Whether you need an EIN for a DBA depends on your underlying business structure, not the DBA itself. Keep in mind that a DBA isn’t a legal entity or tax classification—it simply allows you to operate under a different name. In many cases, businesses with a DBA will need an EIN, though there are a few exceptions—particularly for sole proprietors and single-member LLCs.

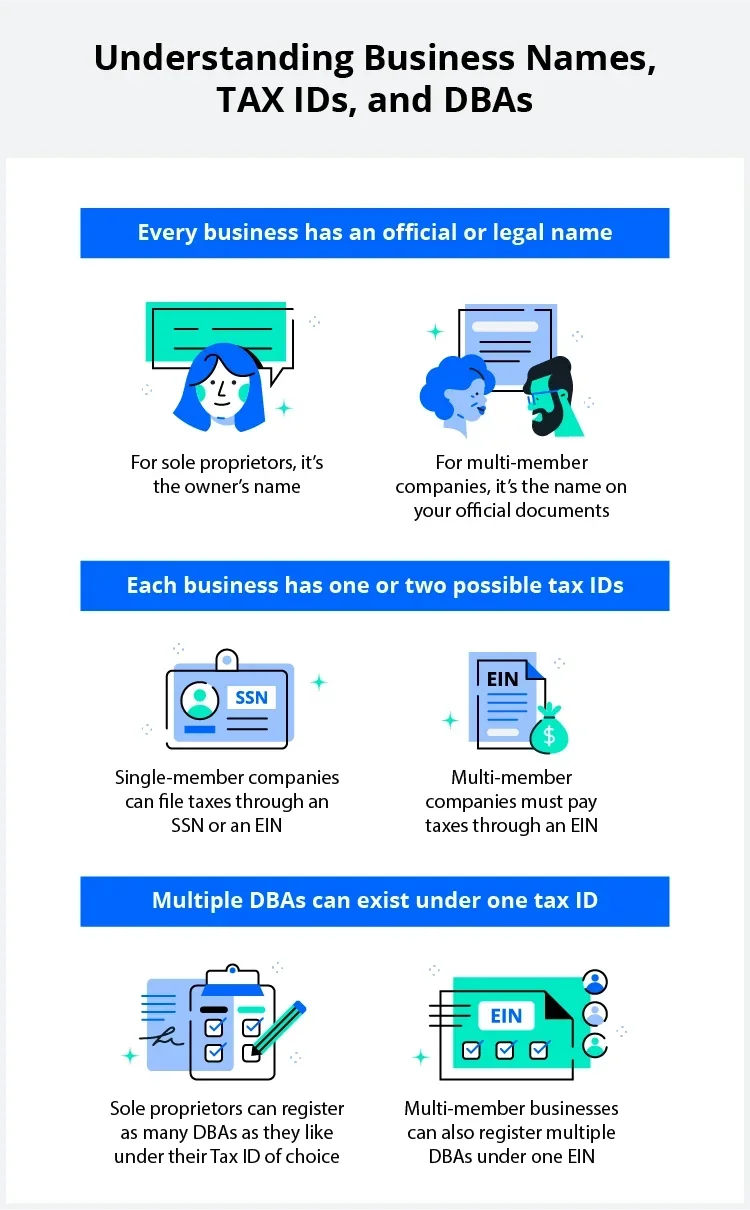

Understanding tax IDs and business names

Does a DBA need an EIN? Not every business using a DBA (a "doing business as" designation) is required to obtain an employee identification number or EIN, but business owners with employees, multiple-member LLCs, and corporations need an employee identification number.

First, let’s start with the terminology:

- EIN. A federal employer identification number issued by the IRS, also known as a business’ “federal tax ID” number. Companies that have an EIN use it to identify themselves on their federal tax return (similar to how an individual usually does so with their Social Security number). Unlike an SSN, however, an EIN is public record.

- DBA. Literally, "doing business as a DBA gives you permission to advertise and run your business using a certain name, even if that’s not your business’s actual legal name. For example, imagine Joseph Jones has formed a limited liability company for his fledgling food truck empire called Jones Hospitality Group, LLC. That may not be the catchiest name to put on his best-performing food truck. So Joe applies for and receives a DBA from his state so the truck can market itself to the public as “Joe’s Fresh Tacos” (on menus, in advertising, and so on). A DBA also allows a sole proprietor to do business under a business name without forming an LLC or corporation.

Do you need an EIN for DBA registrations?

A DBA is simply an alternative business name and doesn’t—by itself—require an EIN. Still, you might need an EIN based on your underlying business structure and operations.

Here’s a breakdown:

- Sole proprietorships with a DBA only need an EIN if they have employees.

- Single-member LLCs with a DBA only need an EIN if they elect to be taxed as corporations or have employees.

- Multi-member LLCs, partnerships, and corporations always need an EIN, regardless of having a DBA.

Additionally, you need an EIN if you file returns for excise taxes, regardless of your business structure or whether you have a DBA. This includes taxes for items like fuel, tobacco, and alcohol, among others, which we’ll discuss in more detail in a later section.

When you don't need an EIN for a DBA

From another perspective, you don’t need a federal tax identification number if:

- Your company operates as a single-person (aka single member) LLC or

- You are a sole proprietorship, and

- You don’t hire employees or pay employment taxes (but you can hire contractors).

If you’re a sole proprietor or operate a single-member LLC, you can use your Social Security number (SSN) instead of an EIN for tax purposes. Still, you might apply for an EIN if you want more privacy, separation between your personal and business finances, or to appear more professional to clients and vendors.

Read on to learn if you need an EIN and if you should get one for the official business name, the DBA, or both.

Does my business need a DBA?

This is a common question business owners have. Businesses aren't required to operate under a DBA, but if the business wants to use multiple names then it must register a DBA. For example, if a corporation is formed under the name “ABC Incorporated” but the business wants to use the name “ABC” on its store sign or advertisements, then the corporation needs to register “ABC” as a DBA.

Consider a DBA the same way you think of a person's nickname. Someone may have a personal name like Joseph Jones and may be called “Joey" or “JJ," but they will only have one Social Security card listing their legal name. A business can likewise operate under different names but use one EIN. However, you can't use one EIN for multiple businesses.

What name should you use for tax purposes?

Most businesses need to apply for and receive a federal tax ID under a formal name for federal tax purposes.

After you register with a tax ID, owners can choose to operate under one or more DBAs. Whether you pay taxes for your business through an SSN or EIN, DBAs are your business nicknames, and therefore, you won't have a separate tax ID for a DBA.

Should I operate under a DBA?

With DBAs, owners can open bank accounts and credit cards under a preferred business name. They also improve visibility by presenting businesses as more professional. Finally, DBAs form a brand identity recognizable to vendors, customers, and competitors.

At the same time, DBAs don't offer financial or tax benefits in and of themselves. The monetary advantages of an EIN apply whether or not a business runs under a DBA.

Overview of the DBA application process

Picking one or more names for your business is fairly simple. But once you've settled on a DBA name, you need to formally register it. These steps include:

- Do preliminary research on your company's fictitious business name, also called a trade name. Make sure no other businesses use the DBA in your area. If it's in use, pick a fallback name for your fictitious name.

- Register the DBA within your state of operation. To avoid fines, file your DBA within 30 days of using the name. Bear in mind that registration fees are typically between $10 and $100.

- Look into county and city registration requirements. While most businesses only have to register with their state, some local governments need you to file a fictitious business name statement with their city or county clerk's office.

- While you don't have to register a DBA with the federal government, be sure to report any DBAs on related tax forms where prompted to do so.

Do I need an EIN for my business?

If your business is a corporation or partnership, whether under a DBA or not, the Internal Revenue Service (IRS) requires you to have an EIN. While limited liability companies don't have their own tax classification, LLCs need an EIN, depending on how they are taxed. For example, sole proprietors and single-member LLCs without employees or excise tax liability don't have to obtain an EIN.

The IRS website explains that you will have to use an EIN to pay taxes if your business:

- Pays its employees.

- Functions as a partnership or corporation.

- Files tax returns related to employment, tobacco, alcohol, excise, and firearms.

- Withholds taxes on income paid to a nonresident.

- Uses a tax-deferred pension plan, otherwise known as a Keogh Plan.

- Works with trusts, estates, real estate investment partners, nonprofits, farmers' cooperatives, or plan administrators.

You can also decide if you need to get an EIN based on your business structure. Single-person businesses that don't file payroll taxes can file with a Social Security number. If you hire employees, pay payroll taxes, and file as an S corp or C corp, you need an EIN.

Taxes aside, many business owners find that they need an EIN to open a bank account, obtain a credit card, obtain a business license, or pay state or local taxes. And others choose to get an EIN to avoid using their personal Social Security numbers for business matters.

How to get an EIN number

There is no filing fee for getting an EIN for your business. If you choose to set it up on your own, you can follow these steps:

- Open a free IRS online application or print out a copy of Form SS-4.

- On the form, provide information about your business, including how it is structured, the number of employees, and your principal business activities.

- Submit your online application on the IRS website. If you filled out Form SS-4, fax or mail it to the IRS.

- Wait for the IRS to respond. Online applicants will receive their EIN immediately. If you apply by fax, you'll receive your EIN within four business days. If you apply by mail, it can take four weeks. International applicants can only apply for an EIN by telephone or by mail.

Once the IRS issues your EIN, open a business bank account and apply for any credit cards you may need. Getting this financial groundwork out of the way will let you focus on expanding your company. When tax season comes around, you should also meet with a tax adviser who can explain EIN deductibles and benefits.

FAQs

Do I need a separate EIN for each DBA?

No, you will use the same EIN for a business and all its DBAs. An EIN is tied to your legal business entity, not to individual trade names, so you can operate multiple DBAs under a single business structure without needing additional EINs.

Can you get an employer identification number as a sole proprietor?

You can, and many sole proprietors choose to do so for tax benefits and added privacy. While not required (if you don’t have employees), obtaining an EIN can help separate personal and business finances, protect your SSN, and potentially make it easier to open business bank accounts or apply for business credit.

Do DBAs pay taxes?

You pay fees with the state to apply for and maintain a DBA for your business, but the DBA itself doesn’t trigger additional tax obligations. Instead, the business that the DBA is associated with files state and federal taxes each year. While you don't have to register DBAs with the IRS, owners must report DBAs on IRS tax forms.

Does a DBA need an operating agreement?

This is how a DBA differs from a limited liability company: Only LLCs are required to have operating agreement forms. In other words, the business structure behind the DBA would have the operating agreement, if applicable.

How do excise taxes play into DBAs and EINs?

If your company incurs excise taxes on certain goods or services, you'll need an EIN for your DBA. Common federal excise taxes are on items such as cigarettes and gasoline. However, any business that deals with these items would pay excise taxes, regardless of whether they operate under a DBA or their legal business name.

Is it necessary to hire someone to help with the EIN process, or can I do it myself?

According to the Small Business Administration (SBA), the IRS has an assistance tool that will guide you through questions and ask for your name, Social Security number, address, and your "doing business as" (DBA) name. Your nine-digit federal tax ID becomes available immediately upon verification. Services like LegalZoom can also help make the process easier.

Anne Brennan contributed to this article.