Whether it's a dream you've been mulling for years or you just had a eureka moment, there's an incredible allure to starting your own business. But wanting to start one and knowing where to start are two very different things. Not to mention knowing everything you need to do to get up and running and start growing.

The complete guide to starting a business is designed to take you step-by-step from coming up with a business idea to launching a new venture to understanding the legal and tax implications of the various business structures.

Each section of this guide will give you an overview of the topic and some article suggestions to help you dig deeper into the areas you want to learn more about. You've already taken the most challenging step in launching your business—starting the learning process. Let's begin.

Why you should start your own business

There are many reasons to start your own business, including the freedom of setting your own schedule, the pleasure of building something from scratch, and the possibility of making more money.

But the best reason to start your own business is that you know you have what it takes to be an entrepreneur, and you're ready to do it.

What makes a great entrepreneur?

While there's no specific formula, entrepreneurs tend to share certain qualities. Many enjoy being their own boss, and some find the chance for a big pay-off exhilarating.

If you're wondering if becoming an entrepreneur makes sense for you, read The top reasons people start their own business.

What every entrepreneur should know

Before committing your time and money to a business, it's a good idea to understand what you're getting into. The following questions can help you determine whether entrepreneurship is a good fit for you:

- Am I comfortable with financial instability?

- Am I passionate about this product/service?

- Am I ready to work long hours and weekends?

- Do I have a business plan?

- Do I have an A-team picked out to help run my business?

- Am I comfortable wearing many hats, including that of a manager?

- Am I good at making decisions?

Everyone has a different reason to start a business. If you're still looking for yours, take a look at 10 reasons to start a business now and Are you ready to start a business? 4 questions to ask yourself. Explore this infographic on how to find your entrepreneur pose (that is, your entrepreneur purpose)

Coming up with a business idea

You have that entrepreneurial urge, and you're ready to put in the time, but how do you decide what business to start?

Start with your interests

Remember that launching a new company requires passion, focus, and a lot of hard work. So, it's a good idea to pick a business that plays into your natural interests.

What are you passionate about? Ask yourself a few questions before you start:

- What am I really good at? Can it be monetized in some way?

- Do I want to help people?

- Do I want to make as much money as possible?

- Does it thrill me to problem solve and strategize, regardless of the product?

- Have I developed a product that's new to the market or improves on similar products already out there?

- Does my past career experience in a specific industry make me uniquely qualified to know what that industry needs?

If you need to do some additional brainstorming, take a look at 10 tips to turn your hobby into a business and How to find the best startup ideas.

Study what's happening in the market

Whether you're in an idea gathering phase or writing your business plan, research is your best tool for launching a successful business.

Look for industries with gaps yet to be filled. These gaps could become an opportunity.

You can also investigate products and services that seem to be performing well. Ask yourself what's working and what's not.

To help determine if the time is right for your idea, ask yourself these questions:

- Is my product or service solving a problem in the world right now?

- How much competition is there in my marketplace?

- Am I (and my family) ready for financial instability and long hours of dedication?

- Do I have time?

Once you've chosen your idea, you want to be sure it's viable before bringing it to market. This requires knowing as much about the market and your potential customer base as you do about your product or idea.

Dive deeper into methods and uses for research in optimizing your business idea in How to find a business idea that will make you money and How to spot a business opportunity or product gap in your industry

Is your idea relevant?

Consider the world around you and the times you're living in. Do you have a product or service that will fill the needs of your potential customers right now? Will their needs today still be their needs tomorrow?

No one has a crystal ball, but you can ask yourself if the time is right for you. You'll find food for thought in When is the best time to start a business? and 5 reasons why you should start a business this year.

Ideas for hands-on businesses

Some business ideas require sizable financial investment and have multiple employees. This image is exciting to some and less appealing to others. Are you passionate about doing the work or managing people who do the work for you?

Think about your skills and personality. If you prefer to operate solo, you might consider turning your crafting hobby into a business, becoming a personal shopper, or offer your services as a house cleaner.

The world has a lot of stressed-out people looking for relief right now. Perhaps you have an idea that could help them. For a bit of inspiration, check out Smart business ideas for a stressed-out world.

Do some market research

Even if you're starting a business in an industry that you know well, conducting a competitive analysis is essential to launching a new venture.

Market research helps you identify the following:

- The latest products and services in your market

- Current gaps in the market you can fill

- Market trends you can capitalize on

- What your potential customers want

Conduct a competitive analysis

Studying the products, markets, strategies, successes, and failures of your competitors give you invaluable data that can help you determine the direction you take your business.

Read an in-depth breakdown of competitor types and how to effectively apply learnings from them to your own business plan in How to conduct a competitive analysis.

Harness the value of focus groups

Another effective tool, focus groups can help you assess how your product or service might perform in the marketplace. Running a focus group costs money, but the investment is worth it when you're able to gauge potential customer/client engagement.

Focus groups can help you:

- Get public opinion on existing products to improve upon them

- Test and maximize a product you've developed before bringing it to market

- Evaluate your marketing and branding strategy for clarity and effectiveness

- Assess optimal price points and distribution channels

Read more about the benefits of running focus groups in How focus groups can help your business.

Where should you start your business?

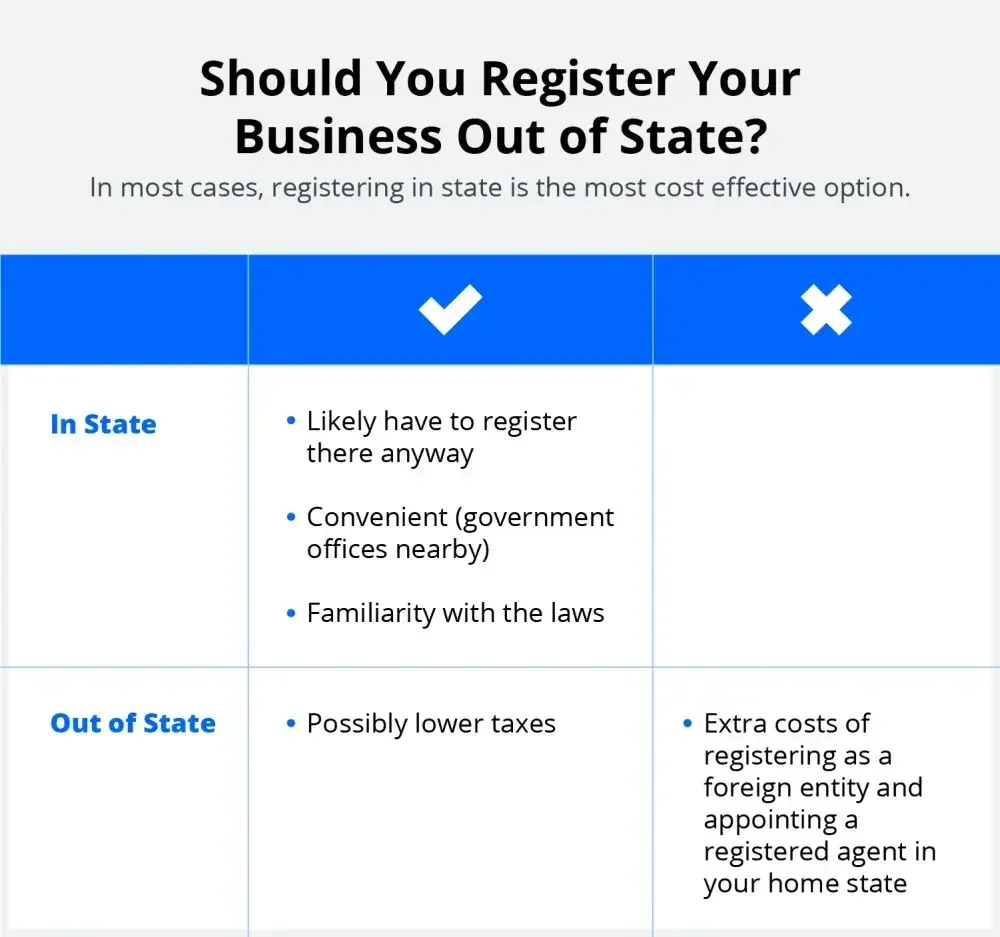

While you can form a company in any state, it makes sense to do it where you live for most business owners. It's almost always the most cost-effective choice. Of course, there are rare exceptions.

The convenience of registering in-state

Even if your home state may have higher taxes and fees, there's a convenience factor to consider. It's much easier to take care of the paperwork when government offices are nearby, and the laws and procedures are familiar to you.

Plus, there's a good chance that your home state will consider you to be doing business there, so you'd still have to register the business in your home state anyway, via a foreign qualification, after forming outside the state.

Pros and cons of registering out of state

Forming your small business outside your home state will likely require the extra step—and costs—of registering as a foreign entity and appointing a registered agent in your home state.

However, the benefit of these lower taxes and fees is eliminated in the likely event you need to foreign qualify your entity in the state(s) where it's doing business. In Delaware specifically, there's the added benefit of a special court, called Chancery Court, with judges devoted specifically to business matters, which helps move those cases through more quickly.

To learn more about which states are friendliest to your business needs, read Which state should you file your LLC in?

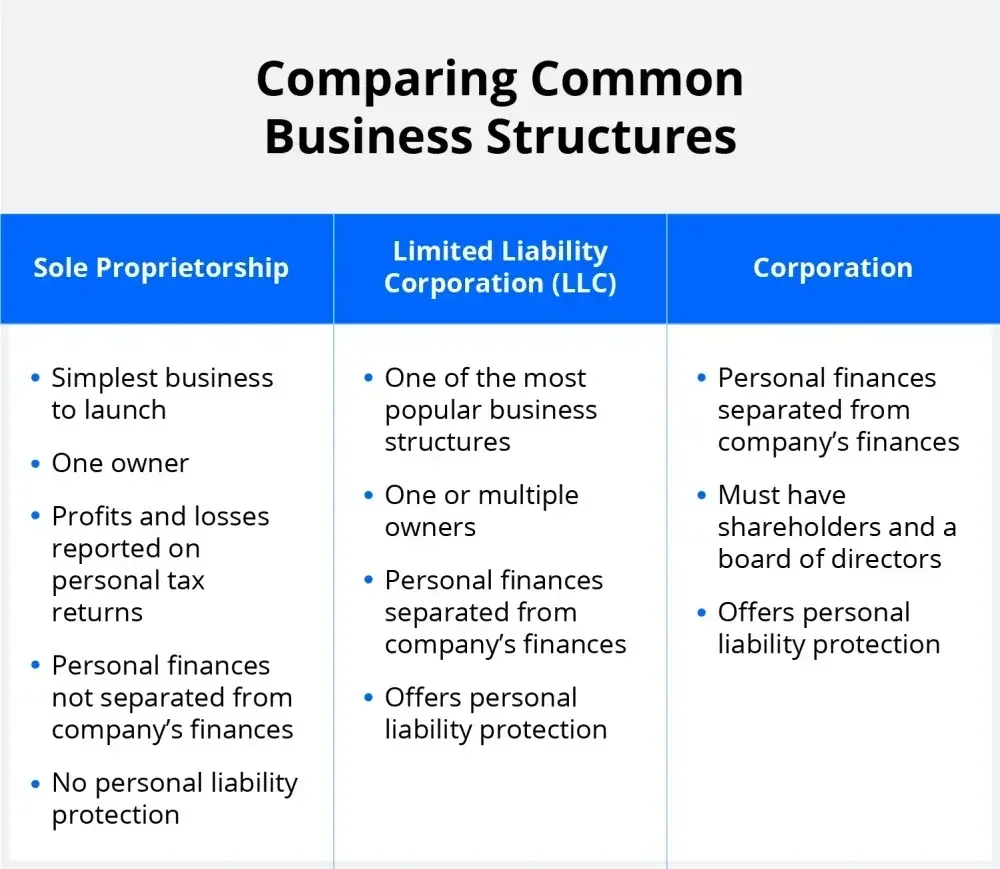

Discover which legal business entity is best for you

When launching a new company, you need to choose a business structure that fits your needs. Here's a brief look at your options to help you determine which structure is best for you.

Benefits of LLCs

One of the most popular entities for people starting a new business is a limited liability corporation, or LLC. This business structure separates your personal finances from those of your company. If your company is sued or files for bankruptcy, it doesn't affect your personal accounts.

As with most entities, there are forms, fees, and tax structures associated with establishing an LLC. But relatively speaking, an LLC is easy to set up and maintain.

To learn more, read What is an LLC (limited liability company)? and How to start an LLC in 7 steps.

Filing a sole proprietorship

A sole proprietorship is the simplest type of company to launch.

You are in complete control, without any partners, officers, or shareholders to answer to. There are no government fees or forms to fill out, no annual reports required, and no necessary public disclosures. Your taxes will simply be a Schedule C (Profit or Loss from a Business).

On the other hand, you won't have partners to help get your idea to market, your personal assets aren't protected and you won't have the benefit of investors as you're starting up.

Learn more about the advantages of setting up a sole proprietorship in What are the main advantages of a sole proprietorship?

Setting up a DBA

Though it doesn't offer the liability protection of an LLC, you'll likely want to set up a DBA if you plan to operate under a different name from the legal name of your business, or a different name from your personal name, if you're a sole proprietor.

There are some minimal fees and forms involved, including publishing your DBA name in local print media.

To read more about DBAs, check out What is a DBA?

Forming a corporation

A corporation is a business entity that, like an LLC, separates the business from its owner(s). Unlike an LLC, a corporation must have shareholders and a board of directors. It will also issue shares of stock to shareholders.

In terms of tax structure, corporations with fewer than 100 shareholders can operate as an S corporation rather than a C corporation.

You'll find more details about corporations and taxes in the Difference between LLC and inc.

Comparing business structures

When deciding on the best structure for your business, you'll want to weigh the pros and cons of each.

If you are unsure of which entity to choose, one of the following articles can help you understand the differences and identify what's right for you.

Define leadership responsibilities and ownership

Whichever business entity you choose, assigning roles, titles, and responsibilities will help you establish a clear structure for your company.

Titles connected to an LLC

The main titles in an LLC are the members and managers. Members are the owners of the LLC.

LLCs can be managed by all members (member-managed), by some but not all members (manager-managed), by some members and outside managers (manager-managed), or by outside managers only (manager-managed).

Corporate titles such as President, Vice President, and Treasurer might be assigned to delineate tasks within the company.

States almost always require LLCs to have a designated registered agent for the purposes o receiving court documents and other official notices.

To learn more about LLC titles, read LLC officer titles explained.

Creating a title for the owner

The owner of an LLC is called a "member." If the owner doesn't hire a third-party manager, then the owner is also a member-manager. However, to the general public, these official LLC titles don't convey their true meaning and can imply that the owner is an employee.

For that reason, many owners give themselves corporate titles like CEO, president, or even owner.

For more insight, read What is the owner of an LLC called? as well as Does an LLC need to have a president or CEO?

Considerations in adding another owner

If you've created a single owner/member LLC and don't have an operating agreement in place, it's wise to create one before adding an additional member to the LLC. To create your agreement, you can refer to a multi-member LLC operating agreement template, but it’s best to consult an attorney to add your business-specific requirements.

It's important to remember that an LLC protects its owners from personal liability, and it's equally important to weigh the pros and cons of adding an additional owner to your business before making that decision.

Different states have different laws governing this process, and you may need to amend the articles of organization that were filed with the state, as well as adjust your IRS tax structure.

To explore the details of adding an owner, read How do I add another owner to my LLC?

Creating a board of directors

If you've chosen to start a corporation, you might need a board of directors. The purpose of the board is to oversee the management of the organization. The board addresses larger issues for the company and generally doesn't involve itself in the everyday workings.

Since the board of directors has certain financial and legal obligations to your organization, it's important to choose the members carefully and to be mindful of any potential conflicts of interest with the company.

Rules governing how the board is elected and how frequently they meet, vary from state to state. A board's role also depends on the needs, mission, and operating agreement for the company.

To look deeper into creating a board of directors, read Roles and duties of your board of directors.

If you're starting a charitable trust, you can learn more about board requirements in Roles and duties of your board of trustees.

Write a business plan

A clear business plan fulfills many requirements for launching your business, and it's also a great way to clarify your ideas and gain confidence that your business will work.

Why you need a business plan

Your business plan is probably the most important document you'll create when launching your business. Not only does the act of writing help focus and refine your idea, but it will also be the tool you'll use to attract investors and explain how your business will operate.

If you've never written a business plan before, read How to write a business plan.

Once you're ready to begin the process, read Start your business off right with a business plan outline.

To gain some pointers on creating a successful plan, read 10 tips for creating a small business plan.

Nonprofit business plans

A nonprofit business plan borrows many elements from the structures of for-profit business plans. Nonprofits are usually reliant on fundraising, so fundraising strategies should be outlined in the business plan.

Since the viability of a nonprofit isn't measured financially, the business plan should outline the guidelines for measuring success as well as the mission that the nonprofit fulfills.

To get started, read How to Write a Nonprofit Business Plan.

Using nondisclosure agreements (NDAs)

After writing your business plan, you'll need to share it with others. A nondisclosure agreement (NDA) will keep your hard work confidential as you necessarily include others on your path to launching the business.

To learn what NDAs should include and how they function, read Using an NDA when building a business plan.

Value of a business plan

Some businesses don't require outside investment, but that doesn't mean they shouldn't have a business plan. A business plan forces you to clarify your goals and make sure your business idea is viable before you invest your time and money into it.

To understand the importance of your business plan as a clarifying exercise, read more about business plan basics

Name and brand your company

Naming your company is a big step, but you'll also need to think about your brand and identity. It can be a challenging endeavor, but will ultimately result in your company making a greater impact than it would otherwise.

Your business identity and brand

Your business identity is more than just a name, and your business brand is more than just a logo. The company's mission, audience, and name all contribute to its identity, and the branding involves not just a logo and logline, but the audience and the marketplace.

In short, your business identity is the title of your story, and the brand identity tells that story.

To understand the differences between your business identity and brand, and to start thinking about yours, read Why you need a business identity, Why you need a brand identity and how to create one, and How to find out if a business name is taken.

Creating a name for your LLC

As you go through the process of creating your business name, it's important to know the unique aspects that go into naming an LLC. When naming an LLC, certain words are restricted and others are required.

Your business name should also function well on social media and translate easily into an identifiable handle. It should also be differentiated from other company names.

You can pick up more LLC naming tips in How to choose an LLC name.

It's all about the logo

It's almost impossible to separate the logos from the most popular brands out there. A successful logo conveys the message, purpose, and feel of the company and does it with simplicity.

There's a lot to consider when creating a logo, including potential future uses. A good logo succeeds based on its ability to evoke a positive feeling about your company in your customer.

Dive into the nuts and bolts of logo creation in What your logo says about your brand identity.

How to finance your business

There are many ways to fund your business, from using your own money to securing loans to seeking venture capital. Each way has pluses and minuses. Here are some things to think about.

Startup funds

If you're planning the launch of your business and you want to know how much money you'll need, the answer is hard to calculate. Detailed business plans and sales projections go a long way to getting you close to an accurate amount. But most experts recommend you allow yourself a significant cushion, as surprises will inevitably arise and sales projections don't always immediately materialize.

You can find out how much money you'll need to set aside in How much money does it really take to start a business?

How to fund a business

There are many ways to gather the funds to start a business. Using your own money offers you the most control, but there are other ways to go about it. Less conventional options are useful to those who have either exhausted or want to avoid more traditional funding methods.

For an overview of traditional funding options, read Small business funding: How to fund your small business.

To explore other funding options, read Unconventional small business funding options for cash-strapped businesses in growth mode.

Venture capital

Acquiring venture capital for your business could provide an influx of much-needed cash, but be careful of what you might be sacrificing for the funding. Venture capital investors end up owning portions of your business, which means they have a say in how the company operates.

If the venture capitalists end up with more shares than you, you'll have sacrificed your ownership for the money. However, your business may be structured in such a way that makes venture capital right for you, especially if your goal is to grow and then sell your business.

To see if venture capital makes sense for you, read Is venture capital a devil's bargain?, What it takes to win over an angel investor, and Venture capitalists on why they pass on startup opportunities.

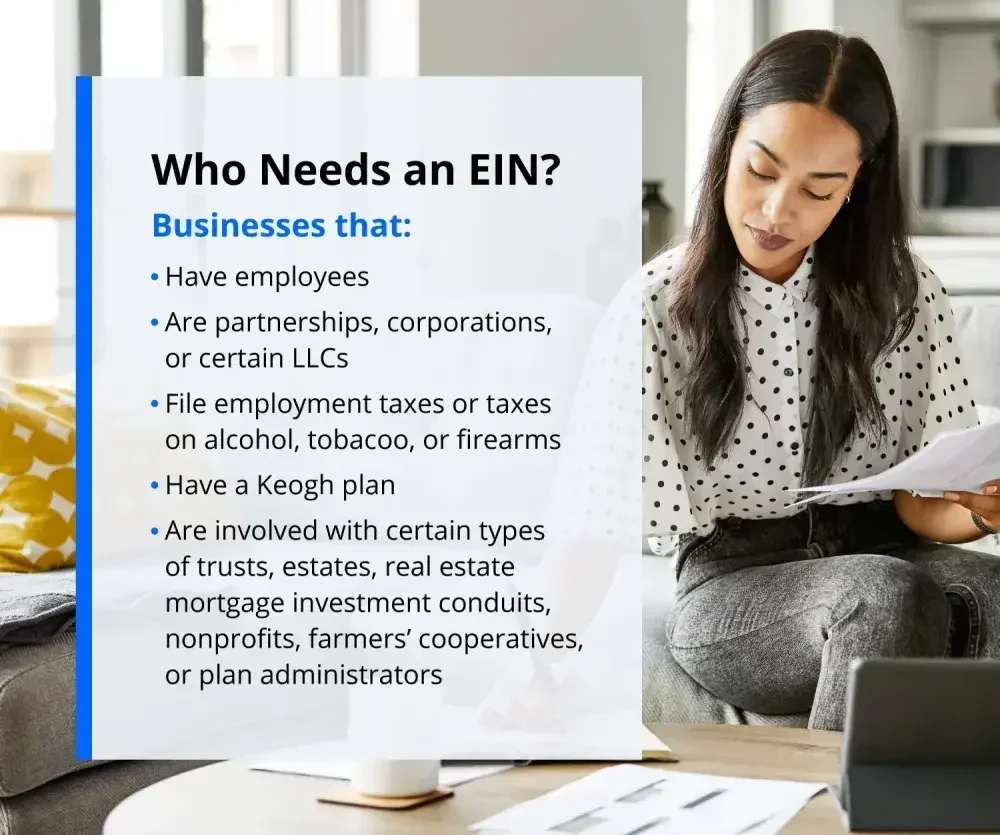

How to get a tax ID

Federal Tax ID, federal identification number, business tax ID—these all refer to an employer identification number (EIN), which you will likely need for your business.

EIN: What it is and who needs it

An EIN is a number from the IRS that becomes the identifying number for your business. Most businesses must secure an EIN for a variety of reasons. Some single-owner businesses aren't required to have an EIN, but it's usually a good idea to get one anyway.

To figure out what an EIN is and who needs it, read What is an EIN and does your business need one? and Which type of business entity needs an employer identification number (EIN)?

Getting an EIN for your LLC

Most LLCs require an EIN for many of the same reasons as other types of businesses. For example, you usually can't open a business bank account without an EIN. Since the main function of an LLC is to protect the business owner from liability, it makes sense to have that added layer of protection from a federal tax ID number as well.

To learn more about obtaining an EIN for your LLC, look at How do I obtain a federal tax ID when forming an LLC?

Business licenses and seller's permits

You should make sure you get all of the appropriate licenses and permits you need to operate your business. You might be required to get more permits than you initially thought you needed.

Your business license(s)

You might be surprised to learn that there are licenses you must acquire before opening your business. You'll definitely need a business license, and that's administered by federal, state, and local government offices.

You might also need other licenses depending on what your business is and how you operate. It's smart to make sure you have all of the proper licenses in place before you launch.

You'll learn more about the ins and outs of business licenses by reading Why you need a business license.

Business licenses and permits

Before you launch, it's a good idea to have a thorough list of all the licenses and permits you'll need for your business.

Where you operate, how you operate, what you sell, what type of business you're running—all of these usually require specific permits or licenses. For many, a business license by itself is not enough, and you might need other permits and licenses to begin operations.

To get a head start on the types of licenses and permits you might need, read Starting a business: License and permit checklist.

Why you need a registered agent

Even one-person LLCs need to designate a registered agent. It's useful to understand what a registered agent is and why you need to designate one before you launch.

What is a registered agent?

The registered agent accepts service of process—documents related to a legal action—and other official notices on your company's behalf. There are all sorts of negative consequences and fines for not having a registered agent, so it's wise to take care of it right at the outset.

Get a thorough explanation of the role of a registered agent in A complete guide to what a registered agent Does and Why do I need a registered agent?

Why hire a registered agent?

Being your own registered agent is not recommended. The registered agent must have a physical address, and someone must generally be present at that address during normal business hours to accept service of process and mail.

Even if you plan to be on the premises at all times, life happens. When you hire a registered agent, you don't have to risk the fines resulting from missing an important communication.

For more reasons to hire your registered agent, read 6 reasons you shouldn't be your own registered agent.

Designating your agent

If you think you don't need a registered agent, you won't get very far in filing your LLC paperwork with the state. That paperwork requires you to designate a registered agent when you file.

If you need to switch agents for any reason, make sure you designate someone else and file the appropriate paperwork. Operating without a registered agent can get your business shut down.

To learn more about these negative consequences, read What is the penalty for not having a registered agent?

How to protect your company's intellectual property

In a competitive marketplace, business owners need to protect the brands, products, and inventions that drive their businesses. As you prepare to launch, begin exploring the protections that best apply to your business.

Intellectual property

When we think about protecting intellectual property, our minds usually go to inventions and big ideas. However, from brand names to website design, many other elements fall under the umbrella of intellectual property and are worth protecting.

To get started on how to protect your business, read Finding the right fit: Comparing intellectual property protections.

Trademark

A trademark is a name, logo, phrase, or sound that identifies your business or product(s). To give your trademark federal protection, you must actively use it and register it with the U.S. Patent and Trademark Office (USPTO).

Certain things are ineligible for trademark protection, and other trademarks might already exist, so thoroughly research your trademark idea before trying to register it.

You can find out more about researching trademarks by reading How to check if a trademark is already registered.

For more on the ins and outs of trademarks, read What is a trademark? and 5 things business owners should know about trademarks.

Copyright

If you think copyright only applies to artists, think again. There might be elements of your business that qualify for copyright protection.

While original works automatically get some copyright protections, once they are created and accessible in the world, it's advisable to register them with the copyright office, especially if you plan to take any legal action against infringement.

You'll learn about copyrights and how they may impact your business by reading Copyright basics: What is a copyright and why is it important? and Why you should file a copyright.

Patent

You can apply for a provisional patent for an invention before you have it fully fleshed out. This gives you the ability to protect your invention and prevent others from gaining ownership of it while you're working on it.

There are a few different types of patent protections available. So, you'll need to understand which is best for your situation. Dig into the elements of patents by reading What is a patent, and how to use it and The basics: Provisional patent vs. utility patent.

How to price your product

We all know the adage, "The value of something is only what someone is willing to pay for it." This concept and a few others will play into the process of pricing your product.

Factor in everything

When you're figuring out how to price your product, the first order of business is to identify your production costs. Some other factors to consider are the marketplace value, customer psychology, and the perceived value of your offering.

Marketing your business and products

It's good to be smart with your time and money as you engage in a marketing strategy. Fortunately, much can be done online for little cost, and your marketing can make all the difference in your business's success.

Developing a marketing plan

A marketing plan goes a long way toward sharpening your focus on your business and its potential impact. Your plan should probably be simple at first, and you should stick to it so that you're always in control of your brand and its message.

By not wavering from your plan, you'll be able to truly gauge its effectiveness when the time comes to reevaluate or expand your marketing strategy down the road.

To understand the value of a marketing plan, read How to develop a marketing communications strategy.

Integrated marketing

Once you have your marketing plan, you'll need to figure out how to implement it. Small investments can lead to big results, and many marketing avenues — like email and social media— can be free.

To get the most bang for your buck, figure out where your customers are and reach out to them there. If you can, try to connect your business to zeitgeist items that are already newsworthy.

To start thinking about integrating strategies, check out How to integrate your marketing efforts for maximum results.

Drive website traffic

With the community of your customers now online, the website is the modern storefront. Linking to other sites, engaging with your audience, and creating new content, are all part of operating a successful business in the modern world.

Businesses that pay attention to the customer's navigating experience, and make adjustments based on what they learn, tend to see a great benefit.

Learn about online optimization and catering to your customers' experience in 5 tips to attract new online customers and How to map your customer's journey.

Leverage social media

Your social media plan for your business should be specific and goal-oriented. Make sure you engage on the platforms where your customers engage.

If you can, connect your social media activity to your website and try to convert your followers into email subscribers. Consistently interact with your followers and be sure to provide value in those interactions.

You'll also want to check out:

- How startups can use Facebook marketing to brand, sell, and grow

- How to use LinkedIn to build your business and find customers

Influencer marketing can work

For many businesses, affiliations with influencers reap tremendous results. It's sometimes hard for a brand to communicate directly with people, but influencers gain their status through this direct connection with followers.

It's not right for every business, but if you can iron out the right deal with the right influencer, the return on investment could be the best of all the elements in your marketing plan.

Explore the idea of influencer marketing.

How to manage your finances

Getting a handle on your business' finances involves many elements, and creating accurate statements helps you meet your financial goals. Some small business banking platforms provide free tools to help you automate your budgeting and simplify cash flow management, but here are some additional tricks to cut costs that can go a long way.

The importance of cash-flow

At the risk of stating the obvious, a healthy business does not spend more money than it takes in. A good cash-flow forecast will maintain a favorable income/spending ratio in the short term and the long term.

To dig into some strategies to help manage your income-spending dynamic, read a beginner's guide to cash-flow management for small businesses.

Why financial statements matter

In creating your cash flow statement, you might realize you need a boost from creditors or investors. If that's the case, you need to make a balance sheet, an income statement, and a statement of owner's equity before you can secure the additional finances you need. Additionally, these statements will give you a more thorough picture of your operations.

You'll learn more about financial statements when you read 4 types of financial statements that every business needs.

Business vs. personal accounts

Even if you use your own personal funds in your business, there are many advantages to having a separate business account and many pitfalls to operating out of your personal checking account.

The benefits of a separate business account range from accounting clarity to liability protection to credit advantages to purchase processing.

To learn why people open separate business accounts, read Are you still using your personal bank account for your business?

Cost-cutting strategies

There are many little ways to cut costs in your business. You might be surprised how quickly some small, cost-saving measures can add up. By looking closely, you can trim expenses through your bank account, credit card, utility bills, and other common items.

To get ideas on how to make your business more cost-efficient, read How lean is your machine: 9 cost-cutting tips for small businesses.

Why credit score counts

You should strive for and maintain a good credit score for your business, especially if you need to secure financing. The factors contributing to a good business credit score are similar to those for a personal credit score.

Learn details about business credit score in Why your business credit score matters.

Hiring and managing employees

If your business needs employees, that's usually a sign you're doing well. There's a bit of work you'll need to do to set yourself up for success before starting the interview process.

How to start hiring

The first step to hiring is to make sure your business is set up with all of the tax and payroll infrastructure to handle employees. A clear job description will help you identify what you actually need and attract strong candidates.

Before having anyone come in to interview, it's also a good idea to create an employee manual. This way, you'll be ready to answer questions in addition to asking them.

To learn more about hiring employees and setting up your business to handle them, read How to hire your first employees and What startups need to know about their first employees.

Hiring employees in an LLC

Various different structures fit under the LLC umbrella, so the rules governing hiring employees differ depending on the structure of your LLC business.

An LLC can hire people so long as the proper paperwork and tax structures are in place. LLC members can also pay themselves through distributions from the business profits.

Get into the nuts and bolts of hiring employees for your LLC by reading Can you hire employees in an LLC?

Outsourcing human resources

While large businesses usually have an entire human resources team, many small businesses forego, including Human Resources, in their structure. Experts suggest this isn't always a wise choice.

While not as knowledgeable of your business as an in-house HR director would be, an HR outsourcing service could prove beneficial to your small business needs and even to your bottom line.

To find out more about HR, read Is outsourcing HR the right move for your small business?

Building company culture

It's no secret that a good company culture has a positive effect on a business's success. But company culture doesn't just mean parties all the time. It involves good communication and feedback between employees and managers.

A successful, positive culture within a business environment is also connected to that particular business's values and purpose.

To give more thought to company culture, read 5 Tips for Building a Thriving Company Culture.

Filing taxes for your business

With a little research and some good bookkeeping, addressing your business taxes needn't be as daunting as you might think.

General small business taxes

Depending on your small business's size and revenue, there are different structures that make the most sense for tax purposes.

Whatever structure your business utilizes—sole proprietor, S corporation, etc. — you should have clear and consistent methods to track your income and expenses so that preparing your taxes isn't overly time-consuming. You should also be prepared to pay the estimated tax throughout the year.

For a good overview of how to approach small business taxes, read Personal taxes vs. business taxes: What are the biggest differences? and Tax tips for small business owners.

LLC taxes

If you know for sure that your business needs the liability protections of an LLC, then you should probably go ahead and form it before addressing other structural questions for your business. Not only are the startup expenses to form your LLC tax-deductible, but an LLC can opt to be taxed as a sole proprietorship, an S corp, a C corp, or a partnership, whichever makes the most sense for your business.

To learn about the tax benefits connected to your LLC, read What are the tax benefits of an LLC? and Are LLC startup expenses tax deductible?

Paying yourself from your LLC

If you operate a single-owner LLC, then you are the sole member of your business. As such, you can pay yourself a salary with all of the standard payroll tax deductions, or you can choose to pay yourself with a distribution of the profits, or you can do a combination of both.

Taking distributions of the profits will require you to fill out a schedule C on your tax return. If your LLC has multiple members, you can't pay one member a salary and not other members.

You'll learn more about how to pay the members of your LLC by reading How to pay yourself in an LLC.

Help and resources

If you're looking for more help with finances or just need more advice, there are resources out there for you. Here are some ideas to get you started.

Online support

While there's a lot of noise on the internet, there's also some remarkable business information and advice available to those who know where to look. Most successful business people rely on others' expertise, and many blogs exist where you find valuable advice for a variety of questions.

Business grants

If you think your for-profit business isn't potentially eligible for a grant, think again. While nonprofits—especially those in research or technology—are the most common small business grant recipients, there are grants out there for other small businesses, particularly from local development centers.

You should note that grant money is always subject to tax. But for many, a grant is exactly the leg up they need to get their business of the ground.

To get started on where and how to look for grants, read How to apply for and get business grants.

You can do this

Starting a business can be an intimidating process, but it doesn't have to be. If you take it step-by-step, you'll soon have your dream business up and running. If you need additional help, there are plenty of educational resources that can help you along the way.

The hardest part of the entire process is simply to start. And if you're reading this guide, congratulations, you've already begun.