Thinking about a prenuptial agreement before you get married? You're not alone. According to a 2023 poll by Axios, a full 50% of American adults said they’d be open to signing a prenup. Overwhelmingly, the demographic most on board with the idea of a premarital agreement was millennials.

That said, popularity isn’t everything, and deciding whether a prenup is appropriate for you and your spouse-to-be is an intensely personal process—a core part of which is knowing exactly what can and can’t be covered within a prenuptial agreement.

What is a prenup?

A prenuptial agreement, or prenup, is a legally binding contract between two people engaged to be married that covers what happens to each person's assets and debts in the event of a divorce. Currently, prenups in 28 states follow the 1983 Uniform Premarital Agreement Act, a piece of federal legislation meant to standardize premarital agreements across the United States. Still, prenups in the remaining 22 states can vary significantly in scope and enforceability, so it's always best to draft your own prenuptial agreement with the help of a family law attorney.

Everything prenuptial agreements can protect

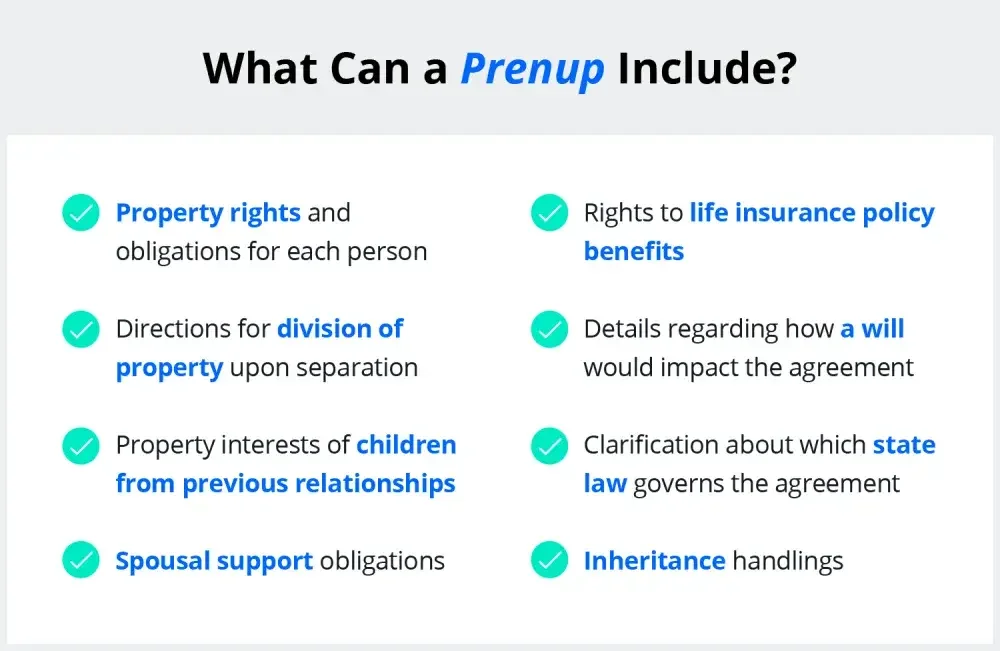

Prenups grant couples broad rights to outline financial and personal guidelines regarding married life, including subjects such as:

Property rights and obligations

If one spouse enters into the marriage with his or her separate property, a well-drafted prenup might contain a provision outlining that maintenance costs post-divorce wouldn't fall on the individual without an ownership interest.

Division of property

Key to any good prenup are provisions outlining how marital and personal property should be divided in the event of a divorce, such as vacation homes or vehicles. So long as such provisions aren't considered unjust or unfair, the law allows broad freedoms for couples to choose to divide assets.

Also, keep in mind that prenups can be used to divide any debts incurred during the marriage. If your future spouse plans on continuing their education, for example, a prenup can specify that repaying that school debt is the spouse's responsibility.

Dependents' interests

For partners with children or dependents from a previous marriage, prenuptial agreements are an excellent way to protect them in the event of divorce. Specifically, prenups can set aside pieces of property or other assets that are intended for existing dependents and, as such, shouldn't be considered marital property.

Spousal support

When most people think about prenuptial agreements, they tend to think of alimony. And, although it's common for prenups to waive rights to alimony completely, they can also be used to set a minimum alimony. By doing so, both partners know the minimum of what to expect in the case of separation.

Life insurance policies

A prenup can contain provisions outlining how to handle a life insurance plan, either by naming your spouse the beneficiary or specifying someone else to receive a part of the payout. Also, prenups can be used to require that your partner get a life insurance policy in order to ensure you're taken care of in the event of their death.

Will and trust considerations

Prenups and estate planning documents have a complicated relationship that we'll explore a little later, but the courts will typically favor a prenuptial agreement over a will. Also, a prenup can require that your spouse create a will, determine how marital property should be divided after death, or waive either spouse's right to their elective share of an existing will.

Inheritances

For individuals who expect to receive an inheritance, a prenup is an excellent way to protect those future assets from becoming shared marital property.

Which state law will govern the agreement?

As we mentioned earlier, the laws regarding prenuptial agreements can vary significantly from state to state. Because of this, many prenups specify which state's laws should be used to govern or arbitrate the agreement.

Everything prenuptial agreements can’t protect

Powerful legal documents, though they may be, prenups have several limitations to be aware of before tying the knot.

Child support and custody

As a blanket rule across all states, prenups cannot predetermine child custody, support, or visitation rights. Instead, the courts will decide what is appropriate in the event of a divorce based on the best interests of the child—not the parents.

Considerations such as the exact amount of child support that should be paid will also factor in state guidelines and the child's specific needs.

Day-to-day household matters

In general, federal and state law restricts prenups to financial issues and marital responsibilities. More personal, routine matters, such as household chores or beliefs about how to raise children, have no place in a prenup and may make it unenforceable.

Also, a prenup is viewed in the eyes of the law as a contract between equals, meaning that neither spouse can include provisions about their partner's physical appearance, religious beliefs, or hobbies.

Illegal provisions

Though this may seem obvious, prenups cannot contain any provisions involving illegal activities or requiring either spouse to engage in such activities.

Anything that encourages divorce

During the divorce process, the court will check your prenup for any language or clauses that go against the general policy of promoting marriage, such as a financial incentive for filing for divorce. Not only are such clauses unenforceable, they may invalidate your prenup in its entirety if included.

Anything unfair or unjust

One of the core underlying philosophies of prenuptial agreements is that they should be fair and just for both spouses. To that end, a prenup cannot contain any provision that significantly favors one spouse over another, such as a disproportionate property division after divorce.

Reasons to get a prenup

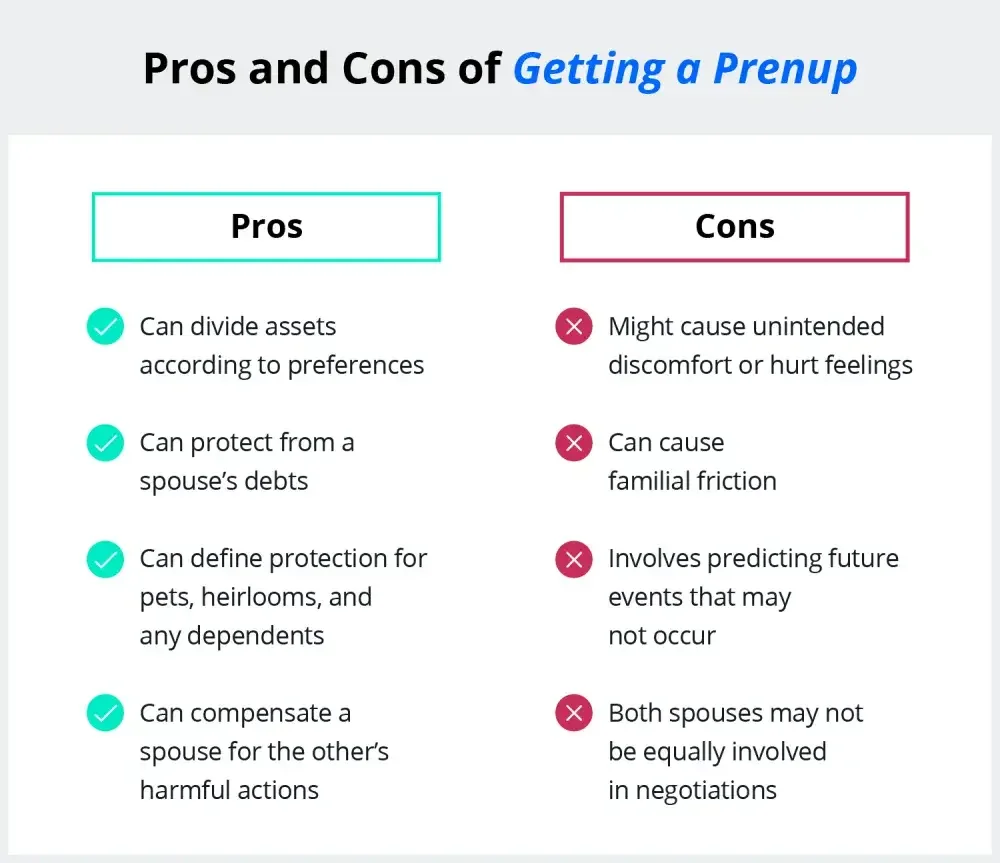

Prenups offer impressive benefits and safeguards for both partners in a marriage, and working together with your spouse to build a clear, fair agreement can set you up for an even stronger relationship. Here are some reasons to consider a prenup:

You have significant assets

If you have significant property/wealth prior to marriage, you may not want to equally distribute those assets in the event of a divorce.

You have significant debts

If you have significant debts in your own name before marriage, such as from medical care or education, a prenup can designate it as premarital debt. Should a divorce occur, the spouse would not be responsible for premarital debt.

You have other dependents

For individuals with children from a prior marriage or elderly parents, a prenup can set aside assets for them that won't be divided in the event of a divorce.

You have a small business

If you have a small business that you run without your partner's help, you may want to make certain that half of the business doesn't go to your spouse in case of a divorce.

Beyond financial value, possessions with sentimental or personal value can be protected with a prenup.

You want to ensure respectful behavior

An often-overlooked benefit of a prenuptial agreement is the ability to outline financial penalties for certain disrespectful or inappropriate behavior, such as drug use, gambling, abuse, or infidelity. Such a clause might give one spouse a greater share of assets if their partner cheats, for example. Keep in mind that these clauses must be carefully written and reviewed to reliably hold up in court.

You have pets

While it may seem strange to think of them as "assets," pets are family, too, and can be protected by provisions in your prenup. Specifically, a prenup can specify "custody" over any pets the couple owns.

Reasons not to get a prenup

While the popularity of prenuptial agreements continues to rise, they may not be right for everyone. Here are some reasons you might consider not getting a prenup:

Trust and relationship dynamics

Although it has become less common in recent years, some couples may still view prenups as a sign of doubt or distrust. This is understandable, even if not necessarily true, and can often be solved by having an open, honest conversation about your goals behind a prenup.

Financial transparency and equality

For relationships where partners are financial equals, a couple may feel that a prenup is unnecessary. While this may work out in the event of a divorce, trusting state law to divide assets fairly is a risk you should consider carefully before accepting.

Complexity and cost

Everything considered, a basic prenuptial agreement is one of the more affordable legal documents to have written (roughly $800-$1,000, on average). That said, more complex prenups, such as those where one or both parties have significant assets, may cost considerably more and take much more time and emotional bandwidth to draft.

Cultural or religious beliefs

In certain cultures or religions, marital wealth is viewed as something to be shared unconditionally. In this light, a prenup may be seen as disrespectful or as going against proper values and traditions.

Protection through other legal means

Today, prenups are some of the most popular ways to protect individual interests in a marriage. Still, some couples may prefer to rely on other types of legal protection, such as wills, trusts, or even postnuptial agreements.

How prenups work: 6 simple steps

From start to finish, prenuptial agreements only take six steps to create and enforce:

1. Discuss the prenup

First, partners sit down to talk out their finances and personal reasons for wanting a prenup, such as to protect assets, heirlooms, or inheritances. These reasons can differ from one person to another, so it's important to discuss what each person wants in clear, reasonable terms.

2. Collect information

Once you've established each partner's goals for the prenup, it's time to start collecting relevant information. This can include itemized lists of assets (bank accounts, real estate, stocks) and debts (credit cards, student loans, medical bills).

In legal terms, this is known as "full and fair disclosure," and is key to making sure your prenup is valid.

3. Write a first draft

Now that you have the right information, it's time to take the first pass at writing your prenup. This is when you and your partner should hire attorneys (one for each of you) to help ensure the prenup is legal and comprehensive.

Remember that a prenup isn't binding until it's signed and notarized, so this first draft doesn't need to be perfect. Instead, focus on covering general areas and your highest priorities.

4. Edit and negotiate

After the first draft of your prenup has been written, each partner should take a copy to read over with their attorney. This gives you both the chance to ask questions, request edits, and negotiate for better or fairer terms.

5. Sign and notarize

When all the edits have been finalized, and both partners are happy with the prenup, the final draft should be signed in the presence of witnesses and notarized by an official notary. Most people pay a professional notary for this, but you can also have a document notarized at most post offices or banks.

Remember that a prenup will be considered void without the proper witnesses and notarization, even if everything else within it is considered fair and legal.

6. Enforce (if necessary)

If, eventually, a separation or divorce occurs, your prenup will be used during divorce negotiations to determine how assets and debts should be distributed, as well as things like alimony. Before this happens, the court will go through and check that the prenup meets all legal requirements, so it's important to make sure that it was prepared and signed according to state and federal guidelines.

What mistakes can make the prenup unenforceable?

Sometimes, a premarital agreement may be tossed out by the court during divorce proceedings—a situation that's especially common with prenups drafted without a lawyer. Some of the most common mistakes that can invalidate a prenup are:

- Including provisions for child support and custody of unborn children.

- Less than full financial disclosure by one or both parties.

- Including provisions that are blatantly unfair or unjust to one party.

- One partner did not have the opportunity to consult an attorney.

- The prenup was signed very shortly before the wedding (such as in the car on the way to the ceremony).

- There is evidence that the prenuptial agreement was signed under duress or coercion.

- One or both parties didn't have their own lawyer.

What happens when a will and prenup conflict?

If parties have a prenup in place during estate planning, it's essential to clarify which document takes precedence. To avoid costly litigation in the future, make sure to use exact, proper language when making this provision (ideally with the help of a qualified attorney).

In cases where it isn't clear which document takes precedence and the terms of a prenuptial agreement conflict with a last will and testament, a probate court carefully examines the terms of the prenup.

Generally speaking, a court is much more likely to favor the terms of a prenuptial agreement over the terms of a last will and testament.

Finally, a valid prenup should clearly indicate which state's law the reader should use to interpret it. If the prenuptial agreement does not contain this information and a spouse dies in a state other than the state where the couple created the document, the laws in the state of the spouse's death take control.

How to ensure your will still matters

For individuals with both a prenup and a will, there are two primary measures you can take to ensure that your wishes are honored after death.

First is what is known as a "sunset" clause, which is a set expiration date within a prenup, after which a will takes legal precedence.

Second, the beneficiaries of the last will and testament can challenge a prenuptial agreement in court if they think it may be invalid.

How to talk about a prenup with your partner

There's never a perfect time to bring up the subject of a prenup, but a small amount of discomfort now may save you both from much greater suffering later on. For fairness and legal reasons alike, plan to have this conversation early in the engagement instead of waiting until a few weeks before the wedding.

Couples who have significant individual assets or debts, dependents, and small businesses should have this conversation even sooner, ideally when the topic of marriage first arises.

Regarding the conversation itself, here are some ways to navigate the initial prenup talks:

- Emphasize that prenups are meant to protect both spouses.

- Ask, don't demand. Setting an ultimatum for your partner rarely works out well for anyone.

- Frame it in terms of mutual respect and boundary-setting.

- Reassure your partner that a prenup is about financial responsibility, not a lack of trust.

Even in the best cases, your partner will likely need a little time to think about your request and research prenuptial agreements on their own. This is natural and healthy, and trying to rush them through the decision would both be unwise and likely invalidate the prenup itself.

As with all complicated legal subjects, seriously consider speaking with an experienced attorney about your options and the process of getting a prenup. Often, having an expert third party can help smooth over any concerns or doubts.

FAQs

What is a postnuptial agreement?

Sometimes, couples prefer to wait until after the big day to talk about legal contracts—this is called a postnuptial agreement. A postnuptial agreement is a contract established between a married couple that will establish how to divide marital property and financial interests in the event of death or divorce.

A postnuptial agreement must be in writing, voluntarily entered into, signed by both parties, and notarized. So long as those requirements are met, a postnuptial agreement can effectively cover anything protected by a prenup.

Can I draft my own prenup?

While it is possible to draft a prenuptial agreement on your own, be aware that it may be unenforceable if it is determined by a court that certain requirements aren't met.

Evidence of technical errors, coercion, and disproportionate terms could invalidate a prenuptial agreement. In addition, certain states have complicated requirements for prenuptial agreements. Judges will evaluate a prenuptial agreement and decide whether it is fair for both parties in the event of a divorce.

Are prenuptial agreements enforceable in a community property state?

There are nine states that are community property states—Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. This means assets are distributed equally in the event of a divorce. But if a prenup agreement is in place, the terms of that agreement override the community property rules.