Hiring your first employee signifies a major milestone for any startup.

Download this free hiring checklist or follow along below to learn about recruiting, hiring, and onboarding your first employees.

1. Make sure you're ready to hire your first employee

If business is booming and you're having to turn away work, you're expecting new product or service offerings to bolster your revenue, or you need a unique skill set outside of your wheelhouse, take a leap and start interviewing qualified candidates.

Just don't get carried away and hire the first person you interview because you need the help. After all, rushed decisions can lead to bad hires, which creates more work for you in the long run.

Calculate if you can afford to hire an employee

Once you've saved up enough money to cover the expenses of hiring a new employee, you need to determine if there's room in your budget to sustain that position.

Beyond the obvious expense of paying a new employee's hourly wage or salary, you also need to budget for any overhead costs, such as buying work equipment or paying for training resources. You'll also have to plan for mandatory expenses like Social Security and payroll taxes, Medicare and workers' compensation insurance, and state unemployment fees.

Before you start posting to job boards, calculate the following costs:

- Recruiting

- Onboarding

- Training

- Payroll

- Benefits

It's generally advised not to pay more than 30% of your gross revenue to payroll unless you operate within a labor-intensive industry such as manufacturing or hospitality.

If you're just budgeting for the basics, it's generally smart to have your employee's salary and about an additional 20% of that amount saved up to cover any surprise expenses or cash flow fluctuations. If you can't afford to hire a full-time employee right now, consider hiring:

- Interns

- Part-time employees

- Contractors

- Temps

Payroll taxes for LLCs, sole proprietorships, and partnerships

Most small companies don't have to pay corporate taxes because limited liability companies (LLCs), partnerships, and sole proprietorships pay individual tax rates instead of corporate rates. These companies typically report all earnings and losses on their personal 1040 income tax return.

Generally, business owners can expect to pay payroll taxes when they hire employees. You must withhold the appropriate amount from employee paychecks to cover state and federal taxes and FICA contributions.

Workers' compensation insurance coverage costs

Workers' compensation insurance pays for your employees' medical bills and sometimes offers cash payouts if they are injured on the job. It also limits their ability to sue you for negligence. Workers' compensation is required in many states; it is often based on the number of employees you have, so check your state's requirements.

You can expect workers' compensation premiums to fluctuate based on where your employees live, your claims history, and the risk associated with your industry.

Budget for employee benefits

Providing employee benefits (other than the mandatory state and federal benefits), such as health insurance and retirement accounts, is not required by all states, but they can certainly help you attract top employees. Be sure to check your state's rules and weigh the pros and cons of adding a benefits package.

On average, paying benefits costs employers $11.42 per hour for each employee, according to the Bureau of Labor Statistics 2021 report. If you hire a full-time employee, this means you could easily end up paying almost $25,000 in benefits each year. Of course, this amount can vary widely depending on your industry, sector, and resources.

The only employee benefits that you are legally required to provide are Social Security, Medicare, and unemployment insurance.

But offering additional benefits like health insurance or an employee stock purchase plan can help boost productivity and cultivate a sense of loyalty to your company. It's also a great way of improving your staff's overall well-being and happiness if you can swing it. Consider offering some combination of these benefits to increase application submissions and to help your staff members thrive:

- Health, life, dental, and vision insurance

- Additional paid time off (PTO) and sick time

- Retirement savings plans and 401(k) matching

- Health and wellness programs

- Work from home (WFH) expense reimbursement

- Financial planning assistance

- Student loan assistance

- Extended maternity and paternity leave

What Role Should You Hire For First?

The first people you hire at a company set the foundation for all employees to come. These are the people who will catapult your business to success or slow its progress. If you can't hire people for all of the positions you need due to financial constraints, think critically about what work can be outsourced and what you can do yourself.

- Tip: Hire someone who's passionate and skilled at something you don't enjoy doing. This frees up your time to work on projects that excite you while giving someone else the opportunity to work on things they excel at.

Once you know what areas of your business could use reinforcements, start thinking about what jobs and skills you need to fill them.

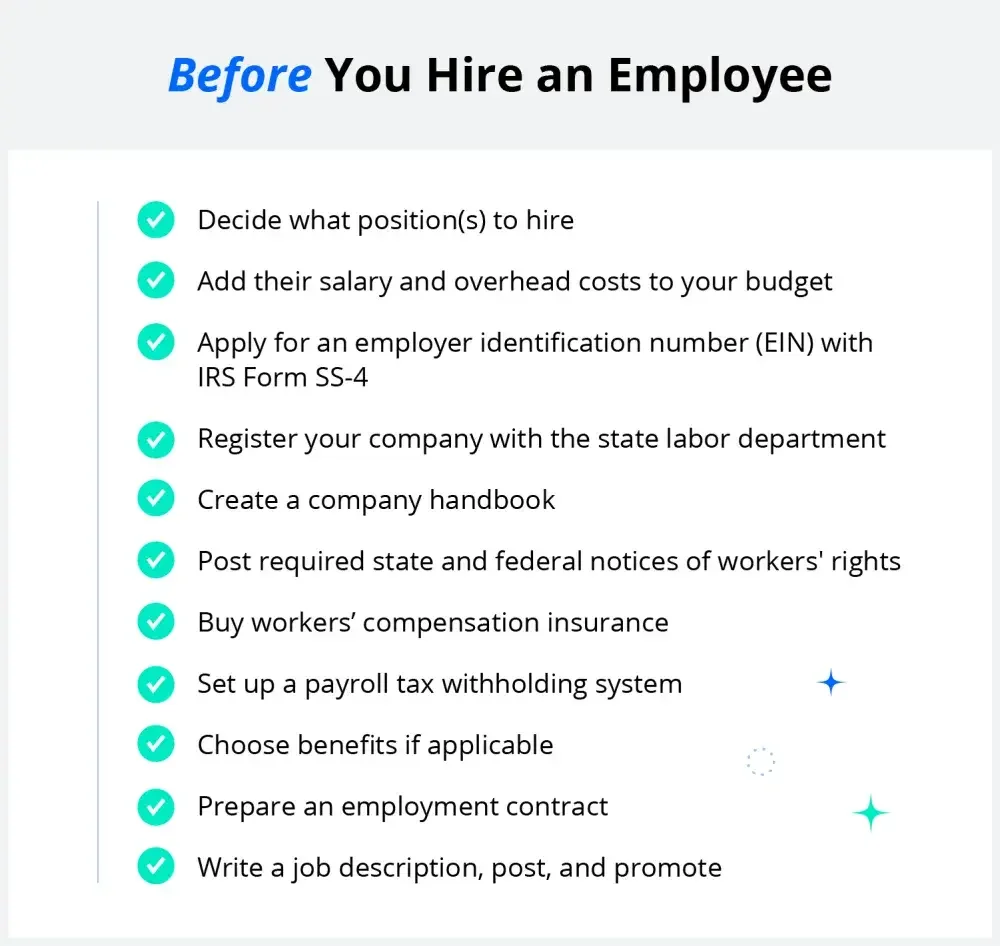

2. Check off the legal requirements for hiring

Some legal necessities you should start researching before you hire employees include:

- Applying for an employee identification number (EIN)

- Registering your company with your state labor department

- Buying workers' compensation insurance

- Setting up a payroll tax withholding system

Apply for a federal Employer Identification Number (EIN)

You need to get a business tax ID before you can add a new employee to your payroll. This ID is a federal employer identification number known as an EIN. All you need to apply for a tax ID is your social security number and information about your company.

Visit the IRS site to fill out Form SS-4 and get an EIN. If needed you can also order a state tax ID number.

Register your business with your state's labor department

You typically must register your business with your state's labor department before you hire anyone. If your state requires residents to submit state tax returns, you will automatically be registered with the unemployment office when you set up tax withholding. If your state doesn't require state tax returns, you probably need to register your business with the unemployment office.

Set up a payroll and tax withholding system

You will need to hold on to a certain amount of each employee's paycheck to pay federal and sometimes state taxes. You will typically need to make monthly payments to the IRS and your state tax board and file quarterly payroll tax reports to both entities. Be sure to talk to a tax professional about these requirements.

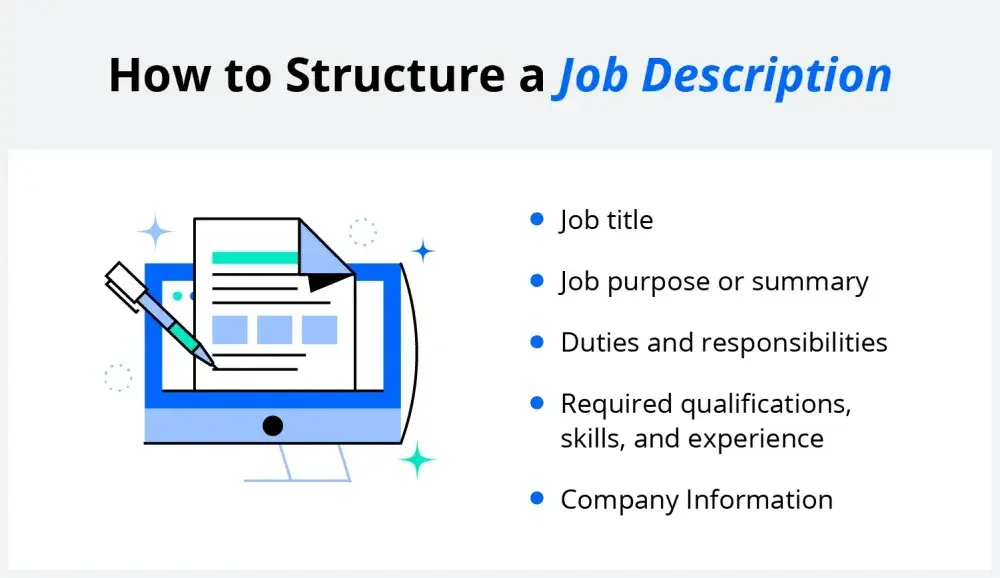

3. Write a good job description

Writing the perfect job description can be difficult. Unclear language can decrease your online visibility and may pull in job seekers who don't fit well within your envisioned role. To ensure ideal candidates can find your job posting and that they will want to apply, write a clear and accurate job title and a well-rounded job description, and be as transparent as possible.

Write an accurate job title

The first thing you should avoid is writing lengthy job titles. The average job seeker doesn't care about department names or the name of your business, and most job posting platforms will let people filter results based on what's important to them. This means there's no need to state every detail in the headline.

- Tip: Avoid creative job titles like "number ninja" when you mean an accountant, "computer overlord" when you mean IT support, or "flavor maestro" when you mean head chef to avoid misleading job candidates.

Write the perfect job description

A potential candidate wants to know if they're qualified for the position to ensure they're not wasting their time. Next, they want to know what you have to offer them, so include information about salary, benefits, and what they'll be doing.

Finally, you can share information about your company. Remember that this is your time to prove yourself to the job candidate. The job interview is their opportunity to prove what they offer you.

Here are a few things you should do when creating a job description:

- Write simply for quick scanning

- Don't use jargon

- Clearly define job responsibilities

- Include work classification information

- Use neutral wording to avoid biases

4. Find and attract top-tier talent

Position your business as a place where people want to work. Show off what you're working on, your values, and your work style to attract talented candidates. Use photos, videos, and text to let candidates know what you have to offer them. Act as a brand ambassador and share on your social media platforms so others can recommend you to people they know.

5. Post your job listing and monitor

Visibility and appeal are key to reeling in qualified candidates. Cross-post job listings across various websites, then promote and monitor them. You can also physically post your job listing at churches, veterans associations, and other locations around town.

If you're not receiving many applications, tweak the benefits or wording to make the job more attractive to candidates. If you're seeing interest from job seekers, start combing through their applications, vetting resumes and scheduling virtual screenings or job interviews.

Best Hiring Websites for Employers

You can post jobs on industry-specific job boards or crawl portfolio websites if you're looking to hire people with niche skills. But if you're just looking for a larger pool of qualified candidates, post your job to one of these popular recruitment websites:

How to promote jobs on social media

Start by promoting the job on Facebook, Instagram, LinkedIn, and Twitter to maximize your visibility. Create a shareable post or story and make sure to:

- Write a short job description

- Upsell company culture

- Share a photo or a graphic to grab the viewer's attention

- Include a link to the application

- Pay for a boosted post to increase visibility

How to get more candidates to apply for a job

If you feel like you're begging people to work or aren't getting enough responses on your job posting, it's time to take a hard look at what you're offering and how you're presenting your company. Many small businesses struggle to hire qualified candidates when competing with large companies, so it's important to make your listing competitive and appealing.

To entice more candidates to apply to your job posting:

- Offer competitive pay. Enter the job title you're hiring for into salary.com or PayScale to determine what the average pay is for that position.

- Streamline your interview process. Don't force candidates to jump through hoops or sit through numerous interviews and tests if it's unnecessary.

- Develop an attractive work culture. Find candidates who share your values by being transparent about the things that are important to your company.

How to deal with getting too many job applications

Having too many applicants is a great problem to have, but it does mean you'll probably need to fine-tune your screening process. If you need to narrow down your applicant list:

- Hide secret directions. Add a fun task somewhere in the job description to see if the applicant catches it. If they find it, they probably have great attention to detail and are genuinely interested in the position and not just mass applying.

- Give them a test. This can be a standard test that ensures they have the knowledge needed to excel in the job, or a test project so you can actually see their skills in action.

- Use artificial intelligence. If compliance is important in your industry, you can run applications through data extraction software to look for key information like education or experience to save time.

Positions to outsource

If you need additional help but not enough to warrant hiring in-house, outsource the work to a skilled professional. You can outsource for mundane tasks, sporadic projects, or anything unrelated to your key service offerings. Examples include:

- Lawyers

- Administrative staff

- Accountants

- Financial advisers

- Human resources

6. Screen and interview applicants

Screening candidates helps verify that an applicant is qualified for the position. You can cut through about 90% of applicants just by checking their resume, cover letter, and/or CV for experience, qualifications, and professionalism.

Be sure not to look up a potential employee online as a part of the initial screening process because that's an illegal hiring practice. Looking at social media before an interview could give you access to protected information like sex, race, and nationality.

Review hiring documents: Resume, cover letter, CV

When you start reviewing submitted resumes and cover letters, check for formatting, employment gaps, spelling and grammar errors, and any informational inconsistencies. These things can sometimes indicate a lack of attention to detail, poor writing skills, fabrications, or that the candidate is mass-applying to jobs.

But remember to show some grace during the hiring process to help you avoid eliminating excellent candidates who may struggle with learning disabilities, non-native English speakers, or other people who need minor accommodations to be successful in the role you're hiring for.

Phone or video call screening: How to conduct a phone interview

Keep this initial conversation under 30 minutes and go over their qualifications, the job description, salary information, and their career goals. This helps you avoid wasting both your and the candidate's time by determining if they're a good fit for the position.

Schedule and conduct a virtual or in-person job interview

If the phone screening goes well, invite them to a more comprehensive job interview or request that they take a skills assessment if necessary. Some things you can ask job candidates about during the interview include their:

- Career goals

- Skills

- Experience

- Strengths and weaknesses

- Accomplishments

Use this formal interview—whether it's virtual or in person—to clarify what you saw on the candidate's application and to learn more about who they are beyond what a one-page resume can tell you.

Contact professional and character references

This is an optional last step that many business owners choose to skip. But if it's important to you, you may request that a candidate send you character or professional references.

You should avoid doing this until the end of the interview process so it doesn't skew your perception of the applicant and open the door for a discrimination lawsuit.

7. Hire your first employee

Once you've decided who to hire, send out rejection letters to anyone who didn't make the cut this time around.

If there were good candidates whom you might consider hiring later, keep their applications handy.

As for the rest, you should file away all rejected applications. You will also need to create a file for your new employee.

Send offer letter

It's now time to send your selected candidate an offer letter formally asking them to work for you. The document should usually include their:

- Name

- Job title

- Supervisor

- Pay rate

- Start date

- Duties

- Job classification

- Schedule

I-9 form for employee eligibility verification

U.S. Citizenship and Immigration Services (USCIS) requires every employer to verify every new hire's eligibility to work in the country. You will use an I-9 employment authorization form to do this. To complete it, you must collect identification documents that prove your employee's identity and their right to work in the United States.

Have new employees fill out a W-4

A W-4 is a legal document that your employee must fill out each year so you know how much money to withhold from their paycheck for taxes. You should provide your new employee with this document and ask them to complete it on their first day of work. Once they complete this form, submit it to the IRS before sending out their first paycheck.

Report new hires to state registry

If your new hire is legally obligated to fill out a W-4, you are legally required to report their employment with your company to the state. The U.S. Department of Health and Human Services (HHS) uses this information to locate parents who owe child support. In most states, you must send the following information to your state's new hire reporting directory within 20 days of their official start date:

- Employee's name and address

- Employee Social Security number (SSN)

- Date of hire (the employee's start date)

- Employer's name and address

- Employer identification number (EIN)

Find out where to report new hires in your state.

Set up direct deposit

You may want to set up a direct deposit for every employee you hire to transfer money from your bank account to theirs on payday. Most banks require employers to pay a direct deposit setup fee, but once that's complete, you will usually only have to pay a small fee. If handling payroll yourself doesn't appeal to you, you can also use HR and payroll programs like Gusto to reduce some of your workload.

Inform employees about their rights

Every employer should have an employee handbook. The employee handbook can include your:

- Mission statement

- Work schedules

- Performance expectations

- Equal Employment Opportunity (EEO) policy

- Occupational Safety and Health Administration (OSHA) regulations

- Company dress code

- Anti-harassment policies

- Employee benefits

- Sick leave and PTO policies

- Nondisclosure agreement (NDA)

Legal forms for your hiring needs

Whether you're getting ready to hire your first or 50th employee, LegalZoom has you covered with the paperwork you need to protect your company from Day 1. Browse our legal templates as you draft employee contracts, NDAs, offer and rejection letters, and consulting agreements.