No one likes to think about their mortality and end-of-life decisions, but estate planning doesn't have to be a dreary experience. In fact, it can be life-affirming as you secure your legacy and ensure your wishes are carried out after you are gone.

An estate plan is a collection of documents that govern where your assets go after you pass away. It also includes directives to manage your final years, especially if you cannot make your own decisions.

The complete guide to estate planning is designed to help you understand key terms and different aspects of estate planning so you can make decisions that are right for you and your family.

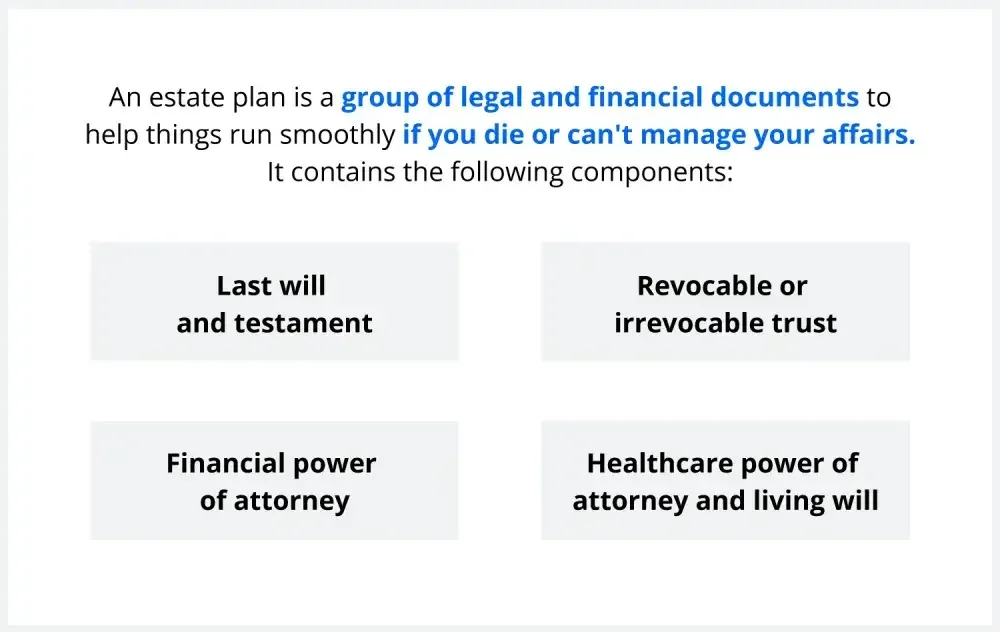

Documents included in an estate plan

While each estate plan is different and designed to meet the creator's needs, most have specific documents in common. Those include:

- A last will and testament (or "will"). The primary purposes of a will are to outline your wishes for who will receive your assets upon your death and to choose a guardian for your children in case you and the other parent cannot act.

- A living trust. A living trust is similar to a will because you are laying out your instructions for who will receive your assets upon your death. However, with trust, your assets are placed into your trust during your lifetime. Upon your death, your assets will be transferred without requiring probate. You can also name a guardian in your trust.

- A living will (health directives). Not to be confused with the last will and testament, a living will is a part of an advance directive that allows someone to make decisions for you if you cannot, especially regarding your health.

- A power of attorney (POA). This document grants another person the power to make financial decisions on your behalf if you are unable to do so for yourself.

There's more to an estate plan than a will. Explore the different documents in our article 4 Essential Estate Planning Documents.

Living trust vs. will—what is the difference?

A trust is different from a will because your assets will be placed into your trust during your lifetime. Your assets will be transferred after you pass away without requiring a court-supervised process called probate. A will, on the other hand, involves the transfer of your assets through probate court.

When people choose to have a living trust, it's usually to avoid their estate going into probate, which can involve additional cost and time depending on your state.

However, each person's individual situation will determine whether a living trust or a will is the best choice. Find out more in Living trust vs. Will: Which One Should You Choose?

Why everyone needs an estate plan

No matter how old you are or how much property you have, you should have an estate plan in place.

If something happens to you without an estate plan in place, the government will decide the fate of your money and your belongings, and their decisions may not align with your wishes. Also, your end of life wishes may not be carried out. Establishing your health care and financial wishes could save your family a lot of time, money, and emotional stress.

While you might only need a simple will in your 30s, your estate plan should be updated as you age, get married or divorced, and have children.

To understand the consequences of not having a will, read What Happens if You Die Without a Will?

For an overview of how your estate plan needs will change over time, read Estate Planning: In Your 20s, 30s, and Beyond.

How to make an estate plan

To begin creating your estate plan, start thinking about what you have and who you want to have it.

No matter how old you are, it's also a good idea to think about who can handle your affairs and make health decisions if you cannot do those things yourself.

Make sure you don't leave out anything important with Estate Planning Checklist and 11 Simple Steps to an Estate Plan.

Do you need an attorney to make an estate plan?

No, you do not need an attorney. But, depending on your particular situation, you may want to hire one. For example, if your child has special needs and is receiving government benefits such as Medicaid, you may need to consider retaining an attorney to establish a special needs trust for your child to make sure that their inheritance from you doesn't disqualify them from receiving these crucial benefits.

You can carry out many elements of your estate plan without hiring an attorney. Certain documents and directives require an attorney to set them up, but they might not be necessary elements for your particular estate plan.

Explore your legal options in When Is An Attorney Crucial to Your Estate Planning?

If you're thinking about setting up a living trust, read Do I Need an Attorney for My Living Trust?

Special considerations for estate planning

While there are universal documents in estate plans that apply to everyone, choosing which you'll need depends on your own unique circumstances.

- Single people will find useful information in Estate Planning for the Single Person.

- People without kids still need an estate plan. Check out 5 Estate Planning Tips When You Have No Children.

- Parents with special needs children can learn more in Estate Planning for Your Special-Needs Child.

- Blended families can learn their options in How Blended Families are Changing the Estate Planning Rules or Including Your Stepchildren in Your Estate Plan.

- Small business owners will find helpful insights in Estate Plan Strategies for Small Business Owners.

Last will and testament

A last will and testament is a legal document outlining your wishes for what happens to your assets after you die.

A will typically includes directives as to how you want to divide your assets and who gets them. It also can include guardianship provisions for minors and many other special instructions.

Explore the uses of a will in Do You Even Need a Last Will? and What Makes a Will Legal?

Learn the limitations of a will in 6 Things a Will Won't Do.

What is probate, and can it be avoided?

Probate is the legal process that oversees the distribution of a deceased person's assets.

Common ways to avoid probate include naming beneficiaries to receive certain assets on your death (e.g. life insurance, retirement accounts, and transfer on death accounts) and/or setting up a living trust.

Depending on which state you live in and the complexity of your assets, probate can be costly and time-consuming. For this reason, many people try to avoid the process to make things easier on their family.

Learn more in What Is Probate? and 10 Tips to Avoid Probate.

Not everyone wants to avoid probate. Find out why in Pros and Cons of Probate.

What is an executor?

An executor is appointed by the probate court to disperse your assets to the beneficiaries you have chosen. In your will, you can nominate an executor. This person will act under the supervision of the probate court. An executor's role may also be referred to as "administrator," depending on how your state defines these terms.

Duties for the executor might include maintaining real property until it can be transferred or sold, paying off debts, and winding down a business.

An executor carries a fair amount of responsibility for the estate. Understand what's expected in Top 10 Duties of an Executor of a Will.

How to make a will

A good place to start writing a will is by making a list of your assets and who you would like to inherit them.

Still not sure what assets you have or where to start? Read Making a Will: A Quick Checklist.

One of the most important decisions parents need to outline in your will is who will be your kids' guardian(s). Learn more in Appointing a Legal Guardian.

Living trusts and other kinds of trusts

A trust is a document that creates a legal framework to hold your assets. There are different types of trusts commonly used in estate plans, and they each have different attributes and benefits.

Revocable living trust

With a revocable living trust, commonly called simply a living trust, you maintain control of the assets in the trust and have full access to them until you die. After your death or incapacity, an appointed successor trustee takes control.

A living trust also helps you avoid probate and keep your wishes private.

For a good overview of living trusts, read Revocable Living Trusts: Everything You Need to Know.

Get more information about the benefits and function of a living trust in What Does a Living Trust Do?, Top 5 Benefits of a Living Trust, and Do Living Trusts Protect Assets From Creditors?

Pour-over wills

A pour-over will is designed to work in conjunction with your living trust. Any assets you neglect or forget to transfer into your living trust will likely need to go through probate. But, with a pour-over will, any of the assets that you didn't transfer to your trust will end up being transferred under the trust terms rather than according to the state's rules of succession.

For this reason, you should be as thorough and up-to-date as possible when transferring assets into your living trust.

Learn how pour-over wills work in Guidelines for Using a Pour-over Will.

Providing for pets through a trust

While separate from a living trust, people can set up a trust for their pets. This allows you to put aside money for a pet's care and even appoint someone to take care of them.

Living trust vs. last will and testament

There's an overlap in the functions of a living trust and a will, but each document has features and options the other doesn't have.

For example, you need a will to name a guardian for your children, but you need a living trust to avoid probate.

Weigh your options in How to Choose Between a Living Trust and a Will.

Family trust

A family trust refers to any trust with family members as beneficiaries. That means it can refer to multiple kinds of trusts.

Find out more about the term and how it's used in Family Trust vs. Living Trust: What's the Difference?

Irrevocable trusts

An irrevocable trust removes your assets from your name, but, unlike a revocable living trust, it also removes your assets from your control.

This added removal provides certain protections for your assets and isolates them in ways that a revocable trust can't.

A revocable trust is fluid, meaning you can change it at any time. An irrevocable trust is set and can't be altered.

Whether you choose a revocable living trust or an irrevocable trust depends on your needs and goals. Find out more in Revocable vs. Irrevocable Living Trusts—Which One Is Right for you?

Testamentary Trusts

A testamentary trust is a trust outlined in your will that only goes into effect once you die.

Testamentary trusts are useful if your beneficiaries include minor-age children or beneficiaries with drug and alcohol dependency issues.

Explore situations where testamentary trusts make sense in 10 Things You Should Know About a Testamentary Trust and Why You Should Consider Creating a Testamentary Trust.

How to make a living trust

Creating a living trust can be quite simple and, in some cases, might not require engaging an attorney. There are steps involved: listing your assets, putting them in the trust, creating a successor trustee, and following all of your state guidelines when creating the trust itself.

Dive deeper into the process of making a living trust in Make a Living Trust: A Quick Checklist and Top 10 Mistakes to Avoid When Writing a Living Trust.

Funding and managing a living trust

The assets that you want to be included in your living trust need to be transferred into the name of your trust. This is called "funding" your trust.

Funding your trust is the process of transferring the titles of your property deeds, your bank and brokerage accounts, and other assets into the name of your living trust. Once your living trust is funded, then you can manage it just as you've always managed your assets.

Get action steps for funding your trust in 11 Steps to Fund Your Living Trust and Living Trusts 101: Funding and Managing a Living Trust.

If you're interested in designating your living trust as the beneficiary for your Roth IRA, read Making a Living Trust the Beneficiary of a Roth IRA.

Advance directives, powers of attorney, and living wills

Advance directives are documents you set up that designate someone to make decisions on your behalf if you need assistance or cannot make them yourself.

Advance directives usually contain a power of attorney and a living will. Find out more in Types of Healthcare Directives.

Powers of attorney for finances

A power of attorney gives a designated person, sometimes referred to as your agent, the power to act on your behalf.

There are two major types of financial powers of attorney:

- A durable power of attorney. This type gives your agent the power to make financial decisions on your behalf even if you become incapacitated.

- A special power of attorney. This type is limited to special circumstances or tasks that you outline.

Get the what and how of powers' of attorney in What Is a Power of Attorney (POA)?, Do I Need a Power of Attorney? and Who Needs a Financial Power of Attorney?

Can I revoke a power of attorney?

You can revoke any POA you designate at any time. The simplest way to revoke a POA is to create a new power of attorney document that designates a new person and revokes any previous POAs.

There are many reasons why you might want to take back a power of attorney. You'll learn about the most common situations: 5 Reasons to Revoke a Power of Attorney

If someone is deemed legally incompetent (by the court or a medical professional), revoking or changing a power of attorney becomes more complicated.

Who needs a living will?

A living will outlines your end-of-life wishes, allowing these wishes to be enacted if you are incapacitated and unable to communicate them.

Everybody should have a living will in place, but it is more urgent if you are older, have a terminal illness, or are undergoing major surgery.

Still a little confused? To understand how a living will differs from a will, read What Is the Difference Between a Living Will and a Last Will and Testament?

How to make a living will

Making a living will requires a fair bit of thought about things most of us don't like to think about.

It's important to include all of your end-of-life wishes in your living will, especially about life support and the person you want to carry them out. It's also important to make your family aware of the document and what it contains.

Make sure you've covered the major considerations in What is a Living Will?.

How to execute your estate plan

It is very important to follow all of the signing requirements for your various estate planning documents. Each state has different execution requirements, but, in most, your last will must be signed in front of two witnesses to be valid, and your other estate planning documents must be properly notarized.

Your last will and testament won't be official unless it is signed in front of two witnesses, and your living trust is void unless you fund it with your assets.

Executing your estate plan is a necessary last step to make sure it functions as you intend. Get the information you need in How to Ensure Your Estate Plan is Executed Properly.

For tips on storing your last will and testament, read our article Where Should I Keep My Last Will?

When to update your estate plan or make a new one

Children become adults, adults get married and divorced, and any number of your relationships, beliefs, and assets can change.

It's a good idea to revisit your estate plan periodically throughout your life to make sure it continues to line up with your wishes.

For a closer look at the life events and situations that merit an update, read Life Is Constantly Changing—So Should Your Estate Plan and 18 Reasons to Revise Your Estate Plan.

Learn which common circumstances should prompt you to revisit your will by reading Top Reasons to Update Your Will Today.

Moving to a new state

While most states view out-of-state wills as legitimate, there may be details within your estate plan that need adjusting once you move to a new state.

Get an overview of what you should plan to update when you move in: Do I Need to Update My Estate Planning Documents if I Move to a New State?

Divorce

When you were married, your estate plan probably listed your spouse not just as a beneficiary of your assets but also as a key figure in other aspects of your estate plan.

At the end of your marriage, you will most likely want to change those designations. Get an overview of what to look for: Revising Your Estate Plan After Divorce.

Empty nest

If you created your estate plan when your kids were little, your plan likely needs major updates.

Adjusting life insurance policies and removing guardianship duties are just two of the many common items that need attention when you get older. Learn more: Why Empty Nesters Need a New Estate Plan.

In the end, estate planning is about empowering you with legal tools to ensure your wishes are carried out. While old age is inevitable, uncertainty about your estate isn't a foregone conclusion. Taking the time to think through this process will bring you peace of mind and be invaluable to the friends and family you leave behind.

Why choose LegalZoom?

LegalZoom does right by you and will refund their fee within the first 60 days if you're unhappy with their services.

LegalZoom's got you covered in all 50 states. Have peace of mind knowing LZ's documents have been legally recognized in every state—and you'll never need to leave home to work with a lawyer.

Flat-rate fees. No hourly charges. No surprises. Really.

Estate Planning FAQs

What is estate planning and why do I need it?

Estate planning is creating a set of legal documents that tell people what to do with your money, property, and personal belongings when you die or become too sick to make decisions yourself. Everyone, not just the wealthy, should have a plan, because without it, the government decides who gets your stuff based on state laws.

What's the difference between a will and a living trust?

A will is a public document that only comes into effect after you die as a way to give your possessions away, while a revocable living trust is private, works while you're alive, and helps avoid court after you pass. The biggest difference is that wills must go through probate court, but living trusts skip it entirely. Living trusts cost more upfront but avoid probate costs, and they can also be helpful if you become unable to make decisions while you’re alive. Wills are simpler and work fine for people with basic estates who don't mind the probate process. LegalZoom can help you decide which you may need and start your estate planning.

What is a power of attorney and do I really need one?

A power of attorney is a legal document that lets someone you trust make financial or medical decisions for you if you can't do it yourself. Yes, you absolutely need one because without it, if you become unable, your family would have to go to court to get permission to help you with basic things like paying bills or making medical decisions. There are many types of power of attorney, and it’s worth looking into which fit your personal needs.

How much does estate planning cost and what are my options?

Estate planning costs depend on how complicated your situation is and whether you use online tools, work with a lawyer, or do a combination of both. Basic estate planning can cost as little as $129–$399 for a simple will through online services like LegalZoom, while hiring a lawyer typically costs $1,200–$3,000 for basic documents. Living trusts cost more, and online services for them can range from $399 to $649.

Traditional lawyers cost much more but give you personalized advice and handle complex situations like business ownership, blended families, or large assets. Many people choose a middle approach; they use online services to create the documents, then pay a lawyer for a one-time review (usually $200–$500). This saves money while making sure everything is done correctly.

What happens if I don't fund my living trust properly?

If you don't fund your living trust (update your assets to legally be owned by the trust) properly, it won't work and your assets will still have to go through probate court when you die. This happens frequently, which is why many online services include funding instructions and some offer attorney assistance to make sure it's done right.

How do I handle digital assets like social media accounts and cryptocurrency in my estate plan?

You need to specifically include digital assets in your estate planning documents. Digital assets include everything from social media accounts and email to cryptocurrency and digital photos stored in the cloud. Include your logins and passwords as well as instructions about which accounts should be deleted and which should be memorialized. Without proper planning, your family might not be able to access anything stored digitally, even if they inherit everything else you own.

When should I update my estate plan?

You should review and update your estate plan every two to three years or whenever you have a major life change such as marriage, divorce, acquisition of real estate, etc. You should also update your plan if the people you chose as executors, trustees, or guardians are no longer able to serve.