The Internal Revenue Service uses an employer identification number (EIN) or federal tax ID number to identify business entities or a small business owner. While a limited liability company (LLC) will typically need an EIN, there are some exceptions.

Multi member LLCs are required as a business entity to use an EIN to file taxes, but sole proprietors and single-member LLCs are not and can use their owner's personal Social Security number instead.

Still, many owners of business licenses prefer to apply for an EIN online, even if they're not required. EINs offer an array of tax options and financial advantages. Here's how you can discover if you need an EIN.

Can you run an LLC without an EIN?

All multiple-member LLCs (or LLCs with more than one owner) require an EIN as a business entity, regardless of whether the small business will pay taxes as a partnership or a corporation.

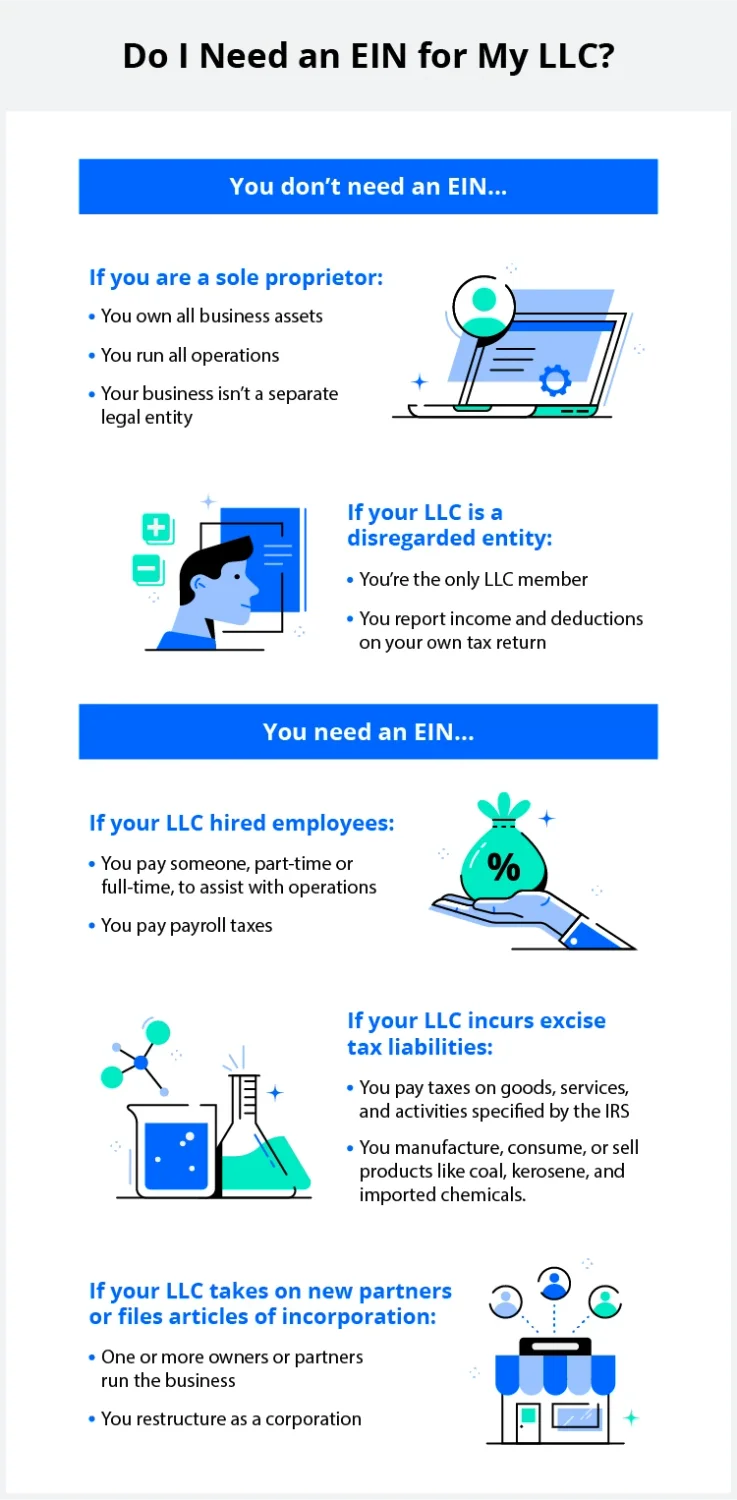

But unless a small business or single-member LLC elects to file taxes as a corporation, the IRS treats it as a disregarded entity. This means that the LLC's income is treated as the owner's income for federal income tax purposes. So if you are the sole owner of an LLC, you can pay income taxes on your business through your SSN. Knowing this information, you may be wondering if your single-member LLC will need an EIN, aka a federal tax identification number.

Can disregarded entities use EINs?

Disregarded business entities do not have to use a federal employer identification number (EIN) for any reporting or filings required for income tax purposes. It can use either the owner's SSN or EIN. This is the case even if you have obtained an EIN for your LLC. A disregarded entity is not required to obtain an EIN unless it has:

- One or more employees. Any behavior that incurs payroll taxes, such as hiring employees or business partners, necessitates an EIN for a small business.

- Excise tax liabilities. The IRS imposes excise taxes on imported chemicals, coal mined in the U.S., kerosene in aviation, expired tax fuel credits, heavy highway vehicle use, and more.

If you make any changes that result in your LLC not being classified as a disregarded entity, you will need to apply for an EIN. For example, you will need an EIN if you add a member (i.e., a new owner) to your LLC and it's no longer a single-member organization.

Do I need an EIN for my LLC?

Depending on the size, structure, and operations of your business, you may be legally obligated to register an EIN. An EIN isn’t always necessary when your business is first starting out, but you’ll usually need to register for one once it starts to grow and develop long-term goals.Our complete guide to EINs can help you determine if and when you should apply.

Even if you're not required to obtain an EIN, your LLC will benefit from one. An EIN will promote the long-term growth of your business. For example, most banks request an EIN if you want to open a business bank account or business credit card under your LLC name. Having an LLC with an EIN will help to keep your business finances separate. It also protects your privacy by keeping your SSN out of business matters and allows you to hire employees. Inquire with your local bank to decide if you need an EIN to hold a business bank account with them.

Not all LLCs need an EIN immediately. Some owners run on a small scale tied to their SSN while forming their business plan. This saves time and paperwork if they haven't settled on long-term goals. When your business is this small, there is no need to run to the bank to open a business checking account. But once you're ready to take the next step, you can apply for an EIN even though the IRS does not require you to have one.

Which LLC tax ID number should I use?

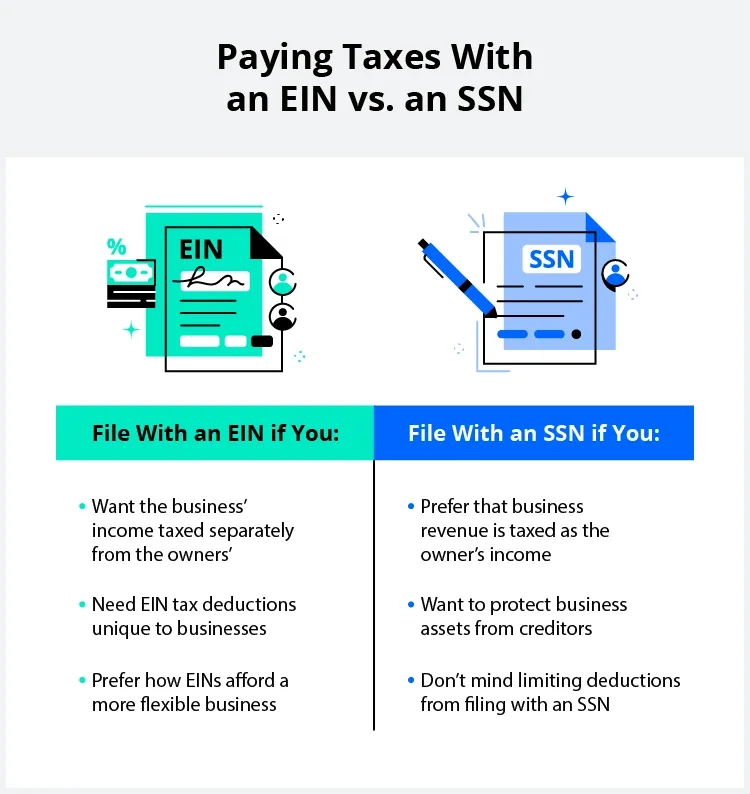

Do you need an EIN or SSN to file taxes? Assuming your LLC doesn't have employees or excise tax liability, you're free to file taxes with an SSN or EIN as a business entity. Before committing to one tax ID or the other, consider the pros and cons of each option before filing business taxes.

Benefits of filing taxes with an SSN

While most businesses file with an EIN, there are a few advantages to paying taxes through an SSN:

- You can file your personal and business-related taxes together

- You're eligible for pass-through taxation, where business profits go straight to you

Benefits of filing taxes with an EIN

EINs are popular thanks to the wide range of benefits they offer:

- Paying taxes through an EIN provides more privacy to business owners

- You can hire employees, pay employment taxes annually, and structure your business with more flexibility

You can weigh the pros and cons of using either situation to decide if your business does indeed need an EIN.

How to get an EIN for an LLC

Applying for an EIN is an easy process with no fees involved. LLCs have two application methods:

- Online Application. You can submit an online application for an EIN directly through the IRS website. This is the quickest way to obtain an EIN, as it will be issued to you immediately after the IRS validates your information.

- Send Form SS-4. You can print out a copy of Form SS-4 and send it directly to the IRS. You can send it to the appropriate fax number or mail in the completed form. For applicants by fax, your new EIN will be faxed to you within four business days. Once a determination has been made that your LLC needs an EIN, mail-in applicants will receive an ID.

Approval times can vary depending on how you file your application. Online applications are processed almost immediately, whereas printed applications mailed in to the IRS can take up to four weeks to be approved.

Next steps after getting an EIN

Once the IRS sends your EIN, save the documents it's listed on. From here, plan on incorporating it into your future business plans.

If you intend to file taxes with your EIN, meet with an adviser who can point out the best savings and deductibles.

- Use the EIN to open bank accounts under your business name.

- Decide whether you want to hire employees in the near future.

- Include your EIN when registering for any DBAs to attach to your business name.

Whether you're required to get an EIN, the nine-digit number assigned by the IRS, or need one for a non-IRS-related reason, applying for an EIN for your LLC is easy and presents financial advantages.

Frequently asked questions

Are an LLC and an EIN the same when it comes to business structure?

No, LLC and EIN aren't interchangeable. LLC refers to a type of company, and EINs are tax IDs that apply to LLCs and other business models.

Should I get an EIN as the sole proprietor of my LLC?

Getting an EIN comes with an array of benefits for a sole proprietorship. EINs grant privacy, access to tax deductions, and more options for opening a business bank account.

Does an EIN cost extra money?

Applying for an EIN is free through the IRS.

How long does it take to get an EIN?

Registering an EIN can be done online in a single day. Other options, including registering by telephone, fax, or mail, can take anywhere from a few days to four weeks.

If my LLC hires employees, will my business need an EIN to report wages paid?

Yes, if you plan to hire employees now or in the future for your LLC, you will need an EIN for tax reporting purposes. If you do not have an EIN, you cannot legally pay your employees or fulfill your tax obligations for federal tax purposes as an employer.

What's the best way to separate personal assets and business finances as an LLC?

The best way to keep your personal and business finances separate as an LLC is to open a dedicated business bank account using the EIN of your LLC. It's important to ensure that every business transaction can be tracked via your business bank account. It may be best to use the EIN to prevent any occurrences of identity theft during the life of your business.

Do I need an EIN to get a business loan or business credit?

Not every bank requires an EIN in order to apply for a business loan or business credit. However, having the EIN can help to verify the legitimacy and financial history of your business. The EIN will also distinguish your personal assets and business finances. Your EIN can possibly prevent identity theft when you don't share your SSN on sensitive business documents.

Halona Black contributed to this article.