Fiduciary duty in a business context refers to acting in the best interests of your shareholders and stakeholders.

Taking the time to understand what fiduciary duty is will help you protect both yourself and your company. Our guide uncovers the types of fiduciary duties, how fiduciary duty relationships work, and what happens when you face a breach of fiduciary.

What is fiduciary duty?

Fiduciary duty essentially means that you are responsible for acting and doing things to benefit someone else. The person with a fiduciary duty is known as the fiduciary, and the person or persons they are responsible to are referred to as the principal or the beneficiary.

In a corporation, the board of directors and the officers have a fiduciary duty to the shareholders and the corporation itself. If you are part of a partnership, you and your partners have fiduciary duties to each other.

When you form your business, it's important to understand your responsibilities and to whom you owe them.

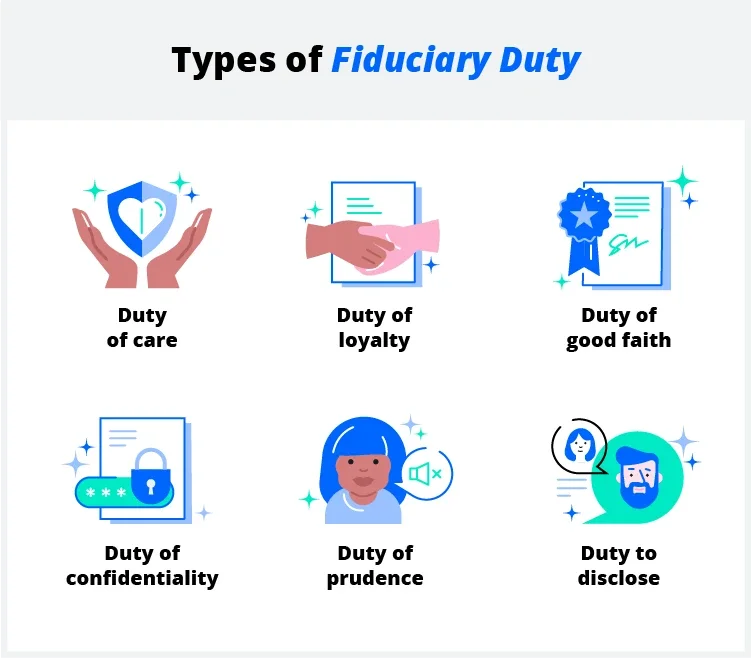

Types of fiduciary duty

Laws surrounding fiduciary duty requirements can differ depending on the state and the type of fiduciary relationship. However, the general types of fiduciary duties are as follows.

- Duty of care: The duty of care requires that you, as a fiduciary, use due diligence to get thorough information before making a decision that could impact your beneficiary. Use reasonable prudence when making decisions and taking any action for the company.

- Duty of loyalty: This requirement means that you work in the interest of your beneficiary and not for your own gain. You should approach all professional responsibilities without personal conflict, and fully disclose any personal conflicts that arise.

- Duty of good faith: A fiduciary must make all decisions in the best interest of the beneficiary. These decisions include keeping the company's information confidential, taking actions that benefit the corporation, and disclosing any conflicts of interest.

- Duty of confidentiality: In the duty of confidentiality, the fiduciary must uphold the confidentiality of all information that pertains to the beneficiary and avoid using this information for personal gain.

- Duty of prudence: The duty of prudence means that fiduciaries must make all decisions with the highest degree of care, caution, and skill.

- Duty to disclose: This duty requires a fiduciary to disclose all information that could impact their beneficiary or their ability to uphold their fiduciary duties.

What is a fiduciary relationship?

A fiduciary relationship is when one party (the beneficiary) places trust and confidence in another party (the fiduciary) to act in their best interest and help them make important decisions—typically in business, finance, or managing assets.

Contracts, wills, trusts, and corporate settings can bind fiduciary relationships. For example, a board of directors has a fiduciary duty to act in the best interest of each other and the company's shareholders. Whereas a doctor has a fiduciary duty to always act in the best interest of their patients.

Fiduciary relationship examples

There are many different types of fiduciary relationships, but the general fiduciary duties always remain the same, no matter the scenario. That is, the fiduciary is responsible for upholding a duty of care, loyalty, and good faith.

Below are some common examples of fiduciary relationships.

- Board of directors and a company

- Trustee and a beneficiary

- Agent and principal

- Controlling stockholder and a company

- Guardian and ward

- Attorney and client

- Doctor and patient

- Real estate agent and buyer or seller

Developing and maintaining a healthy fiduciary relationship

For a healthy fiduciary relationship to work, trust must exist between the two parties. As a fiduciary, you have a responsibility to act in the beneficiary's best interest and ensure that trust is maintained. In some cases, you may represent another person as a fiduciary, like a lawyer to a client. In other cases, your responsibilities come with the role, like how directors on a company's board are responsible to each other and their stakeholders.

To maintain a healthy fiduciary relationship, you must always:

- Act in the best interest of the beneficiary and never for personal gain

- Disclose all information related to the fiduciary relationship

- Always act honestly, fairly, and with the utmost care

- Never allow personal conflicts to come in the way of the fiduciary relationship

What is a breach of fiduciary duty?

A breach of fiduciary duty happens when a fiduciary fails to uphold their duties and responsibilities and doesn't act in the beneficiary's best interest. For example, if a board member leaked information about an upcoming deal to a friend and the deal fell through because of it, this would be a breach. The corporation can recover damages for any breach by a fiduciary through a lawsuit.

Some examples of breach of fiduciary duty examples include:

- Failure to disclose a conflict of interest

- Failure to comply with your obligations and duties as a fiduciary

- Failure to act in the best interest of the beneficiary

- Failure to share important information with a beneficiary or partner

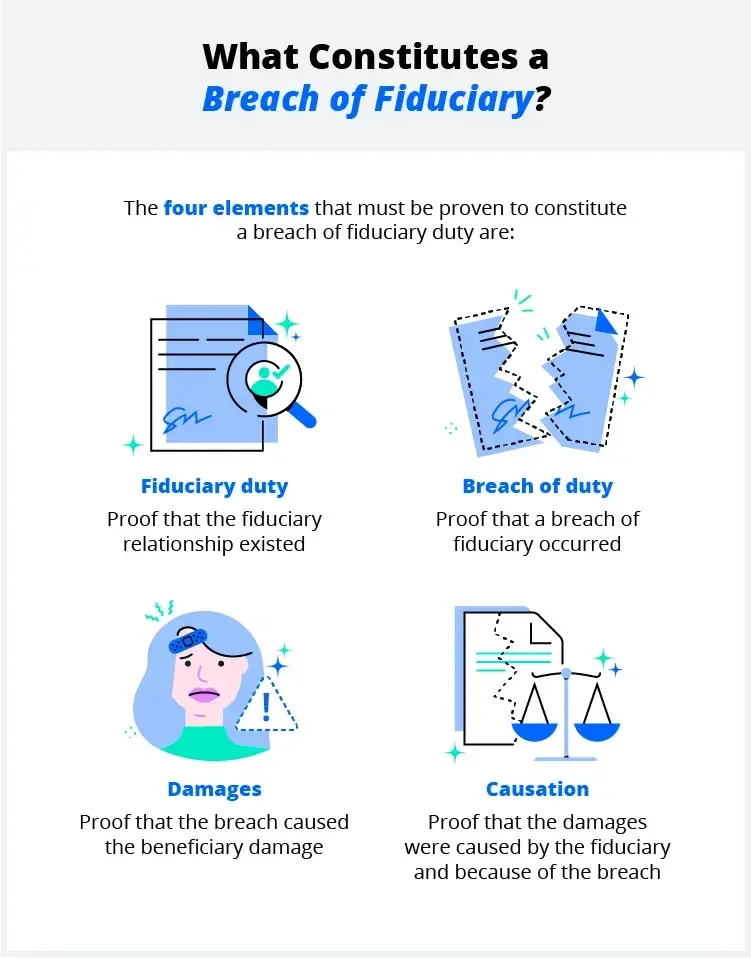

Breach of fiduciary duty elements

There are four elements that must be proven in order to constitute a breach of fiduciary duty, including:

- Fiduciary duty: The beneficiary must prove that the fiduciary relationship existed and that the fiduciary had duties and responsibilities to uphold.

- Breach of duty: The beneficiary must prove that a breach of fiduciary occurred.

- Damages: The beneficiary must show that the breach caused them damage.

- Causation: The beneficiary must prove that the damages were actually caused by the fiduciary and because of the breach.

What happens when you face a breach of fiduciary?

If all four elements of a breach of fiduciary duty are proven, the fiduciary involved can face many consequences—both in a legal and professional sense. Possible consequences include monetary penalties for any damages and even the removal or suspension of a fiduciary.

Here are a few consequences you can face if you are involved in a breach of fiduciary duty:

- Compensatory damages: If a fiduciary breach reaches litigation, the fiduciary may be responsible for compensating the beneficiary for any losses resulting from the breach.

- Punitive damages: Punitive damages are payments that the fiduciary must make outside of compensatory damages. This consequence is a ploy to discourage fiduciaries from engaging in further breaches. Punitive damages typically only happen in cases of fraud or malice.

- Professional consequences: Being involved in a breach of fiduciary can lead to termination of your position or a loss of license, which can hurt your professional reputation.

What to do when you face a breach of fiduciary

If someone has accused you of a breach of your fiduciary duties, it's important to act quickly. Get a lawyer or attorney to support you so you can keep yourself protected and avoid a breach from occurring. A fiduciary breach accusation is a huge deal, but a legal team can help you build a case to defend yourself properly.

Tip: In a corporate setting, have your corporate policies clearly outlined so all employees know the duties they must uphold in their roles. This can help decrease the chances of a fiduciary breach occurring.

Fiduciary duty FAQs

Who is considered a fiduciary?

Any person who has an obligation to act in the best interest of another person or persons is considered a fiduciary. A fiduciary can be a lawyer representing a client, a trustee and a beneficiary, a corporate board and shareholders, and even employees and a company. In most cases, a fiduciary is legally responsible for helping their beneficiary make important decisions related to business, finances, and managing assets.

What is the most important fiduciary duty?

There are many different fiduciary duties that an individual must uphold, including the duty of loyalty, good faith, care, confidentiality, prudence, and the duty to disclose. However, a fiduciary's overarching and most important duty is to always act in the beneficiary's best interest. Acting in your own best interest for personal gain can lead to a conflict of interest and a potential breach of fiduciary.

What does fiduciary duty mean in real estate?

In real estate, a fiduciary relationship can exist between an agent (fiduciary) and the buyer or seller (beneficiary). So the agent has an obligation to act in the best interest of the buyer or seller. They must disclose all relevant information regarding the transaction and act with the utmost care and loyalty to the client.

What are some examples of fiduciary duty?

In the duty of care, you have an obligation to do your due diligence. Be sure to research and inform the beneficiary of all information that could help them make sound decisions.

Example: If you are a director, before you vote on anything before the board, it's your responsibility to research the matter that's up for a vote and become informed before you cast your vote. Being informed doesn't mean just passively accepting the information at hand, though. It requires critical thinking and independent consideration.

With the duty of loyalty, you must always act in the beneficiary's best interest and not for your own gain. Avoid any situation that could act as a potential conflict of interest.

Example: If you are the president of a corporation, it would be a violation of the duty of loyalty to push for a contract to be awarded to your spouse because, in doing so, you're acting in your personal interest and not in the best interests of the shareholders.

Stay compliant as a fiduciary

Fiduciary duty is a critical component of an officer's, director's, or partner's responsibilities in their role at the company. Fiduciary duties are there to protect the company and its shareholders. Understanding and upholding fiduciary duties will give you peace of mind and ensure your company benefits.