In estate planning, per stirpes is a distribution provision for assets. This Latin phrase, which literally translates into “by branch” or “by root,” serves an important purpose and comes into play when a listed beneficiary dies before you do. Per stirpes designation determines who will inherit the deceased beneficiary’s share of the assets.

If you’re curious about what the per stirpes designation means, this guide explains the per stirpes clause, how it works, and what it means for listed beneficiaries.

Per stirpes meaning

Per stirpes is a legal term in estate planning. This method is commonly used in last wills and trusts. Per stirpes means a designation that dictates where and how the assets should be passed down if a beneficiary dies before the testator. When an asset is designated to pass “per stirpes,” it ensures that, should a named beneficiary predecease the testator, that beneficiary’s share is distributed equally among their lineal descendants, rather than reverting to the surviving beneficiaries or residuary estate.

Who is included in a per stirpes distribution?

- The deceased beneficiary’s shares are divided equally among their direct or lineal descendants, which include children (biological and adopted), grandchildren, and great-grandchildren.

- This distribution method is only for biological and legally adopted children. It excludes stepchildren unless the testator has legally adopted them, as stepchildren are not considered the testator's legal lineal descendants.

- Per stirpes doesn’t apply to spouses, siblings, relatives, or parents.

- This distribution method can get difficult to administer in large and blended family setups

How does per stirpes work?

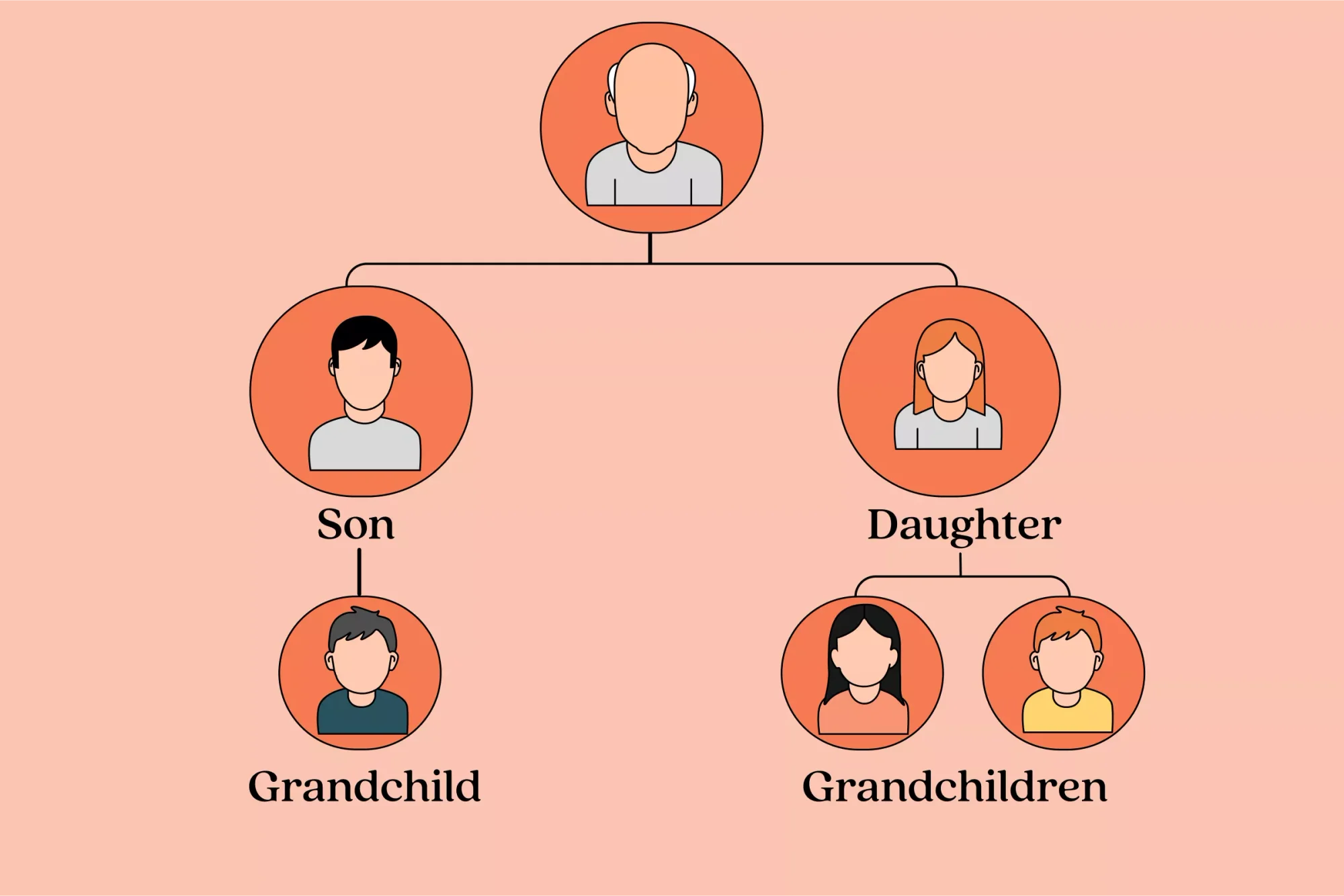

To understand per stirpes, consider a family tree where assets are automatically passed down the tree to the beneficiary's heirs, who may be their children or grandchildren. Each lined descendant gets equal shares. This asset distribution method safeguards the heirs of a deceased beneficiary. When a named beneficiary passes away, their inheritance share typically goes to their children rather than to a spouse or other relative.

The beauty of the per stirpes model is that it eliminates the need to constantly update an estate plan. The executor or trustor doesn't have to take any action if a beneficiary dies unexpectedly or if more children are added to the line of descendants. The per stirpes designations preserve the intended inheritance flow without additional paperwork hassles.

Per stirpes examples

Let’s understand how per stirpes distribution plays out in the real world.

Example 1: When a named beneficiary dies before the testator

Samuel's estate plan divides his wealth evenly between his children, Ginny and Emily, per stirpes. Emily dies before Samuel, leaving behind her two kids. Emily’s original 50% share is not lost to Ginny or returned to Samuel’s estate; instead, it is split equally between Emily’s children, who each receive 25%. Ginny, who is still living, continues to receive her full 50% as originally planned.

Example 2: When a named beneficiary and their children die before the testator

Robert, who has no spouse or kids, names his three cousins, Jerry, Matt, and Sophia, as primary beneficiaries, per stirpes. Matt has a biological child, Mary. Matt and Mary die in a car accident before Robert. Mary is survived by her biological child, Sandy. One-third of Robert’s assets, which were willed to Matt, will now pass to Sandy.

Example 3: When a named beneficiary with no descendants dies before the testator

Here's a breakdown of the different scenarios involving beneficiaries with no descendants and how the distribution of assets occurs.

a. Beneficiary dies without descendants—other beneficiaries in the generation remain

If a named beneficiary in a per stirpes will dies before the testator and leaves no descendants, their share of the inheritance typically goes to the other beneficiaries of the same generation, not to their spouse or other relatives outside the direct lineal line. For example, if a will specifies that assets are to be divided per stirpes among the testator's three issues, and one issue, who predeceased the testator has no descendants, that issue's share would be divided equally between the other two issues (or their descendants if they are deceased).

b. Beneficiary dies without descendants—no other beneficiaries in the generation remain

- If there are no other beneficiaries left in that generation, the share may pass to the next generation of descendants.

- If there are no other beneficiaries from the next generation and the will doesn’t indicate what to do in this case, the state’s intestacy laws will determine how the assets shall be distributed.

In some other cases, per stirpes distributions may stop at the first generation, while others may involve grandchildren, great-grandchildren, or even great-great-grandchildren inheriting the estate.

It's recommended to consult an estate planning attorney to ensure the will or trust accurately reflects the testator's wishes and to address situations where a beneficiary may not have descendants.

We’ll help guide you through your estate plan—whether you need a will or trust.

What are the pros and cons of per stirpes?

If you’re considering including a per stirpes designation in your estate plan, it’s important to understand both its potential advantages and drawbacks.

Pros

The per stirpes distribution method is an attractive estate planning strategy because it:

- Maintains family branches. Allows assets to remain within a family chain or bloodline as they pass from the deceased beneficiary to his or her own heirs, sans the hassle and costs associated with probate.

- Simplifies estate planning. It eliminates the need to name a secondary beneficiary or update estate plans every time there’s a change in family structure, such as the birth of a great-grandchild or when one of the beneficiaries dies before you.

- Protects the interests of future generations. Children and heirs of the deceased beneficiary are protected against disinheritance, ensuring they have a safe and secure future.

- Reduces conflict. The inclusion of a per stirpes clause ensures clear predictability about who is next in line to receive estate benefits, thereby reducing confusion and conflict among other beneficiaries.

- Ensures the testator's wishes are followed. The per stirpes model allows the testator's property to be distributed as per their wishes, even if family dynamics change, such as the adoption of a child.

Cons

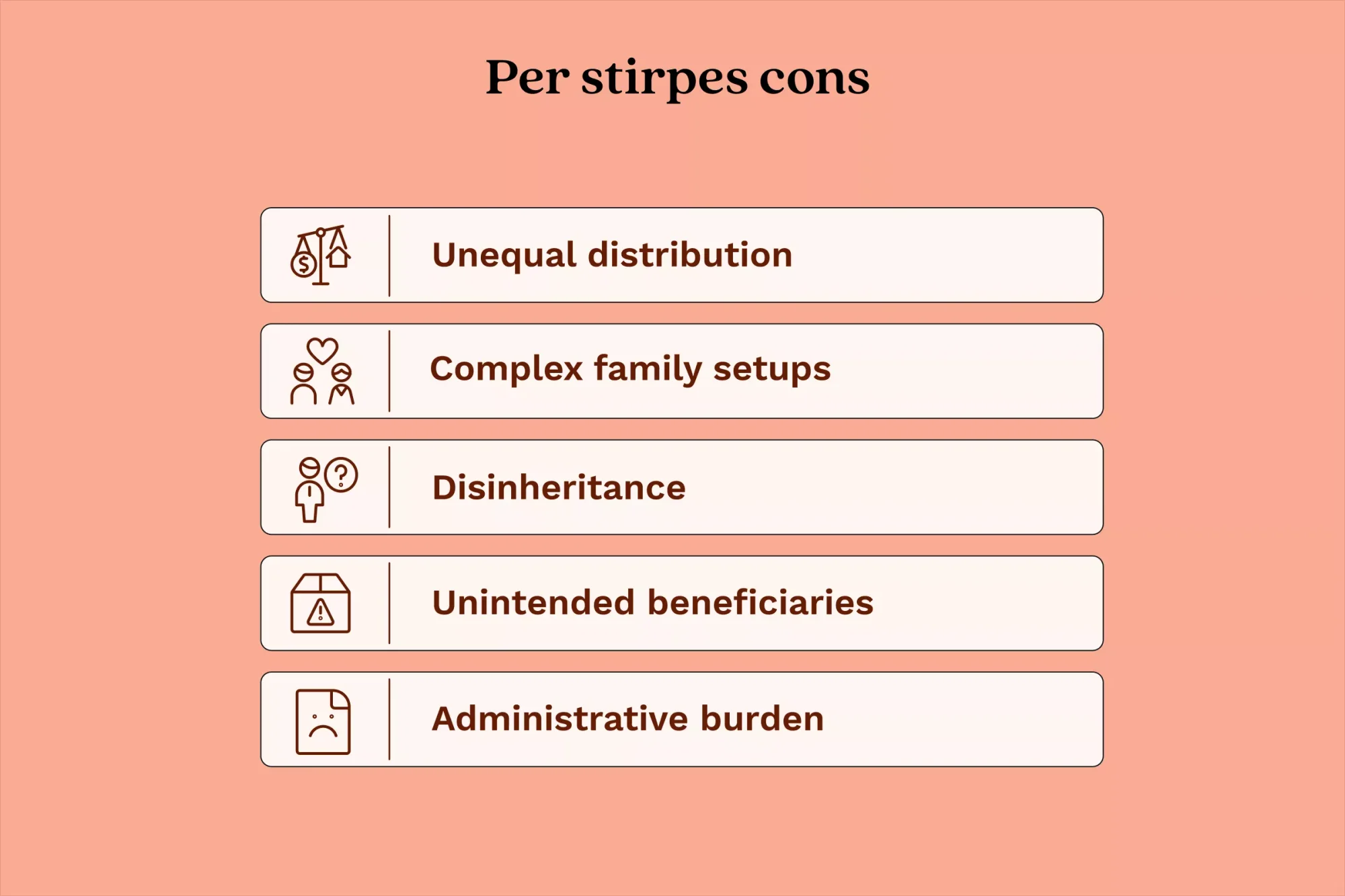

Per stirpes distribution may have some limitations, such as:

- Unequal distribution. If you prefer to distribute your estate evenly, descendants per stirpes might not fulfill that wish. Suppose you use per stirpes to leave property to your son and daughter. Your son has four children, while your daughter has only two. If your son dies first, his inheritance will be divided equally among his four children, with each grandchild receiving a 12.5% inheritance. If your daughter dies first, her share will only be divided between her two kids, giving that set of grandchildren a quarter stake each.

- Complex in large, blended family setups. Per stirpes distributions can be confusing to track and implement for large families with numerous descendants or multiple generations. Some people may believe that simply using the term "per stirpes" in a will guarantees that all heirs will understand their shares. However, if there is a lack of clarity in the will, it may lead to disputes among family members regarding the intended distribution.

- Disinheritance of non-lineal descendants. Non-lineal descendants, such as unadopted or stepchildren, can be shut out from receiving an inheritance. The chain of distribution only flows downwards, not sideways.

- Assets may get passed on to unintended beneficiaries. The method doesn’t consider the current status of relationships. If you have a falling out with a named beneficiary and forget to update your will, your assets can still go into their decedent’s hands in the event of their death.

- Administrative burden. In some cases, assets can fall into the hands of minor children. This may require establishing a trust or guardianship, which can bring additional administrative and financial burdens.

Per capita meaning

Per capita is an alternative way to distribute your estate’s assets. In Latin, per capita means “per head.” In estate planning, per capita refers to the “per head” distribution of assets going to the surviving beneficiaries. It ensures that all beneficiaries within the same generation receive equal shares of the estate.

Considering estate planning, per stirpes and per capita are two distinct methods for distributing assets when a beneficiary predeceases the testator. Let's understand how each works and how per stirpes compares to per capita and other distribution methods.

How does per capita distribution work?

There are different ways to implement a per capita distribution in a will or trust, often specified as either “to my children, per capita” or “to my descendants, per capita". Let’s understand how each of them works:

- To my children, per capita. If a will says “to my children, per capita,” the estate will be divided equally among all of the surviving children. If one of the children predeceases, their intended share will not pass to their offspring; instead, it will be reallocated among the remaining living children.

- To my descendants, per capita. Choosing “to my descendants, per capita” means that the estate will be divided equally among all the living descendants, which includes not only the children but also grandchildren, great-grandchildren, and so forth.

Similarity between per stirpes and per capita in estate planning

The similarity between the two methods is that they ensure that remaining beneficiaries or living descendants receive an equal share of the estate.

Per stirpes vs. per capita: What’s the difference, with examples

| Per Stirpes | Per Capita |

| With a per stirpes distribution, the deceased's descendants receive the inheritance, which may be passed down to grandchildren, great-grandchildren, and so on. | With a per capita designation, the deceased beneficiary's shares are redistributed equally to the remaining living beneficiaries. |

| It automatically trickles down to the deceased's children or their direct descendants who are alive at the time of the testator's death. | It doesn't automatically trickle down to the deceased's children as it would with per stirpes. |

Example:

Let’s understand the application of per stirpes vs per capita with a scenario.

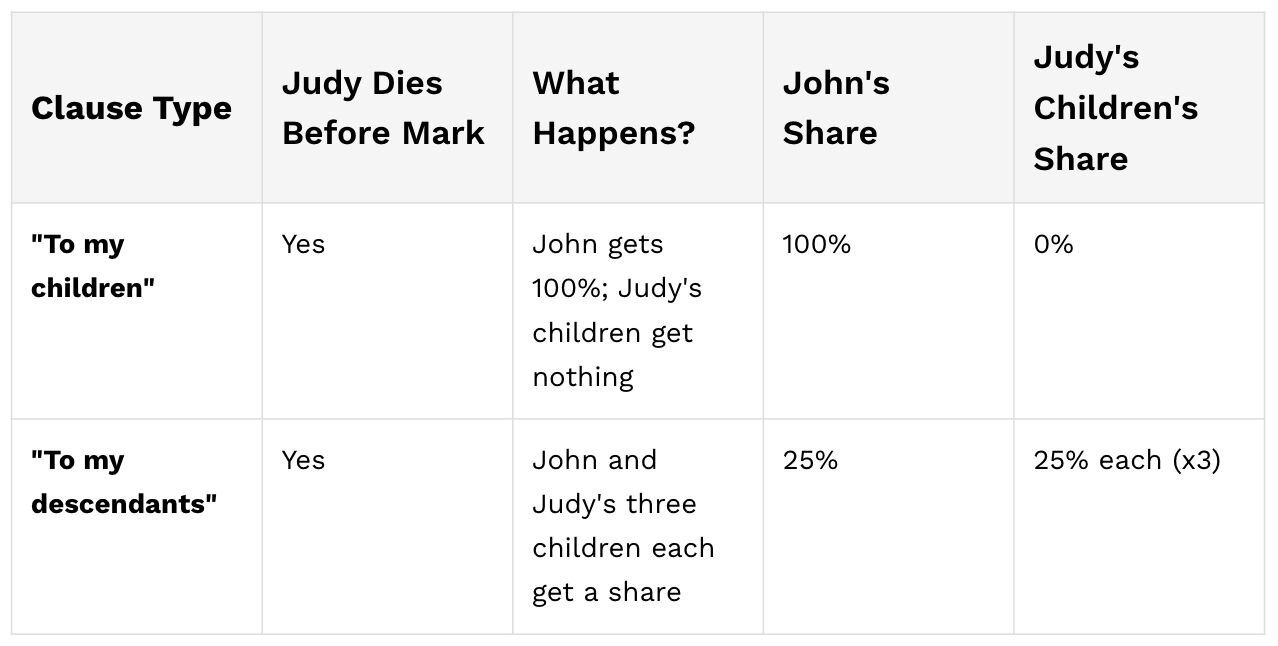

Scenario: Mark names his two children, Judy and John, as equal beneficiaries. Judy has three children, and John has none.

Under the per stirpes distribution, if Judy dies, her share automatically goes to her surviving descendants, her three children. Her original share is divided equally among the three. John gets the other half of Mark’s estate.

Under the per capita distribution, if Mark’s will says “to my children” as beneficiaries using a per capita clause and Judy, one of his children, passes away before him, Judy’s share goes to his other child, John, even though Judy has kids of her own—Mark’s grandchildren don’t receive anything. This is because per capita among “to my children” looks only at Judy and John, not their descendants.

Under the per capita distribution, if Mark’s will says “to my descendants” as beneficiaries using a per capita clause, then Judy’s three children are also considered beneficiaries if she dies first. In this case, John and Judy’s three children would each receive equal shares, instead of everything going to John.

| Clause Type | Judy Dies Before Mark | What Happens? | John's Share | Judy's Children's Share |

| "To my children" | Yes | John gets 100%; Judy's children get nothing | 100% | 0% |

| "To my descendants" | Yes | John and Judy's three children each get a share | 25% | 25% each (x3) |

Other types of asset distribution alternatives to per stirpes

Let’s understand other alternative distribution methods to per stripes, such as “By representation, “Share and share alike,” and “Pro rata.”

1. By representation

In the “by representation” method of estate distribution, each surviving child, or the closest direct descendants of the decedent within the same generation, receives one share. The remaining shares are then divided equally among the surviving descendants of any deceased children who are within the same degree of kinship or generation.

For example, Adam had three children, John, Sarah, and Emily. John has two kids, Alicia and Charlie. Sarah had two kids, Mac and Chuck.

John and Sarah predeceased Adam. In this case, the only living child of Adam, Emily, will receive her one-third share of the estate. The remaining two-thirds of the estate will be divided equally among the living children of John and Sarah. Following the “by representation” method, it implies that each of the four grandchildren of Adam: Alicia, Charlie, Mac, and Chuck, would inherit equal parts of the remaining two-thirds, which is one-sixth each.

2. Share and share alike

"Share and share alike" is a distribution method to divide a deceased person's assets among their surviving beneficiaries, who are their direct descendants. It's commonly used in estates, trusts, or gifts, and ensures that each of the direct descendants receives an equal share of the estate.

If a descendant dies before the testator, the other direct descendants can divide the deceased descendant's share among themselves. Often, this is done through a per capita division, meaning the assets are shared equally among everyone in the same group.

For example, Adam had four children: Mike, John, Sarah, and Emily. Mike had three kids, Michael, Jessica, and David. Mike predeceased Adam.

In this case, three living children of Adam—John, Sarah, and Emily—and the three living children of Mike—Michael, Jessica, and David—will inherit Adam’s estate following the “share and share alike method,” which implies that the total assets will be divided equally among all six individuals.

3. Pro rata

The pro rata distribution allocates the assets to the beneficiaries proportionally, according to the percentage of the total inheritance specified by the testator in the will. Pro rata distribution helps ensure that everyone receives their rightful portion, as per the testator’s wishes. It applies to assets, including property, investments, and other personal belongings.

What is per stirpes versus pro rata?

Pro rata means that asset distributions are made proportionately among the beneficiaries of the same generation, as outlined by the testator. In contrast, per capita means that distributions are made evenly among the beneficiaries of the same generation.

For instance, let's say Brian has two children, Thomas and Candy. Brian didn't have talking terms with Thomas and wanted to leave him a decent amount, but not as much as Candy. Instead of distributing the estate evenly between Thomas and Candy, Brian allocates 40% to Thomas and 60% to Candy, meaning the assets of Brian are divided such that Thomas inherits a prorated share of 40% and Candy inherits 60%.

Furthermore, Brian may also specify that the distribution is specifically "pro rata" per capita and strictly "not per stirpes." If Thomas predeceases Brian, 100% of his estate would pass to Candy. The allocated portion of Thomas's share of the estate would not be passed down to his own children.

What are the legal considerations for using per stirpes?

The application of "per stirpes" varies from state to state and is subject to local regulations. Testators need to understand that the per stripe clause aligns with their intentions and fulfills the requirements of the laws and regulations. Let's explore the application of per stripes in some states:

New York

New York law recognizes per stirpes will as an estate distribution method, allowing descendants to inherit their parent's share. Here, a per stirpes will divide the property into equal shares among the deceased's closest living descendants. If a descendant has died but left children, those children inherit their share, which is further divided among them. Each living descendant in the closest generation receives one share.

Ilinois

Per stirpes in Illinois is followed according to 755 ILCS 5/ Probate Act of 1975. It's the default method of distributing a deceased person's estate if the testator didn't explicitly mention it in their will.

Florida

Per stirpes in Florida is governed by the provisions articulated in the 2025 Florida Statutes, including the Florida Trust Code in Chapter 736 and the Probate Code provisions in Chapter 732. It ensures that the descendants of a deceased individual inherit their respective shares of an estate according to their family lineages.

Ohio

Per stirpes in Ohio, as outlined in Ohio Revised Code Section 2107.52 and Section 5808.19, allows the descendants of a deceased beneficiary to inherit their parent's share of an estate. It guides the distribution process in a will or trust when a beneficiary predeceases the decedent, outlining their rights and the protocol of property management. Together, these sections ensure assets are distributed according to family lines, honoring the deceased's intentions.

How to write a per stirpes clause

A per stirpes clause distributes inheritances based on family lineage. It's important to draft this clause carefully as follows:

1. Introduce the "per stirpes" clause

Include a definition of "per stirpes," a clause that provides a clear explanation indicating if any of your children predecease you, their share will pass down to their children in equal parts. Explain how your assets will be distributed among your heirs upon your death.

2. Identify the beneficiaries

List your children directly, as they will typically be the primary beneficiaries of your estate. A per stirpes distribution in a will must list each primary beneficiary's full legal Name and description of the property they will inherit. If you have additional eligible beneficiaries (such as grandchildren), ensure to address their inheritance under the per stirpes clause.

3. Use legal language

Some examples of how to use legal language when incorporating a per stirpes clause may include:

"I give to my son, John Brown, one-third of my estate. If John Brown does not survive me, this inheritance should be distributed to John Brown's descendants, per stirpes."

Or

"I bequeath my estate to my children, [Name of child 1], [Name of child 2], and [Name of child 3], per stirpes. In the event that any of my children predecease me, their share shall be distributed equally among their descendants."

Or

"I direct that my estate is to be divided equally among my children, per stirpes, with the share of any deceased child passing to their surviving children."

Ensure that an estate planning attorney reviews your documents to guarantee compliance with state laws and regulations.

What are some best practices to create a per stirpes will?

Before drafting a will with a per stripes clause, it’s good to understand the practical considerations first.

1. Have clarity in wills

To avoid confusion, the will should clearly state the intention of the testator to distribute their assets per stirpes. Ambiguous or complicated language can lead to disputes and litigation among heirs. Avoid legal jargon to the extent possible. Make the clause straightforward to ensure there are no misunderstandings.

2. Communicate with the family members

Discuss estate planning decisions with family members beforehand to minimize confusion and disputes later on. It will help all heirs to understand the testator's intentions and thus promote harmony among them.

3. Consider changes in family composition

Major life-changing events, such as births, deaths, marriages, or divorces, can significantly impact how an estate is distributed. Regularly updating and reviewing the clauses of the will to reflect the current family structure is considered a good practice.

4. Understand the tax implications

Understanding the potential tax-related consequences for beneficiaries receiving their inheritance per stirpes is important. Consulting a tax advisor can provide clarity on any implications.

5. Document the records

Having updated copies of the will and other supporting documents can help to make the distribution process easier for everyone involved and address potential challenges (if any).

It's recommended to get the will reviewed by an estate planning attorney or other legal professionals to ensure compliance with state laws.

Create a "per stirpes will" with LegalZoom

Planning for the future is one of the most important things you can do for yourself and your loved ones. If your goal is to ensure care for your loved ones and protection for your assets after your death, LegalZoom's Will & Trust services offer a user-friendly, affordable, and legally sound solution. By combining technology with attorney guidance and review options, LegalZoom simplifies the process of creating estate plans, providing you peace of mind and control over your future through the following features.

- Accessibility: Create estate planning documents from the comfort of your home, at your own pace and time.

- Convenience: Our user-friendly platform simplifies the creation of estate planning documents.

- Safe and secure storage: Enjoy 24/7 access to your documents, as they are stored securely online for easy access and updates.

- Affordability: Get transparent pricing with clear package options.

- Personalized documents: We provide state-specific documents created by experienced estate planning attorneys accepted in all states that reflect your unique situation.

- Guidance and support: Get step-by-step guidance and resources, such as easy-to-follow questionnaires and instructions to guide you through the document creation process. Get attorney review and consultation options to help you make informed decisions. Get your documents reviewed by an experienced estate planning attorney licensed in your state for added assurance at an affordable price.

- Comprehensive planning: Beyond wills and trusts, LegalZoom's plans also include Healthcare Directive (Living Will & Medical Power of Attorney), Financial Power of Attorney, HIPAA Authorization.

Join 1.4 million people who have confidently created their last wills online with us. With thousands of 5-star reviews on TrustPilot, here’s what our customers have to say:

LegalZoom made this easy to understand, and they were helpful and fast about it.

- Jerry M., last will & testament customer

It amazes me something so important was so easy to do... everything was exactly as I had stated. I have peace of mind now.

- Jan F., last will & testament customer

Glossary

- Decedent: A decedent is the individual who is dead.

- Estate: The decedent's estate is all the property owned by the decedent at the time of their death.

- Spouse: A person's husband or wife.

- Stepchildren: A stepchild is a child of one's spouse from a previous marriage or relationship. This child isn't biologically related to one of the parents in a new marriage or relationship.

To learn more about other common terminology used in law and business, you may explore our "Complete Glossary of Legal and Business Terms."

Frequently asked questions

1. How many generations does per stirpes cover?

The per stirpes clause covers as many generations as necessary to fulfill the will. The deceased beneficiary's share will continue to be passed down through their family branch till a living descendant is identified.

2. What is per stirpes in a will?

Per stirpes is defined as an asset distribution method that specifies how assets will be passed on if a beneficiary predeceases the willmaker or testator. When the per stirpes clause is included in someone's last will and testament, it means that if a named beneficiary dies before them, their share of assets gets passed on to the next generation nearest to the decedent, which could be their children or even grandchildren.

3. How is “per stirpes” used in wills and trusts?

By including “per stirpes” in a will or trust, the intended distribution becomes clear, and it helps prevent any family conflicts over who gets what. Additionally, having a per stirpes clause in a will or trust respects the lineage of family members and ensures that when a beneficiary dies before the person who wrote the will, their children are provided for.

4. What does “per stirpes” mean on beneficiary forms?

Beneficiary forms allow individuals to designate a beneficiary who would inherit their non-probate assets—such as retirement funds, life insurance payouts, financial accounts, or other assets—upon their death. It can ensure that the assets are allocated according to their wishes, allowing them to bypass the probate process. This approach simplifies the distribution process, saving time and costs for their loved ones during a difficult period.

5. Does per stirpes include spouse?

Per stirpes distribution doesn't include the surviving spouse, as this distribution method primarily focuses on passing assets down the family line of the decedent, such as to their lineal descendants (children, grandchildren, and so on).

6. Is a spouse considered a lineal descendant?

No, a spouse is not considered a lineal descendant.

7. Does per stirpes include stepchildren?

No, per stirpes distribution doesn't include stepchildren unless the testator legally adopts them, as stepchildren are not legally the testator's lineal descendants, such as biological or adopted children, grandchildren, and great-grandchildren, who directly descend from the testator.

8. Is a son-in-law a lineal descendant?

A son-in-law is not a lineal descendant. Lineal descendants are individuals who are in a direct line of descent from a person, such as children, grandchildren, and great-grandchildren, both biological and adopted. A son-in-law is related through a person's daughter's marriage, not by blood or legal adoption as a child, and therefore doesn't fit in the definition of a lineal descendant.

9. Is a grandchild a direct descendant?

Yes, a grandchild is considered a direct descendant. Lineal or direct descendants include children, grandchildren, great-grandchildren, and further generations in the direct line of descent.

Swara Ahluwalia contributed to this article.