A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated for any reason, including illness and accidents.

Durable powers of attorney (DPOA) help you plan for medical emergencies and declines in mental functioning. Having these documents in place helps eliminate confusion and uncertainty when family members have to step in to handle finances or make tough medical decisions.

What is a POA?

A power of attorney is a legal document that authorizes someone you trust—called an agent or attorney-in-fact—to make legal, financial, or medical decisions on your behalf. You, as the principal, grant this authority and can customize the scope of what your agent can do.

Powers of attorney vary by scope and duration. Understanding these distinctions helps you choose the right type for your situation.

POAs can be classified by scope.

- General POA: Covers a wide range of legal and financial transactions, giving your agent broad authority

- Limited POA: Restricts authority to specific tasks or timeframes, such as signing closing documents on a single real estate transaction

They can also be classified by duration.

- Ordinary POA: Expires when you become incapacitated or on a date you specify. Commonly used for convenience in business transactions, like authorizing someone to handle your finances while you're traveling abroad

- Durable POA: Remains valid even if you become incapacitated, making it essential for long-term planning

What is a durable power of attorney?

A durable power of attorney also authorizes an agent to handle financial and legal matters for you, but it includes unique wording that makes it effective even if you become incapacitated. The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you can't make decisions for yourself.

Since a DPOA remains in effect during periods of incapacity, it is an important part of long-term planning. Your agent can manage finances, pay bills, or make medical decisions without court delays, ensuring your affairs are handled smoothly when you need it most.

You can also name a successor agent, someone who will step in if your primary agent becomes unwilling or unable to serve. This ensures the document remains effective and avoids gaps in authority during times when your affairs need continuous management.

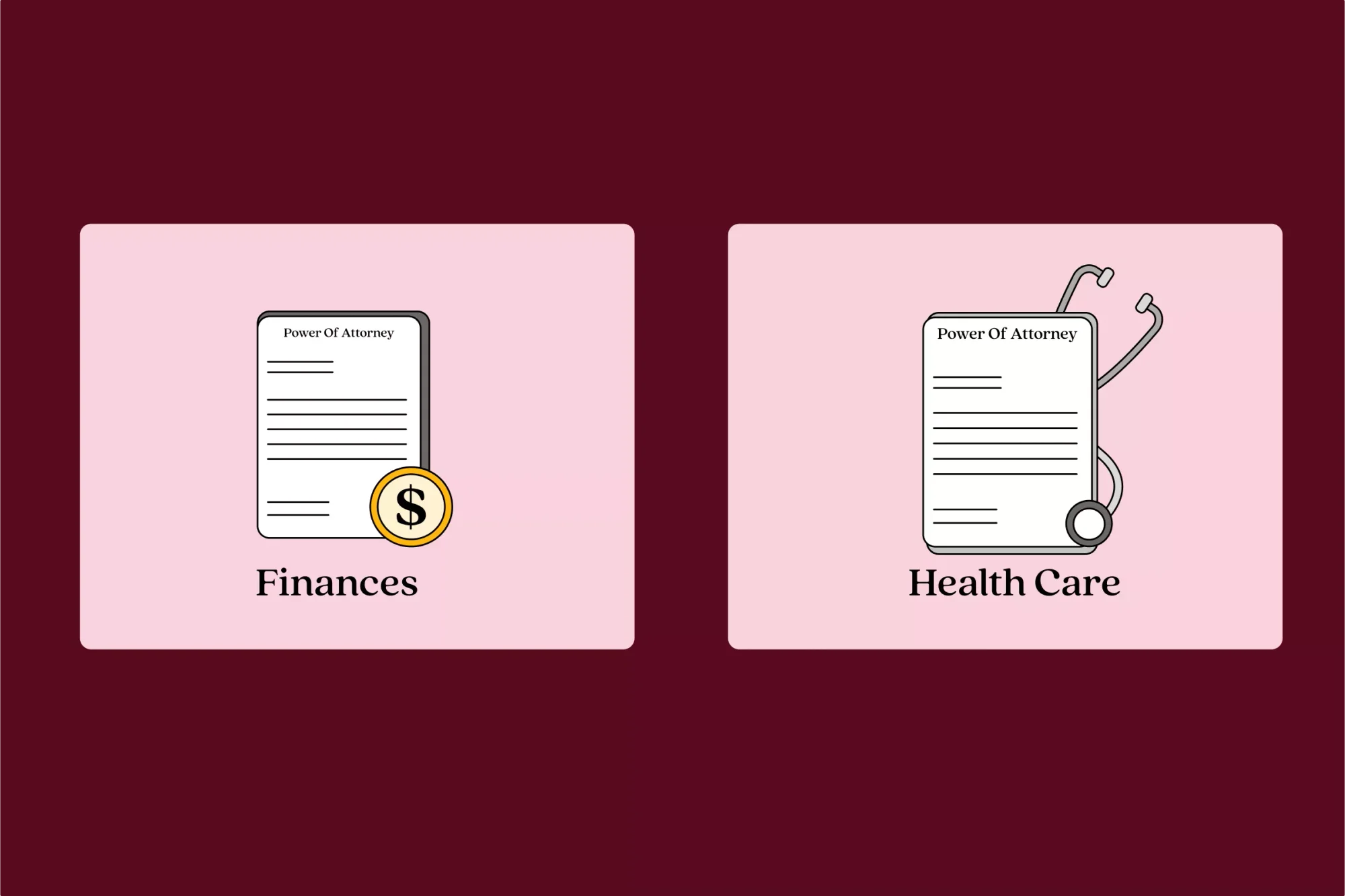

What are the types of durable power of attorney?

There are two features of durable POAs—one for financial matters and one for medical matters—and they are usually contained in separate documents. Most estate plans include durable POAs along with a last will and testament. Each type serves a distinct purpose and comes with different powers and responsibilities.

| Feature | Financial DPOA | Healthcare DPOA |

|---|---|---|

| Purpose | Manages financial and legal matters | Makes medical decisions |

| Agent's authority | Bank accounts, property, taxes, investments | Treatment choices, care facilities, end-of-life decisions |

| When it activates | Immediately or upon incapacity | When you're unable to communicate medical wishes |

1. General durable power of attorney for finances

A general durable power of attorney authorizes someone to act in a wide range of legal and business matters and remains in effect even if you become incapacitated. This document is also known as a financial durable power of attorney or a durable power of attorney for finances.

The POA can take effect immediately or can become effective only if you are incapacitated. Even if your POA is immediately effective, you don't have to use it right away—you can continue to handle your own finances just as you always have.

The person you appoint in your POA, an agent or attorney-in-fact, doesn't have to be a lawyer. An attorney-in-fact can handle many types of financial affairs on your behalf, including:

- Buying and selling property and other assets

- Managing bills, bank accounts, and investments

- Filing tax returns

- Applying for government benefits

If you become incapacitated through illness, accident, or mental decline as you age, a general durable POA allows the agent you have selected to step in and handle your finances right away. If you don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent before they can take care of your finances for you.

2. Durable power of attorney for health care

A durable healthcare power of attorney—also called a medical POA or healthcare proxy—authorizes someone to make medical decisions when you can't. This becomes critical during emergencies when you're unconscious or unable to communicate.

You can give your healthcare agent the authority to:

- Communicate with doctors. Discuss your condition and treatment options with medical providers.

- Make treatment decisions. Choose procedures, medications, or care facilities based on your known wishes.

- Access medical records. Review your health information to make informed decisions.

Who should get a durable power of attorney and why?

Creating a durable power of attorney isn't just for seniors; it's smart planning for anyone at any age. Accidents and emergencies happen unexpectedly, making a DPOA a key component of any well-rounded estate plan. Having one in place minimizes stress and legal hurdles for your loved ones during a crisis.

You might need a durable power of attorney if you're:

- An aging adult who wants to prepare for possible cognitive decline

- A caregiver seeking to help an elderly parent manage their finances

- A business owner who may need someone to act on their behalf during absences

- A young professional who travels frequently and wants to ensure someone can handle financial or legal matters while they're away

- Someone has recently been diagnosed with a long-term illness

- Someone who wants to proactively plan for the unexpected and ensure their affairs are managed smoothly, no matter what the future holds

How does a durable power of attorney work?

Some DPOAs become effective immediately upon signing. Others are referred to as a "springing power of attorney," meaning they only take effect once a specific condition is met, most commonly a doctor certifying that the principal is incapacitated. Springing DPOAs offer control, allowing you to delay the agent's authority until truly necessary. However, they may also cause delays in emergencies, since formal medical documentation is often required before your agent can act.

Once active, your agent's authority depends on what you specify in the DPOA document. It can be broad or focus on specific tasks, such as managing bank accounts or paying medical bills. Regardless of scope, your agent must legally act in your best interests. This includes:

- Acting in good faith. Following your known wishes, even if they differ from the agent's personal preferences. State laws like Virginia's statute require agents to operate only within granted authority.

- Managing finances properly. Keeping your funds separate, maintaining detailed transaction records, and avoiding self-dealing unless explicitly authorized.

- Avoiding conflicts of interest. Never using their position for personal gain. Transferring your assets to themselves requires explicit authorization. For example, in New York, this must be stated in the "Modifications" section per General Obligations Law § 5-1513.

- Respecting your autonomy. Not overriding your decisions while you're mentally competent and staying within their granted authority. Certain actions like voting or changing your will can never be performed by an agent.

How to get a durable power of attorney

Creating a DPOA involves more than just filling out a form. It’s a strategic process to ensure your financial, legal, or health-related decisions are handled smoothly if you become unable to manage them yourself. Here's a step-by-step guide to help you draft a valid and effective DPOA.

1. Choose the right agent (attorney-in-fact)

The first step is to choose someone you trust to act responsibly and in your best interest during critical situations. This individual should be:

- Honest, reliable, and able to act in your best interest

- Comfortable handling medical, legal, or financial matters

- Capable of making difficult decisions under pressure

Consider naming a backup agent in case your first choice is unavailable. You might appoint a close friend, adult child, or other relative as your agent. Be sure they're willing to take on the responsibility before you sign a durable POA. The person you designate as your medical POA does not need to be the same person you name to make financial decisions.

2. Decide what powers to grant

Determine the scope of authority your agent should have. Powers can include:

- Managing bank accounts or paying bills

- Making health care decisions

- Buying or selling property

- Filing taxes or applying for benefits

- Representing you before the IRS for tax matters (if authorized under a financial power of attorney)

3. Use the right form

Each state has its own DPOA laws and may offer a statutory form for use. Make sure to:

- Include the durability clause (e.g., “This power of attorney shall not be affected by the principal’s incapacity”)

- Use a form that suits your needs—financial, medical, or both

- Review your state’s specific template or sample for compliance

You can create a durable POA using a POA form online. It must be signed, and depending on your state, it may also need to be witnessed or notarized.

4. Comply with state-specific legal requirements

To make your DPOA legally binding, you must follow your state’s signing, witnessing, and notarization rules. In most states, the document must be signed by the principal and notarized. Some states also require witnesses, while others may mandate filing or recording the DPOA, particularly if it involves real estate.

State requirements can vary significantly. For example, New York requires the use of a statutory short-form DPOA, which must be notarized by both the principal and the agent to be valid. Texas provides a statutory durable power of attorney form that requires notarization to be valid as per § 752.004. Filing with the county clerk is optional, though recommended for real estate transactions.

Because of these variations, it’s always best to check your state’s official laws or consult an attorney to ensure your DPOA is valid and enforceable in your jurisdiction.

5. Distribute and store safely

Once your DPOA is executed, store it securely, but keep it accessible to those who may need it. Here's how.

- Distribute copies: Provide copies to your agent, family members, doctors, and healthcare providers. For financial POAs, also share with your bank and financial advisor.

- Store the original securely: Keep it in a home safe or with your attorney. Avoid safety deposit boxes unless your agent has guaranteed access during emergencies.

- Record for real estate matters: If your DPOA grants property powers, record it with your county recorder's office to establish your agent's authority in public records and avoid transaction delays.

- Consider digital backup: Store a scanned copy in a password-protected cloud folder that only trusted individuals can access.

What is a living will, and how is it different from a POA?

A living will, also known as an advance healthcare directive, describes your wishes for medical care at the end of your life. It deals specifically with treatments that would prolong your life if you're terminally ill or permanently unconscious with no hope of recovery. The living will only come into play if you're unable to communicate your wishes yourself.

A living will helps loved ones and health care providers make decisions about treatment. It means your family doesn't have to guess at what you would have wanted. Most states have a standard form for a living will.

In contrast, a medical durable power of attorney provides your agent the flexibility to make real-time decisions based on your current medical situation, even if you're expected to recover fully. This flexibility is crucial when mental capacity is in question, such as when a loved one is no longer of sound mind.

These two documents often work together to give your care team and loved ones both clarity and authority. To better understand how a living will differs from a medical power of attorney, check LegalZoom’s guide on power of attorney vs. advance directive.

How to revoke a durable power of attorney

You can revoke a durable POA at any time, as long as you're of sound mind.

Here’s what you need to do:

- Create a written revocation stating your intent to cancel the existing DPOA.

- Notify your agent in writing and retrieve all copies of the original DPOA if possible.

- Inform relevant parties, such as financial institutions, health care providers, and other businesses that relied on the document, of the update.

- Consider notarizing the revocation for extra legal protection, even if not required by your state.

How to terminate a durable power of attorney

A DPOA automatically terminates when:

- The principal dies (authority ends immediately upon death).

- If the principal becomes incapacitated and the POA is not durable.

- A court invalidates the POA, such as in cases of abuse or breach of duty.

- The principal divorces their spouse in states where divorce automatically revokes the spouse’s authority as agent.

If you're wondering how to end a power of attorney, the most effective way is to do it in writing and notify all relevant parties.

How to override a durable power of attorney

The question of who can override a power of attorney for a loved one is more difficult. If you believe someone is abusing their position as a power of attorney, you may be able to go to court to have them removed. An attorney with experience in both estate planning and elder law can help.

Durable power of attorney form (sample) for the US states

DPOA requirements vary significantly across the United States. Each state has its own laws regarding execution, witnessing, notarization, and the specific language needed for validity. Here are the representative sample document(s) for each US state. These materials are for informational purposes only and do not constitute legal advice. Because laws and requirements can change and individual circumstances can vary, your final forms, documents, and filings may differ depending on your state. It is highly recommended to consult a qualified attorney to ensure your POA complies with applicable state laws and meets your needs.

Note: You will need Adobe® Acrobat Reader to view the sample document.

State-wise durable power of attorney form (sample)

How to include digital assets in your durable power of attorney?

In today’s digital age, estate planning isn’t complete without accounting for your digital footprint. A DPOA can authorize an agent to manage your digital assets if you become incapacitated, but doing so requires awareness of relevant legal frameworks and includes clear language that complies with evolving laws like Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA).

1. What are digital assets?

Digital assets are electronically stored or online-accessible assets that hold financial, personal, or sentimental value. Here are some of the common examples:

- Email accounts (e.g., Gmail, Outlook)

- Social media profiles (e.g., Facebook, Instagram, LinkedIn)

- Online banking and investment platforms (e.g., online banking, PayPal, investment portals)

- Cloud storage services (e.g., Google Drive, Dropbox)

- Domain names and blogs

- E-commerce accounts (e.g., Amazon, Shopify)

- Digital wallets and cryptocurrency holdings

Note: Not all platforms allow third-party access, even with a POA, unless their terms of service permit it or you’ve provided specific consent.

2. Legal framework: RUFADAA and why it matters

RUFADAA ensures that your agent can legally access your digital property, but only if your durable power of attorney explicitly grants them permission. Without clear authorization, digital service providers may refuse access due to privacy laws or their terms of service, even if your agent has general powers.

How to authorize access in your DPOA?

To ensure your agent has legal authority over these assets, clearly define what “digital property” means in your DPOA. For example:

“My digital property includes all online accounts, email communications, cloud-stored files, social media accounts, digital currency, and any other intangible electronic assets, including access credentials.”

3. Best practices for securing digital access

Managing digital assets is now just as important as managing physical ones. Here are some practical steps to help your agent access your digital accounts securely and efficiently:

- Use a password manager. Use a password manager to securely organize and encrypt your digital account information, so your agent can access important accounts when needed.

- Keep credentials updated. Regularly update your passwords and ensure your agent knows where the latest information is stored.

- Tell your agent where to look. Make sure your agent knows exactly where to find your digital access details, whether you’ve stored them in a physical place like a locked drawer or digitally in a secure cloud folder or encrypted drive.

How does a durable power of attorney fit into estate planning?

A DPOA is more than a standalone document—it’s often a key piece of a broader estate plan. While a will outlines how your assets should be distributed after death, and a trust helps manage those assets during your lifetime or after, a DPOA fills a critical gap by allowing someone to manage your affairs during your lifetime if you're unable to do so yourself.

This means your agent can step in to handle financial decisions, communicate with doctors, or manage ongoing obligations without requiring court intervention. It also works alongside other documents, such as a healthcare directive or living will, to ensure all aspects of your care and property are addressed, particularly in cases of incapacity.

When combined with a will, trust, and other planning tools, a DPOA helps create a more comprehensive and proactive estate plan, one that protects you while you're alive and eases the transition for your loved ones after you pass away.

Why choose LegalZoom to create your durable power of attorney?

Creating a durable power of attorney is a crucial step in protecting your financial and medical decisions, especially in times of incapacity. LegalZoom simplifies this process by offering tools and support that make it easy, secure, and compliant with your state’s laws. Here's how LegalZoom can help you get it done with confidence:

1. Guided, step‑by‑step process

LegalZoom guides you through each stage, from selecting the agent to reviewing state-specific terms, ensuring your document is thorough and correctly formatted.

2. State‑specific customization

LegalZoom’s POA tool helps ensure your document meets legal standards. It guides you through adding the necessary provisions, such as durability wording, notary signing. The final form is tailored to align with your state’s execution requirements.

3. Easy access and secure delivery

Once your power of attorney is complete, you can download it instantly or choose to have a physical copy mailed to you. Your document is also stored in your LegalZoom account for future access.

4. Optional attorney assistance

You can choose to avail attorney assistance for added peace of mind. An independent attorney licensed in your state can review your document and answer questions to ensure everything meets your specific needs.

With thousands of 5-star reviews on TrustPilot, here’s what our customers have to say:

I didn't just get a POA. I got instructions, information ... That was a pleasant surprise. Great service.

- Jacqueline L., power of attorney customer

I am now a firm believer of LegalZoom. What I thought would be ... complicated ... was ... easy to ... navigate.

- Angela D., power of attorney customer

Durable power of attorney FAQs

1. What does power of attorney durable mean?

A durable POA gives someone else legal authority to act on your behalf, and it continues in force even if you lose your mental capacity. Financial POAs give your agent financial powers that may include managing your assets, paying bills, and buying and selling real estate. Durable POAs for medical care allow your agent to communicate with doctors and make health care decisions if you are incapacitated and unable to make them yourself.

2. What does durable mean in legal terms?

“Durable" means a power of attorney continues in effect even if you are incapacitated. This makes it distinct from an ordinary POA, which would otherwise end.

3. What is the difference between a durable and a general power of attorney?

A general power of attorney gives your agent broad powers but ends if you become incapacitated. A durable power of attorney remains in effect even if you lose the ability to make decisions. That durability makes it a key part of incapacity planning.

4. What is the best form of power of attorney?

The best type of power of attorney depends on the reason you need one. If you want a power of attorney to make it more convenient to conduct business temporarily—for example, if you plan to be out of town frequently—then an ordinary power of attorney may suit your needs. But if you are also planning for a possible future where you may not be able to manage your own affairs or make health care decisions, you'll want a durable POA. An estate planning lawyer can advise you and create the POA document that's best for your needs.

5. What is a durable power of attorney in NYS?

In New York state, all powers of attorney are durable unless otherwise stated. A durable healthcare power of attorney is known as a healthcare proxy in New York.

The New York power of attorney form also allows you to grant your agent the ability to give gifts or support funds to themselves or other people you designate.

6. How does a durable power of attorney terminate in New York?

A durable POA in New York terminates on the death of the person granting the power of attorney unless the power of attorney document specifies a different termination date or event triggering a termination. You can also revoke a New York power of attorney as long as you are not incapacitated.

7. How long does a power of attorney last in California?

You can specify that an ordinary power of attorney will expire on a certain date or after the completion of a task. If you sign a durable power of attorney in California, it will remain in effect until you cancel it or die.

8. Can I have more than one agent?

Yes, you can name multiple agents, also called co-agents. You’ll need to specify whether they must act jointly or independently, depending on what works best for your needs. Here's how both options work.

- Joint authority: This approach may be ideal when you want mutual accountability. It can help prevent misuse of power by requiring both agents to agree. However, it can also slow down urgent decisions if one agent is unavailable or there's disagreement.

- Independent authority: This offers greater flexibility, allowing each agent to act independently. This is particularly helpful when they live in different locations or when quick decisions are needed. But it also requires a high level of trust, since one agent could act without the other's input or oversight.

Whichever setup you choose, clearly defining their roles in the power of attorney document helps reduce confusion and conflict.

9. What happens if the agent is unavailable or unwilling to act?

If your primary agent can’t serve, your DPOA becomes ineffective, unless you’ve named a successor agent. A successor steps in when the original agent is unavailable, ensuring that someone is still authorized to act on your behalf without delay or court intervention.

10. Can a durable power of attorney change beneficiaries?

No. While a DPOA can handle financial matters, changing beneficiaries on accounts or wills typically requires separate legal authority and may be restricted.

11. How to transfer a durable power of attorney?

You can’t transfer a durable power of attorney from one agent to another. Instead, the principal must revoke the current POA in writing and create a new one naming a different agent. The new POA must be properly signed, dated, and witnessed or notarized according to state law. If the principal is already incapacitated and they can’t make this change, a court may need to appoint a guardian or conservator, a court-authorized individual who manages the principal’s affairs when they’re unable to do so.

12. Do banks accept a durable power of attorney?

Yes, banks and credit unions are generally required to accept a valid, state-compliant DPOA. If the document includes proper durability language and meets your state’s execution requirements (such as notarization or witness signatures), financial institutions should honor it. However, in practice, acceptance can vary depending on the institution’s internal policies or staff unfamiliarity, which may lead to delays or requests for additional documentation.

13. What is a non-durable power of attorney?

A non-durable power of attorney, also sometimes called a general power of attorney, authorizes someone (your agent) to act on your behalf for financial, legal, or other matters. However, this authority ends if you become mentally incapacitated. It’s best suited for short-term or specific situations, like when you're traveling or temporarily unable to handle your affairs.

14. What do I do if I'm the attorney-in-fact?

If you hold power of attorney for someone else, bring a certified copy of the attorney document with you when you conduct business or communicate with health care providers. If you're signing documents as a power of attorney, use your name and then indicate that you're signing as a power of attorney. Ask about the preferred format before you sign.

Jane Haskins, Esq., contributed to this article.