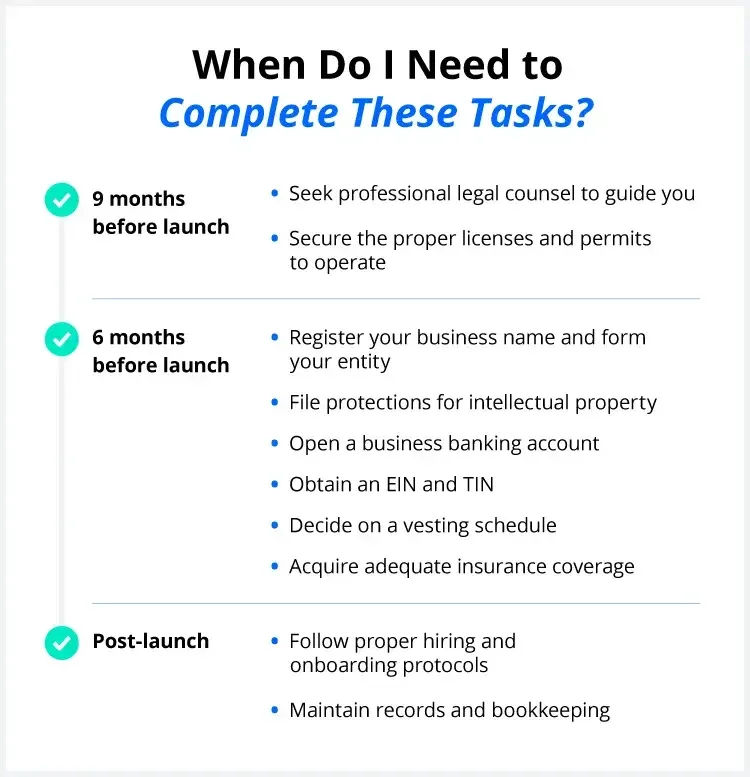

Legal requirements and best practices for starting a small business center around licensing and registration, tax liability, human resources (HR), and insurance coverage. By checking off the 13 steps in the following list, your business could have better legal protection and a stronger edge against potential competition.

You'll also want to get the scoop on common small business legal mistakes, which you can view in our infographic below:

Establish and define your business

Licensing requirements or mandated registrations are meant to help your business flourish wherever it operates. Each state governs small business formation differently, and requirements can change if you plan to do business across state lines.

Legally forming your business, coming to an agreement with your business partners, securing licenses to operate, and protecting your name, slogan, and other assets are all requirements for launching a successful company. Read on to explore each of these steps in detail.

1. Sign a founders' agreement

Properly documenting the rights and responsibilities of each owner is crucial if your small business is the result of an agreement with another party. A founders' agreement makes clear the breakdown of duties and liabilities between business partners. This is one of many important legal documents for startups that could protect you and your share of company profits in the event of a dispute.

2. Form your business entity

You may operate one of four types of businesses when you officially form your entity: a sole proprietorship, partnership, S corporation, or limited liability company (LLC). Each offers a different structure and unique protections to you as the business owner.

- Sole proprietorship: A structure for solo entrepreneurs that carries no filing requirements to form in most states and has increased liability exposure.

- Partnership: Either a limited, limited liability, or general partnership with basic filing requirements and possible liability exposure.

- S Corporation: A corporation that shields owners from liability and has a beneficial tax structure.

- LLC: A company that can be owned by unlimited individuals or entities, boasting greater liability protection.

LLCs and S corporations offer greater personal liability protection, which can save you time and money as the owner. Meanwhile, starting a partnership if you have multiple owners can be simpler than forming another entity, depending on the arrangement.

3. Register your business name

Excluding sole proprietorships that allow you to operate under your legal name, each business entity requires its own unique name that you file with the state. Once you determine that your business name is available, register and make it official:

- A trademark solidifies your business name and prevents other businesses from using it in every state.

- A Doing Business As (DBA) registration clarifies that the business name is fictitious and separate from your name or the official business name.

These two terms go hand-in-hand when announcing your business name to the world, but they don't carry equal protections. In fact, a DBA doesn't carry protections at all—it's just a name.

4. File protections for slogans and logos

In addition to protecting your business name, trademarks can protect intellectual property that brands your business. You can trademark slogans, catchphrases, logos, and any other names associated with your business.

The U.S. Patent and Trademark Office (USPTO) handles trademark applications at the federal level. The cost to trademark your business name averages $300 and changes depending on your state.

5. Secure the proper licenses and permits

After obtaining your DBA and registering your business, you'll need to secure operating permits and licenses. These vary widely depending on which state is home to your business, whether you do business in multiple states, whether you do business with a federal agency, or whether your business is in an industry with heavy federal oversight.

The Small Business Administration details industry-specific contact information for federal business permits as well as a database for state permit questions. If you have questions about the laws in your state, a professional can help you sort out your business queries.

Get your financial and tax-related legal requirements in order

Determine a vesting schedule if you plan to issue stock, and comply with tax laws by claiming the proper employer status. Tackle these steps to ensure you're on top of your finances and prepared for your taxes.

6. Open a business banking account

Record your business finances separately from your own. This not only ensures that you properly keep your records but also decreases your personal liability in the event of an audit. To open a business bank account, you'll need an EIN and founding documents that prove your ownership.

7. Get an Employer Identification Number

While it's possible that you will operate your business without hiring any employees, if and when you do hire anyone, you'll need to pay them. To pay your employees, you'll need to obtain an Employer Identification Number (EIN) that associates your business as an entity the Internal Revenue Service (IRS) recognizes. Keep in mind that you might also need a state tax identification number (TIN) depending on your state.

Even if you don't have employees, you still might want to obtain an EIN. EINs act like Social Security numbers for your business so you can avoid submitting yours on official documents. This small step can protect your business against identity theft and shield your information from view.

8. Decide on a vesting schedule

If your small business is classified as a corporation and issues stock, you can protect its value with a vesting schedule for early investors. A vesting schedule determines:

- When your investors can begin selling their shares

- What percentage of their stock investors can sell

This process protects the interests of your investors by ensuring that control and ownership remain only with people actively involved in ongoing business. Many investors demand a vesting schedule before making a commitment, so be sure not to overlook this preventative step.

Protect your business

Without proper protection, your newly formed small business is vulnerable to legal challenges and intellectual property theft. Business insurance and proper oversight in the hiring process both protect from liability, albeit in different ways.

Follow these preventative steps to up the legal defenses of your business.

9. Acquire adequate insurance coverage

Businesses protect their owners' personal liability but are vulnerable themselves to legal challenges. Protect your business with adequate insurance coverage to reduce business liability on several fronts. Some types of insurance are mandatory, while others are optional in some states. Here are common types of business insurance:

- General liability insurance: Guards your business and assets from several damage claims

- Commercial property insurance: Protects physical property (buildings, tools, and equipment) in the event of theft or, in some cases, damage

- Workers' compensation insurance: Covers your employees if they become sick or hurt as a result of their job; mandatory (except in Texas)

There are many other types of business insurance that can protect your investments against specific threats, like earthquakes, floods, and even data breaches. Consider all the potential risks you're facing before writing off a particular type of insurance.

10. Hire the right people

Hiring your first employees is an exciting step that signals growth. It's also a step that demands a high degree of attention to detail. By performing background checks and verifying employment eligibility, you'll assure regulators that your hiring is legal.

Many states have laws about at-will employment that govern employee terminations. In certain states, it's much more difficult to release an unfit employee, so do your homework before hiring someone you're unsure is a good fit for the job.

11. Follow proper onboarding protocols

As an employer, you must register with the U.S. Department of Labor. Complying with labor laws is important to protect your liability and ensure the safety of your employees. Requirements include:

- Displaying the correct labor posters

- Establishing an employee handbook

- Creating a labor compliance checklist

Labor law posters and employee handbooks are transparent measures that empower your employees to know their rights. In the same way, a labor compliance checklist empowers you to get ahead of potential issues that could lead to labor disputes or strikes.

12. Keep good records

As you begin to conduct business, government agencies will require records detailing your operations and profits. The law demands that you keep accurate accounting records specific to your industry, so if you have questions about proper business reporting, consult with a professional who can guide you with relevant advice.

13. Seek professional consultation to answer questions

You don't have to make any moves you're unsure about. Legal counsel and professional advice can help guide you through the business formation process so that all your individual needs and legal requirements are met.

To prepare yourself for launch and to ensure seamless operations, you can download the interactive checklist below to identify any legal requirements you might've missed. Use each step to think about your industry, location, employees, and anything else that might determine regulations that affect your business.

Once you meet the legal requirements to form a business, you're ready to launch. Running your business smoothly isn't a solitary job, even if you're forming a sole proprietorship or a single-member LLC. Remember that preparation is your biggest asset—the more prepared you are for launch, the more likely your small business will succeed.