Wills and trusts are the cornerstone documents of estate planning, each serving unique purposes in protecting your assets and ensuring your wishes are carried out. A will directs how your personal property should be distributed after your death, while a trust can manage your assets both during your lifetime and beyond.

This comprehensive guide breaks down the legal jargon into plain English and provides practical guidance for making informed decisions about your family's financial future.

What are wills and trusts?

Understanding the fundamental differences between wills and trusts is essential for creating an effective estate plan. While both documents help you control what happens to your assets, they work in distinctly different ways and offer unique advantages depending on your specific situation and goals.

A will is a legal document that specifies how your assets should be distributed after your death. It only takes effect upon your death and must go through probate court, where a judge validates the document and oversees the distribution of your estate. Wills are public documents, meaning anyone can access the details of your estate and beneficiaries once the probate process begins.

A trust, on the other hand, is a legal arrangement where you transfer ownership of your assets to a separate legal entity managed by a trustee. Trusts can be active during your lifetime or created through your will. Unlike wills, trusts typically avoid probate court and remain private documents, offering greater confidentiality for your family's financial affairs.

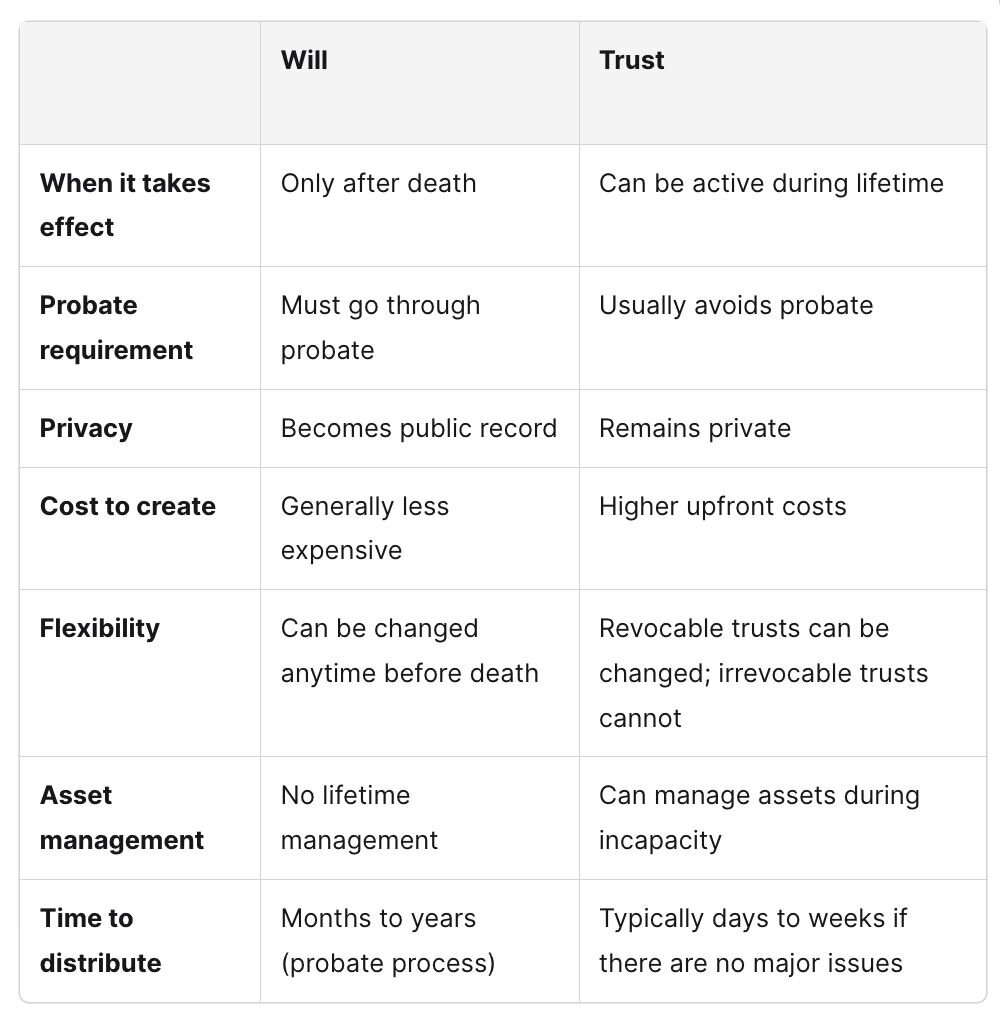

Will vs. trust: key differences

| Will | Trust | |

|---|---|---|

| When it takes effect | Only after death | Can be active during lifetime |

| Probate requirement | Must go through probate | Usually avoids probate |

| Privacy | Becomes public record | Remains private |

| Cost to create | Generally less expensive | Higher upfront costs |

| Flexibility | Can be changed anytime before death | Revocable trusts can be changed; irrevocable trusts cannot |

| Asset management | No lifetime management | Can manage assets during incapacity |

| Time to distribute | Months to years (probate process) | Typically a few weeks |

Common terms in wills and trusts

The specific legal terminology used in estate planning documents can be difficult to navigate. These terms appear frequently in wills, trusts, and related documents, and knowing their meanings can help you communicate effectively with attorneys, understand your options, and make informed decisions about your estate plan.

The following glossary covers the most important terms you'll encounter when creating or reviewing estate planning documents. We've organized these alphabetically so you can find what you need—and get answers quickly.

Beneficiary

A beneficiary is the person or organization designated to receive assets through a will or trust. Primary beneficiaries are first in line to inherit, while contingent beneficiaries are backups in case the primary ones are unable or unwilling to accept the inheritance. Naming both types helps ensure your assets are distributed according to your wishes. Clear designations can also reduce family disputes and probate complications.

Bequest

A bequest is a gift left to someone in your will. It can be a specific dollar amount, a particular item like a piece of art, or even a percentage of your estate. Bequests are a way to personalize your legacy by passing on cherished possessions or values. They are a core component of a well-structured will.

Codicil

A codicil is a legal document used to make changes to an existing will without rewriting the entire thing. It can add, modify, or revoke specific provisions while preserving the rest of the will. However, to avoid confusion or legal disputes, many people choose to create a new will instead. This approach ensures your intentions are clearly documented and up to date.

Estate tax

Estate tax is a federal tax applied to the transfer of a person’s assets after their death. As of 2026, estates valued above $15 million per individual are subject to federal estate tax. Some states have their own estate taxes with much lower exemption thresholds. Strategic estate planning can help reduce or eliminate these taxes through trusts and lifetime gifting.

Executor of a will

An executor of a will is the person you appoint in your will to carry out your final wishes. Their responsibilities include managing the estate, paying off debts and taxes, and distributing assets to beneficiaries. Some states use the term “personal representative” instead. While traditionally gendered terms like “executrix” exist, “executor” is now widely used regardless of gender.

Gift Tax

Gift tax is a federal tax on assets you give away during your lifetime. In 2026, you can gift up to $19,000 per person annually without triggering a gift tax return or affecting your estate tax exemption. Gifts above this threshold may reduce your lifetime estate tax exemption amount. Thoughtful gift tax planning can be an effective way to transfer wealth early and reduce future estate tax exposure.

Grantor / Settlor

Grantor, also known as settlor, is a legal term referring to the person who creates and funds a trust. These terms are used interchangeably, though “grantor” is more commonly used today. The grantor determines the trust's terms and selects the trustee and beneficiaries. Establishing a trust allows for greater control over how assets are managed and distributed.

Guardian

A legal guardian is the individual named in your will to care for your minor children if you die before they reach adulthood. You can choose one person to handle both the children’s care and their finances, or appoint separate individuals for each responsibility. Choosing a guardian is a deeply personal decision that ensures your children are raised according to your values.

Heir

A legal heir is someone entitled by law to inherit personal and real property when a person dies without a valid will, according to the state’s intestacy rules. Common heirs include surviving spouses, children, parents, and siblings. The specific order and share depend on your state's laws. Having a will allows you to override these defaults and distribute your estate according to your true intentions.

Inheritance tax

Inheritance tax is levied on the individuals who receive assets from an estate, rather than on the estate itself. Unlike the federal estate tax, the inheritance tax is imposed by only a few states. The rate and exemption levels for each state’s inheritance tax vary depending on the relationship to the deceased person. Beneficiaries in these states may need to prepare for unexpected tax liabilities.

Intestate

Dying intestate means dying without a valid will. When this occurs, your state’s laws determine who inherits your personal property, which might not align with your wishes. This can result in assets going to unintended relatives or causing family disputes. A will can ensure that your voice is heard even after you’re gone.

Issue

In estate planning, “issue” refers to a person’s direct lineal descendants—children, grandchildren, and beyond. This term includes both biological and legally adopted descendants. It’s commonly used in wills and trusts to ensure clarity in generational distributions. Defining “issue” precisely helps prevent confusion in complex family trees.

Power of attorney

A power of attorney gives someone you trust the right to make decisions on your behalf. There are two key types of powers of attorney most encountered in estate planning: financial power of attorney and medical power of attorney. These legal terms or designations give someone the right to make financial decisions for you if you’re unable to do so and medical decisions if you’re unable to make them yourself. It’s a good idea to choose someone you’re confident can be legally responsible with your money and your well-being.

Probate

Probate is the legal process of validating a will, settling debts, and distributing assets under court supervision. It typically takes several months to over a year and may involve court fees, legal costs, and public disclosure of assets. In some states, probate isn’t as lengthy or expensive. Many people use trusts and other tools to avoid or minimize probate.

Residuary estate

Your residuary estate consists of everything left after all specific gifts, debts, taxes, and expenses have been paid. This “remainder” should be addressed in your will so it’s clear who receives it. If not specified, it may be distributed under intestacy laws, regardless of your original intentions.

Testator

The testator is the person who creates and signs a will. This individual must be legally competent and acting voluntarily. Although the term “testatrix” was once used for women, “testator” is now the standard term for this role. A valid will reflects the testator’s wishes and serves as a legal roadmap for asset distribution.

Trustee

A trustee is the person or entity responsible for managing the assets held in a trust. The trustee must act in the best interest of the beneficiaries and follow the terms outlined in the trust document. During your lifetime, you can serve as your own trustee for a revocable trust. After your death or incapacity, a successor trustee steps in. This successor trustee should be someone you trust and someone who will look after your best interests.

Types of wills

Estate planning includes a variety of wills tailored to different family situations, goals, and asset levels. Choosing the right documents depends on your personal and financial needs, and often involves combining several strategies. These are some of the most commonly used types of wills you’ll want to consider.

Joint will

A joint will is a single document executed by two people, usually spouses, which cannot be changed after the first person dies. This setup can simplify estate planning for couples with identical wishes for personal and joint or community property. However, joint wills can become inflexible and problematic if one partner’s wishes evolve. They are less commonly used today in favor of separate wills or mirror wills that allow each person to specify what happens to their personal property while still accommodating their wishes for community property.

Pour-over will

A pour-over will works hand-in-hand with a living trust. It ensures that any assets unintentionally left outside the trust at your death are “poured” into the trust. While these assets still pass through probate, this will acts as a safeguard for full asset coverage. It’s especially useful for people actively managing their trust.

Simple will

A simple will is the most basic form of estate planning. It allows you to name designated beneficiaries (friends, family members, and other similar individuals), appoint an executor, and specify guardians for minor children. Ideal for individuals with straightforward estates, this document serves as the foundation of many estate plans. It’s affordable and effective when used in appropriate situations.

Types of trusts

There are two types of trusts and many variations on the two. Though trusts and wills are often used together, they work in different ways. These are some of the most frequently used terms for trusts, so you can better understand your options and make the best choice for your estate plan.

Asset protection trust

Asset protection trusts are designed to shield assets from creditors and lawsuits. It allows the grantor to retain some benefit while protecting the principal. While not for everyone, asset protection trusts are useful in high-risk professions or litigious environments.

Charitable remainder trust

This trust allows you to support a charitable cause while still receiving income during your lifetime. You transfer assets to the trust, receive regular payouts, and the remainder goes to charity upon your death. This arrangement offers income tax deductions, capital gains tax deferral, and a lasting philanthropic legacy.

Generation-skipping trust

This trust allows assets to pass to your grandchildren or further descendants, bypassing your children’s estates. It helps reduce the impact of estate taxes over multiple generations. Particularly valuable for wealthy families, it’s a long-term strategy for preserving generational wealth while still passing it on to family members you love.

Irrevocable trust

An irrevocable trust is one that cannot be changed or revoked after it’s established, except under very limited circumstances. Because the assets are no longer considered part of your estate, this type of trust can provide tax advantages and protect assets from creditors. However, it requires giving up a degree of control, so it’s best suited for long-term strategies.

Irrevocable life insurance trust (ILIT)

An ILIT is specifically designed to own life insurance policies outside your taxable estate. By removing these policies from your estate, you can reduce estate taxes while providing liquidity for your heirs. Irrevocable life insurance trusts require careful setup and administration but offer powerful tax and planning benefits for high-net-worth individuals.

Revocable living trust

This is the most commonly used trust in estate planning due to its flexibility. You retain full control of your assets during your life and can update or revoke the trust at any time. It avoids probate and provides a clear plan for incapacity. A well-drafted revocable trust can streamline estate administration and maintain privacy.

Special needs trust

A special needs trust is used to provide financial support to a disabled beneficiary without jeopardizing their eligibility for government benefits. It can cover expenses not met by public programs, such as education, hobbies, or medical care. This trust ensures a higher quality of life for a loved one with special needs.

Testamentary trust

A testamentary trust is created through your will and takes effect only after your death. These trusts can provide structured distributions for beneficiaries, such as minors or individuals who aren’t ready to manage large sums. However, because they are tied to your will, they must go through probate first.

Choosing the right combination

Most effective estate plans combine multiple types of documents to address different aspects of your planning needs. A typical comprehensive plan might include a revocable living trust for most assets, a pour-over will as backup, and specialized trusts for specific purposes like charitable giving or tax minimization.

The key is working with experienced professionals who can evaluate your specific situation and recommend the most appropriate combination of documents. What works for your neighbor or friend may not be the best solution for your family's unique circumstances.

How LegalZoom can help you understand common terms in wills and trusts

LegalZoom makes it easy to create a will that looks out for your loved ones and honors your final wishes. Create a simple will to provide general guidance for your loved ones and your estate. Or create a more comprehensive estate plan that establishes healthcare directives, medical and financial powers of attorney, and more.

Over time, as your will needs to be updated, LegalZoom can help you review your existing will and make the necessary changes quickly.

If you’re interested in establishing a trust, you can create one through LegalZoom to protect your loved ones’ best interests.

FAQs about wills and trusts

What is the difference between a will and a trust?

A will is a legal document that directs how your assets should be distributed after your death and must go through probate court. A trust is a legal arrangement that can manage your assets during your lifetime and distribute them after death, typically avoiding probate. Wills become public records during probate, while trusts remain private. Trusts generally cost more to create but can save time and money in the long run by avoiding probate costs and delays.

Do I need both a will and a trust?

If you have a will-based estate plan, you don’t need a trust. But if you have a trust-based estate plan, you should also have a will. Even if you create a living trust to hold most of your assets, you still need a "pour-over will" to handle any assets not transferred to the trust before your death. The will also allows you to name guardians for minor children and handle other matters that trusts cannot address.

How often should I update my estate plan?

Review your estate plan annually and update it promptly after major life changes such as marriage, divorce, births, deaths, significant changes in wealth, or moves to different states. At a minimum, review your plan every one to two years, even if no major changes have occurred. Don't forget to review and update beneficiary designations on retirement accounts and life insurance policies, as these often need attention more frequently than your primary estate planning documents.

What happens if I die without a will?

If you die without a will (called dying "intestate"), state laws determine how your personal property and real property are distributed. These laws typically give priority to surviving spouses and children, but the specific distributions may not match your wishes. The probate process becomes more complex and expensive, and the court will appoint an administrator to handle your estate. For parents of minor children, the court will also decide who becomes their guardian, which may not align with your preferences.

Can I create a will or trust online?

Yes, online estate planning services like LegalZoom can help you create basic wills and trusts at a lower cost than traditional attorney services. These tools work well for straightforward situations with simple asset distributions and uncomplicated family structures. However, complex estates, blended families, or significant tax concerns typically benefit from working directly with experienced estate planning attorneys who can provide personalized advice and sophisticated planning strategies.

How can I avoid probate?

The most common probate avoidance strategies include creating a revocable living trust and transferring your assets to it, using joint ownership with rights of survivorship, naming beneficiaries on retirement accounts and life insurance policies, and utilizing transfer-on-death or payable-on-death designations for bank and investment accounts. However, completely avoiding probate requires careful planning and ongoing attention to asset titling and beneficiary designations.

Are online wills and trusts legal?

Online wills and trusts can be legally valid if they meet your state's requirements for execution and comply with applicable laws. The key is ensuring proper signing, witnessing, and notarization according to your state's specific rules. While the documents themselves can be legally sound, the main limitations of online services are the lack of personalized legal advice and the potential for choosing inappropriate strategies for your specific situation. For complex estates or unusual circumstances, working with an attorney provides additional assurance and customized planning.

Brette Sember, J.D. contributed to this article.