Starting a corporation in Kentucky provides significant benefits for business owners, including personal asset protection, potential tax advantages, professional credibility, and more. This comprehensive guide walks you through the complete process of forming a Kentucky corporation, from choosing a business name to maintaining ongoing compliance with state requirements.

What is a corporation?

A corporation is a legal entity that exists separately from its owners (shareholders). When you form a corporation in Kentucky, you create a distinct business structure governed by Kentucky Revised Statutes Chapter 271B.

In the Bluegrass State, corporations offer several key advantages:

- Limited liability protection. Your personal assets are typically shielded from business debts and lawsuits.

- Perpetual existence. The corporation continues to exist even if ownership changes.

- Enhanced credibility. Corporations often appear more established to customers, vendors, and lenders.

- Tax flexibility. You can elect different tax treatments, including S corporation status.

- Easier access to capital. Corporations can issue stock to raise funds and attract investors.

Liability protection may shield your personal assets if one of your employees is sued or if the business faces financial difficulties. However, this protection isn't absolute. The corporate veil can be pierced in cases of fraud or other malpractice.

Is a corporation right for my business vs. an LLC?

Before forming a Kentucky corporation, consider whether a corporation or limited liability company (LLC) better suits your business needs. Both structures offer liability protection, but they differ significantly in taxation, management structure, and compliance requirements.

Kentucky corporation advantages

- Easier to attract investors through stock issuance

- Potential for S corporation tax election to avoid double taxation

- Established legal precedent and structure

- Better for businesses planning to go public

Because of these advantages, you should consider starting a corporation if you plan to seek outside investment or go public. It’s also a good option if you prefer traditional corporate formality structure or need to offer multiple classes of stock.

Kentucky LLC advantages

- Simpler tax reporting (pass-through taxation by default)

- Option to elect S corporation status

- More flexible management structure

- Fewer ongoing compliance requirements

So, if you want a business with fewer owners and more operational flexibility, you probably want to consider an LLC.

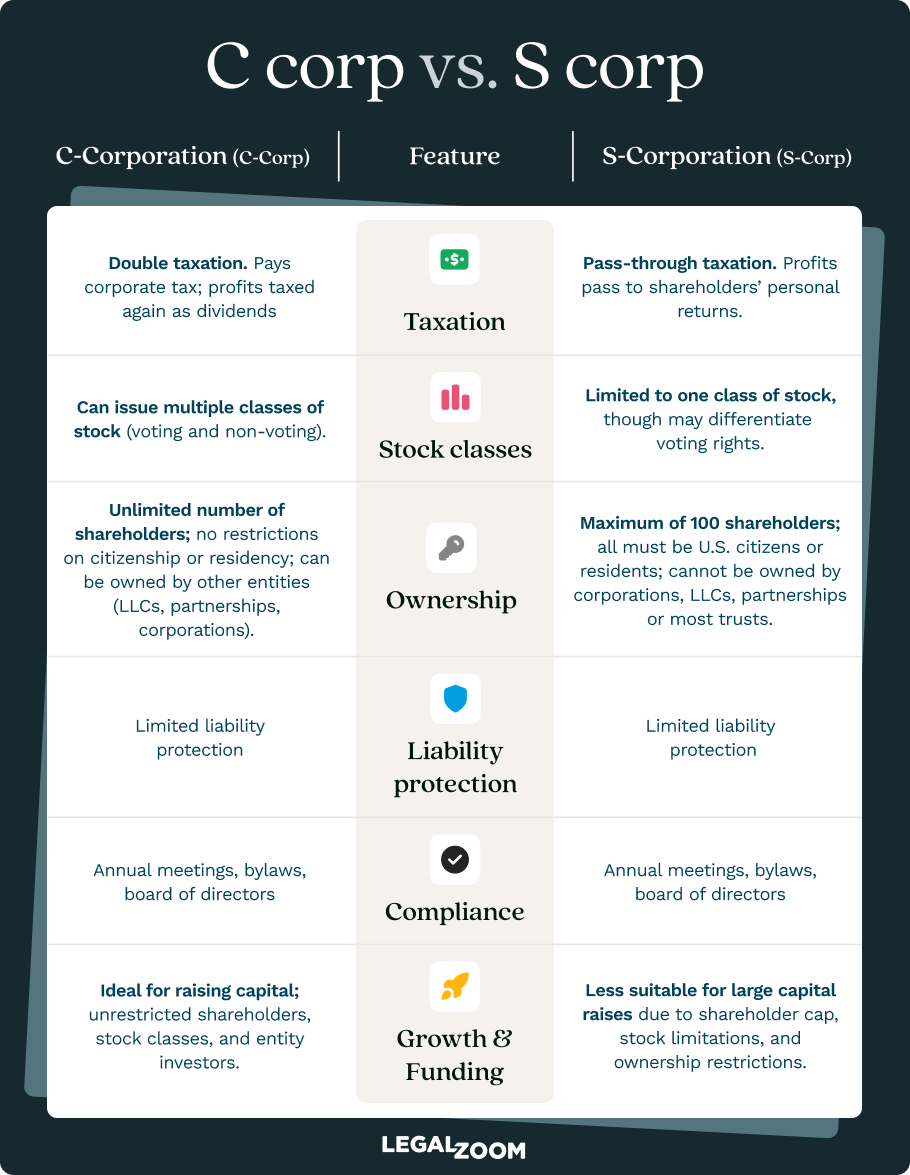

C corporation vs. S corporation: What's the difference in Kentucky?

Kentucky recognizes both C corporations business entities and S corporation tax statuses, but the distinction is primarily for federal tax purposes. All Kentucky corporations are formed as general business corporations. The distinction between a C corporation and S corporation refers to federal tax treatment, not a separate state entity type.

C corporation in Kentucky

- Taxation: C corporations are subject to "double taxation,” where the corporation pays state and federal corporate income tax, and shareholders pay tax on dividends.

- Kentucky taxes: Kentucky corporations pay a corporate income tax and the Limited Liability Entity Tax (LLET).

- Ownership: There are no restrictions on the number or type of shareholders.

- Stock classes: A C corp can issue multiple classes of stock with different rights.

S corporation in Kentucky

- Taxation: S corporations have "pass-through" taxation, where profits and losses pass through to shareholders' personal tax returns.

- Kentucky taxes: S corporations in Kentucky are generally exempt from state corporate income tax but shareholders may owe tax on their share of income. The LLET also applies to S corporations.

- Ownership restrictions: Ownership is limited to 100 shareholders, who must all be U.S. residents. There is only one class of stock allowed.

- Election timing: According to the IRS, businesses must file IRS Form 2553 “no more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the tax year preceding the tax year it is to take effect.”

Making the S corporation election in Kentucky

To elect S corporation status for your Kentucky corporation, take the following steps:

- File Form 2553 with the IRS within the required time frame.

- Obtain shareholder consent from all shareholders.

- Notify the Kentucky Department of Revenue of your S corp election.

- Maintain eligibility by adhering to S corp ownership and operational requirements.

What are the requirements for incorporating in Kentucky?

According to Kentucky Revised Statutes Chapter 271B, your corporation must have the following:

- Corporate name that complies with Kentucky naming requirements

- At least one incorporator

- At least one shareholder

- Registered agent and registered office with a Kentucky street address

- Articles of incorporation filed with Kentucky Secretary of State

- Defined stock structure (authorized shares and classes)

- Corporate bylaws adopted by directors or incorporators

How to start a corporation in Kentucky: Step-by-step

Follow these detailed steps to successfully form your Kentucky corporation.

Step 1: Choose a business name and check availability

Your corporation's name must be distinguishable from existing entities registered with the Kentucky Secretary of State. Here are other Kentucky business naming criteria:

- Must contain "Corporation," "Company," "Limited," or the abbreviations "Corp.," "Inc.," "Co.," or "Ltd."

- Cannot imply that it’s organized for a purpose other than the one permitted

- Cannot contain certain prohibited words without proper licensing

Once you’ve come up with your desired name, check its availability on the Secretary of State’s Business Entity Search. It’s also a best practice to perform a Kentucky state trademark search and federal trademark search to ensure that the name doesn’t infringe on state and federal protections.

If the name is distinguishable from registered state entities as well as state and federal trademarks, you can begin your corporation filing. If you’re not quite ready to file, you can reserve your chosen name for 120 days by filing the Reservation of Reserved Name form with the Kentucky Secretary of State and paying the required fee of $15. This prevents others from using your name while you prepare your incorporation documents.

Step 2: Designate a registered agent and office in Kentucky

Every Kentucky corporation must maintain a registered agent and registered office for receiving legal documents and official correspondence. The registered agent must:

- Maintain a Kentucky street address (not a P.O. box) identical to the registered office address

- Be an individual who resides in Kentucky OR a business entity authorized to transact business in Kentucky

- Be accessible during normal business hours

- Be listed in the articles of incorporation with a street address

- Sign the articles of incorporation or provide written consent to serve as the corporation’s registered agent

While you can be your own registered agent and list your business address as the registered office address, it’s often a good idea to use another individual or a professional service like LegalZoom’s Louisville-based registered agent service. This ensures that someone is always available to receive important notices and documents.

Step 3: Prepare and file articles of incorporation

The articles of incorporation officially create your corporation when filed with the Kentucky Secretary of State. You can either file online through the Secretary of State’s FastTrack portal or mail your Articles of Incorporation form to:

Office of the Secretary of State

P.O. Box 718

Frankfort, KY 40602-0718

Here is the information you’ll need to provide on your articles of incorporation:

- Corporate name

- Number and classes of authorized shares, including rights, preferences, and par value

- Registered office street address and name of registered agent

- Principal office mailing address

- Incorporator names and addresses

- Incorporator signature

- Registered agent signature

The filing fee for Kentucky articles of incorporation is $40.

Step 4: Establish corporate bylaws

Corporate bylaws are internal rules that govern how your corporation operates. While not filed with the state, bylaws are legally required in Kentucky. Corporate bylaws typically cover the following:

- Shareholder meetings. When, where, and how meetings are held

- Number of directors. Kentucky requires at least one director

- Director meetings. Frequency, notice requirements, quorum rules

- Officer roles. Duties and powers of president, secretary, treasurer, etc.

- Stock transfers. How shares can be bought, sold, or transferred

- Amendment procedures. How bylaws can be changed

- Indemnification. Protection for directors and officers

- Fiscal year. Corporation's accounting period

Kentucky corporate bylaws must be adopted by directors or incorporators and cannot conflict with Kentucky law or the articles of incorporation. To ensure your corporation is compliant, LegalZoom can assist with creating corporate bylaws to fit your company’s needs.

Step 5: Hold an organizational meeting

After filing the articles of incorporation, the incorporators will hold an organizational meeting to complete the corporation's formation. Here’s what you should do at that meeting:

- Elect directors

- Officially adopt corporate bylaws

- Elect or appoint officers (president, secretary, treasurer)

- Authorize issuance of stock certificates

- Approve corporate seal and stock certificate form

- Authorize opening of corporate bank accounts

- Adopt accounting methods and fiscal year

- Authorize reimbursement of incorporation expenses

Per Kentucky statutes, make sure that you keep written minutes of the meeting and maintain them in your corporate records book.

Step 6: Issue stock

After the organizational meeting, issue stock certificates to initial shareholders and establish proper corporate records. The following are general stock issuance requirements:

- Issue shares only after they're fully paid for.

- Maintain a stock ledger showing all issued shares.

- Provide stock certificates to shareholders.

- Record all stock transactions in corporate minutes.

- Comply with federal and state securities laws.

Step 7: Obtain federal and state tax IDs

Your Kentucky corporation needs federal and state tax identification numbers. You can apply for an employer identification number (EIN) on the IRS’ website or with LegalZoom’s EIN service.

For Kentucky state tax registration, visit the Kentucky Department of Revenue’s Business Registration webpage for tax information. Here, you can register for tax accounts, complete specialty tax applications, and get more information about applicable local taxes.

Step 8: Open a corporate bank account and secure licenses

Complete your corporation setup by establishing business banking and obtaining necessary licenses and permits. A corporate bank account typically requires a copy of your articles of incorporation, information about your business, information about the owners, and authorization for a credit check. Specific requirements may vary by financial institution.

Kentucky does not have a general statewide business license, but your company may still need one depending on the nature of the business and its location. Here are some tips for determining what licenses or permits you need:

- Research Kentucky-specific professional licensing requirements for your industry.

- Check local city and county permit requirements.

- Obtain federal licenses if required for your business type.

How much does it cost to start a corporation in Kentucky?

Understanding the costs involved in forming a Kentucky corporation helps you budget appropriately for your business launch.

- Articles of incorporation: $40

- Name reservation: $15

- Certified copies: $5 for up to five pages; $0.50 for every additional page

- Registered agent: $0–$300 annually (depending on if you use a professional service)

- Annual report: $15

- LLET: Minimum $175 annually

- Corporate income tax: 5% tax rate (varies based on income)

- Corporate kit: $99–$140 (binder, seal, stock certificates)

- Accounting and bookkeeping: Varies by location and scope of services

- Legal consultation: Varies by location and scope of services

- Business licenses: Varies by industry and location

What ongoing filings keep a Kentucky corporation compliant?

Maintaining good standing with Kentucky requires ongoing compliance with state filing requirements and corporate formalities.

Annual report and Limited Liability Entity Tax

Businesses must submit their Kentucky annual report by June 30 each year and pay the filing fee of $15. The annual report lists current information about directors, officers, the registered agent, and principal office address. The penalty for a late filing may be administrative dissolution by the Secretary of State.

Corporations must also pay the state Limited Liability Entity Tax by June 15 every year. The exact amount is calculated based on a company’s gross receipts or gross profits, but the minimum amount is $175. You can file your LLET form by mail with Form L-ECON or online by logging into your Kentucky Department of Revenue tax account.

Registered agent information

Corporations must maintain a registered agent at all times. If the registered agent changes or the office address changes, you must notify the Secretary of State by filing the Statement of Change of Registered Agent and/or Registered Office Address form. You can also file this form online through your FastTrack account.

The consequences of not complying with this requirement may be administrative dissolution and a loss of good standing status.

Corporate minutes and records

Corporations need to keep detailed records to comply with state law:

- Articles of incorporation and amendments

- Bylaws and amendments

- Minutes of shareholder and director meetings for the past three years

- Written communications to shareholders for the past three years

- Stock ledger and certificates

- The most recent annual report filed with the state

- A list of the names and business addresses of current directors and officers

- Accounting records and tax returns

How LegalZoom can help you form a Kentucky corporation

Now that you have all the information, it’s time to form your business. LegalZoom’s corporation formation service makes the process straightforward and seamless, helping you launch your new venture. From name search assistance to step-by-step assistance with completing your paperwork, LegalZoom is your one-stop shop for all of your corporation formation needs.

FAQs about Kentucky corporations

Can one person form and run a corporation in Kentucky?

Yes, Kentucky allows single-person corporations. One individual can serve as the sole incorporator, director, officer, and shareholder.

Can I start a Kentucky corporation myself, or should I use a service?

You can form a Kentucky corporation yourself by filing the required documents with the Kentucky Secretary of State. However, professional services, like LegalZoom’s business formation services, can help ensure compliance and offer ongoing support.

How long does it take to form a corporation in Kentucky?

The Kentucky Secretary of State typically processes business documents the same day in which they are received, but the process could take up to three business days.

What documents are required to form a Kentucky corporation?

The primary document required to incorporate in Kentucky is the articles of incorporation, which must include the corporate name, registered agent information, stock structure, and incorporator details. You'll also need to adopt bylaws and maintain various corporate records, though these aren't filed with the state.

What is the difference between a Kentucky corporation and an LLC?

Corporations have a more formal structure with directors, officers, and shareholders, while LLCs offer more operational and management flexibility. Corporations are also preferred for raising investment capital. LLCs have simpler tax reporting and fewer compliance requirements. Both offer liability protection for owners.

Do I need a registered agent in Kentucky?

Yes, every Kentucky corporation must have a registered agent with a Kentucky street address (not a P.O. box). The registered agent receives legal documents and official correspondence on behalf of the corporation. You can serve as your own registered agent if you have a Kentucky address, or hire a professional service.

What are the tax implications of forming a corporation in Kentucky?

Kentucky corporations pay state corporate income tax and Limited Liability Entity Tax (LLET). C corporations face double taxation on federal returns, but eligible C corporations can elect S corporation tax status to have pass-through taxation. Consult a tax professional for advice specific to your situation.

Jane Haskins, Esq., contributed to this article.