.

- The things they most commonly expect to pass down are values and life lessons (67%), an inheritance (57%), and family or cultural traditions (55%).

This mix of tangible and intangible legacies suggests that, for younger Americans, inheritance is about more than money. It’s also about preserving family identity and support systems.

Conversations About the Future

- 39% of younger Americans have not had conversations with relatives about future financial plans, such as inheritances.

- More than 1 in 10 (12%) say they never plan to have those discussions.

These conversations, while difficult, can align expectations and reduce the risk of misunderstandings later.

Wills and Estate Planning Among Younger Americans

- Only 13% of Americans aged 18–44 currently have a will.

- Of the 85% who don’t, 34% say they lack the assets to leave behind, 31% think they don’t need one yet, and 17% don’t know where to start.

These observations reflect a common misconception that wills are only necessary for those with significant assets. In reality, a will can help ensure even modest estates, or non-financial items with sentimental value, are distributed according to one’s wishes.

Younger Americans may feel less financially secure than older generations, but they’re still committed to the idea of leaving a legacy. Whether it’s financial assets, property, or family traditions, this group views inheritance as a way to provide stability and continuity for loved ones.

Next, we’ll shift focus to older Americans to understand what they expect to leave behind and how they’re preparing for it.

The Inheritance Plans of Older Americans

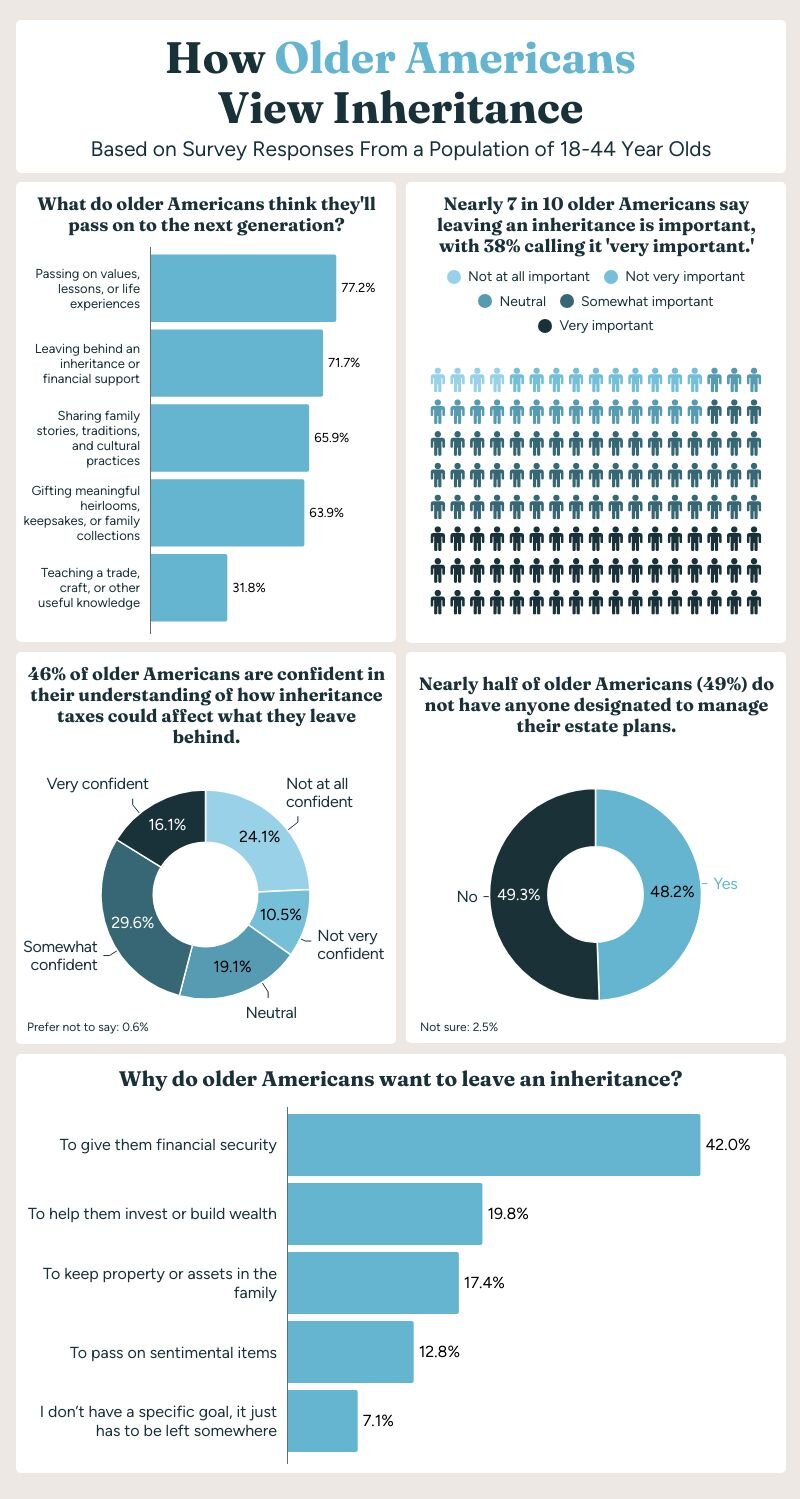

For many older Americans, inheritance planning isn’t just about assets. It’s about values, stability, and the future of their families. Our survey of Americans aged 45 and older with children reveals a group that largely intends to leave something behind, though confidence and readiness vary depending on financial standing and life circumstances.

Financial Confidence in Later Years

- 13% of older Americans feel very confident in their financial situation, while 36% report some level of “not confident.”

- Renters are nearly three times as likely as homeowners to say they are “not at all confident” about their finances (24% vs. 9%), underscoring the role homeownership plays in financial security.

Compared to the 7% of younger Americans who feel very confident, this group is modestly more assured, but financial insecurity still weighs on many.

What Older Americans Plan to Pass On

When asked what they expect to leave to the next generation, the most common responses included:

- Values and life lessons (77%)

- An inheritance (72%)

- Family or cultural traditions (66%)

- Meaningful heirlooms or keepsakes (64%)

The emphasis on both tangible and intangible legacies mirrors younger Americans’ priorities, but older Americans are slightly more likely to prioritize leaving financial assets.

Passing on a Home

- Two-thirds of older Americans are at least somewhat confident their heirs could keep and maintain a home if they inherited one.

- 11% are not confident they could, and another 11% do not intend to leave a home at all.

For homeowners, property can represent both financial value and family history, which are driving reasons behind many aims to keep it in the family.

How Important Is Leaving an Inheritance?

- Nearly 77% say passing on an inheritance is important to them, with 38% calling it very important.

- Parents with children under 18 are especially focused on financial legacy. 47% say it’s very important, compared to 34% of parents whose children are all adults.

- Homeowners are more confident than renters about leaving something behind, with 59% of owners saying they’re “very likely” to do so, versus 37% of renters.

Another example that illustrates how both life stage and asset ownership play a major role in shaping how strongly people prioritize leaving a financial legacy.

Why Leave Something Behind?

The main motivations include:

- Giving heirs financial security (42%)

- Helping them invest or build wealth (20%)

- Keeping property or other assets in the family (17%)

Women are more than twice as likely as men (16% vs. 7%) to prioritize leaving sentimental items as their top reason, and renters are nearly twice as likely as homeowners to say the same (21% vs. 9%).

Conversations About Inheritance Plans

- 49% of older Americans have already discussed their inheritance plans with loved ones.

- 43% haven’t had the conversation yet but are open to it.

- 8% say they will not have that conversation.

Common reasons for not having discussed it yet include plans to do so in the future (40%), not feeling it’s the right time (29%), the plan not being finalized (28%), and having unclear plans (24%).

Clear communication about inheritance can help bridge the expectation gap we identified earlier, yet for many families, these conversations are still pending.

Estate Planning and Preparedness

- 48% of older Americans have a will or estate plan in place.

- Of those without one, 45% haven’t gotten around to it, 12% are in the process of creating one, and 12% don’t know where to start.

- Homeowners are almost twice as likely as renters to have a will or estate plan (56% vs. 28%).

- Nearly half of respondents (49%) do not have someone designated to manage their will, highlighting a key gap in estate planning.

Concerns About Taxes

- More than 48% of older Americans are worried about taxes reducing their loved ones’ inheritance. 20% are very concerned, and 27% are somewhat concerned.

- Nearly 70% haven’t taken any steps to reduce the potential tax burden.

There seems to be a significant gap between the intention to leave an inheritance and the steps taken to ensure those wishes are carried out.

Older Americans largely share the same intent as younger generations: to pass something meaningful on. But their ability to do so depends on financial confidence, asset ownership, and taking proactive steps to formalize their plans.

Strengthening communication with heirs and putting estate planning documents in place can help ensure their legacies, both tangible and otherwise, are preserved.

“An inheritance is more than assets. It’s a story, a safety net, and a gift to the future. With clear, accessible estate planning, families can turn intentions into legacies and ensure what they’ve built truly makes an impact for generations to come.”

— Matt Palmer, Senior Product Counsel at LegalZoom.

Closing Thoughts

Our study highlights a gap between what younger Americans expect to inherit and what older Americans plan to leave behind. While many in both groups value the idea of passing on assets, whether financial, property, or personal, the details often don’t align perfectly. Economic pressures, financial confidence, and asset ownership all play a role in shaping those expectations and plans.

Bridging that gap requires more than good intentions. Clear communication, documented plans, and informed decision-making can help ensure that inheritances meet both the giver’s wishes and the recipient’s needs.

LegalZoom offers tools and guidance to make estate planning more accessible, helping families turn their intentions into legally sound plans. From creating a will to designating someone to manage an estate, these steps can preserve legacies and provide peace of mind for generations to come.

Methodology

To better understand how inheritance expectations are shaping financial behaviors across generations, we surveyed 2,000 U.S. adults in August 2025. The sample included 1,000 respondents ages 18–44 (Gen Z and millennials) and 1,000 respondents ages 45 and older who have children (Gen X and baby boomers).

Respondents were screened to ensure representation across income levels. Younger participants were not restricted by homeownership, while older participants were required to have children to reflect the population most likely to leave property or other assets.

The survey asked younger respondents about their expectations of receiving an inheritance and how those expectations influence financial decisions. Older respondents were asked about their plans to leave an inheritance, the assets they intend to pass down, and how economic factors or taxes may affect those plans. Questions also explored communication patterns, knowledge gaps, and confidence around estate planning.

The survey was conducted online over one week in August 2025.