If you are considering setting up a living trust, you need to understand the difference between a trustor and a trustee, as well as the relationship between them. Although one person can be both trustor and trustee, or both trustee and beneficiary, the roles of the trustor, trustee, and beneficiary are distinctly different. Each comes with its own rights and responsibilities.

Living trust basics

What is a trust?

At its core, a trust is a legal arrangement and a fiduciary relationship in which a trustor transfers ownership of assets to a trustee. In a trust, the trustor transfers property to the trust, which is then held and managed by the trustee for the benefit of the beneficiaries.

A beneficiary is a person or entity for whom the trust was established and who will benefit from the trust assets. Most often, the trustor, a child or other relative of the trustor, or a charitable organization is assigned as the beneficiary. There can be, and often is, more than one beneficiary.

Beyond these core roles, a trust also involves:

- Trust assets. These are the assets that are placed into the trust, which can include real estate, investments, cash, businesses, and other valuable possessions.

- Trust agreement. The trust agreement establishes the guidelines the trustee is to apply in managing the trust assets. It is typically created by a trustor and agreed upon by a trustee and the beneficiaries. It details the roles and responsibilities of the trustee, how assets will be managed, distributed, and under what circumstances. A trust agreement is also referred to as the trust document or the trust instrument.

A trust is a powerful tool in estate planning, offering numerous benefits beyond simply distributing assets after death, such as protecting assets from going through probate, minimizing estate taxes, and managing assets in the event of the trustor’s incapacity.

A trust is an entity that is separate from the trustor, or creator of the trust. The trust holds title to property, has its own federal tax identification number (TIN), and files separate tax returns.

What are the different types of trusts?

Trusts can be broadly categorized into two main types based on when they become effective:

1. Living Trust. It is a legal tool for managing one's assets both during a person's lifetime and upon death. Living trusts are often used to avoid probate, minimize or delay taxes, maintain privacy, and manage assets in the event of incapacity. Living trusts can be:

- Revocable trusts, where the trustor can change or cancel the terms of the trust, or,

- Irrevocable trusts, where the trustor cannot change or cancel the trust terms without the consent of the beneficiaries, or sometimes not at all. A living trust may also be used to qualify for Medicaid payment of long-term health care if it is made irrevocable.

2. Testamentary Trust. It is created through a will and takes effect only after the trustor’s death. Testamentary trusts are typically used to provide for minor children, disabled beneficiaries, or to control the distribution of assets over time.

Apart from these basic types, you can create a trust to address specific needs such as Asset Protection Trusts, Charitable Trusts, Special Needs Trusts (SNTs), Spendthrift Trusts, Irrevocable Life Insurance Trusts (ILITs), and many more.

Understanding the relationship between the trustee and the trustor

The relationship between the trustee and the trustor is foundational to the effective operation of any trust. This dynamic is built on a complex interplay of legal duties, ethical obligations, and the initial intent of the trustor.

The relationship is inherently interdependent. The trustor relies on the trustee to uphold their intentions and effectively manage the legacy they have created. Conversely, the trustee's authority and responsibilities are entirely derived from the trustor's initial act of establishing the trust and defining its parameters.

Understanding the roles of trustor and trustee is fundamental for effective estate planning. This guide provides a detailed comparison, responsibilities and practical insights to help individuals and families navigate trust creation with confidence.

1. Definition, meaning, and types: Trustor vs. Trustee

Who is the trustor of a trust?

A trustor is defined as a person or entity that establishes a trust and transfers assets into it. It can typically be either an individual person or a married couple. A trustor may also be referred to as a grantor or a settlor. They establish the trust by defining its terms, naming the beneficiaries who will receive the trust assets, and appointing the trustee who will manage the trust's assets according to the trustor's instructions.

At its core, the trustor is the individual who initiates the trust agreement. This involves several key steps:

- Intent. The trustor must have the clear intention to create a trust.

- Assets. They must identify and transfer specific assets (such as real estate, investments, or other property) into the trust. This process, known as "funding the trust," legally moves ownership of these assets from the trustor to the trust itself.

- Trust document. The trustor works with legal counsel to outline the trust's purpose, beneficiaries, trustee's duties, and the conditions under which assets will be distributed.

Trustor vs Settlor vs Grantor: When they’re used

While "trustor" is a widely recognized term, you will often encounter "settlor" and "grantor" used interchangeably. The choice of term can sometimes depend on regional legal traditions, the specific type of trust, or even the attorney drafting the document's preference.

- Trustor: This term is generally understood across all types of trusts and is often used to emphasize the act of creating the trust.

- Settlor: This term is commonly used, particularly in some jurisdictions, and emphasizes the act of settling or establishing the trust's terms and funding it with assets.

- Grantor: This term is frequently used, especially in the context of real estate or when referring to a grantor trust (a specific type of trust for tax purposes where the grantor retains control over the trust assets). It highlights the act of granting or transferring assets into the trust.

Despite the varying terminology, a trustor is the same as a grantor or settlor, and their fundamental role remains the same: they are the owners of the trust. The legal nuances are minimal; courts and legal professionals generally understand these terms to refer to the same party. However, consistency within a single trust document is crucial to avoid any ambiguity.

Who is a trustee of a trust?

A person or an institution designated by a trust document to hold and manage the property in the trust. Some trusts may have multiple trustees, collectively referred to as co-trustees. A trustee is a crucial figure in the administration of a trust, serving as the legal owner of the assets held within the trust but with a fiduciary duty to manage those assets for the sole benefit of the beneficiaries.

In legal documents and financial accounts, a trustee is abbreviated as “TTEE” to distinguish their actions within the trust from their personal affairs. This role carries significant responsibilities and legal obligations, making the selection of a trustee a critical decision in estate planning.

What are the different types of trustees?

Selecting the right trustee depends on the assets, the beneficiary's needs, and their preferences. Consult an estate planning attorney for alignment with goals and legal requirements.

- Individual trustee/Sole trustee: An individual trustee can be a family member or friend who understands the family dynamics. They’re cost-effective, but may lack corporate expertise, have conflicts, or be limited by personal circumstances. Best suited for simpler trusts that require a personal touch.

- Corporate trustee: A corporate trustee is a financial institution (a bank or a specialized company) offering professional expertise, such as investment, tax, and legal, along with benefits like continuity and impartiality. This is expensive and less personal as they don’t understand the family dynamics. Ideal for complex trusts, large assets, or long-term professional management.

- Co-trustees: A trust may appoint multiple trustees to leverage complementary strengths, such as combining family insight with corporate expertise. This arrangement provides personal and professional management. However, it can also lead to disagreements or slower decision-making due to differing opinions, priorities, or management styles among trustees. To ensure smooth operation, clear roles and guidelines are essential.

- Successor trustee: A successor trustee is an individual or entity designated to assume the role of a trustee if the original trustee is unable or unwilling to continue serving. They are responsible for managing and distributing the trust's assets in accordance with the wishes of the trustor.

- Special needs trustee: They specialize in trusts for beneficiaries with disabilities (Special Needs Trusts), understanding specific rules to protect government benefits.

2. Eligibility: Trustor vs. Trustee

Who can be a trustor?

A trustor can be individuals, married couples, and even parents establishing trusts for their children. Generally, for an individual to be a trustor, they must meet certain requirements to ensure the trust is valid and enforceable:

- Legal capacity. The most fundamental requirement is that the trustor must have the legal capacity to enter into a contract. This means they must be mentally competent and legally an adult—usually 18 years old, though the exact age may vary by state law. They must understand the nature and consequences of their actions in creating the trust and be free from undue influence or coercion.

- Ownership of assets. The trustor must legally own the assets they intend to transfer into the trust. You cannot put assets into a trust that you do not have a rightful claim to.

- Intent to create a trust. The trustor must clearly intend to create a trust. This intent is typically demonstrated through a written trust agreement, which outlines the trust's purpose, assets, beneficiaries, and the powers and duties of the trustee.

Who can be a trustee?

A trustee can be an individual, two or more individuals, or a business entity such as a corporation. A business entity serving as trustee is typically a bank, law firm, or other professional trustee company. The trustor can also be the initial trustee of their own trust. If this is done, the trust needs to designate a successor trustee who will step into that role upon the death or incapacity of the trustor.

Beneficiaries may also be designated as trustees. Many parents designate their children as both beneficiaries and as successor co-trustees. However, this has the potential to create conflict between the children if they disagree about how the trust assets are managed.

To become a trustee, they must possess the following qualifications:

- Trustworthiness and integrity. Given the significant control over assets, the trustee must be an individual or entity of unquestionable honesty and reliability. In choosing a trustee, it is important to select one who can be trusted to follow your wishes as expressed in the trust agreement and who can be trusted to act in the best interests of the beneficiaries.

- Financial acumen. A trustee must have the ability and knowledge to manage the trust assets. A basic understanding of financial principles, investing, and accounting is highly beneficial, especially for managing complex portfolios.

- Organizational skills. A trustee must have the ability to maintain meticulous records and adhere to deadlines is crucial for proper trust administration.

- Impartiality. Ideally, a trustee should be impartial and capable of making decisions that are fair to all beneficiaries, even when difficult choices arise.

- Availability and willingness. The trustee must be willing and able to dedicate the time and effort required to fulfill their duties, which can be considerable.

3. Key responsibilities: Trustor vs. Trustee

What are the responsibilities of a trustor?

The trustor is the creator of the trust, laying the foundation and defining its parameters. Their primary duty is to establish the trust instrument and fund it with assets. Here are some key trustor responsibilities:

- Defining the trust's purpose and terms. Clearly articulate the trust's goals, beneficiaries, assets, distributions, and trustee responsibilities within a trust agreement. The trustor can further mention trustee removal scenarios and trust termination conditions.

- Funding the trust. Transfer ownership of assets (e.g., real estate, bank accounts, investments) into the trust's name to ensure its effectiveness. Improper funding can render the trust ineffective for those untransferred assets.

- Appointing a trustee. Select a trustee (or co-trustees) to manage and distribute assets, and designate successor trustees for continuity.

- Designation of beneficiaries. The trustor must clearly identify the beneficiaries (individuals, charities, or other entities) and specify the terms for distributing the assets in the trust document.

- Considering the tax implications. Understand the varying tax consequences of different trust types (revocable vs. irrevocable) for income, gift, and estate taxes, ideally with professional consultation.

- Ensuring legal compliance. Ensure the trust instrument complies with all relevant state and federal laws, including those related to establishment, property location, witnesses, notarization, and language.

- Amending or revoking the trust (if applicable). If revocable, retain the right to amend or revoke the trust; irrevocable trusts are generally difficult to change.

- Giving up control (for certain trusts). For certain types of trusts, such as those used for estate planning or asset protection, the trustor must relinquish most control over the assets they deposit into the trust. If they retain too much control, they may be required to pay taxes on the trust’s income or have the trust’s assets included in their own estate for tax purposes.

While a trustor’s active duties may diminish once the trust is established and funded, their initial decisions and actions are crucial for the trust's effectiveness and its ability to achieve their intended goals for asset management and distribution.

What are the responsibilities of a trustee?

The duties of a trustee are to follow the terms of the trust document and to act impartially in the best interests of beneficiaries in following those terms, a responsibility known as fiduciary duty. Most trusts provide that trust income and assets are to be used for the benefit of the trustor during the trustor's lifetime. Upon the trustor's passing, the trust either continues for the benefit of the beneficiaries or ends, in which case the remaining assets are distributed to the beneficiaries.

In order to achieve the desired tax deferral benefits, it is common for the trust to continue beyond the trustor's death, to the benefit of the trustor's children and their descendants. Therefore, the trustee's role is likely to continue for some time after the passing of the trustor. Key responsibilities of a trustee include:

- Adherence to the trust document. The trustee must strictly follow the trust instrument's terms and instructions, unless illegal or impossible. This includes understanding the trust's purpose, beneficiaries, distribution provisions, and any specific trustee powers or limitations.

- Fiduciary responsibility. At the core of the trustee's role is their fiduciary responsibility, which requires them to act in the best interests of the beneficiaries, avoiding any conflicts of interest and exercising utmost loyalty and good faith.

- Asset management. This involves safeguarding the trust's assets, investing them prudently, and ensuring their growth for the beneficiaries. The trustee must adhere to the "prudent investor rule," meaning they must invest assets as a knowledgeable and careful person would.

- Communication. Effective communication with beneficiaries is essential. This includes providing regular updates on the trust's performance, explaining investment strategies, and addressing any questions or concerns they may have.

- Distribution to beneficiaries. The trustee is responsible for distributing income and principal to the beneficiaries according to the terms outlined in the trust document. This requires a thorough understanding of the trust's provisions and often involves making discretionary decisions based on the beneficiaries' needs and circumstances.

- Record-keeping and accounting. Accurate and detailed records of all trust transactions, including income, expenses, investments, and distributions, must be maintained. Regular accountings are typically provided to the beneficiaries, ensuring transparency and accountability.

- Tax compliance. The trustee is responsible for understanding and complying with all applicable tax laws related to the trust, including filing tax returns and paying any taxes due.

How do the trustor and trustee roles differ in living trusts vs testamentary trusts?

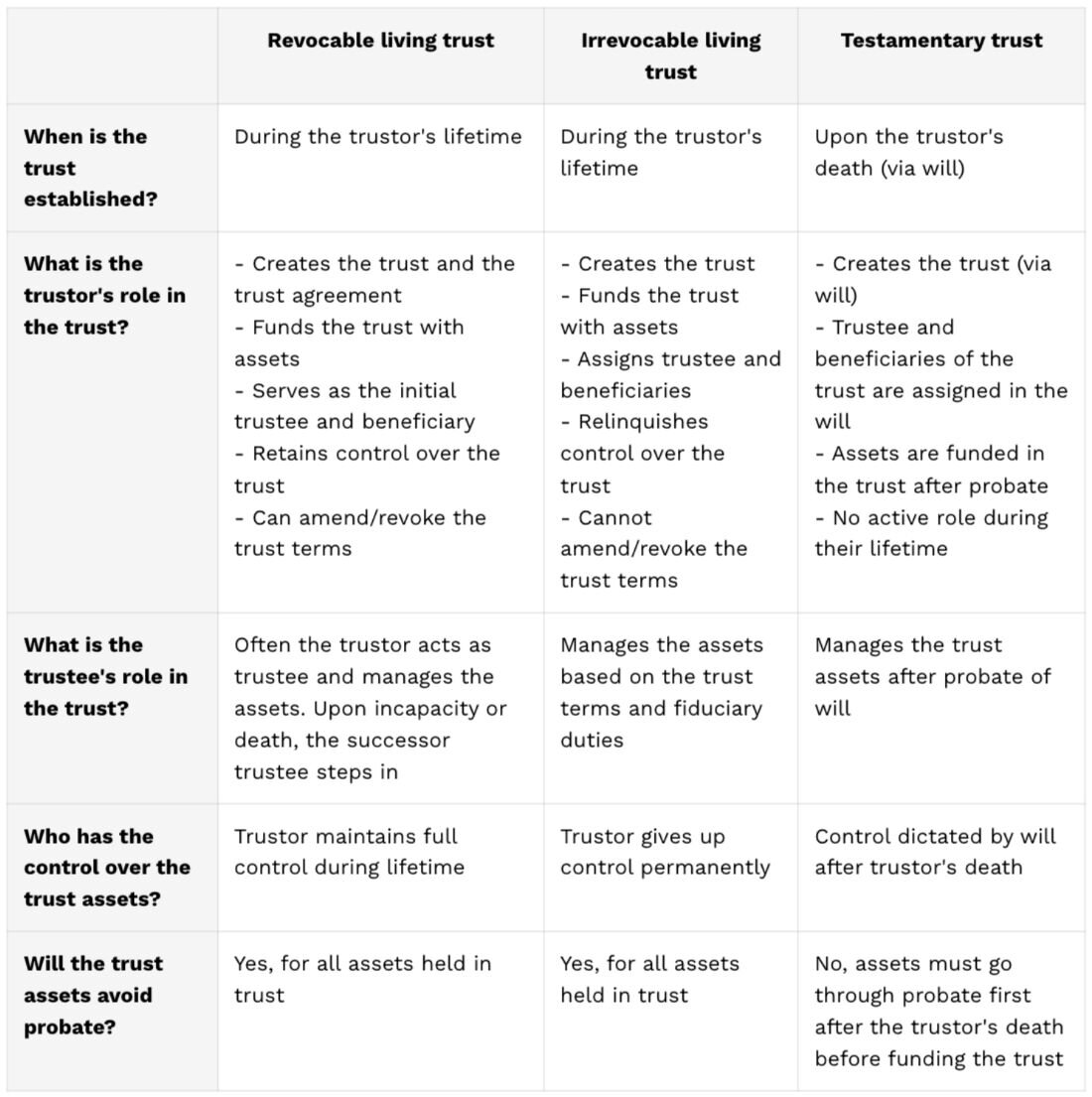

While the core functions of a trustor (creating and funding) and a trustee (managing and distributing) remain consistent across all trust types, the degree of control the trustor retains and the independence of the trustee's role are the primary differentiators, especially when comparing living trusts to irrevocable and testamentary trusts. These distinctions are fundamental to understanding the implications and benefits of each trust structure.

| Revocable living trust | Irrevocable living trust | Testamentary trust | |

| When is the trust established? | During the trustor's lifetime | During the trustor's lifetime | Upon the trustor's death (via will) |

| What is the trustor's role in the trust? | - Creates the trust and the trust agreement - Funds the trust with assets - Serves as the initial trustee and beneficiary - Retains control over the trust - Can amend/revoke the trust terms |

- Creates the trust - Funds the trust with assets - Assigns trustee and beneficiaries - Relinquishes control over the trust - Cannot amend/revoke the trust terms |

- Creates the trust (via will) - Trustee and beneficiaries of the trust are assigned in the will - Assets are funded in the trust after probate - No active role during their lifetime |

| What is the trustee's role in the trust? | Often the trustor acts as trustee and manages the assets. Upon incapacity or death, the successor trustee steps in | Manages the assets based on the trust terms and fiduciary duties | Manages the trust assets after probate of will |

| Who has the control over the trust assets? | Trustor maintains full control during lifetime | Trustor gives up control permanently | Control dictated by will after trustor's death |

| Will the trust assets avoid probate? | Yes, for all assets held in trust | Yes, for all assets held in trust | No, assets must go through probate first after the trustor's death before funding the trust |

4. Fundamental rights: Trustor vs. Trustee

What are the rights of a trustor?

A trustor possesses several fundamental rights, such as the right to create a trust, appoint a trustee, define beneficiaries, specify trust terms, and fund the trust with assets.

These trustor rights are crucial to the formation, ongoing management, and eventual termination of the trust. They are primarily exercised during the trust's creation and can be retained or relinquished depending on the terms of the trust and whether it is revocable or irrevocable.

Once a revocable living trust is established and funded, the trustor retains significant control and flexibility with additional rights such as:

- Right to modify any terms of the trust agreement.

- Right to terminate the trust at any time, taking back full ownership of assets.

- Right to remove assets from the trust as needed.

- Right to act as trustee retaining complete control over assets.

- Right to control the assets during incapacity by appointing a successor trustee.

In contrast, once an irrevocable trust is established and funded, the trustor generally relinquishes most of these rights, where they cannot amend, revoke, or withdraw assets, with assets typically removed from their taxable estate.

What are the rights of a trustee?

A trustee’s fundamental rights are:

- Managing and controlling trust assets. Authority to invest, sell, buy, and deal with trust property for the beneficiaries' best interests.

- Incurring reasonable expenses. Pay legitimate, necessary, and reasonable costs of trust administration from trust assets.

- Compensating for services. Entitled to reasonable payment for time, effort, and expertise in managing the trust.

- Seeking instruction from the court. Petition the court for clarification or direction on ambiguities or complex legal issues.

- Delegating certain duties. Delegate ministerial or specialized tasks as permitted by the trust agreement or law, while retaining ultimate oversight and responsibility.

- Protecting trust assets. Protection of trust assets from personal financial loss for liabilities incurred in good faith and within the scope of duties.

5. Tax obligations: Trustor vs. Trustee

What are the tax obligations for a trustor?

A trustor’s tax obligations are:

- Gift tax implications. When a trustor transfers assets into an irrevocable trust, it may be considered a taxable gift to the beneficiaries. The trustor is generally responsible for filing a gift tax return (Form 709) if the value of the gift exceeds the annual gift tax exclusion.

- Income tax (for Grantor Trusts). When the trust is classified as a "grantor trust" for income tax purposes, the trustor may still be responsible for the income tax on the income generated by the trust assets. In such cases, all income, deductions, and credits of the trust are reported directly on the trustor's personal income tax return (Form 1040).

- Estate tax inclusion (for Revocable Trusts). Assets transferred into a revocable living trust are generally still considered part of the trustor's taxable estate upon their death. While a revocable trust avoids probate, it typically doesn’t remove assets from the trustor's gross estate for federal estate tax purposes.

- Generation-Skipping Transfer (GST) Tax. If a trust is established so that assets are transferred directly to “skip persons”—that is, beneficiaries who are two or more generations younger than the trustor (such as grandchildren)—this is known as a “direct skip.” Such transfers may be subject to the GST tax, in addition to any gift or estate tax that may apply.

What are the tax obligations for a trustee?

A trustee holds a significant and complex role, entrusted with managing assets for the benefit of beneficiaries. This responsibility entails a range of tax obligations that require careful attention and adherence to established principles.

- Obtaining a Taxpayer Identification Number (TIN): If the trust is considered a legal entity, a TIN is mandatory. Revocable trusts typically use the trustor's Social Security Number (SSN) during the trustor’s lifetime, as they function as the trustee. However, for irrevocable trusts, or following the trustor's death, an Employer Identification Number (EIN) is required.

- Paying taxes: The trustee must ensure that all applicable federal, state, and local taxes are paid on time, including income tax, capital gains tax, and potentially estate or GST taxes (for taxable termination), depending on the nature and value of the trust assets.

- Filing income tax returns: The trustee is responsible for filing annual income tax returns for the trust (Form 1041, U.S. Income Tax Return for Estates and Trusts) with the IRS and, if applicable, with state tax authorities.

- Issuing K-1s: If the trust distributes income to beneficiaries, the trustee must issue Schedule K-1 to each beneficiary, reporting their share of the trust's income, deductions, and credits. Beneficiaries then use this information to report their income on their personal tax returns.

Understanding these multifaceted obligations is paramount for any individual considering establishing a trust. Failing to meet these obligations can expose a trustee to personal liability, including fines, penalties, and even removal from their position by a court. Consulting with an experienced estate planning attorney and a tax advisor is highly recommended to ensure the trust is properly established, funded, and managed in compliance with all applicable laws and to achieve the trustor's specific financial and legacy planning goals.

6. Impact of death on trust: Trustor vs. Trustee

What happens if the trustor dies?

When a trustor dies, it triggers the activation of the trust's terms. However, certain actions and consequences depend heavily on the type of trust that has been established.

- A revocable living trust typically becomes irrevocable upon the death of the trustor. If the trustor was serving as a trustee for the trust, then the successor trustee steps in to manage and distribute the assets according to the trust agreement, thereby bypassing the need for probate.

- For an irrevocable trust, the death of the trustor has little direct impact, as the trustee continues to manage and distribute assets according to the original trust agreement, with assets not subject to probate.

What happens when a trustee dies?

When a trustee dies, the administration of a trust can become complicated, and the specific course of action depends largely on the provisions outlined in the trust document itself. A well-drafted trust agreement will anticipate such an event and provide clear instructions on how to proceed.

- Successor trustee: Most trusts designate one or more successor trustees to assume the responsibilities of the deceased trustee. They will typically take over the management of the trust assets and continue to administer the trust according to its terms.

- No designated successor trustee: If there is no successor trustee named in the trust document, the beneficiaries may need to petition a court to appoint a new trustee. The court will then select a qualified individual or corporate trustee to oversee the trust.

- Co-trustees: If the trust had multiple co-trustees, and one of them dies, the surviving co-trustees typically continue to manage the trust. The trust document should specify whether the surviving co-trustees can act independently or if a new co-trustee must be appointed.

- Impact on trust administration: The death of a trustee can cause a temporary disruption in trust administration as there might be delays in making distributions to beneficiaries, managing investments, or handling other trust-related financial matters.

- Responsibilities of the deceased trustee's estate: If a trustee dies, the people managing their estate may need to help transfer the trust’s assets and records to the next trustee. This means they must make sure everything related to the trust is given to the new person in charge, so the trust can keep running without problems.

The death of a trustee highlights the importance of careful estate planning and trust drafting. Regularly reviewing and updating trust documents, including the designation of successor trustees, can help avoid future complications and ensure the smooth and efficient administration of the trust, even in unforeseen circumstances.

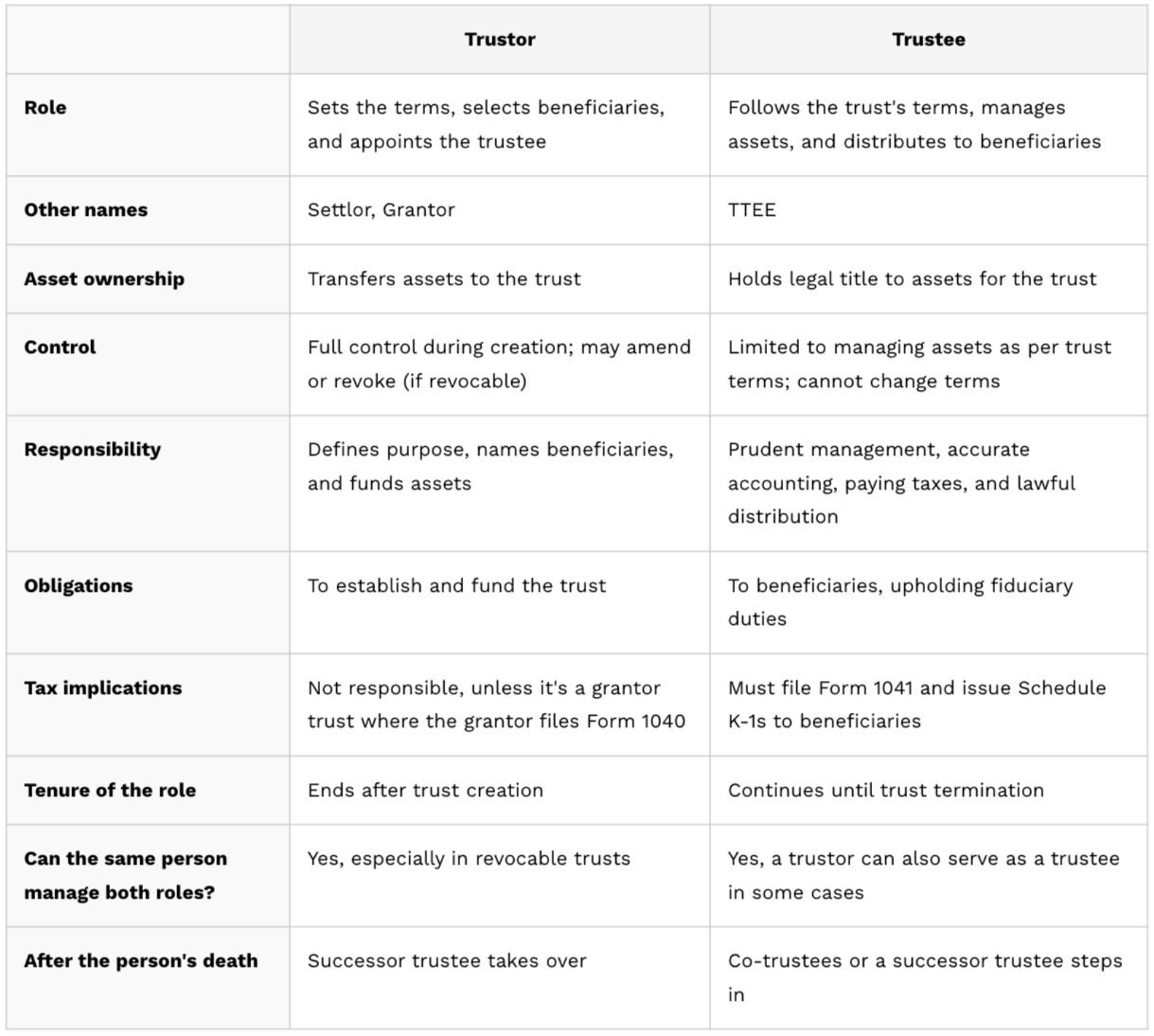

Comparison table: Key differences between the Trustor and the Trustee

| Trustor | Trustee | |

| Role | Sets the terms, selects beneficiaries, and appoints the trustee | Follows the trust's terms, manages assets, and distributes to beneficiaries |

| Other names | Settlor, Grantor | TTEE |

| Asset ownership | Transfers assets to the trust | Holds legal title to assets for the trust |

| Control | Full control during creation; may amend or revoke (if revocable) | Limited to managing assets as per trust terms; cannot change terms |

| Responsibility | Defines purpose, names beneficiaries, and funds assets | Prudent management, accurate accounting, paying taxes, and lawful distribution |

| Obligations | To establish and fund the trust | To beneficiaries, upholding fiduciary duties |

| Tax implications | Not responsible, unless it's a grantor trust where the grantor files Form 1040 | Must file Form 1041 and issue Schedule K-1s to beneficiaries |

| Tenure of the role | Ends after trust creation | Continues until trust termination |

| Can the same person manage both roles? | Yes, especially in revocable trusts | Yes, a trustor can also serve as a trustee in some cases |

| After the person's death | Successor trustee takes over | Co-trustees or a successor trustee steps in |

Creating a trust with LegalZoom

When creating a living trust, you need to consider your particular situation as it relates to tax laws and possibly to long-term care planning. You can use a DIY legal service to receive assistance in determining how a living trust can be part of your estate plan.

LegalZoom's Will & Trust services make it easy and affordable for individuals to protect their assets and care for their loved ones. Unlike traditional estate planning, which can be complicated and expensive, LegalZoom uses technology and legal advice to simplify the process. This gives customers confidence and control over their future plans.

Here is what our customer has to say:

The process was fast, easy, and met my needs. The final product I received in the mail was spectacular! It exceeded my expectations!

- Barbara F., living trust customer

When you choose LegalZoom as your partner to create a living trust, you can access the following features:

- State-wise documents created by experienced estate planning attorneys that can be customized to your interests.

- Step-by-step questionnaire to guide you through the document creation process.

- Consult with an experienced attorney, get your documents reviewed, and update your estate plan accordingly.

- Store your documents securely online for easy access and updates.

Conclusion

To summarize, understanding the distinct roles of a trustor, who establishes the trust and its assets, and a trustee, who manages and distributes those assets according to the trustor's wishes, is crucial for effective estate planning. For personalized guidance and to ensure that your trust documents align with your specific needs, it is highly recommended that you consult with an experienced estate attorney. Reviewing your trust documents regularly can also help ensure they remain current and legally sound.

FAQs

1. Can a trustor be a trustee?

Yes, in many jurisdictions and for many types of trusts, the trustor or settlor can also serve as one of the trustees, or even the sole trustee. This arrangement is quite common, particularly in the context of revocable living trusts.

2. Can a trustor be a beneficiary?

Yes, a trustor can be a trust beneficiary. This is often seen in revocable living trusts, where the creator serves as the initial trustee and primary beneficiary. This allows them to control and benefit from assets during their lifetime, with provisions for distribution to others after their death.

3. Which type of trust allows the trustor to retain the right to end or change the terms of the trust?

A revocable living trust allows the trustor to retain the right to terminate or modify the trust's terms.

4. What is a trustor in real estate?

A trustor in real estate is the individual who makes the strategic decision to remove real property from their personal ownership and place it under the legal framework of a trust for future management and distribution.

5. What is a trustee in real estate?

In real estate, a trustee is an individual or entity that manages property on behalf of a beneficiary through a legal trust. The trustee of a house acts as a fiduciary, legally obligated to manage the assets responsibly and in the best interest of the beneficiary. Their responsibilities include holding legal title, managing the property (collecting rent, handling maintenance), making investment decisions, distributing income or proceeds to beneficiaries, and maintaining records.

6. Is a trustee the same as an owner?

No, a trustee is not the same as the owner of the trust (trustor). A trustor creates the trust, funds the assets, and establishes the rules, while the trustee must follow these rules and administer the trust accordingly.

7. Is a trustee the same as a beneficiary?

No, a trustee is not the same as a beneficiary. In a trust, a trustee is the person who manages the trust and distributes assets, while a beneficiary benefits from the trust by receiving assets.

8. Can a trustee be a beneficiary of trust?

Yes, a trustee can also be a beneficiary (e.g., family trusts), but this may create conflicts of interest requiring court oversight.

9. Will the trustees have total discretion, and beneficiaries have no recourse?

Trustees must follow the terms of the trustor and the law, although they have some discretion. Beneficiaries have legal rights to take action if trustees fail in their duties.

10. What are the risks of being a trustee?

Trustees face potential legal and financial consequences if they mismanage the trust. Acts like breaching fiduciary duty, making poor decisions, or failing to follow the trust’s terms can be risky for a trustee. Personal conflicts with beneficiaries and the necessary time commitment are also significant risk factors to consider.

11. What happens if a trustee violates duties?

A trustee is legally bound by a set of fiduciary duties to the beneficiaries of a trust. When a trustee fails to uphold these duties, it constitutes a breach of trust, which can lead to serious legal consequences and significant financial repercussions for the beneficiaries.

If a trustee commits a mistake, beneficiaries have several options for responding. They can ask the trustee to provide a detailed accounting report, sue for damages, or ask the court to remove the trustee and appoint a successor. Acting quickly and obtaining good legal advice is crucial to protect their rights and ensure the trust is managed properly.

12. How to replace an unresponsive trustee?

Replacing an unresponsive trustee typically involves a legal process that varies depending on the terms of the trust document and applicable state laws. Generally, the beneficiaries or co-trustees can petition a court to remove the unresponsive trustee and appoint a successor. The court will usually consider whether the trustee has breached their fiduciary duties, demonstrated incapacity, or otherwise failed to administer the trust as required. It's crucial to consult with an attorney experienced in trust law to understand the specific steps and requirements for your situation.

Edward A. Haman, Esq., contributed to this article.