A Georgia corporation is a type of legal business entity that you can form with the Georgia Secretary of State (SOS). Unlike sole proprietorships or partnerships, a corporation exists independently from its owners (the shareholders), which means shareholders generally aren’t personally responsible for the corporation's debts or legal obligations.

Corporations are made up of three distinct groups: shareholders (who own the company), directors (who set the company’s strategic direction), and officers (who handle day-to-day operations). While they’re typically more complex to manage than other business structures, they offer several advantages that can be well worth the added effort.

Benefits of forming a corporation in Georgia

- Limited liability protection. The corporate structure generally shields shareholders' personal assets from business debts and lawsuits.

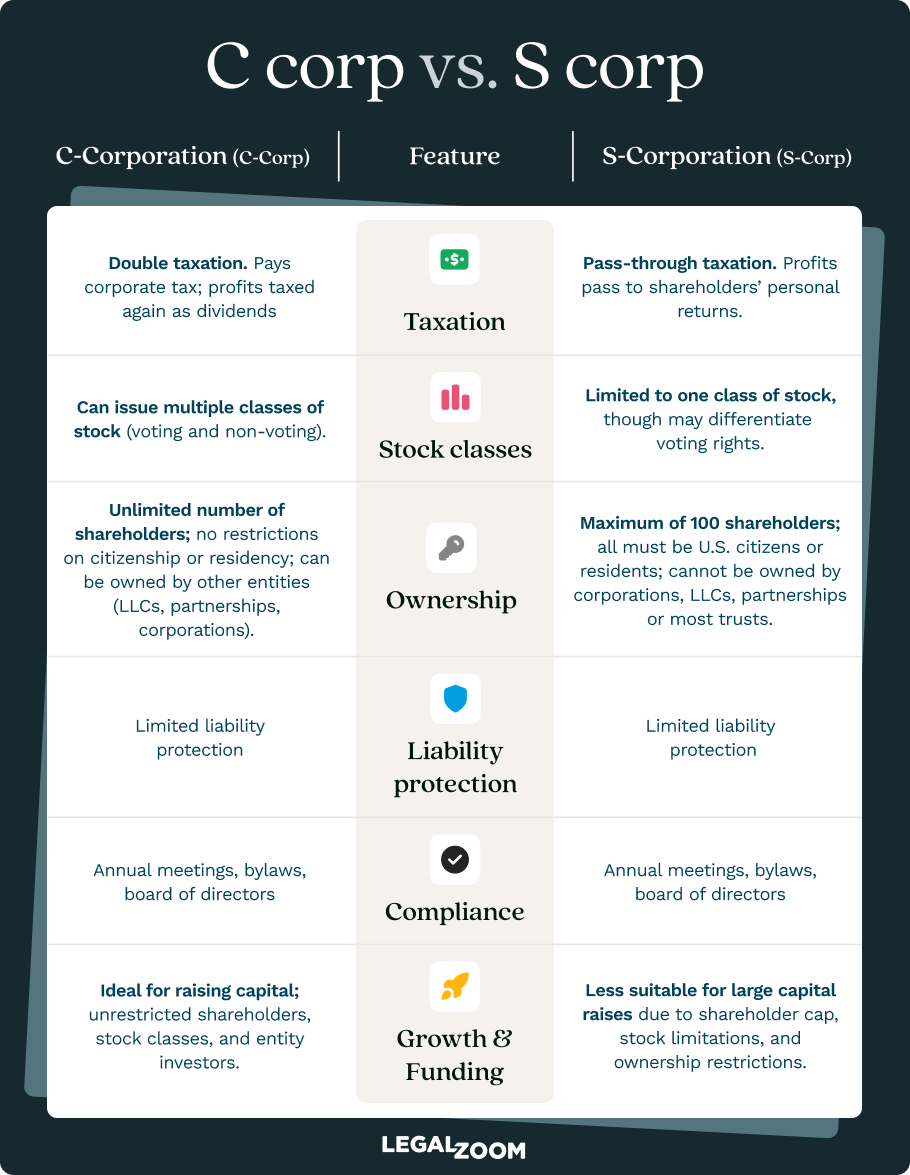

- Tax flexibility. Georgia recognizes S corporation status, which can help eligible small businesses avoid double taxation while maintaining certain corporate benefits.

- Credibility. The corporate structure enhances business credibility with customers, vendors, and lenders.

- More opportunities to raise capital. Corporations can issue different classes of stock to attract investors.

- Georgia's business climate. The Peach State consistently ranks among the top states for businesses in the U.S., with supportive regulations and economic incentives.

- Streamlined processes. The Georgia SOS’ online filing portal and streamlined process make incorporation more straightforward than in other states.

How to register a corporation in Georgia

To form a corporation in Georgia, you need to file articles of incorporation with the Secretary of State. You can have us file for you or file yourself through these steps.

But, it doesn’t end there. Once you’ve incorporated, there are a few more steps to get your business operational and in compliance with state and federal laws.

Step 1: Confirm name availability

Before you file articles, make sure your proposed business name is available and meets Georgia naming requirements:

- All corporation names must include the words "corporation," "incorporated," "company," or "limited," or the abbreviations "corp.," "inc.," "co.," or "ltd."

- A corporation's name must be distinguishable from the names of other business entities on file or currently reserved with the SOS.

- A corporation name can’t be more than 80 characters long, including spaces and punctuation.

- The name can’t contain obscene language or imply the corporation is organized for purposes that are illegal or contradict its articles of incorporation.

The easiest way to check name availability is to conduct a Georgia business search. The SOS provides an online database of currently registered businesses. If your desired name doesn’t pop up on their database, it’s likely available.

Note. If you’re not ready to file articles yet, you can file a name reservation application with the SOS to reserve it for 30 days. It costs $30 to file online and $35 to file by mail or in person.

Step 2: Appoint a Georgia registered agent

A registered agent is a person or entity that receives official correspondence and legal documents on behalf of the corporation. Georgia law requires every corporation to maintain a registered agent and registered office within the state. While you get to choose your own agent, they must meet state requirements:

- Is an individual Georgia resident, or

- Is a domestic or foreign Georgia business entity, such as a corporation or LLC

- Has a business office in Georgia that’s identical to the registered office

- Is available at their registered office during regular business hours

A corporation can’t serve as its own registered agent, but a director or officer of the corporation can. That said, many businesses choose to hire a professional agent for the security and flexibility.

Step 3: Publish a notice of intent to incorporate

Georgia has a unique requirement that incorporators must arrange for the publication of a notice of intent to incorporate. Page six of the articles of incorporation outlines how to format the notice. It must appear in the official local government newspaper, or “legal organ,” in your registered office’s county.

The Clerks’ Authority has a helpful “clerks” page that you can use to search your registered office’s county and learn its legal organ. Send the request for publication with a $40 filing fee to the newspaper either before or no later than one day after filing articles of incorporation.

Step 4: File articles of incorporation

Articles of incorporation is the set of documents that officially forms your corporation under Georgia law. Here’s what it needs to include:

- Name of the corporation

- Number of shares it will be authorized to issue

- Registered agent name

- Registered office county and address (not a P.O. box)

- Names and addresses of incorporators

- Corporation’s mailing address

The filing fee is $100. You can file online through the Secretary of State's business portal, by mail, or in person to the following address:

Office of Secretary of State

Corporations Division

2 Martin Luther King Jr. Dr. SE

Suite 313 West Tower

Atlanta, Georgia 30334

Step 5: Hold an organizational meeting and adopt bylaws

After incorporation, you’ll need to elect a board of directors and hold an organizational meeting to do the following:

- Adopt bylaws

- Elect directors

- Appoint officers (at least one)

- Authorize issuing stock

- Adopt corporate resolutions

- Authorize corporate bank accounts

Corporate bylaws outline the internal rules and procedures for operating your corporation. While bylaws are not filed with the Secretary of State, they must be adopted after incorporation.

These are some common provisions to consider:

- Number of directors and officers

- Duties and responsibilities of directors and officers

- Procedures for shareholder meetings

- Voting procedures and quorum requirements

- Stock transfer restrictions

- Amendment procedures

- Indemnification provisions

Step 6: Obtain state and federal tax IDs

Next, you’ll need to apply for an employer identification number (EIN). An EIN is a federal tax ID that your corporation requires in order to file federal taxes. It's also necessary for opening a business bank account, hiring employees, and obtaining certain licenses and permits.

You can apply for free online through the Internal Revenue Service (IRS) or have LegalZoom handle it for you.

Once you have your EIN, you can register with the Department of Revenue. This is a mandatory step for most corporations to sign up for the following taxes:

- Corporate income tax: 5.19%

- Sales and use tax: 4% state rate, county rates vary

- Withholding tax: For employers

These are just the most common, but certain professions or business activities will require you to sign up for additional taxes—a CPA or tax advisor can help you know for sure. You’ll receive an email with your state tax ID number after you sign up. Keep this information safe. You’ll need it to log in and file your business taxes.

Step 7: Open a corporate bank account

This step is helpful to maintain your limited liability status and protect your personal assets. A separate business bank account will also help ensure your business keeps proper financial records.

Here’s what you’ll generally need:

- Certificate of incorporation

- EIN

- Corporate bylaws

- Board resolution authorizing account opening

- Identification for authorized signers

Step 8: File initial annual registration

Don’t skip this step! Georgia corporations must file an initial registration within 90 days of incorporation and then annually thereafter. The initial registration requires information about the corporation's officers and registered agent and includes a $60 filing fee. You can file this report online or by mail as well.

Georgia annual registration and ongoing compliance

In addition to keeping up with taxes and licenses, Georgia corporations need to file an annual registration to maintain compliance with the state. The purpose of this report is to update the SOS on your business’ basic information, such as officer, registered agent, and mailing information.

Annual registrations are due anywhere between January 1 and April 1. File with the Secretary of State either online or by mail and pay a $60 filling fee.

Start your Georgia corporation with LegalZoom

There's a reason more than four million businesses have chosen LegalZoom to help them get off the ground. Our incorporation service can take care of everything you need to form your Georgia corporation.

Here are some of the perks:

- Streamlined process. LegalZoom combines technology and experience to take the guesswork (and paperwork) out of business formation. Our online process can help you start your corporation in minutes.

- Expert support. All of our corporation formation packages include a meeting with a small business specialist and a consultation from 1-800Accountant.

- A full suite of services. Beyond just incorporation services, LegalZoom supports all your business filing needs. We provide year-round compliance management, bookkeeping tools, dedicated business attorneys, registered agent services, and trademark registration.

FAQs about Georgia corporations

How long does it take to form a corporation in Georgia?

Standard processing takes seven to 15 business days. However, you can elect for two-day processing for an additional $100, one-day processing for $250, or one-hour processing for $1,000.

Do I need a lawyer to incorporate in Georgia?

No, Georgia doesn’t require you to have a lawyer to file articles of incorporation. But, the state does recommend getting professional advice. Consulting an attorney can help ensure you choose the right business structure for your goals and are aware of the various compliance requirements.

What is a registered agent and why do I need one?

A registered agent is a person or entity that receives official documents and legal notices on behalf of your corporation. Georgia law requires every corporation to have a registered agent with a Georgia address to ensure the state and courts can reach your business.

Can I be my own registered agent?

Yes, you can be your company’s registered agent if you’re a Georgia resident. However, the registered agent must be available at the registered office during regular business hours, which can be challenging for busy business owners.

How do I change my corporation's name or address?

To change your corporation's name, file articles of amendment with the Secretary of State for a $30 fee.

What happens if I miss my annual registration?

Late annual registrations have a $25 penalty fee. If you fail to file for two consecutive years, the Secretary of State may administratively dissolve your corporation. Dissolved corporations can be reinstated by filing all delinquent registrations and paying associated fees and penalties.

How do I dissolve a Georgia corporation?

To voluntarily dissolve your corporation, you must file articles of dissolution with the Secretary of State (no fee) after obtaining shareholder approval and settling all debts and obligations. You must also file final tax returns and cancel any business licenses.

Jane Haskins, Esq. contributed to this article.