If you’re looking for the right state to form a corporation, Florida might be a great choice. The state recently earned the top spot on WalletHub’s list of the best states to start a business in 2026, thanks in large part to its low corporate tax rate, growing population, and favorable business climate.

But before you jump into business in the Sunshine State, you’ll need to understand exactly what you need to do to get your corporation off and running in the great state of Florida and how to tell if it’s the right business structure for you.

What is a corporation?

A corporation is a business entity that exists separately from its owners. When you incorporate in Florida, you create a legal entity that can own property, enter into contracts, sue and be sued, and conduct business independently.

The primary benefit of this separation is that it means owners are not personally liable for the corporation's debts and obligations. This protection extends to lawsuits against business partners or employees, provided corporate formalities are maintained.

Florida corporations are governed by the Florida Business Corporation Act (Florida Statutes Chapter 607) and must comply with ongoing requirements including annual report filings, maintaining corporate records, and adhering to corporate formalities to preserve limited liability protection.

Benefits of forming a corporation in Florida

A corporation offers significant advantages for business owners in Florida:

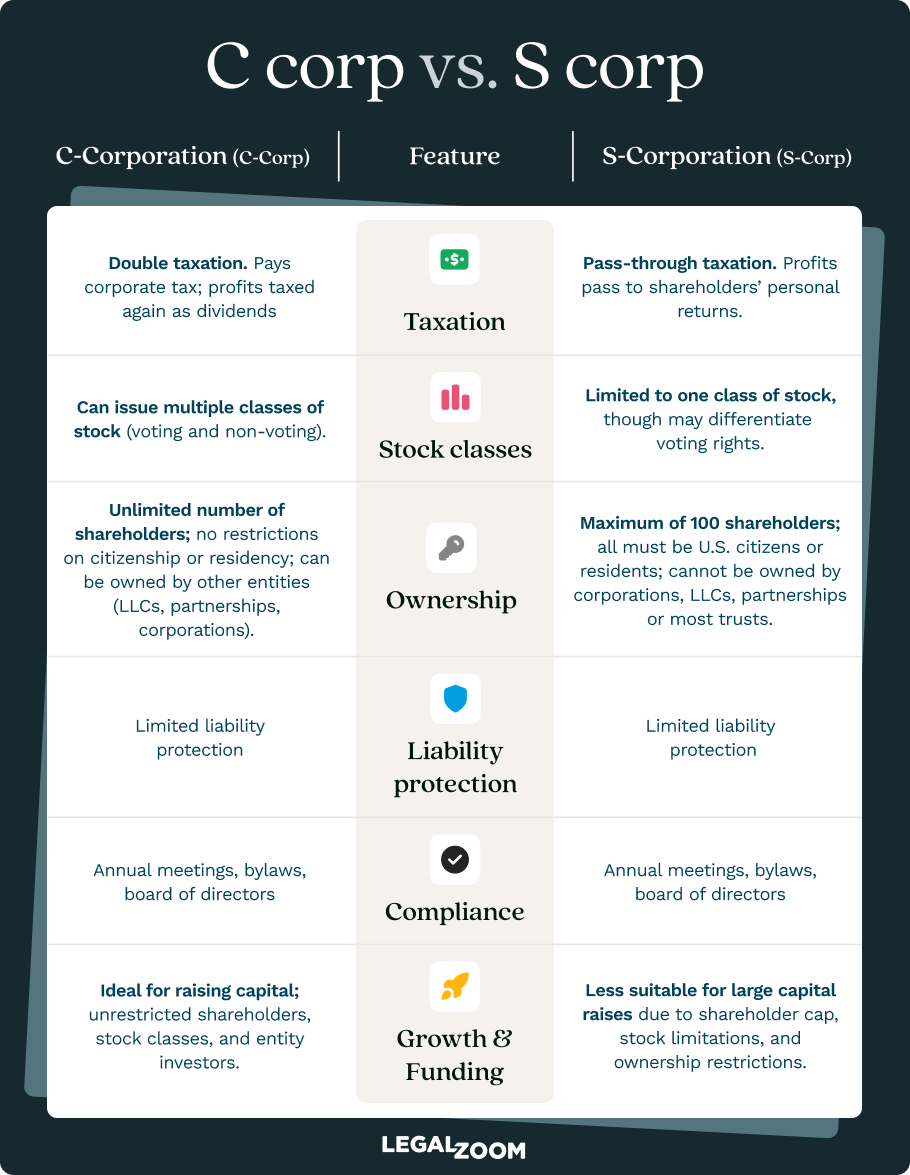

- Tax flexibility. Florida corporations can elect different tax treatments with the IRS, including S corporation status, to avoid double taxation. Florida also has no state income tax on individuals, making it attractive for business owners.

- Competitive corporate tax rate. At 5.5%, Florida’s corporate tax rate is lower than many other states, which can be a huge benefit for corporations that aren’t exempt from double taxation.

- Healthy business climate. As touched upon earlier, Florida’s business climate is considered one of the best in the country for a number of reasons, including streamlined regulatory processes and the size and availability of its labor force.

How do I form a Florida corporation?

Step 1: Choose a corporate name

Before you can register your corporation with the state, you’ll need to decide on a name. Your Florida corporation name must comply with specific requirements:

- The name must include "Corporation," "Incorporated," "Company," or the abbreviations "Corp.," "Inc.," or "Co."

- The name must be distinguishable from all other legal entity names on file with the Florida Division of Corporations.

- The name must be available. Search the Florida Division of Corporations database to verify name availability.

Unlike other states, Florida does not allow you to reserve a name before filing your formation paperwork. If you want a specific name, you will have to get your paperwork together quickly so that no one else grabs it first.

Step 2: Appoint a registered agent

Every Florida corporation must have a registered agent and registered office address. The registered agent requirements under Florida law include:

- The registered agent must have a street address (not a P.O. box) in Florida.

- The registered agent must consent by signing the articles of incorporation agreeing to serve.

- The agent must be an individual Florida resident aged 18 or older, or a business entity authorized to do business in Florida.

- The agent must be available during normal business hours to receive legal documents.

The registered office address must be identical to the registered agent's business address in Florida and may be the same as your corporation's principal place of business if one of your employees is serving as the registered agent. Note that your business cannot serve as its own registered agent.

Step 3: Prepare and file articles of incorporation

File your articles of incorporation with the Florida Division of Corporations. The articles must include:

- Corporation name

- Principal place of business street address

- Mailing address (if different)

- Corporate purpose

- Stock structure details

- Registered agent name, signature, and Florida address

- Incorporator names, signatures, and addresses

Submit your form and pay the relevant fees ($35 for articles of incorporation plus $35 registered agent designation fee).

Step 4: Appoint directors

Florida corporations must have at least one director who meets these requirements:

- Must be an individual (not a corporation)

- Must be 18 years or older

There is no Florida residency requirement, nor must they be a shareholder. Additional eligibility requirements may be imposed by articles or bylaws. Note that directors have fiduciary duties to act in good faith and place corporate interests ahead of personal interests.

Step 5: Hold an organizational meeting and create bylaws

While not required for incorporation in Florida, bylaws serve as the corporation's internal operating manual. Directors or incorporators must adopt bylaws unless the articles of incorporation give this power to shareholders. Bylaws should:

- Be consistent with Florida law and the articles of incorporation

- Include provisions for managing corporate affairs

- Be kept at the corporation's place of business (not filed with the state)

Incorporators must hold an organizational meeting to adopt bylaws.

Step 6: Obtain an EIN and set up business banking

All Florida corporations must apply for a federal employer identification number (FEIN, also called an EIN) with the IRS using Form SS-4 or online at IRS.gov. This number is needed to pay income taxes and hire employees.

Your EIN may also be needed if you open a business bank account, which is a helpful way to establish further separation between your personal and business life. While requirements can vary by financial institution, banks will typically ask for some identifying information for your corporation, such as an EIN, your articles of incorporation, or other documents.

Step 7: Register for taxes (if applicable)

In addition to obtaining your EIN number with the federal government, you may need to register for other types of taxes, depending on your business type.

For example, if your corporation plans to sell taxable goods or services, you’ll need to register with the Florida Department of Revenue to collect sales tax. If you’re hiring employees, you’ll need to register for reemployment tax to have taxes withheld from their paychecks for distribution into an unemployment fund.

Step 8: Maintain corporate records and compliance

Owning a corporation comes with a laundry list of ongoing responsibilities, including things like renewing business licenses and permits, holding annual shareholder and director meetings, keeping accurate financial records, and filing annual reports with the state. Staying compliant with these tasks is essential to maintain good standing in the state of Florida.

How LegalZoom helps with Florida corporation formation and compliance

LegalZoom provides comprehensive corporation formation services tailored to Florida's specific requirements. Our experienced team can help with everything from name searches to preparing and filing articles of incorporation. Plus, our ongoing compliance support can take the guesswork out of annual report preparation and filing as well, ensuring you never miss a deadline.

How much does it cost to incorporate and maintain a corporation in Florida?

It will cost you $70 to form your Florida corporation ($35 to file your articles of incorporation and $35 for your registered agent designation fee).

However, there are also ongoing compliance costs to be aware of. Annual reports—which must be filed annually by May 1—have a filing fee of $150. Annual reports that are filed late incur a $400 penalty fee.

Additionally, if your business requires any other business licenses, permits, professional licenses, or certifications, these typically need to be renewed at a regular cadence and may incur additional costs.

Florida corporation FAQs

Can I be my own registered agent in Florida?

Yes, if you're a Florida resident aged 18 or older with a Florida street address. However, using a professional registered agent service ensures you never miss important legal documents and maintains privacy by keeping your personal address off public records.

How long does it take to form a corporation in Florida?

Online filings through Sunbiz are typically processed immediately during business hours. Mail filings take 5–10 business days, while in-person filings receive same-day processing. Your corporation legally exists once the Division of Corporations accepts your filing.

Do I need an attorney to form a Florida corporation?

While not required, consulting with an attorney is recommended for complex situations or if you need guidance on corporate structure, bylaws, or compliance requirements. Many business owners successfully form corporations using online services or by filing directly with the state. All of LegalZoom’s corporation formation plans include a consultation with a small business specialist to help you get off the ground.

Can a Florida corporation have just one owner?

Yes, Florida allows single-shareholder corporations. You still need at least one director (who can be the same person as the shareholder) and must maintain corporate formalities including bylaws, meetings, and proper record-keeping.

What's the difference between incorporators and directors?

Incorporators are the people who sign and file the articles of incorporation. They have no ongoing role after formation unless they're also named as directors. Directors are responsible for managing the corporation and making major business decisions. Florida requires at least one director who must be 18 or older.

Jane Haskins, Esq., contributed to this article.