Women-owned small businesses play a critical role in local economies, but their presence and impact aren’t evenly distributed across the country. Some cities and states have far more women at the helm, while others continue to lag in representation and support.

To better understand where women entrepreneurs are thriving, we analyzed the most recent data from the U.S. Census Bureau’s Annual Business Survey and the Small Business Administration (SBA). The data includes the number of women-owned businesses, how many people they employ, and how much they contribute to payroll. All broken down by state and major city.

Our analysis explores where women-owned businesses are most common, where ownership is most equitable, and where these businesses are creating the greatest economic value.

Small business funding by gender shows a persistent gap

Before looking at where women-owned small businesses are most common and most impactful, it’s important to consider the broader funding landscape.

In 2024, just 21% of all SBA-approved small business loans went to businesses where women owned more than a 50% share. That’s a total of 14,609 loans, far behind the 48,884 approved for male-owned businesses, which made up nearly 70% of all approvals.

Not only are fewer loans going to women-owned businesses, but those that are approved tend to be smaller. The average loan amount for women-owned businesses in 2024 was $332,739. For men, it was $469,856. That’s a difference of about $137,000.

Whether it’s due to the types of businesses being started or the broader structural barriers women face in accessing capital, the funding gap is present and worth exploring. It also reinforces the importance of looking at where women-owned businesses are still finding ways to thrive, contribute to local economies, and close the gap in ownership and opportunity.

Now, let’s get into our findings.

Key findings

Our analysis of the most recent Census and SBA data revealed several patterns in where women-owned small businesses are most concentrated and how they contribute to local economies:

Here are some of the standout insights from our analysis:

- Florida has the highest rate of women-owned small businesses relative to its population, with 5.77 per 100 residents, and Miami leads the way for cities with 8.85.

- Georgia is the state that’s nearest to parity when comparing the women-to-men-owned small business ratio at 0.86 to 1. Memphis is the only city in our study where women owned more small businesses than men (ratio of 1.01 to 1).

- Hawaii leads all states in both employment (7.2 people employed per 100 adults) and average payroll ($481,836) among women-owned employer firms. Wichita (7.7) and San Jose ($546,288) lead all cities in those categories, respectively.

These findings show that while gaps persist, women-owned businesses are making a significant economic impact, especially in places that foster inclusive business growth.

U.S. cities & states with the most women-owned small businesses

The share of women-owned small businesses looks very different depending on where you live.

To understand where women entrepreneurs are thriving, we analyzed the most recent data from the SBA and the census, looking at the number of women-owned businesses relative to local populations in both states and major cities. Let’s take a closer look.

Where do women own the most small businesses?

Some states and cities stand out for their high concentration of women-owned small businesses, indicating strong entrepreneurial ecosystems and access to support networks and funding.

States with the most women-owned small businesses (per 100 residents):

- Florida – 5.77

- Georgia – 5.22

- Colorado – 4.71

- Louisiana – 4.48

- Vermont – 4.45

These states reflect a mix of business-friendly climates and growing populations. Florida and Georgia, for example, have rapidly expanding metro areas that foster entrepreneurship across industries.

Colorado’s presence reflects the state’s consistent focus on small business development and support services, while Vermont stands out as a smaller state with a relatively dense population of women business owners.

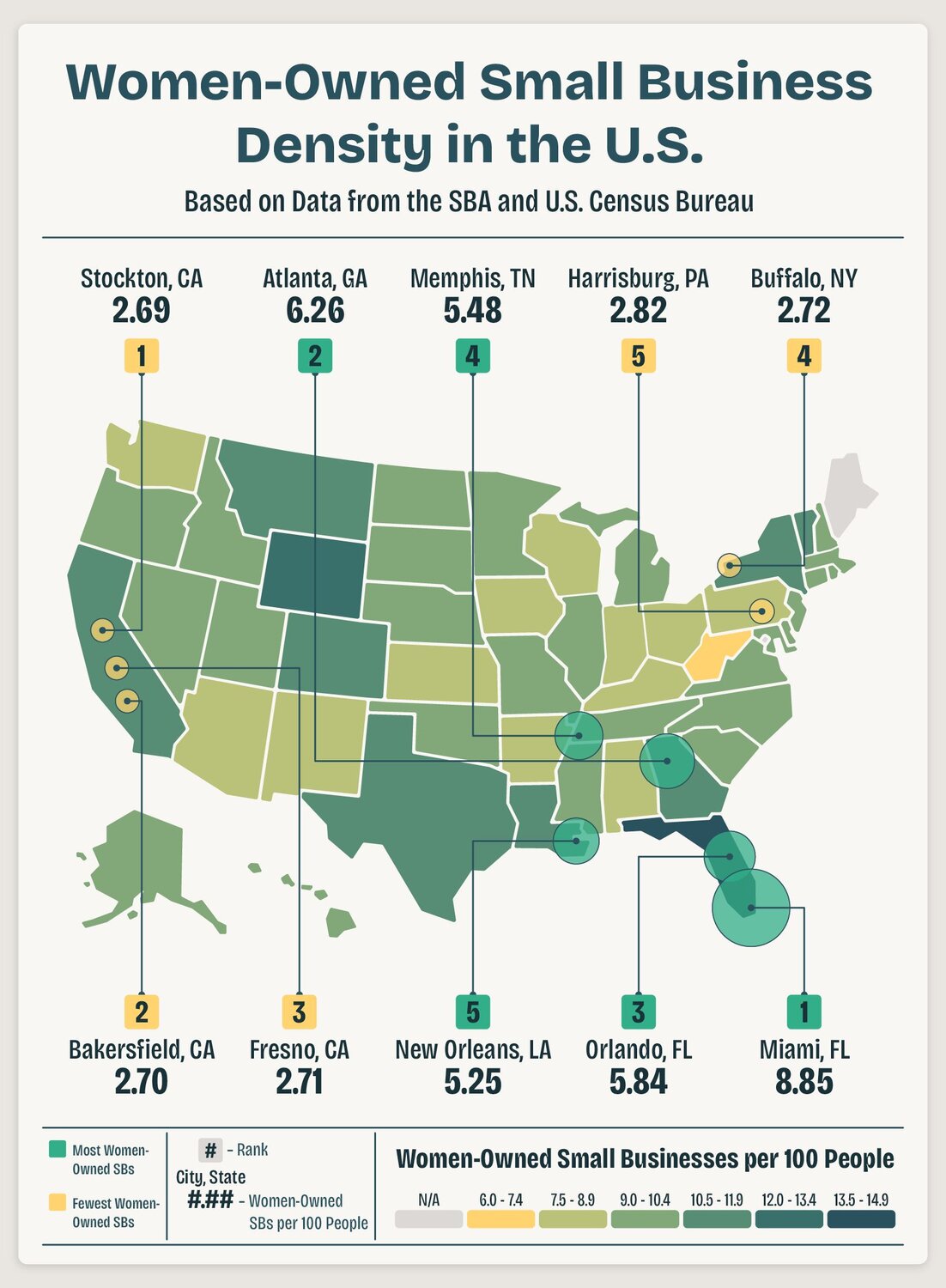

Cities with the most women-owned small businesses (per 100 residents):

- Miami, FL – 8.85

- Atlanta, GA – 6.26

- Orlando, FL – 5.84

- Memphis, TN – 5.48

- New Orleans, LA – 5.25

Miami leads all major U.S. cities in the rate of women-owned small businesses, signaling a strong entrepreneurial culture that likely stems from a combination of cultural diversity and a community that fosters independent enterprise as a means of economic advancement. For example, the Greater Miami Chamber of Commerce has a Diverse Business Empowerment program to support the growth and sustainability of small women-owned businesses in the greater Miami area.

Atlanta and Orlando show how regional growth in the Southeast continues to create opportunity, while Memphis and New Orleans highlight the importance of community-driven business growth in historically underserved areas.

“Women-owned businesses are one of the fastest-growing segments of the small business economy,” said Allison DeSantis, Senior Director of Product Counsel at LegalZoom. “We’ve seen firsthand how more women are taking the leap into entrepreneurship. And not just to build wealth, but to create flexible, purpose-driven careers on their own terms. It’s incredibly important to support them with access to resources that make running a business more financially manageable.”

Where do women own the fewest small businesses?

At the other end of the spectrum, some areas report much lower rates of women-owned small businesses. Often in regions with slower population growth, less urbanization, or fewer small business resources.

States with the fewest women-owned small businesses (per 100 residents):

- West Virginia – 2.39

- Wisconsin – 2.9

- Pennsylvania – 3.04

- Kentucky – 3.05

- Iowa – 3.1

These states are generally more rural, which may limit access to capital, mentorship, or community-based business networks that support women entrepreneurs. In states like West Virginia and Kentucky, longstanding economic challenges may also contribute to fewer business formations overall.

Cities with the fewest women-owned small businesses (per 100 residents):

- Stockton, CA – 2.69

- Bakersfield, CA – 2.7

- Fresno, CA – 2.71

- Buffalo, NY – 2.72

- Harrisburg, PA – 2.82

Several of the lowest-ranking cities, Stockton, Bakersfield, and Fresno, are located in California’s Central Valley, a region with lower median incomes and fewer business resources than the state’s coastal metro areas. These economic conditions may limit access to entrepreneurship support and contribute to fewer women-owned businesses relative to the population, showing how disparities can exist even in higher-opportunity states.

Understanding where women-owned businesses are flourishing and struggling illustrates how local policies, economic conditions, and population trends shape business opportunity. Next, we’ll look closer at one of the most persistent gaps in small business: the disparity in ownership between men and women.

The gender gap in small business ownership across the U.S.

While women-owned businesses are present in every state, the ratio of male to female business owners varies widely by location. In some places, the gap is nearly closed, while in others, men own small businesses at nearly double the rate of women.

Where are the narrowest small business ownership gender gaps?

These states and cities have the smallest disparities between male and female small business ownership.

States with the narrowest gender gaps (female to male ratio):

- Georgia – 0.86 to 1

- New Mexico – 0.82 to 1

- Hawaii – 0.82 to 1

- Oregon – 0.81 to 1

- Louisiana – 0.80 to 1

Georgia stands out as the state with the highest ratio of female-to-male business ownership, aligning with the high rates of women-owned businesses we observed overall. Hawaii and New Mexico likely see more gender parity because of the cultural diversity and strong traditions of community-based ownership that encourage entrepreneurship across demographics, including among women.

Cities with the narrowest gender gaps (female to male ratio):

- Memphis, TN – 1.01 to 1

- Virginia Beach, VA – 0.91 to 1

- Atlanta, GA – 0.89 to 1

- Palm Bay, FL – 0.87 to 1

- Albuquerque, NM – 0.84 to 1

Memphis stands out as the only major U.S. city where women outnumber men in small business ownership. This milestone reflects a strong presence of women entrepreneurs, likely supported by local programs that focus on minority- and women-owned business development.

Virginia Beach is another city where women entrepreneurs can benefit from strong community support through their Small, Women-owned, and Minority-owned Business program, while the continued presence of Atlanta near the top of these rankings highlights how strong regional economies can help close gender gaps. These cities show how local efforts to support diverse entrepreneurship can influence broader patterns of ownership.

This type of ownership parity may also indicate strong foundations for new business formation, whether through LLCs, sole proprietorships, or other small business structures.

Where are the widest small business ownership gender gaps?

These parts of the country have the greatest disparities in ownership between men and women.

States with the widest gender gaps (female to male ratio):

- South Dakota – 0.60 to 1

- New Jersey – 0.61 to 1

- Pennsylvania – 0.61 to 1

- New York – 0.62 to 1

- North Dakota – 0.62 to 1

In states like the Dakotas and Pennsylvania, persistent gender gaps may stem from structural economic factors, including industry makeup and rural access to business resources. Even in a major economic hub like New York, a wide gap suggests that opportunity isn’t evenly distributed, especially in sectors where men historically dominate ownership.

Cities with the widest gender gaps (female to male ratio):

- Harrisburg, PA – 0.58 to 1

- New York, NY – 0.61 to 1

- Provo, UT – 0.61 to 1

- Fresno, CA – 0.62 to 1

- Pittsburgh, PA – 0.62 to 1

These cities reflect broader statewide patterns. Harrisburg and Pittsburgh show how gaps persist even in smaller metro areas, while New York City’s ranking underscores that large markets alone don’t close disparities. The wide gap in Provo may reflect cultural and demographic influences on business formation and entrepreneurship.

These gaps highlight the ongoing need for inclusive business support systems. Helping more women launch businesses, whether as a DBA, corporation, or nonprofit, can improve local economic resilience and employment outcomes.

Next, we’ll look beyond ownership rates to examine the scale of economic impact. Specifically, how many jobs women-owned small businesses create and how much payroll they generate.

The places where women-owned small businesses have the greatest impact

Ownership is just one measure of economic participation. To understand where women-owned small businesses are driving the most local impact, we looked at employment and payroll. Two indicators of how these businesses support workers and contribute to economic growth.

Where do women-owned small businesses employ the most people?

This list shows the states and cities where women-owned small businesses employ the highest number of people, normalized by the working-age population (ages 18–64).

States with the most people employed by women-owned small businesses (per 100 working-age adults):

- Hawaii – 7.19

- Delaware – 6.81

- Maryland – 6.01

- New Hampshire – 5.94

- Oregon – 5.93

Hawaii leads the nation in employee impact, continuing its strong showing from earlier in our observations. Delaware’s position highlights how smaller states can still support a high density of active, job-creating businesses. States like Maryland and Oregon may benefit from strong regional economies and more access to business development resources.

Cities with the most people employed by women-owned small businesses (per 100 working-age adults):

- Wichita, KS – 7.71

- Tucson, AZ – 7.41

- McAllen, TX – 7.24

- New Orleans, LA – 7.16

- Richmond, VA – 7.08

Wichita tops the list with the highest employment impact among women-owned businesses, suggesting strong ties to local hiring and business retention. Cities like Tucson and McAllen have fast-growing populations, which support sustained small business activity. Meanwhile, New Orleans makes another appearance in our study, likely thanks to programs like the National Association of Women Business Owners - LA, which helps provide funding for women-owned small businesses.

Where do women-owned small businesses have the highest payrolls?

Payroll figures reflect the financial footprint of women-owned employer firms. These are the states and cities with the highest average payrolls among those businesses.

States with the highest average payrolls for women-owned small businesses:

- Hawaii – $481,836

- New Hampshire – $469,888

- Tennessee – $439,056

- Maryland – $409,126

- Massachusetts – $399,007

Hawaii and New Hampshire continue to rank near the top, showing that women-led businesses there not only employ at high rates but also pay well. Tennessee’s inclusion signals strong performance in women-owned businesses like those in Memphis, while Maryland and Massachusetts reflect higher-cost, higher-wage markets.

Cities with the highest average payrolls for women-owned small businesses:

- San Jose, CA – $546,288

- San Francisco, CA – $510,584

- Washington, DC – $497,116

- Albuquerque, NM – $488,417

- Greenville, SC – $479,261

High payrolls in California cities like San Jose and San Francisco reflect the influence of tech and professional services industries, where wages tend to be higher across the board. Washington, DC’s ranking likely stems from a high concentration of consulting, policy, and nonprofit work. Meanwhile, cities like Albuquerque and Greenville show that strong payroll figures aren’t limited to coastal or traditionally high-income markets.

Together, these employment and payroll figures show how women-owned businesses contribute not just to ownership diversity but also to economic output and job creation. Their presence strengthens local economies and supports a broader push toward more inclusive business growth.

Closing thoughts

This study highlights how women-owned small businesses show up differently across the country. Sometimes leading in ownership, other times driving local economies with job creation and payroll figures. But across states and cities, the data make one thing clear: women-led businesses play a vital role in the health and growth of local economies.

LegalZoom provides the tools and support entrepreneurs need to take the next step. Whether that means forming an LLC, registering a DBA, or exploring other business structures. By making the process more accessible, LegalZoom helps open the door for more people to start and grow businesses on their own terms.

Methodology

We analyzed the most recent data from the Small Business Administration and the U.S. Census Bureau to identify the U.S. states and cities with the highest concentrations of women-owned small businesses and where those businesses have the greatest economic impact. Our analysis focused on three areas: where women-owned businesses are most common, where business ownership is most balanced between men and women, and where women-owned businesses contribute most to employment and payroll.

The firm counts include both nonemployer businesses and employer firms with fewer than 500 employees. Employment and payroll figures reflect only employer firms.