A simple will is a legal document that states who will inherit your assets and belongings after you pass away. A will is also sometimes called a last will and testament, and the person creating the will is called the testator.

If you don't create a will, your state laws—called intestacy laws—will determine who inherits your assets.

Making a simple will doesn't have to be complicated, and having one will give you the peace of mind of knowing that your wishes are carried out.

Key Takeaways

- Choose a simple will for small estates, straightforward distributions, and uncomplicated family situations. It may not be the best choice if you have a large estate, complex assets, or need a trust.

- Use a codicil to make legally valid changes to your will without rewriting the entire document from scratch.

- State laws vary. Always follow your state’s formalities for executing a will.

- Use precise, unambiguous language to ensure your intentions are honored.

- Witness and notarization requirements differ by jurisdiction, so make sure to check your local laws.

- Store your codicil safely with your original will and inform your executor of its location.

- Consulting an estate planning attorney can help ensure your will is legally sound and enforceable.

What's included in a simple last will and testament?

A simple will is made up of a basic set of components. In general, it:

- Identifies the testator, the person who prepares a will, detailing the distribution of their property and assets upon their death

- Indicates that the testator is of sound mind and understands that the legal document is a will

- States who the beneficiaries of the will are, often including family members such as a spouse, children, or siblings, and what they are receiving

- Name an executor, or a person who will be responsible for distributing the assets to the beneficiaries

- Contains the signature of the testator

- Contains witness signatures

These elements form the basic will format used in most simple wills. In addition to financial assets, you can also outline your wishes for personal items and property like family heirlooms, furniture, or collectibles.

We can help cover the essentials, plus healthcare and financial documents that go beyond naming beneficiaries.

How to make sure your simple will is legally valid?

Because a simple will is short and has basic terms, you can consider creating your own will. However, be aware that each state has its own specific requirements for what must be contained in a will for it to be legally valid.

You must check your state laws and follow their requirements. These include:

- The required age of the testator (in most states, you must be age 18)

- Testamentary intent (the intent to make a will when creating the document)

- Lack of coercion, duress, or fraud (you must know it is a will and sign it freely)

- Signature of the testator

- The correct number of witnesses (in most states, this is two, but be sure to check your own state laws)

Are handwritten wills legally valid?

In general, it's best if a will is typed or printed and witnessed, but some states permit unwitnessed handwritten wills (also called holographic wills). To be valid, a holographic will must meet that state's specific requirements.

This might include a witness who can identify the testator's handwriting. The following are the states that allow handwritten (holographic) wills:

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Delaware

- Hawaii

- Idaho

- Kentucky

- Louisiana

- Maine

- Maryland

- Michigan

- Mississippi

- Montana

- Nebraska

- Nevada

- New Jersey

- New York

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- West Virginia

- Wyoming

Note: Some states, like Texas, New York, and Maryland, recognize holographic or handwritten wills only for members of the armed forces and only for a limited time following the military service.

Is a simple will good enough?

A simple will covers just the basics and may be sufficient for a young single person or a married couple with no children and few assets. The more complicated your life, the more complex your will needs to be. Wills can also include the following:

- Naming a guardian for a minor child

- Joint provisions with a spouse—deciding who is legally considered to have died first if both spouses pass away at the same time; affects inheritance order and asset distribution

- Establishment of a trust, including a special needs trust for a disabled child or spousal trusts

- No-contest clauses, which prevent beneficiaries from challenging the will by risking forfeiture of their inheritance if they contest and lose

- Complex clauses, determining the portion of the estate that will go to each child or grandchild

- Specific and detailed bequests of personal property, real estate, vehicles, investments, collectibles, and more

- Donations to charitable organizations or charitable trusts, if they involve large sums, tax benefits, or require administration for long-term management

A simple will is easy to prepare and gives you control over what happens to your belongings after you die. Everyone should have a will so they can make their wishes known, but if you have a complex estate, multiple properties, or wish to leave unequal inheritances among family members, a more detailed estate planning tool like a trust might be a better choice.

Who should use a simple will?

A simple will is ideal for individuals with modest financial assets and uncomplicated family dynamics. It works well if you plan to leave your entire estate to a single person or divide it equally among a few people. You might consider creating a simple will in one of the following scenarios:

- Single adults or married couples without children who want to name beneficiaries and an executor

- People with modest assets or a small estate that won’t be subject to estate taxes

- Individuals who don’t need to establish trusts or add complex instructions

- Those with straightforward wishes regarding property distribution and a minimal risk of potential disputes among heirs

A simple will can help ensure your basic wishes are honored after your death, but it's important to understand both its capabilities and limitations.

What can a simple will do?

- Let you name beneficiaries for your property and belongings

- Appoint an executor to manage your estate

- Specify guardians for minor children

- Help your loved ones avoid confusion after your passing

What a simple will can’t do?

- Create or manage trusts

- Make health care decisions or end-of-life instructions

- Distribute assets that pass outside of the probate process, like life insurance with named beneficiaries or jointly owned property

- Avoid probate altogether

If you're unsure whether a simple will fully addresses your needs, seeking legal counsel can help you explore alternatives like trusts.

Simple will vs. living will

It’s easy to get confused between a simple will and a living will, but they serve very different purposes.

- A simple will addresses your wishes after death, primarily how your property should be distributed and who should carry out those instructions.

- A living will, by contrast, outlines your medical care preferences if you're incapacitated and unable to communicate, such as in a coma or facing a terminal illness.

Both a living will and a simple will serve different purposes, but they can work together as essential parts of a comprehensive estate plan.

How to write a simple will: Step-by-step guide

Writing a simple will doesn’t have to be complicated. Here’s a simple will format to help you get started.

1. Identify yourself clearly

Start by stating your full legal name, address, and a declaration that the document is your last will and testament. This helps confirm your identity and intent.

2. Declare mental capacity

Include a statement that you're of legal age (usually 18 or older) and mentally capable of making the right decisions at the time of writing the will.

3. Name an executor

Choose someone you trust to carry out the instructions in your will. This person is called the executor of your estate.

4. List your beneficiaries

Specify the people or organizations who will inherit your property. Include full names and details to avoid confusion.

5. Describe what each beneficiary will receive

Clearly state what each person is receiving, whether it’s specific items, money, or a percentage of your estate.

6. Name guardians for minor children (if applicable)

If you have children under 18, name a guardian who will care for them in the event of your death.

7. Sign the will

You must sign the will, typically at the end of the document, to make it legally valid.

8. Have witnesses sign the will

Most states require two witnesses to sign the will in your presence. They should not be beneficiaries.

9. Store the will safely

Keep the original will in a secure place, such as a fireproof safe or with an estate attorney. Let someone you trust know where to find it.

Some states may also require notarization or a self-proving affidavit to validate your will. Be sure to check the specific legal requirements in your state.

How much does it cost to make a simple will?

The cost of creating a simple will depends on how you choose to prepare it.

1. DIY or online estate

Many online platforms offer simple will templates or guided tools for individuals to create their own wills. Prices can range from free to approximately $10 to $250, depending on the level of support and customization required. For example, LegalZoom offers a simple will starting at $119, which also includes other estate planning documents such as a healthcare directive, medical power of attorney, pet care provisions, and more. The plan also provides the ability to make revisions and consult with an attorney.

2. Attorney-drafted wills

If you prefer personalized legal advice, hiring an attorney to draft your will may cost between $300 and $1000+, depending on your location and needs. This reflects the average cost of a simple will prepared by a legal professional. Prices may vary depending on the attorney’s experience and your state’s cost of living.

3. Optional costs - notarization and storage

While most states don’t require a will to be notarized by a notary public, some people opt to create a self-proving affidavit, which may require notarization for a small fee. Additionally, if you choose to store your will using a service or method, there may be associated storage or service fees.

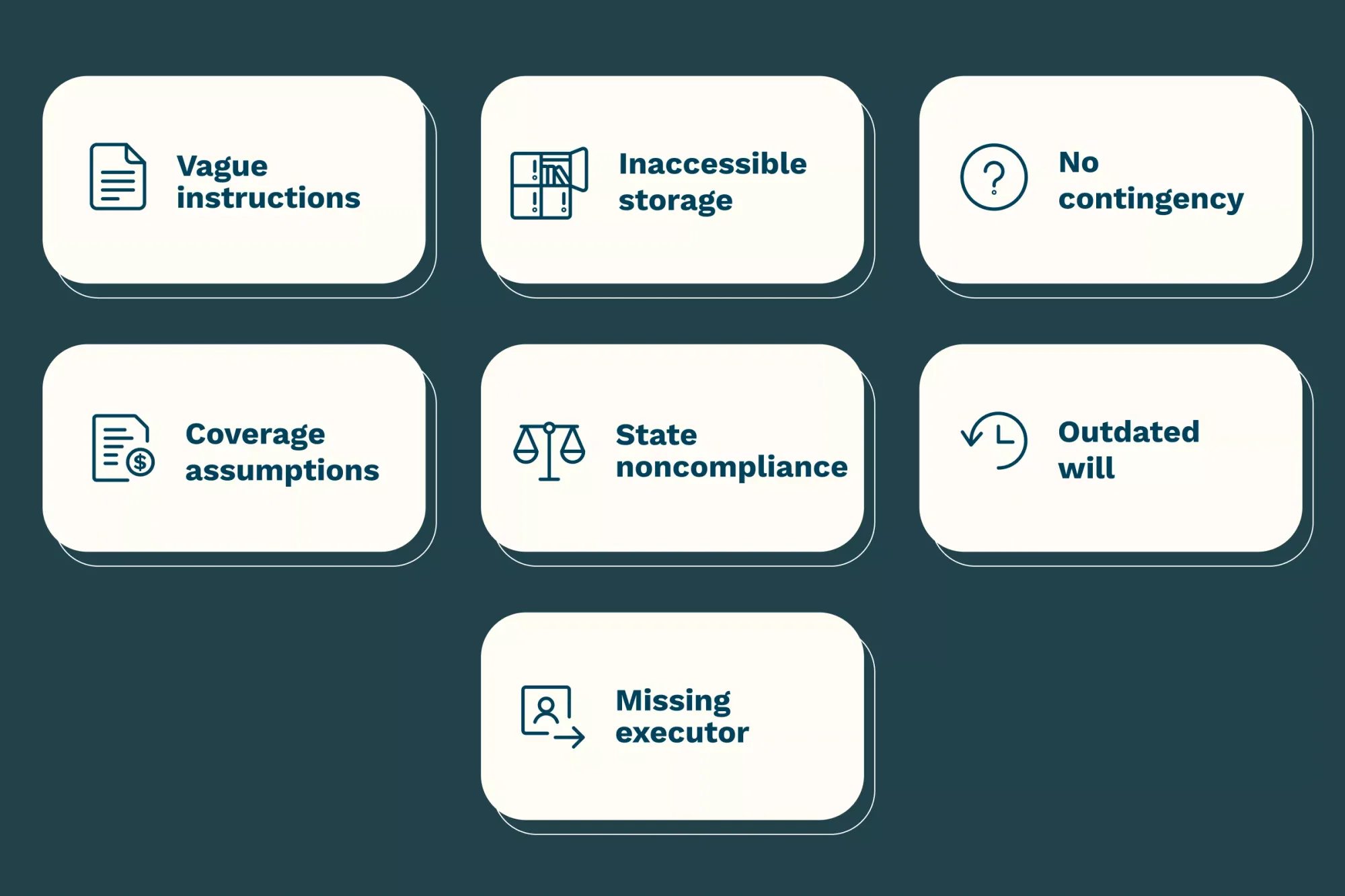

Common mistakes to avoid when writing a simple will

Although a simple will is straightforward, certain mistakes can lead to confusion, delays, or legal issues during the probate process. Here are some common pitfalls to watch out for:

1. Not following state requirements

Each state has its own rules regarding what constitutes a valid will, such as the number of witnesses required or the manner in which the last will must be signed. Failing to meet these can result in the will being rejected. Relying solely on generic will kits without understanding your state’s legal requirements could result in an invalid or incomplete will.

2. Forgetting to name an executor

If you forget to name an executor, the court reserves the right to appoint someone to manage your estate, who may not be your first choice.

3. Being too vague with assets or beneficiaries

Unclear wording or nicknames in the last will can lead to disputes among heirs. If disagreements arise, the court oversees the interpretation and enforcement of your will, which can delay the process and increase costs. To avoid this, be specific about who gets what, and use full legal names whenever possible.

4. Leaving out contingency plans

Failing to include contingency plans, such as alternate beneficiaries or a backup executor, can create complications if your first choice is unable to serve. For example, if they have died, are seriously ill, refuse the role, or are otherwise disqualified. In such cases, the probate court may need to intervene to settle your estate.

5. Not updating the will after life changes

Major life events such as marriage, divorce, the birth of a child, or significant changes in your assets may require you to update your will to ensure it accurately reflects your current wishes.

6. Storing the will in an inaccessible location

A will locked away without anyone knowing its location can cause delays. Let someone you trust know where the original will is stored to avoid any future disruptions.

7. Assuming a will covers everything

Some assets, such as jointly owned property or financial accounts with named beneficiaries, pass outside of the will. Ensure your estate plan accounts for these by regularly reviewing and updating ownership documents and beneficiary designations.

Simple will template/sample/example

The will requirements vary significantly across the United States. Each state has its own laws regarding execution, witnessing, notarization, and the specific language needed for validity. Here are the representative sample forms for each US state. These templates are for informational purposes only and do not constitute legal advice. Because laws and requirements can change and individual circumstances can vary, your final forms, documents, and filings may differ depending on your state. It is highly recommended to consult a qualified attorney to ensure your will complies with applicable state laws and meets your needs.

Note: You will need Adobe® Acrobat Reader to view these sample documents.

Why choose LegalZoom to create your simple will

LegalZoom makes it easy to create a simple will through a guided online process from the comfort of your home. LegalZoom offers:

- Step‑by‑step guidance to help you create your will with clarity and confidence

- State‑specific customization to align your will with local legal requirements

- Access to attorney consultations for support while completing your documents

- Unlimited updates and revisions during your subscription, so your will stay current as your life changes

- Secure digital storage for easy access and updates whenever needed

Get peace of mind with us—join the 2.1 million who have confidently created their last wills online with us. With thousands of 5-star reviews on TrustPilot, here’s what our customers have to say:

It amazes me something so important was so easy to do...everything was exactly as I had stated. I have peace of mind now.

- Jan F., last will & testament customer

[The] lawyer … was so helpful in explaining the process, what to expect, and when we'd move on to the next steps. Amazing. I highly recommend this service!

- Nicholi P., last will & testament customer

Frequently asked questions

1. What’s the difference between a simple will and a trust?

A simple will directs how your property should be distributed after your death and goes through probate. A trust, on the other hand, allows you to transfer assets outside of probate, often with more control, privacy, and flexibility. Trusts can take effect during your lifetime and may be useful for managing complex estates or providing for minor children, special needs, or long-term asset protection.

2. Do I need a lawyer to make a simple will?

If your estate is straightforward, will kits, online templates, or DIY(do-it-yourself) tools are often used to create a simple will. However, if you have complex assets, blended families, or specific legal concerns, consulting an attorney or estate planning expert can help ensure your will is valid and covers all necessary details.

3. Does a simple will need to be notarized to be valid?

In most states, a will does not need to be notarized to be valid. It only needs to be signed by the testator and witnessed according to state law. However, having your will notarized by a notary public makes the will self-proving, meaning the court can accept it without contacting the witnesses, which speeds up the probate process. Check your state’s laws for specific requirements.

4. Does a simple will avoid probate?

No, a simple will does not avoid probate. It only directs how your assets should be distributed after death through the probate court process. If you want to bypass probate, you may need other tools, such as a living trust, payable-on-death accounts, or transfer-on-death deeds.

5. Who receives my possessions with a simple will, and how is it distributed?

With a simple will, you decide exactly who will inherit your possessions after your death. The ones who inherit are called beneficiaries and are usually family members, like your spouse, children, or close relatives. However, you can also choose to leave assets to close friends, charities, or any other individuals or organizations you want to support.

Your will also specifies how your possessions among beneficiaries are distributed, either equally, also called per capita, or by family branches, also called per stirpes. If no beneficiaries or instructions are given, state laws decide who inherits the possessions, which are usually close family.

Brette Sember, J.D., contributed to this article.