Owners of a limited liability company (LLC) can choose and change how they file business taxes with the guidance of a tax professional. This flexibility is one of the qualities that make LLCs appealing to small business owners. But if you're starting out, the annual LLC tax filing process can seem confusing.

There are several types of LLCs, and each business structure has its own tax rules. LLCs can file like sole proprietorships, partnerships, or corporations, and it's essential to understand their differences and how they affect how your business pays federal taxes and state income taxes. This article serves to highlight different tax classifications, their requirements, and best practices to find the best tax strategy for your business.

LLC tax overview

An LLC's tax classification depends on its members, i.e., the business owners. The IRS assigns a default tax structure based on the number of members. From there, members can elect to change their tax classification. The IRS assigns two default tax designations:

- Sole proprietorship if an LLC only has one owner.

- General partnership if an LLC has more than one member.

How to file LLC taxes by LLC type

LLCs file taxes under their default designation. But if you'd prefer to have your LLC taxed like a corporation, you can change its tax status by filing a form with the IRS. It can also re-form as a partnership or proprietorship if the LLC adds or loses members.

Knowing how to file business taxes for an LLC is an important step in keeping your finances on track. If you're starting out, you'll probably prefer to file as a sole proprietorship or partnership. But as your business grows, you should consult a tax adviser or accountant to see if your LLC might benefit from taxation as a corporation.

Here's how LLCs file federal income taxes under each tax classification:

Single-member LLCs

- Forms needed: Schedule C of Form 1040

- Filing due date: April 15

Single-member LLC business taxes work like those of a sole proprietorship. LLCs report their business income and expenses on Schedule C of the member's personal individual income tax return. The member then lists the net profit or loss on the income section of Form 1040, U.S. Individual Income Tax Return.

Because the IRS disregards LLC status for tax purposes, the company files like a sole proprietorship according to U.S. tax law. This is what is meant by referring to an LLC as a "disregarded business entity" for tax purposes. Aside from this tax treatment, however, one benefit of being a single-member LLC is that they still retain all of their limited liability protection.

Multiple-member LLCs

- Forms needed: Schedule K-1 of Form 1065, Schedule E of Form 1040

- Filing due date: March 15 (Schedule K-1) and April 15 (general filing date)

If your LLC has more than one member and files as a partnership, the LLC's income will flow through to the members themselves. The members will report this income on their personal or individual income tax returns. Paying multiple-member LLC business taxes involves:

- Issuing a Schedule K-1 to each LLC member, showing the member's share of the LLC's profit. Your LLC's operating agreement form should list each member's percentage share of the LLC's profits and losses. The due date for filing Form 1065 and Schedule K-1 is March 15.

- Filing Form 1065, an informational tax return that reports all of the partnership's income and expenses. The general filing due date is April 15.

LLC members then report their share of profit (or loss) on Schedule E of their personal tax returns. Members must report and pay tax on their entire profit share, even if they leave some of those profits in the business rather than taking them home.

LLCs taxed as C corporations

- Forms needed: Form 1120, Schedule B of Form 1040

- Filing due date: April 15

It is advisable to consult an accountant before electing to pay taxes as a corporation.

An LLC can file as a C corp by filing Form 8832, Entity Classification Election, with the IRS. Corporate taxation is complicated, and it's a good idea to consult an accountant before paying business taxes as a corporation. Some reasons an LLC might choose corporate taxation include:

- You plan to leave a substantial amount of money in the business each year to finance expansion or for other reasons.

- Your profits are far greater than the amount the owner/employees should reasonably make in salary, and you want to minimize self-employment taxes.

An LLC taxed as a C corp files a corporate income tax return each year. It will file corporate income tax on Form 1120. The shareholders also report any salary and dividends they receive on their personal tax returns. Owners report their dividends on Form 1040 of their tax return.

It is important to note that C corporations are subject to taxation at both the corporate level and the shareholder level (on personal returns, double taxation must be considered).

LLCs taxed as S corporations

- Forms needed: Form 1120-S, Schedule K-1 of Form 1120-S

- Filing due date: March 15

A business entity or LLC can also make a further election to file as an S corp (or Subchapter S corporation). An LLC taxed as an S corp (or Subchapter S corporation) follows a procedure similar to a partnership:

- The LLC files an informational return and provides members with a Schedule K-1 form showing their share of the profits (or losses). In order to do the S corp election, an LLC has to file IRS Form 2553.

- The members report that income on Schedule E of their personal tax returns.

What other taxes do LLCs pay?

Like all business structures, LLCs have to pay more than just federal income taxes. Other types of taxes may be owed to the to state and federal governments depending on their location and tax classification. The main ones include:

- Self-employment tax

- State income taxes (personal and corporate)

- Payroll taxes

- Property tax

- Social Security tax

- Excise tax

- Sales tax

We'll cover some of the more confusing IRS taxes below.

Self-employment taxes

If an LLC files taxes as a sole proprietorship or partnership, the IRS considers its members self-employed for federal tax purposes. When you work for an employer, your employer pays half of your Social Security and Medicare taxes, and you pay the other half. But when you're self-employed, you must pay the full amount yourself.

On your annual tax return, you can deduct half of this tax from your business income, which slightly offsets the impact of the self-employment tax. You must file Schedule SE Form 1040 for Self-Employment Tax with your tax return.

Estimated quarterly taxes

Self-employed individuals need to make estimated payments on their self-employment and their personal income tax every quarter. Failure to file quarterly taxes can lead to penalties and interest.

LLC members can make estimated tax payments on Form 1040-ES.

State income taxes

States can set their own tax rate on personal and corporate income when paying estimated taxes. Making accurate payments on state taxes is just as important as federal filings. LLCs and their members may need to file income and franchise taxes in every state in which they do business. State tax forms and due dates vary from state to state.

These state income taxes come in addition to your LLC's annual renewal fee. Similar to business income taxes, every state sets a unique fee. Due dates also vary by state. Consult a business advisor for information on renewal fees and due dates.

In addition to your LLC's annual renewal fee, it's important to note that state income taxes may also apply. These state income taxes are separate from the annual renewal fee and are specific to each state. The due dates for state income taxes may vary depending on the state. For more information about the specific due dates for your state, we recommend consulting a trusted tax adviser.

Virtually every business needs to appoint a registered agent. A registered agent service may be able to advise on tax matters and other business questions, depending on who you use. If you need help finding a registered agent, LegalZoom offers expert registered agent services.

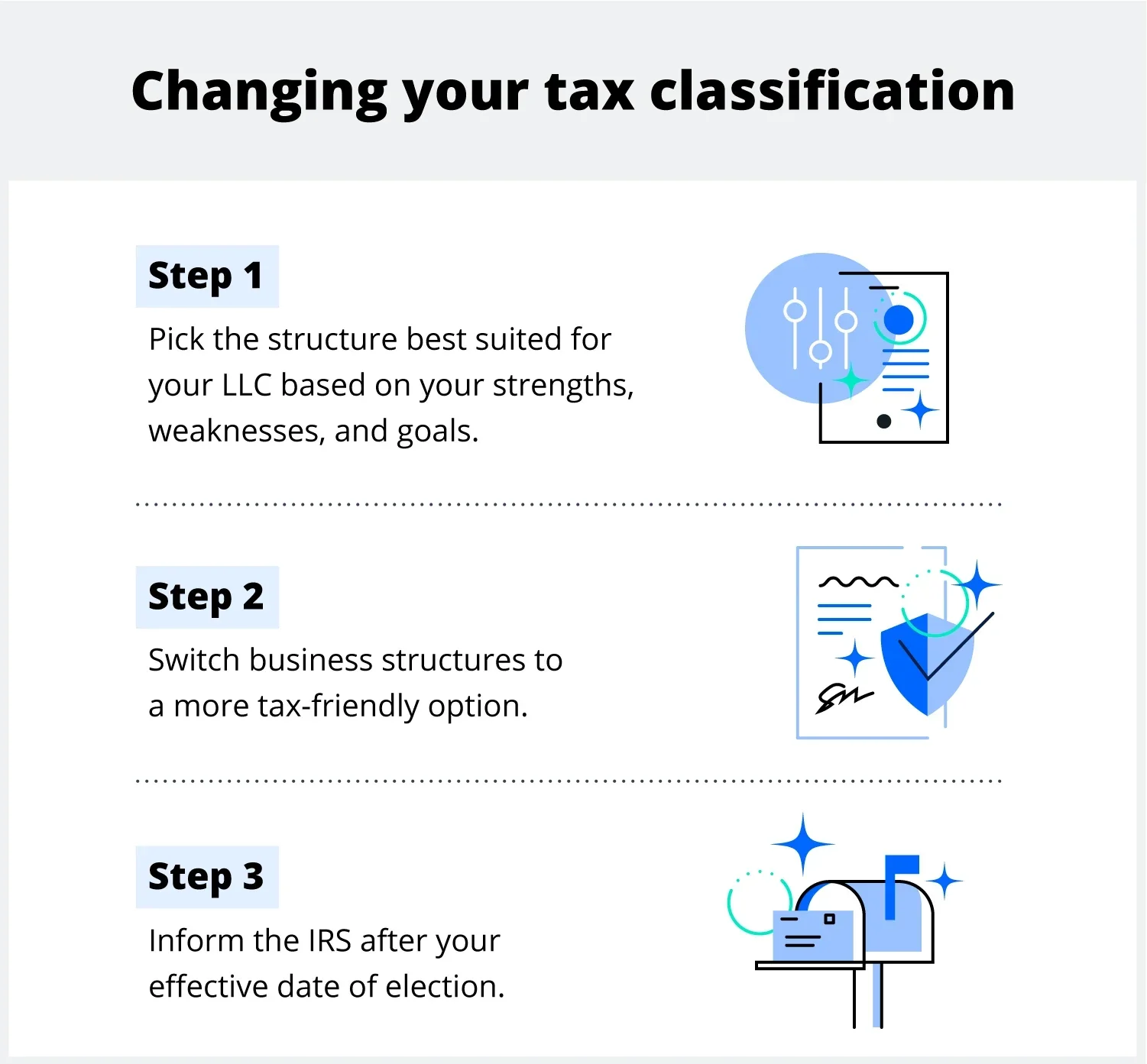

How to change your tax classification

LLCs can change their tax classification by adjusting their ownership structure or electing to file as a corporation. LLCs can change their tax status at any time. However, they cannot elect to change their status again until 60 months after the first effective date of election.

You can change your LLC tax classification in three steps:

1. Pick the structure best suited for your LLC

You can file LLC taxes as a:

- Sole proprietorship

- General partnership

- C corp

- S corp (or Subchapter S corporation)

Many LLCs change their classification to become a corporation. But in rare cases, they may switch from partnerships to proprietorships or vice versa. Carefully consider each structure's strengths and weaknesses before making a decision.

2. Convert your business structure

Every tax classification comes with distinct requirements. To file as a sole proprietor, you must:

- Found your business as the only member; or

- Buy out other owners to convert to a sole proprietorship

To file taxes as a partnership, you need to:

- Found your LLC with more than one member; or

- Add another member to a sole proprietorship

To file LLC taxes as a C corp, you need to:

- Receive consent from all LLC members or one properly authorized officer

- Pay double taxation for personal and corporate income; and

- Exchange the assets and liabilities under your previous business model for shares

To file as an S corp, you must:

- Retain fewer than 100 shareholders

- Restrict nonresident aliens from becoming shareholders

- Offer only one class of stock

- Restrict other corporations or partnerships from becoming shareholders

3. File after your effective date of election

Once the members decide on an LLC structure change, they must file with the IRS. If an LLC doesn't submit the proper form in time, it may have to pay taxes based on its default classification. The form you submit to change your classification depends on your new structure:

- Disregarded entities, partnerships, and C corporations: Submit Form 8832

- S corporations: Submit Form 2553

Best practices for filing LLC taxes

LLC filing, with or without a trained tax professional, takes expertise and patience. To see the best tax results for your business, be sure to implement the following best practices.

Get organized as soon as possible

Every LLC tax classification needs to file unique forms on different tax due dates. Study IRS guidelines regarding estimated tax payments in advance to prevent incorrect fillings or missed deadlines in tax season. This proactive approach will also highlight tax deductions, tax benefits, and tax loopholes that may benefit you.

Deduct LLC startup costs

The IRS offers special deductions to LLCs during their first few years of operation. You stand a better chance of seeing your business grow by capitalizing on these opportunities.

Will my LLC receive its own tax return?

A multiple-member LLC has to file a separate Form 1065, and an S corp LLC has to file Form 1120-S.

Does my LLC need to file its own tax return?

If you have a multiple-member LLC, or if your LLC elects to file taxes as an S corp or a C corp, then the LLC will have to file a tax return separate from your personal tax return.

Are you unsure of what legal structure best suits your business needs? Are you having trouble distinguishing between whether you are an LLC with only one member or multi member LLC? It is best to do further research with experienced tax advisors in order to get the best tax benefits.

Whether you need legal guidance, information on corporate tax returns, or tax expertise from tax professionals, LegalZoom can help get your LLC off the ground.