With no corporate or personal income tax, a straightforward franchise tax system, and transparent regulatory requirements, Texas consistently ranks as one of the best states for business. Like most states, however, if you’re thinking about forming a corporation in Texas, you will need to follow specific state requirements. This comprehensive guide walks you through each step of the Texas corporation formation process.

What is a Texas corporation?

A Texas corporation is a legal entity for your business that keeps it separate from its owners or shareholders. This provides you with limited liability protection for the corporation's financial obligations, which means creditors cannot pursue your personal assets to pay the corporation's debts and obligations.

Corporations in Texas must be registered with the Secretary of State and follow certain rules like filing formation documents, paying franchise taxes, and keeping proper records. Under Texas law, corporations are governed by the Texas Business Organizations Code, which provides the legal framework for formation, operation, and dissolution of corporate entities in the state.

Benefits of incorporating in Texas

A Texas corporation provides several key advantages for business owners:

- Limited liability protection. Owners are generally not personally liable for corporate debts and obligations, so your personal assets are protected from business liabilities and your employees' or business partners' actions.

- Tax flexibility. Corporations can elect S corporation status for pass-through taxation or maintain C corporation status.

- Investment and business appeal. The ability to issue and transfer shares makes corporations attractive to investors and can enhance business credibility with customers, vendors, and lenders.

- Perpetual existence. Texas corporations can exist indefinitely, continuing beyond the death or departure of the founders.

How to form a Texas corporation: Step-by-step

To form a Texas corporation, you’ll follow a series of steps to make sure your business is legal, protected, and in compliance. Let’s review everything you need to do, from choosing a name to filing your paperwork and setting up your internal rules.

Step 1: Choose your corporation's name

Before filing your certificate of formation, you must select an available corporate name that complies with Texas naming requirements. First, your corporation's name must meet the below Texas-specific requirements.

- Corporate identifier: Must contain one of these words: "company," "corporation," "incorporated," or "limited," or an abbreviation such as "Co.," "Corp.," "Inc.," or "Ltd."

- Uniqueness: Cannot be the same as or deceptively similar to the name of another Texas entity or a name that has been reserved with the Texas Secretary of State.

- Availability: Must not conflict with existing trademarks or assumed names on file with the state.

The easiest way to conduct a Texas business name search is through the state’s SOSDirect system:

- Access SOSDirect: Visit the Texas Secretary of State's SOSDirect website, create an account, and log in.

- Select search type: Choose "Entity Search" from the menu options.

- Enter search criteria: Input your proposed corporate name. You should also try different corporate identifiers (Corp., Inc., Company, etc.), search without punctuation and abbreviations, and check for similar spellings and phonetic variations.

- Review results: Check for identical or deceptively similar names.

- Verify availability: Confirm no conflicts with existing entities.

Once you find an available name, you can reserve it before you file your formation documents:

- Complete Form 501, Application for Reservation of Entity Name.

- Submit the filing fee of $40 to the Texas Secretary of State.

- Receive your confirmation, which reserves your name for 120 days.

- File your certificate of formation within the reservation period.

Step 2: Appoint a registered agent

Every Texas corporation must maintain a registered agent and registered office to receive legal documents and official correspondence. You can be your own registered agent, appoint another individual, or use a registered agent service.

Individual Texas registered agents must:

- Be at least 18 years old

- Maintain residency in Texas

- Have a business address in Texas (P.O. boxes are not allowed)

- Be available during normal business hours (9 a.m. to 5 p.m., Monday through Friday)

- Provide written consent to serve

If you choose to use another business entity as your Texas registered agent, the business must:

- Be authorized to conduct business in Texas

- Not be the same as the business entity you are incorporating

- Maintain a physical business office in Texas

- Have an individual available to receive documents during business hours

- File appropriate authorization documents with the Secretary of State

Hiring a professional registered agent service can take this compliance requirement off your hands and provide reliable handling of documents. LegalZoom's registered office in Frisco, TX is fully staffed, meets all state requirements, and offers document scanning and unlimited cloud storage.

Step 3: Prepare the certificate of formation (Form 201)

The certificate of formation (sometimes called the articles of incorporation in other states) is the foundational document that creates your Texas corporation. For a for-profit corporation in Texas, this is Form 201. Fill it out carefully so that you don’t miss any of the specific information required by Texas law:

- Entity name and type. Include the complete legal name of the corporation and designate it as a “For-Profit Corporation.”

- Registered agent and office. List the registered agent’s name, the full street address of the registered office in Texas, and provide the registered agent’s written consent.

- Organizer information. Include the name and address of each organizer, with at least one required. Organizers may be individuals 18 or older, corporations, or other legal entities, and there is no Texas residency requirement.

- Director information. Provide the names and addresses of the initial directors, with at least one required. There are no age, residency, or citizenship restrictions.

- Share structure. This is the total number of authorized shares and whether they have par value or no par value. Shares with par value cannot be sold below that amount, while no-par-value shares can be sold at prices set by the board. If there are multiple classes, you’ll also need to outline the details and rights of each.

- Duration. Specify “perpetual” if the corporation will exist indefinitely, or you may provide a set termination date.

- Effective date. The corporation begins once the certificate of formation is filed, unless you choose a delayed effective date. Any delayed effective date can’t be more than 90 days after filing.

Step 4: File your certificate of formation

You can file your certificate of formation through the SOSDirect system, in person, or by mail. Both methods also offer expedited and priority services. The Texas Secretary of State encourages online filing because it’s typically faster.

If you file by mail, send your certificate of formation to:

Texas Secretary of State

Corporations Section

P.O. Box 13697

Austin, Texas 78711-3697

If you’re local to the Austin area, you can deliver it in person to:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701

Once the Texas Secretary of State accepts your certificate of formation, your corporation is officially recognized as a legal entity. Online filings are usually processed within a few business days, but you can request expedited service for an additional fee. After the filing is accepted, the state issues a stamped certificate confirming that your corporation has been legally established.

Steps to take after forming your Texas corporation

Even though you’ve filed your certificate of formation, you’re not quite done setting up your corporation. There are a few more steps to take to make sure your corporation is compliant.

Consider your federal tax status

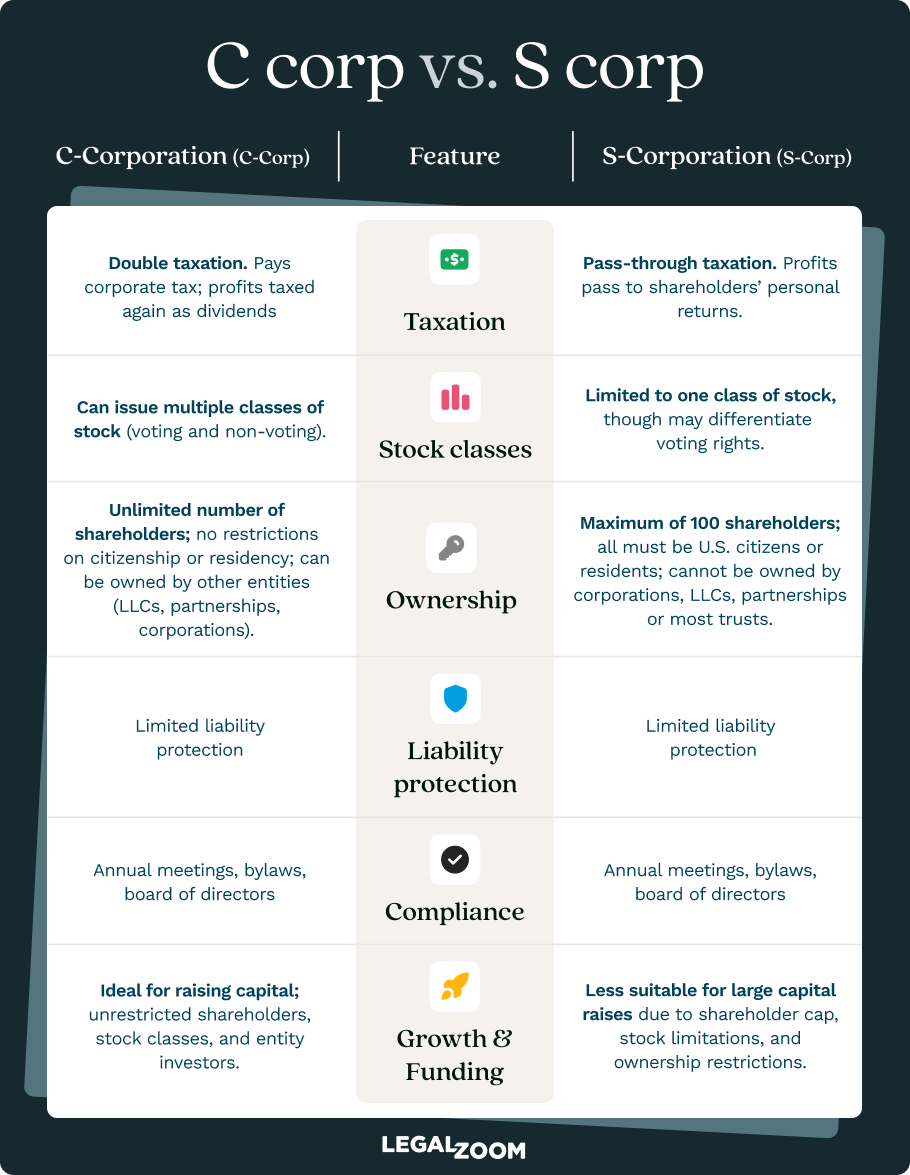

After forming a corporation in Texas, you can choose from different types of federal tax classifications: C corporation or S corporation. Both provide limited liability protection, but have other pros and cons.

A C corporation in Texas is a tax classification for a corporate structure. It’s the traditional corporate structure that’s often chosen by businesses planning to grow or attract investors.

- A C corporation can have unlimited shareholders, making it easier to raise capital.

- It allows ownership by individuals, other corporations, or foreign investors without restrictions.

- It offers the ability to issue multiple classes of stock, giving flexibility in ownership and profit distribution.

- It’s taxed at both the corporate level and again when dividends are distributed to shareholders, which can increase the overall tax burden.

An S corporation is a federal tax classification Texas corporations can elect after formation. It’s designed for smaller businesses that want corporate liability protection but prefer a simpler tax structure.

- An S corporation passes profits and losses directly to the owners’ personal tax returns, avoiding double taxation.

- It is limited to 100 shareholders, which can restrict growth potential.

- It only allows one class of stock.

- Shareholders must be U.S. citizens or residents.

- S corporations are still subject to the Texas franchise tax, which is calculated based on revenue, not on a pass-through basis.

To elect S corporation status for federal tax purposes, you’ll file Form 2553 with the IRS. You must file within 2 months and 15 days of formation.

Draft your bylaws

After your certificate of formation is filed, the initial directors must adopt corporate bylaws. Your bylaws should address the items below.

- Director provisions: Number, qualifications, election, removal, and meeting procedures

- Officer provisions: Titles, duties, selection, and removal procedures

- Shareholder provisions: Meeting procedures, voting rights, and notice requirements

- Share provisions: Issuance, transfer restrictions, and certificate requirements

- Committee provisions: Authorization and powers of board committees

- Amendment procedures: Process for modifying bylaws

Bylaws are not filed with the Secretary of State, but must be maintained at the corporation's principal office and made available for inspection by shareholders.

Hold an organizational meeting

Once you’ve drafted your bylaws, hold an organization meeting with the initial directors to:

- Formally adopt the corporate bylaws

- Elect corporate officers (President, Secretary, Treasurer, etc.)

- Authorize issuance of shares

- Approve corporate resolutions

- Approve the opening of corporate bank accounts

- Adopt corporate seal and stock certificates

- Set the fiscal year

- Authorize necessary business licenses and permits

Document all organizational meeting actions, including resolutions and decisions, in your corporate minutes and maintain these records at the corporation's principal office.

Obtain an EIN

All Texas corporations must obtain a federal employer identification number (EIN) from the Internal Revenue Service (IRS). An EIN is required for key business activities such as opening corporate bank accounts, filing tax returns, and hiring employees. You’ll also need it if you plan to make an S corporation election. Here’s what’s required on your EIN form:

- Legal name of the corporation (exactly as shown on the certificate of formation)

- Corporate address and registered office address

- Responsible party information (typically a director or officer)

- Business start date and accounting period

- Reason for applying (new entity formation)

You can apply for an EIN online through the IRS website, by phone with the IRS Business & Specialty Tax Line, or by mailing or faxing Form SS-4. Using an EIN application service like LegalZoom can take the process off your hands.

Issue shares

Once you’ve authorized the issuance of shares in your organizational meeting, you can officially issue the shares. Follow these rules to help protect the corporation’s structure and create a clear record of ownership:

- Issue shares in accordance with the certificate of formation

- Comply with par value restrictions (if applicable)

- Prepare and issue stock certificates or maintain electronic records

- Maintain a stock ledger recording all share transactions

- Document share issuance in corporate resolutions

As with your meeting minutes, you should maintain documentation of your share ledger at your principal office. Also, be sure to keep records of all share transfers and maintain up-to-date shareholder contact information.

Set up corporate records

Texas corporations need to keep accurate and organized records that show how the business is managed, and make them available to shareholders:

- Certificate of formation and all amendments

- Corporate bylaws and amendments

- Minutes of shareholder and director meetings

- Stock ledger and share transfer records

- Annual financial statements

- Tax returns and supporting documentation

How much does it cost to form a corporation in Texas?

Forming a Texas corporation costs a minimum of $300 for domestic corporations to file your certificate of formation or $750 for a foreign corporation to file an application for registration. You might also pay other fees if you want to reserve a name or choose expedited processing.

| Fee type | Cost | Description |

|---|---|---|

| Certificate of formation (Texas entity) | $300 | Required filing fee with Texas Secretary of State |

| Certificate of formation (foreign entity) | $750 | Required filing fee with Texas Secretary of State |

| Name reservation | $40 | Optional 120-day name reservation |

| Expedited processing | $25 | Faster processing option |

Additional formation costs

Starting a Texas corporation often involves more than just filing fees—you may also need to budget for services that help set up and maintain your business. These costs can vary based on complexity, but they often make the process smoother and more reliable.

- Attorney fees: Hiring an attorney to assist with formation may cost between $500 and $2,000.

- Accounting setup: Setting up initial bookkeeping with an accountant typically ranges from $200 to $500.

Ongoing compliance

Texas corporations must meet yearly compliance requirements that come with certain expenses. Most of these costs are tied to taxes and filings with the state.

- Public Information Report (PIR). This report (called an annual report in many other states) must be filed by May 15 of each year. Remember to file the report with the Texas Comptroller's Office, not the Secretary of State. An annual report service like LegalZoom can take care of this for you and ensure it’s filed on time.

- Franchise Tax Report (FTR). If your corporation must submit a FTR, then you will submit it with your PIR by May 15. For tax year 2025, you are exempt from the franchise tax and do not have to file the FTR if your total revenue is $2,470,000 or less. For 2026 and 2027, you won't have to file if your total revenue is $2,650,000. Above that threshold, retail and wholesale corporations pay 0.375% of their taxable margin as franchise tax. Other businesses pay 0.75%. Thresholds and rates may change for future tax years.

Other ongoing costs

Beyond taxes, there are a few other expenses you may face in running your Texas corporation. These costs vary but are important for staying compliant and organized.

- Registered agent services: A professional registered agent service costs about $100–$300 annually.

- Annual meeting costs: Annual meetings may involve expenses depending on the size and complexity of your corporation.

Texas corporation formation FAQs

How long does it take to form a corporation in Texas?

It depends on how you file your certificate of formation. Online filings are usually the fastest and can sometimes be processed in just one business day, while mailed filings may take longer. After the state approves your filing, you need to complete other steps like adopting bylaws and issuing shares before your corporation is fully operational. That timeline depends on how quickly you can complete those steps.

What is the minimum number of directors required for a Texas corporation?

Texas law requires at least one director for a corporation. There is no maximum number of directors, and directors are not required to be Texas residents or U.S. citizens if you form a C corporation. The certificate of formation must include the names and addresses of the initial directors.

What is the difference between organizers and directors in Texas?

Organizers and directors serve different roles in a Texas corporation. Organizers, also called incorporators, are responsible for filing the certificate of formation but have no ongoing duties once the business is formed. They can be individuals, corporations, or other legal entities.

Directors, on the other hand, manage the corporation’s business and affairs, take control once the certificate of formation is filed, adopt bylaws, hold organizational meetings, and maintain ongoing fiduciary duties to the corporation.

Do I need an attorney to form a Texas corporation?

You do not need an attorney to form a Texas corporation. However, legal advice can be helpful if your business has a complex structure, multiple share classes, licensing requirements, or tax planning needs. Services like LegalZoom can also provide guidance to help you complete the incorporation process and stay compliant with state law.

How much does it cost to maintain a Texas corporation annually?

The cost to maintain a corporation in Texas can vary depending on the size of your business and the services you need. For example, businesses with total revenue of $2,470,000 or less do not have to pay franchise tax, but those with revenue over that amount have to pay a set percentage. You might also need business licenses or choose to pay for things like registered agent services ($100–$300 per year) or legal and accounting services (which varies based on complexity).

Can a Texas corporation do business in other states?

A Texas corporation can conduct business in other states, but it must register as a foreign corporation in each state where it operates. This typically requires filing a certificate of authority or similar form, appointing a registered agent in that state, paying fees, and meeting the ongoing corporate requirements for that jurisdiction.

How do I dissolve a Texas corporation?

To dissolve a Texas corporation, the directors must first approve a resolution, and the shareholders must give their consent. After that, you will need to file a certificate of termination (Form 651) with the Secretary of State, pay final franchise taxes, notify creditors, and distribute remaining assets to shareholders. The process also includes closing bank accounts and canceling any business licenses to fully wrap up the corporation’s affairs.

Jane Haskins, Esq., contributed to this article.