Many people dream of winning the lottery and the life-changing purchases and investments they will make, but those fantasies may not include the specifics of how they will actually manage their winnings. If you win the lottery and don’t have a plan for how to protect your payout, you run the risk of significant financial loss.

If you win a substantial jackpot, taking the time to consider how you might protect and manage your wealth is a smart move. Some lottery winners choose revocable trusts to safeguard their winnings, protect their privacy, and control how their winnings will be managed.

Here’s what to know about what a lottery trust is, why to use a trust to claim lottery winnings, and the step-by-step process for starting a lottery trust.

What is a lottery trust?

A lottery trust is a legal entity set up to claim and manage lottery winnings on behalf of one or more beneficiaries. It can help keep winners from blowing the payout from their winning ticket on a spending spree, protect their privacy, and support estate planning goals.

A lottery trust isn’t a special kind of trust. Rather, it is usually a revocable or irrevocable living trust that is used strategically after a lottery win.

Why use a trust to claim lottery winnings?

The core benefits of a lottery trust include the following:

- Privacy protection. In many states, lottery winners must go public. A trust can claim the prize instead, allowing the winner to stay anonymous (where legally allowed). Whether you can choose to remain anonymous after a lottery win depends on your state.

- Asset protection. A trust can be designed to discourage impulsive spending and unwise financial decisions. An irrevocable lottery trust can help shield winnings from lawsuits, opportunistic friends and family, and creditors.

- Estate planning benefits. Lottery winners can use a trust to control how the money is distributed both during their lifetime and after their death.

Tax planning. With the proper setup, a lottery trust can help winners bypass probate and reduce estate taxes. A trust doesn’t reduce income tax liability on the prize itself—lottery winnings are still subject to income tax—but it can be used to help control how the winnings are invested, distributed, and taxed over time.

How to start a lottery trust in 5 steps

Follow these five steps to create a lottery trust.

Step 1. Talk to an estate planning attorney

You’ve won the Mega Millions and put your winning ticket in a safety deposit box. Now what? Most lottery winners don’t consider things such as how their lottery prizes can be affected by marital funds or the extent to which an LLC or a blind trust can help protect their privacy.

Your first step after winning the lottery should be talking to a lawyer or a legal services company like LegalZoom to get professional guidance on setting up a lottery trust. Whether you use an attorney or an online legal platform, it’s essential that you speak to someone who is experienced in both trust law and high-value windfalls. Timing matters—ideally, you’ll want to set up the trust before you claim the prize.

Step 2. Choose the type of trust

The next step is choosing the type of trust you will use. When you create a trust, you establish provisions for managing and distributing the assets placed in it.

Two common kinds of trusts are revocable and irrevocable trusts.

The primary benefit of a revocable trust is that you can retain control over the assets in the trust, remove them, change beneficiaries, or revoke the trust at will. However, a revocable trust does not offer the tax advantages and asset protection that an irrevocable trust can provide.

If you create a revocable trust, you can be the trustee, but you should name one or more people or institutions as successor trustees to serve during periods of your lifetime incapacity and after your death.

With a revocable trust, you can also name one or more people or charitable organizations to receive trust assets during your lifetime or when you die (aka beneficiaries). When naming minors or financially irresponsible beneficiaries or when leaving significant sums of money to an individual beneficiary, consider how to best structure distributions to protect the beneficiaries' interests. Financial and tax professionals can help you evaluate your options.

One of the main advantages of an irrevocable trust is that it can protect your assets from lawsuits and creditors. Additionally, an irrevocable trust can help reduce taxes and enable you to meet income eligibility criteria for certain government benefits. The main drawback of an irrevocable trust is that it is permanent and can’t be modified once it has been created.

Step 3. Name the trust and choose a trustee

Next, you will need to name the trust and select a trustee. Many people use a generic name such as “XYZ Nominee Trust” to protect their identity.

You’ll need to name a trustee, or someone who oversees the management and distribution of the assets, and who will adhere to the terms of the trust agreement. The trustee of a lottery trust is often the winner or a financial professional.

Step 4. Draft the trust agreement

Your trust agreement should specify whether funds will be distributed as a lump sum or in installments and include provisions for heirs, taxes, and your long-term financial goals.

Keep in mind that just as state laws govern lottery winners' anonymity, state laws also govern trusts. Your new trust agreement must meet state-specific requirements.

Generally, most states require you to clearly identify your trustees and beneficiaries and define the terms for trust management and distribution. Still, you should understand what your state's laws say about how to execute a trust agreement. In some states, the grantor, or creator, must sign the agreement before a notary public. Other states impose requirements for having witnesses sign as well.

Step 5. Claim the prize in the trust’s name

After creating your valid trust agreement, you are ready to open a bank account or investment account in the name of the trust to hold the proceeds from your winning lottery ticket.

You will need to follow your state’s lottery claim procedure to claim the prize in the trust’s name and may be required to submit trust documentation. If you create your new trust before claiming your lottery winnings and if your state's laws say trusts can claim prizes, you can claim the winnings as a trustee rather than as an individual winner.

Even if you claim lottery winnings in your own name, you can put the assets into your new trust. Doing so may have several advantages, including avoiding probate court when you die and potential protection from creditors if you choose an irrevocable trust.

Whether you won a major lottery jackpot or simply want to protect other assets through proactive estate planning, consider using a trust. You may want to work with an online service provider to ensure your trust complies with your state's laws. Or, you might consider hiring an estate planning attorney in your state for assistance.

Should you start an LLC or a trust for lottery winnings?

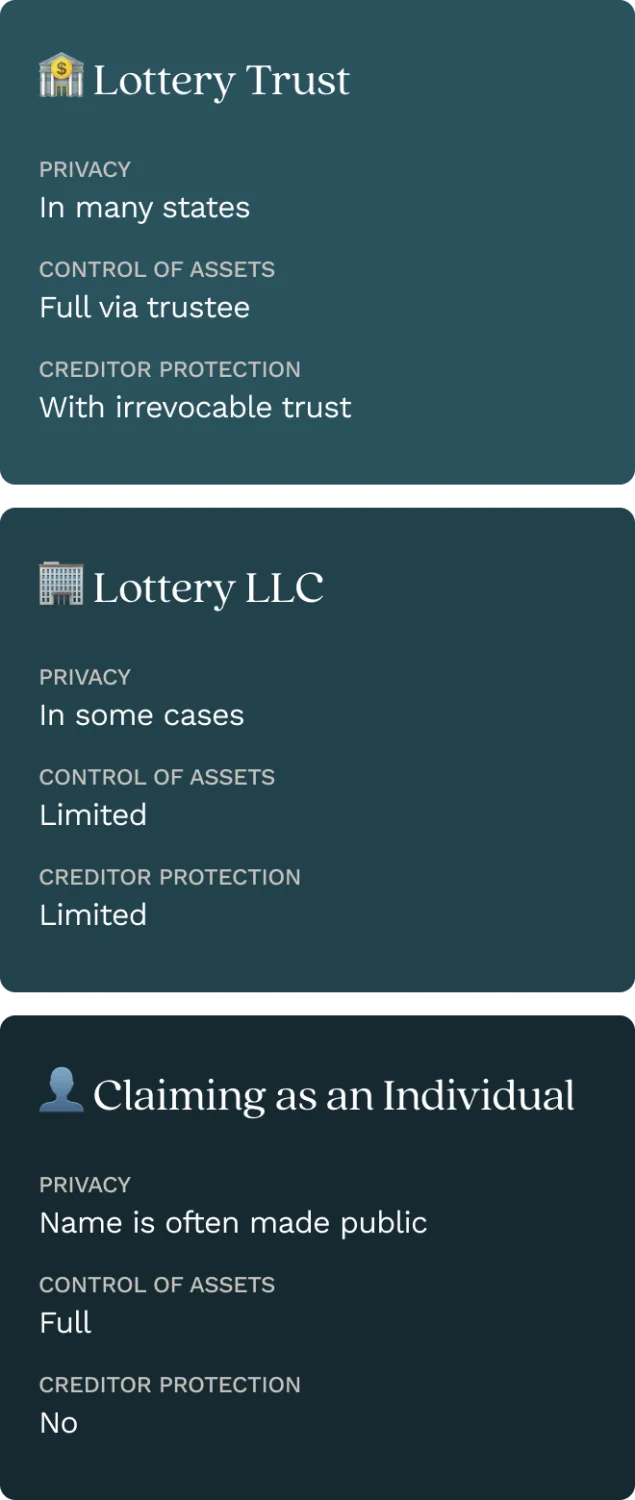

Here’s a quick look at a few important considerations when deciding whether to start an LLC or a trust for lottery winnings, including privacy, control of assets, and protection from creditors.

| Lottery Trust | Lottery LLC | Claiming as an Individual | |

| Privacy | In many states | In some cases | Name is often made public |

| Control of Assets | Full via trustee | Limited | Full |

| Creditor Protection | With irrevocable trust | Limited | No |

Lottery trust state guidelines

You can create a trust relatively quickly, but you first need to determine whether your state allows for anonymity in claiming lottery winnings. The rules regarding lottery trusts and anonymity can vary based on the amount won and the specific lottery game, so you shouldn't assume a trust will protect your identity. Investigate your state's laws before deciding on a course of action.

After determining what your state allows, you can create a trust to claim your lottery winnings.

States that allow trusts to claim prizes and maintain anonymity

Lottery winners in the following states may be able to retain partial or complete anonymity:

- Arizona

- Arkansas

- Delaware

- Georgia

- Indiana

- Kansas

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Maryland

- North Dakota

- New Jersey

- Ohio

- South Carolina

- Texas

- Virginia

- West Virginia

- Wyoming

States that allow trusts to claim prizes but require winner disclosure

Some states allow lottery winners to set up a trust and use it to claim the prize, but the name of the trust—and in some cases, the winner’s name—is disclosed to the public as required by transparency laws. Bear in mind that whether lottery winners can claim prizes with a trust depends on how the trust is set up and the individual state’s rules.

Individuals in certain states—such as Colorado and Wisconsin—cannot use a legal entity such as a trust to claim lottery winnings and must claim the winnings directly. After that, the winner may put the money into their own trust.

States where individuals need to claim prizes

Keep in mind that a trust may still be used to receive and manage funds in these states once the lottery prize has been claimed by an individual.

State lottery policies are subject to change, and some states are more flexible than others. Be sure to check with the state’s lottery office or a trust attorney who understands lottery law before claiming your prize.

How long does it take to set up a trust for lottery winnings?

The time it takes to set up a lottery trust depends on the complexity of the trust and how long it takes you to draft and finalize your trust agreement.

FAQs

How much does it cost to set up a lottery trust?

The cost of setting up a lottery trust depends on factors including the complexity of the trust and how much the individual attorney or legal service charges.

Can I be both the trustee and beneficiary of my lottery trust?

Yes, you can be both the trustee and beneficiary of your lottery trust.

What should I name my lottery trust for privacy?

Many lottery winners choose a generic name such as “XYZ Nominee Trust” to protect their privacy. However, the rules for naming your trust and maintaining anonymity vary by state.

Will a trust reduce my lottery taxes?

A trust can’t reduce income taxes, but, depending on the type of trust, it can be used to reduce estate tax liability.

Can I create a trust after claiming the prize?

You can create a trust after claiming your lottery winnings, but ideally, you’d want to set up the trust before claiming the prize to take advantage of the anonymity, tax advantages, and asset protection it may offer.

It’s a good idea to consult with a law firm, financial adviser, or legal planning service to discuss your options before claiming your prize.