Every business owner must report their business expenses to the Internal Revenue Service (IRS), so keeping track of them is paramount. Here are the most common types of small business expenses and seven foolproof tips to help you easily manage them.

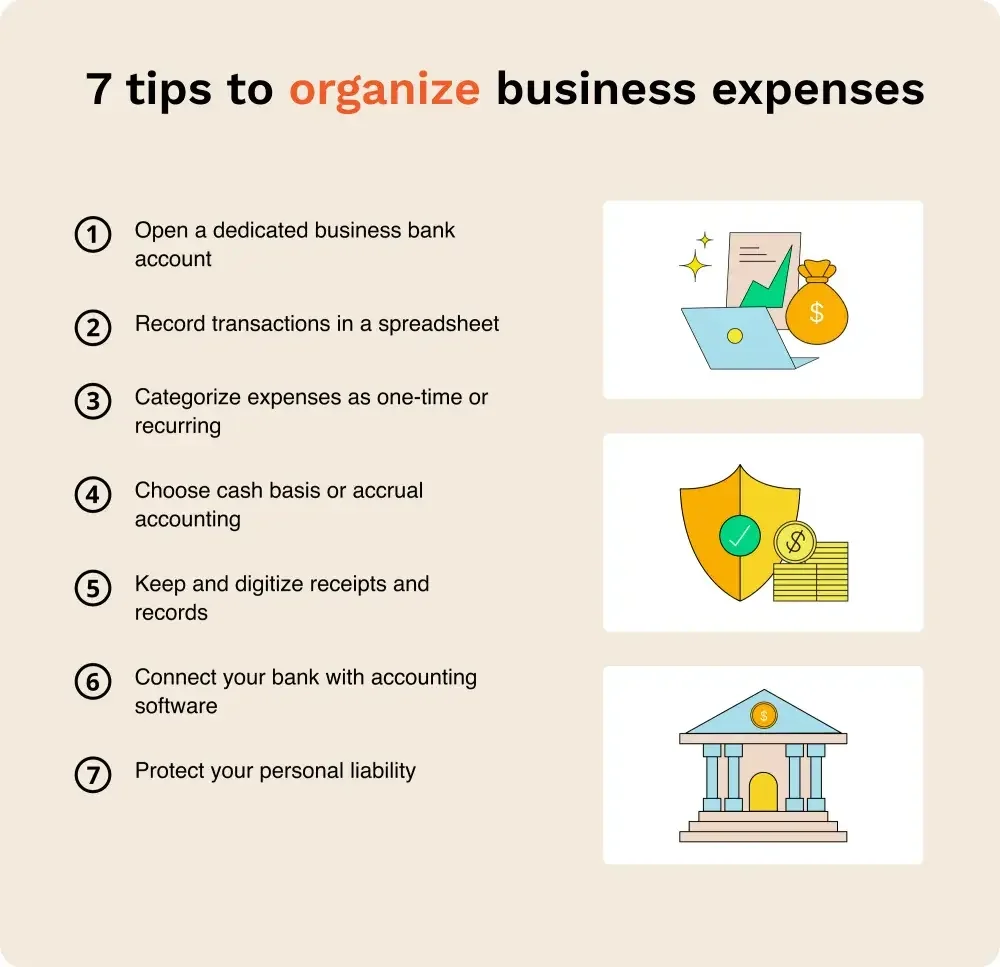

7 steps to organize small business expenses

1. Open a business bank account

If you want to organize your business expenses, first, you'll need a bank account for those transactions.

A business bank account is your go-to destination for all business-related transactions to keep things organized. You should never use your business account for personal expenses or vice versa.

- Best practice: Don't use cash when spending money on your business. Cash is much harder to track and is very difficult to reconcile with receipts and statements when compared to debit or credit transactions.

2. Categorize your expenses by how often they occur

For a better understanding of how your business spends money, categorize your small business expenses by how often they occur. Starting a business takes lots of upfront cash compared with the long-term costs of running the business, and knowing which expenses fall into which category can help you look ahead.

There are two primary types of expenses: One-time expenses only occur once and usually involve startup costs like permits, licenses, and fees. They can also include high costs like furniture and heavy equipment that isn't replenished regularly. Recurring expenses occur regularly, and you should account for paying them monthly. Common recurring expenses include rent, payroll, utilities, and small office supplies.

- Best practice: Limit your recurring expenses before you launch your business so you can allocate more money to startup costs.

3. Keep (and digitize) your receipts and records

No matter which accounting method you choose for your business, it would help if you made a regular habit of saving and digitizing your receipts and records. Receipts are your only proof of legitimacy for business expenses when it comes time to file your small business taxes, and receipts can easily fade.

Make sure you scan or take pictures of your receipts to avoid missing out on tax deductions before filing. In addition, you should aim to make digital copies of important documents related to your business, including:

- Permits, licenses, and leases

- Purchase agreements, invoices, and estimates

- Intellectual property applications and records

- Tax returns and other documents

- Employee records and payroll documents

- Bank statements and other records

A digital record of necessary business information can be much easier to access than digging through a filing cabinet.

- Best practice: Save your important documents in several places to avoid losing them completely in an emergency. Consider separate hard drives, cloud storage, and physical storage.

4. Use accounting software to avoid missing expenses

If your business has grown to the point where a spreadsheet is no longer easy to maintain, consider switching to accounting software to automate the process. Accounting software can connect automatically with your business banking account to record and categorize transactions so you never miss a beat. LZ Books is an accounting software solution that auto-categorizes income and expenses into tax-ready categories, plus makes it simple to export data for your tax preparer.

- Best practice: Use accounting software as soon as you can afford it to limit mistakes from manual bookkeeping.

5. Use a spreadsheet to record transactions

A spreadsheet can help you learn the ins and outs of simple business bookkeeping by familiarizing you with your business' expenses. Spreadsheets help you manually record transactions regularly and categorize them with filters, tags, or formatting.

- Best practice: Record transactions as often as possible, preferably daily, to avoid missing any expenses for your records.

6. Choose (and stick to) an accounting method

Consistency is key when organizing your business expenses, and that applies to the accounting method you choose, too.

As a small business owner, you can choose to keep track of transaction payments, or once a service or sale is complete. Each method offers different benefits: Cash-based accounting records transactions once you send or receive a payment. It's a more simple method to manage for smaller businesses. Accrual accounting records transactions once a service or sale is complete. This method gives a complete picture of business financials.

- Best practice: If you anticipate scaling your business, accrual accounting can help you plan for the future by ensuring you have an up-to-date balance sheet.

7. Protect your liability as a business owner

It means nothing to organize your small business expenses if you don't protect yourself and your business with business insurance or liability protection through your business entity. When you start a new LLC or form an S corporation, these entities also shield your personal assets from liability if you run into legal issues through your business.

- Best practice: Structure your business as an LLC to limit your liability and obtain business insurance to protect your business' finances.

Common expenses

The key to organizing small business expenses is placing them in the right categories. These categories can help you budget and analyze your business' performance. It will also make it easier to identify expenses that qualify for tax deductions or credits quickly.

Broad expense categories

On an income statement, you separate expenses into broader categories and then subdivide those into more specific categories. The broadest categories for expenses are:

Operating expenses: Most common. Include expenses incurred during the regular course of business.

You may find another broad category on the income statement within operating expenses: Selling, general, and administrative (SG&A) expenses. SG&A expenses include all costs not directly related to the production of a good or the performance of a service, like:

- Advertising

- Marketing

- Accounting

- Legal

- HR

- IT

Rent, utilities, and supplies not directly used in producing a good are also included in SG&A.

Non-operating expenses: Incurred through an activity unrelated to the business' core operations.

While operating expenses are more common, most businesses also have non-operating expenses. Common examples of non-operating expenses include:

- Interest

- Taxes

- Impairment charges

- "One-offs" or unusual expenses

Specific expense categories

The general ledger is the core of a business' accounting record-keeping and where you record all financial transactions and subdivide expenses into their most basic elements. You can use this ledger to generate the business' financial statements, including the income statement.

These are some of the most common specific categories for expenses:

- Salaries and wages: Salaries are a fixed amount paid to an employee during a pay period, and wages are based on a set hourly or annual rate. Employee pay is generally tax deductible for small businesses.

- Benefits: Common benefits on the general ledger include health insurance, life insurance, short- and long-term disability, retirement contributions, unemployment, and workers' compensation, along with certain insurance premiums and contributions to qualified retirement plans.

- Training and education: A tax deduction is available for work-related education expenses to maintain or improve a skill needed for your present line of work. It is also available for a training or education cost required by law to keep your present job or status.

- Marketing and advertising: Business cards, website hosting fees, web or print ads, and brochures are all part of marketing and advertising expenses. Reasonable costs incurred to advertise your business are tax deductible.

- Rent: Generally, rent for the use of a space that is not owned by your business is a tax-deductible expense.

- Supplies: Supplies consumed during the year, such as office cleaning supplies, are typically tax deductible.

- Clothing: Clothing that is job-specific and cannot be used as daily wear outside work is tax deductible.

- Research and development (R&D): An R&D tax credit is available to businesses that develop new or improved products, processes, software, techniques, formulas, or inventions that result in new or improved functionality, performance, reliability, or quality.

- Repairs and maintenance: Repairs and maintenance that do not improve the value of an existing asset or extend its life are tax deductible. If the cost is an improvement, it is capitalized and depreciated over time for tax purposes.

- Utilities: Electricity and gas are examples of utilities. They are tax deductible when directly business-related.

- Communications: Internet, landline phones, and business cell phones are examples of communication expenses. They are tax deductible when directly business-related.

- Depreciation: This is the value lost by property, plant, and equipment (PP&E) over time. Depreciation isn't tax deductible in the year you incur the original cost, but rather the expenses are spread over multiple future years.

- Amortization: This is the value lost by an intangible asset over time. Amortization is tax deductible in future years, but not the year the original cost is incurred.

- Interest: This represents the ongoing cost of a business' debt, typically paid to a lending financial institution. Interest expense is typically tax deductible, but certain limitations are based on the total amount and type of debt.

- Taxes: The total taxes payable by your business is an estimate throughout the year based on current activities.

- Impairment charges and “one-offs": Currency exchange fluctuations, obsolete inventory impairments, restructuring costs, and expenses incurred due to a rare natural disaster are examples of "one-offs."

There are many categories and subcategories of expenses. Your industry and specific business needs will help you identify which expense categories are necessary and useful to track and analyze.

Organization helps prepare for tax season

You can't run your business efficiently or effectively without staying organized, and you shouldn't head into tax season without organizing your business expenses.

When it comes time to put your organization to the test and file an annual report for your business, it can help to speak with a qualified attorney who can ensure you put your best foot forward.