Starting a new business? Applying for a federal tax ID number (FEIN) should be a top priority on your to-do list.

When you form a business entity such as an LLC, you may need to apply for a federal tax ID number—also known as an employer identification number (EIN)—to hire employees, file taxes, pay taxes, open a business bank account, and complete other business tasks. This nine-digit number is similar to a Social Security number and is issued by the Internal Revenue Service (IRS). The easiest and quickest way to get one is to apply online: You simply fill out and submit a one-page form.

What is a tax ID number?

When someone refers to a federal tax ID, they're generally talking about a federal employer identification number (FEIN) from the Internal Revenue Service. This tax ID number may also be called an EIN, and the terms EIN and FEIN are often used interchangeably.

In order for a business to get a FEIN, an individual that the IRS refers to as the "responsible party" must supply their name and a valid taxpayer identification number, usually their personal Social Security number. The responsible party must be someone who "controls, manages, or directs" the applicant entity, such as an owner or general partner.

Some businesses in some states may need to apply for a FEIN as well as a separate state tax ID number used to pay state-specific taxes. The U.S. Small Business Administration offers a lookup tool a business owner can use to see if they need a state tax ID number.

What is the difference between a FEIN and an EIN?

A federal tax ID number (FEIN) and an employer identification number (EIN) are the same things. Other terms often used to describe a FEIN or federal EIN include:

- Tax ID number

- Taxpayer identification number (TIN)

- Federal tax number

- Federal tax ID

- Tax ID number

A business tax ID number is easy and fast to get, especially if you apply online on the IRS website, and EIN numbers never expire.

Types of IDs your business can use for federal taxes

Depending on your business, you may not necessarily need to get a federal tax ID and may be able to use these other types of ID numbers for federal and state taxes:

- SSN: The Social Security Administration (SSA) issues Social Security numbers to identify U.S. citizens for various purposes—including filing federal taxes and state taxes.

- ITIN: The individual taxpayer identification number is a tax ID the IRS issues to non-U.S. citizens who work in the country.

A sole proprietor may use their personal Social Security number to file and pay taxes since there is no Internal Revenue Service requirement for them to obtain a business tax ID number, unlike larger businesses. But this can increase their risk for identity theft, so a federal EIN may offer a safer choice.

How long does it take to get a FEIN?

If you determine you need a federal tax ID, be sure to apply for an EIN tax ID well before you need to use it. The time frame to get an EIN varies depending on how you apply. Here are the ways to apply for a FEIN and how long each one takes:

- Apply for an EIN online—If you fill out the EIN online application, you can get your tax ID number instantly. The IRS recommends applying for an EIN online for the fastest, easiest service.

- Apply for an EIN by fax—If you fax form SS-4 to the IRS, it will send an EIN to your fax number within four business days.

- Apply for an EIN by mail—If you mail form SS-4 to the IRS, it will send an EIN to your mailing address within four weeks.

- Apply for an EIN by phone—If you call the IRS, you can receive an EIN over the phone right away. Only international applicants may apply this way by calling the toll-free number between 6 a.m. and 11 p.m. Eastern time.

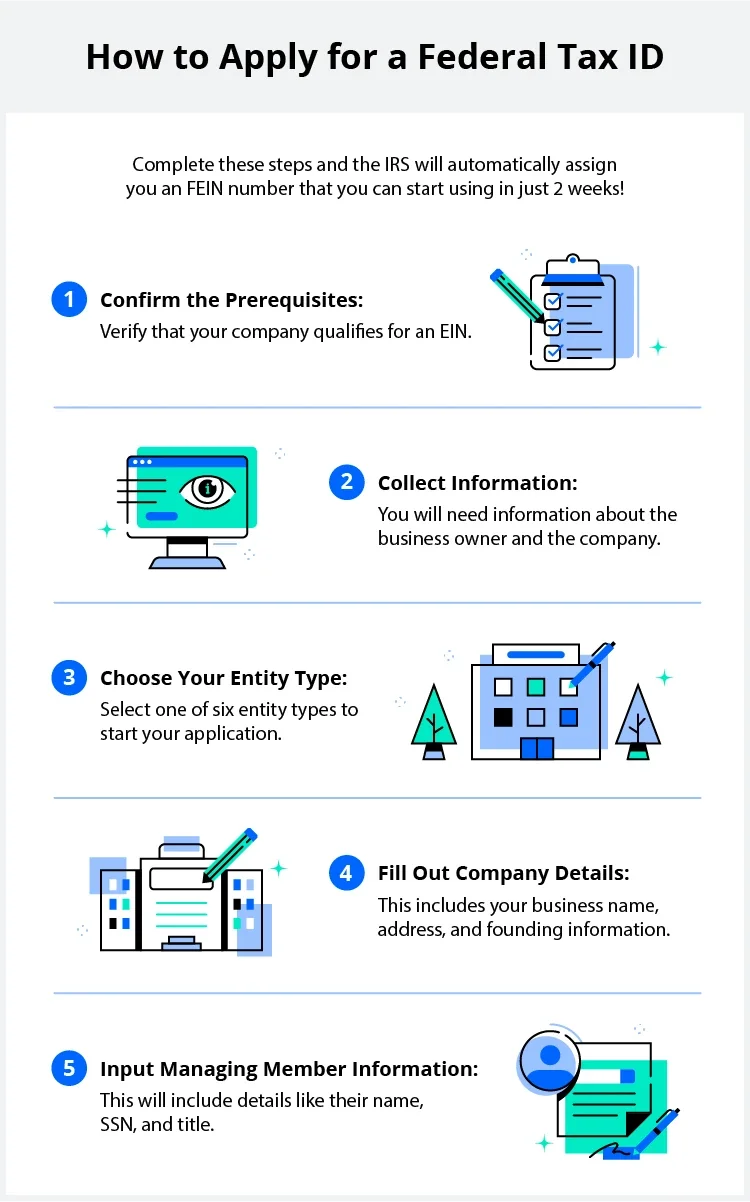

How to apply for a FEIN

It's an easy application process as long as you prepare before you apply. Here's how to apply for a FEIN.

1. Confirm the prerequisites

If you already have a taxpayer identification number (TIN), it will be easy to apply for a new EIN online. Some qualifying TINs include:

- Social Security numbers (SSN)

- ITIN

- EIN (for another entity)

If you don't already have one of these tax IDs, visit the Internal Revenue Service website to determine if you're eligible. The standard qualifications include:

- Being located in the U.S. or one of its territories

- Having a valid SSN, ITIN, or EIN

- Not already having been assigned an EIN

2. Collect information

Whether you're the company's responsible party or just filing on their behalf, you will need to input the following identifying information on the application: name, taxpayer ID, and company's legal or DBA name.

3. Choose your entity type

You can start the FEIN application by selecting the legal entity type that matches your company's structure. Your options include: sole proprietorship, estate, trust, corporation, S corporation, limited liability company, partnership, and nonprofit organization.

4. Fill out company details

Supply details about the company, including the following:

- Legal name

- Trade name/DBA (optional)

- Number of members

- Taxation status

- State it was opened in

- Reason for applying

- Primary activity

- Start or acquisition date

- Closing month of accounting year

You will also need to list the address of the company's headquarters (not a P.O. box.)

5. Input managing member information

Then, input the information about the owner that you collected in step 2. These details will include name, SSN, and title.

Who needs a federal employer identification number?

Any U.S. business can use an FEIN, but very small businesses may not need one. For example, a sole proprietorship with no employees isn't legally required to have a federal tax ID number. However, you may need to get an FEIN for certain activities, including:

- Hiring employees

- Changing business type

- Handling estates, trusts, or IRAs

- Opening business credit cards

- Applying for business loans

- Establishing a nonprofit organization with tax-exempt status

- Having a Keogh plan (a tax-deferred pension plan)

Does a single-member LLC need a federal tax ID number?

Generally, no. The individual who owns the company can use their Social Security number to file federal income taxes and can report company activities on their tax return.

If the single-member LLC is a “disregarded entity" that has staff and pays federal employment or excise taxes, it will need to have a tax ID number. And because a federal tax ID number may be needed to open a company bank account (many banks require a FEIN) and to carry out other business-related activities, many single-member LLC owners choose to obtain one.

When do you need to request a new EIN for your business?

You may need to request a new federal ID number from the IRS at some point. The factors that dictate this depend on the situation and type of legal entity.

Typically, you only need to get a new EIN if the overall structure of your business changes. A simple change like a new name or address generally doesn't warrant an update, but it depends on your situation. Here's an overview.

Sole proprietorships

A sole proprietorship is owned by a single person and is not incorporated or an LLC. As a sole proprietor, you may need a new EIN if you file for bankruptcy, incorporate your business, operate under a partnership, or buy or inherit a preexisting business.

Corporations

A corporation is an entity created by a single person or a group of people using a charter that separates the owner(s) from personal liability.

Apply for a new EIN if:

- The secretary of state awards your corporation a new charter

- You form a new corporation following a merger

- The corporation transitions to a sole proprietorship or partnership structure

- You become a subsidiary of a corporation and use the parent company's EIN

Partnerships

A partnership is an unincorporated company with two or more owners who work together to carry out daily operations.

You must get a new EIN if:

- You incorporate

- One partner takes over and turns the company into a sole proprietorship

- You end an old partnership to begin one with someone else

LLCs

An LLC is a business entity created by state statute. Since limited liability companies are created under state statutes, they don't have federal tax classifications, making them “disregarded entities."

Your LLC may need to get an EIN if you:

- Form a multimember LLC under your state's laws

- Were required to fulfill the employment tax filing requirement for wages you paid on or after Jan. 1, 2009

- Form a single-member LLC but choose to be taxed as a corporation or S-corporation

- Have a single-member LLC that was required to pay excise taxes starting on or after Jan. 1, 2008

Keep in mind that if you want an EIN for banking or state tax purposes, you can still apply. You just don't need one for federal tax purposes.

How to find your federal tax ID

If you ever misplace your federal tax ID, you can generally find it on one of these business documents:

- The confirmation letter the IRS emailed for your online EIN application

- Old federal income tax returns filed using your FEIN

- Official forms or tax notices from the IRS

- Business licenses or permit applications, if you kept a copy

- Business bank statements that contain your tax ID number

Or you can call the IRS at (800) 829-4933 and ask a representative to look up your EIN for you.