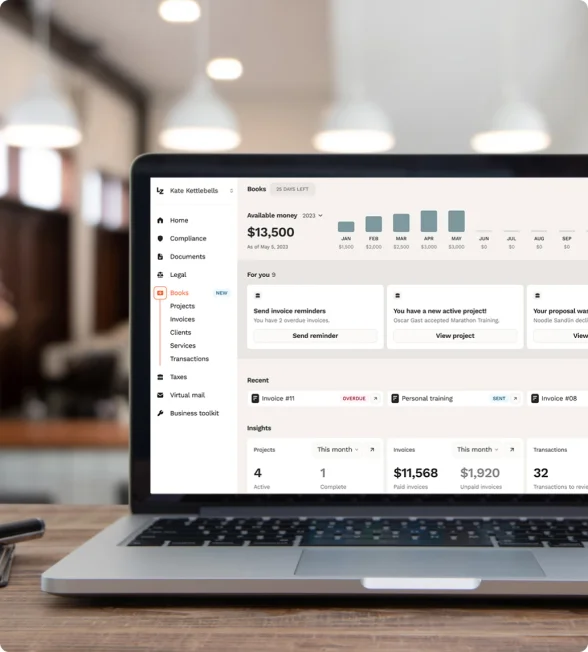

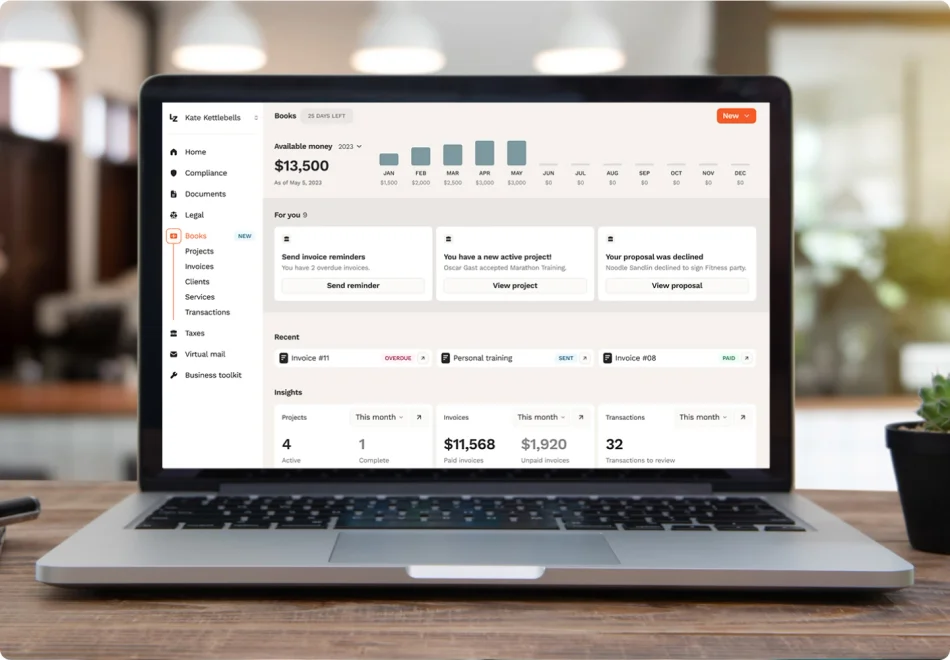

Simplify your small business accounting

LZ Books helps you easily manage your books with expense and income tracking, invoices, and payments all in one place. Plus, conveniently access other small business solutions from LegalZoom.

30-day free trial, no credit card required. $9.99/mo if you subscribe after the trial.

Why use LZ Books to manage your bookkeeping and projects?

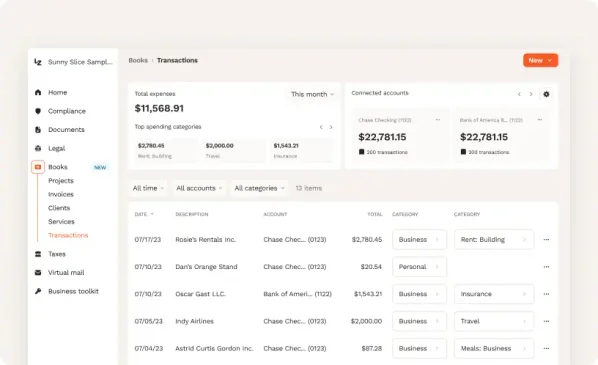

Accounting made easy

Connect your bank accounts to automatically categorize your income and expenses and simplify bookkeeping.

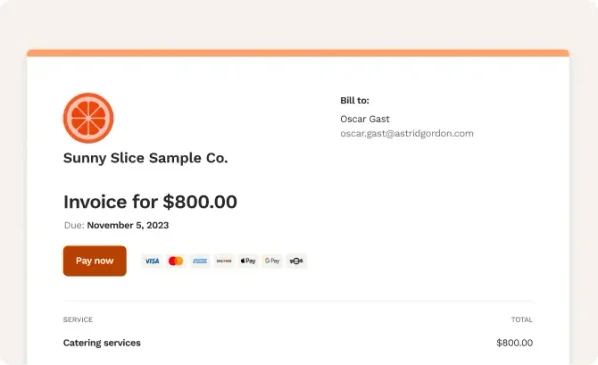

Get paid for your work

Create unlimited proposals and invoices that match your brand, and let clients pay with bank transfers and credit or debit cards.

Be ready for tax time

Seamlessly export financial statements for your tax preparer to maximize deductions.

Get a free trial of LZ Books—on us

LZ Books

$0 for 30 days (no credit card required)

$9.99

/mo if you subscribe after trial

Start free trial

With LZ Books, you can:

Track income and expenses with auto-categorization

Connect your bank accounts

Send unlimited customized proposals and invoices

Receive credit and debit card payments and bank transfers 24/7

Export data easily for tax season

How to get started with LZ Books in 3 easy steps

Sign up for your free trial

Start your 30-day free trial and explore the many ways we make the financial side of running your small business easier.

Connect your bank account

Securely connect your bank accounts to LZ Books—stay organized and maximize tax deductions with auto-categorization of income and expenses.

Engage with your clients

Create custom proposals to attract new clients, and easily generate branded invoices with your logo—no need for separate invoicing software.

Start free trial

What’s included with LZ Books

Get an easy-to-use accounting software solution for your small business.

Proposals

Book more work with custom proposals.

Unlimited proposals. Send as many proposals to clients as you want with the option to request formal acceptance with built-in eSignature. Edit proposals whenever you need as you work out project details.

Customization. Brand your proposals with your small business name, logo, and colors. Plus, add service details.

Client directory. Save as many client contacts as you'd like, making it simple to send proposals.

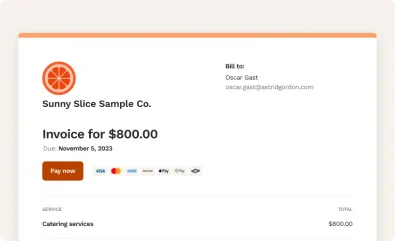

Invoicing

Get paid fast with easy-to-use invoicing features.

Unlimited invoices. Send as many invoices as you want to clients—and edit, and resend as needed.

Deposit requests. Include required deposits in your proposals for added confidence before getting started.

24/7 payments. Accept credit, debit, and ACH payments directly to your bank account, anytime.

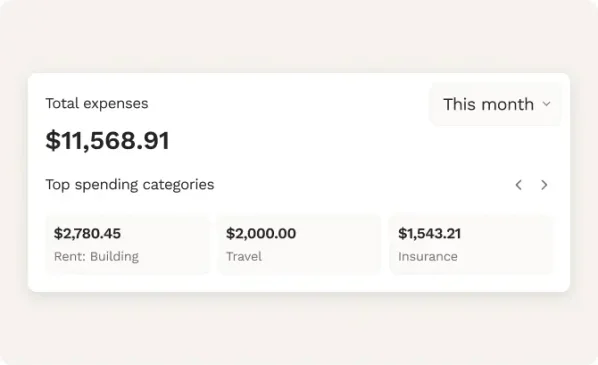

Bookkeeping

Free up your time by automating your bookkeeping.

Bank connection. Securely connect your bank accounts to seamlessly import your transactions.

Transaction tracking. Separate personal and business transactions and auto-categorize income and expenses into tax-ready categories.

Cash-based bookkeeping. Use this simpler method of bookkeeping, ideal for your service-based business.

Tax time ease

Get prepared for tax season and maximize your refund.

Tax auto-categorization. Automatically categorizes your transactions into tax-ready categories—no need to do this manually.

Financial reports. Download basic financial statements to provide to your tax preparer.

Seamless integration. Easily share financial information with your tax preparer.

Ready to start your free trial of LZ Books?

Start free trial

Why it’s important to use accounting software for small business

Manage your books

Ensure your income and expenses are tracked and categorized correctly.

Win new work

Customize and send proposals to potential clients and take deposits upfront.

Invoice clients easily

Generate invoices easily to make it convenient for clients to pay.

Get paid sooner

Accept credit and debit payments and bank transfers directly into your bank account.

Understand trends

Track your income, expenses, profits, and invoices with month-over-month trends.

Save time at tax season

Seamlessly download and share with your tax preparer.

How do small businesses track income and expenses?

There are many different ways that small business owners choose to track income and expenses—from manually adding info to spreadsheets to using more robust solutions like accounting software. For many small businesses, it makes sense to use a solution that combines the benefits of accounting, invoicing, and expense tracking software—like LZ Books.

LZ Books makes it easy to customize proposals, send unlimited invoices, connect to your bank accounts, separate personal from small business expenses, and automatically categorize income and expenses to get you ready for tax season.

What is the best way to track expenses for a business?

Every small business owner finds expense tracking solutions that work for them, and which often evolve as their small business grows. When just starting out, some small business owners use two credit cards and two separate bank accounts. Others use notebooks or Excel spreadsheets to track business expenses. Some find it necessary to hire a bookkeeper.

LZ Books is an accounting software designed for small business owners who want a simple solution that takes care of a lot of the work for them. Once you connect your bank accounts, LZ Books lets you separate your business from personal expenses while auto-categorizing business expenses and income to help prepare for tax season.

And as part of LegalZoom, LZ Books offers access to a one-stop small business solutions shop. This includes industry-leading and affordable subscription plans for personalized services including expert tax advice, and attorneys for legal guidance.

Start free trial

What expenses should I track for my small business?

Small business owners typically track both operating and non-operating expenses—some related to the day-to-day tasks of running your business, and some more unusual. With LZ Books, you don’t have to worry whether you’re tracking the right expenses, since our accounting software auto-categorizes your transactions.

Operating expenses

These expenses include everything incurred during the regular course of business, such as:

Marketing and advertising

Accounting, legal, and IT help

Rent and utilities

Rent and utilities

Training and education

Non-operating expenses

These expenses are unrelated to a business' core operations, such as:

Interest

Taxes

Impairment changes

"One-offs" or unusual expenses

Frequently asked questions

How does LZ Books help me manage bookkeeping?

LZ Books simplifies bookkeeping for your small business with many convenient features.

Our cash-based accounting software takes the challenging task of bookkeeping off your plate every month, plus saves you time and energy when tax season arrives.

You can securely connect your bank accounts to LZ Books and automatically import up to 24 months of transactions. This lets LZ Books separate your personal and business transactions—and, auto-categorize your business expenses and income into tax-ready categories, all of which you can edit.

LZ Books is unique because it’s not only an easy accounting software solution, but as part of LegalZoom, offers access to a one-stop small business solutions shop. This includes industry-leading and affordable subscription plans for personalized services including attorneys for legal guidance.

How does LZ Books help me secure work?

To help make it easier to manage current clients, LZ Books lets you create and send invoices, track their status—even accept online payments.

How does LZ Books help me get paid?

You can easily add your contact information and details about services to your invoices and save your settings to use later—saving you time and effort.

We even allow you to accept debit, credit, and bank transfer payments so you can go from invoicing a client to having more money in your bank account even faster.

How does LZ Books help me maximize deductions and save time during tax season?

LZ Books is an accounting software solution that auto-categorizes income and expenses into tax-ready categories, plus makes it simple to export data for your tax preparer.

How does LZ Books help me track and manage projects and clients?

LZ Books also allows you to use invoicing features like creating custom invoices and accepting digital payments from your clients.

How much does bookkeeping software cost?

How do I keep track of expenses when I’m self-employed?

There are many benefits to using an accounting software solution like LZ Books, such as automatically separating personal and small business transactions, and auto-categorizing business expenses into tax-ready categories, which can help you maximize tax deductions. There are also invoicing features, like the ability to customize and send unlimited pay-enabled invoices to clients; and other accounting features such as income tracking and trends, to help you run your business more easily.

What should I track for my small business?

LZ Books makes it simple to track proposals you’ve sent to clients and whether they’ve been accepted, as well as track client invoices and whether they’ve been paid or not. We also let you create a client directory so you can keep track of their contact info and other service details.

You'll get helpful business insights allowing you to stay on top of your income, expenses, profit, and unpaid invoices with month-over-month trends.

Where can I learn more about using LZ Books?

For an in-depth tutorial on LZ Books and how to best use its features, visit our LZ Books knowledge base.

Ready to start your free trial of LZ Books?

Start free trial

I highly recommend ... LegalZoom for your business needs. … I would recommend them to everyone who is looking to start a business.

—C. Sgroi, LegalZoom customer

LegalZoom was quick, accurate, and attentive to detail. They make sure to emphasize quality results and customer care…

—G. Wallace, LegalZoom customer

LegalZoom made everything 10 times easier for my business. Fast, easy, and very professional.

—Luis C., LegalZoom customer