A corporation is a legal business entity that is separate from its owners, which can protect you from any business liabilities and help get your business off the ground.

1. Choose a business name

An important first step when starting a corporation is selecting a business name. In most states, you'll need to include a corporate designation or a word that identifies your business as a corporation.

Examples of corporate designations include:

- Incorporated (Inc.)

- Corporation (Co.)

When choosing a corporate name, you should also be sure that your name of choice doesn't infringe on any existing trademarks. A trademark search can help you ensure that your name is available to use.

It's also a good idea to check your state's list of restricted words. This list includes words that are off-limits for use in your business name. Examples include “bank" and “insurance."

Certain words are prohibited unless you are legally allowed to run your business as such by the respective government agency. To ensure that your name is legally available, check with your state's Secretary of State's office.

2. Register a DBA

If you want to do business under a name that is different from the corporate name you've chosen, you may need to register a fictitious name. This allows you to operate without using your full corporate name.

A fictitious name may also be known as:

- Doing business as (DBA)

- Assumed name

- Trade name

Depending on where you're located, the laws surrounding DBA names can vary. Be sure to check with your Secretary of State's office to ensure your DBA name meets all legal guidelines.

3. Appoint directors

When forming a corporation, the owners will often appoint directors. The owners can appoint themselves and/or others to be directors.

A director's responsibilities include:

- Governing the corporation

- Managing the corporation's business and affairs

- Electing corporate officers

- Attending corporate meetings

The number of directors needed will depend on the laws and guidelines of your state and could also depend on the number of owners your corporation has.

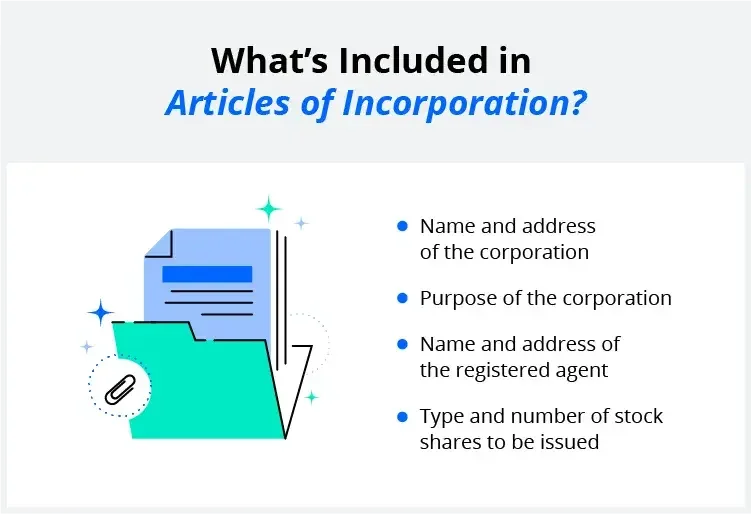

4. File your articles of incorporation

Next, you'll need to complete and file articles of incorporation with your Secretary of State's office. By doing so, you will establish your corporation as its own business entity.

- Name and address of the corporation

- Purpose of the corporation

- Name and address of the registered agent

- Type and number of shares of stock certificates to be issued

The registered agent is the contact person listed for your corporation. They will receive service of process notices, government correspondence, and compliance-related documents on behalf of your corporation.

Depending on your state, articles of incorporation may be called the certificate of formation or certificate of incorporation.

5. Write your corporate bylaws

Another important step is writing corporate bylaws. Bylaws are written rules that determine how your corporation will be governed.

Corporate bylaws typically cover things like:

- How many shares of stock your corporation can issue

- How many directors are required

- Meeting and recordkeeping procedures

Although these bylaws are not required to be filed with the state, they are an important part of the incorporation process. It can be helpful to reach out for legal assistance when creating corporate bylaws to ensure nothing slips through the cracks.

6. Draft a shareholder agreement

A shareholder agreement will help protect the interests of any remaining shareholders in case certain events take place.

This agreement will be used:

- In the event of an owner's death

- If an owner transfers ownership of their shares

While optional, a shareholder agreement is a great document to have in an unexpected event. If needed, a business attorney can help you draft this document.

7. Hold initial board of directors meeting

No matter how many directors your corporation has, it's important to hold an initial meeting with your entire board of directors. Without an initial meeting, the board might lack direction or clarification that enables them to make clear decisions about the corporation.

An initial board of directors meeting should cover:

- Adoption of corporate bylaws

- Appointment of corporate officers

- Authorization to issue stock

Additionally, if you wish to elect S corporation status, you should also discuss this at the initial meeting and gain approval.

8. Issue stock

In this kind of business structure, stock is issued to raise capital to help finance the corporation. After the board of directors has authorized the issuance of stock, you may begin issuing and distributing stock to investors.

- Who purchased the shares

- How many shares they bought

- How much the shares cost

- When they bought the shares

Stock is typically issued as a physical certificate or in the form of digital shares.

9. Obtain business permits and licenses

Before you can start doing business as a corporation, it's also important that you obtain all of the required business permits and licenses.

The permits and licenses required will depend on your:

- City and county laws

- State government and federal laws

- Your specific industry

As you begin the application process, check out your state's specific requirements on the Small Business Administration website.

10. Register your business

Because corporations are separate taxpaying entities, you will need to obtain specific tax ID numbers to ensure you are paying the appropriate taxes.

You will likely need tax ID numbers from:

- The Internal Revenue Service (IRS)

- Your state revenue agency

Depending on the state you're doing business in, and your corporation type, the taxation your corporation could face will vary. For the most up-to-date information about the taxation of corporations, you can visit the IRS website.

11. Open a corporate bank account

A crucial step in forming a corporation is opening a corporate bank account. This account will be separate from the bank accounts of its owners, which helps protect your personal funds from any business liabilities. LegalZoom works with Bank of America to help our customers open business checking accounts.

Be sure to check with the bank you choose to see what documents will be required. Examples of required documents and information include:

- Corporate resolution

- Articles of incorporation

- Employer identification number (EIN)

If you're unsure what your corporation's EIN is, you can obtain it from the IRS.

Forming a corporation: A state-by-state guide

Whether it's the cost to incorporate, the difference in tax laws, or the variation in document names, it is common for the incorporation process to vary slightly from state to state. Here are some states with some notable differences in the incorporation process.

California

When forming a corporation in California, you must also file a Statement of Information. This document must be filed within 90 days of filing your articles of incorporation.

This form will also contain the information that's included in your articles of incorporation.

Delaware

Delaware is a popular state to incorporate in because of its lenient laws for business owners. When incorporating in Delaware, you do not have to be a Delaware resident. This allows those from other states to benefit from Delaware's business-friendly tax advantages.

Florida

To remain active as a corporation in Florida, you must file what's known as the Annual Report. This report form must be filed by May 1. Find more about how to get a business license in Florida?

Georgia

When incorporating in Georgia, you must publish a notice of intent to incorporate in a newspaper in the county where your office will be located. This process must be initiated within one business day after filing your articles of incorporation and published once a week for two consecutive weeks starting within 10 days after receipt of the notice by the newspaper.

Missouri

After registering as a corporation in Missouri, you must file the Missouri Annual Report within 30 days.

Nebraska

When forming a corporation in Nebraska, you must also publish a notice of incorporation in a legal newspaper located in the same county as your corporation's office.

The published notice must contain:

- The name of your corporation

- The number of authorized shares to be issued

- The address of the corporation's registered office and agent

- The name and address of each incorporator

This process must take place after filing your articles of incorporation with the Nebraska Secretary of State.

Nevada

Additional paperwork is required when filing your articles of incorporation in Nevada. You must also file the Nevada Initial List of Directors and Business License Application.

New Mexico

To officially register your corporation in New Mexico, you must file the New Mexico Corporate Initial Report. It must be filed within 30 days of receiving your certificate of incorporation from the New Mexico Secretary of State.

New York

All New York corporations must file a statement every two years. This statement must be filed with the Secretary of State during the same month that the certificate of incorporation was filed.

South Carolina

As a corporation in South Carolina, you must also file the Initial Annual Report of Corporations. This additional document must be filed with the South Carolina Department of Revenue along with your articles of incorporation.

Tennessee

To officially create a corporation in Tennessee, you will need to file the Domestic For-Profit Corporation Charter. Similar to articles of incorporation, this document will officially register your business as a corporation. This document must be filed with the Tennessee Secretary of State.

Texas

To incorporate in Texas, you must file a certificate of formation with the Secretary of State. Once this certificate has been filed along with the filing fee, the corporation is official.

Washington

To incorporate in Washington, you must file the Washington Initial Report within 120 days of your incorporation date. You may also include this report with your articles of incorporation.

Forming a corporation FAQ

Here are answers to some common questions you may ask yourself when determining if forming a corporation is the right move for you and your business.

Q: What's the difference between a corporation and an LLC?

Just like a corporation, a limited liability company (LLC) protects owners from business liabilities and debts. The main difference between the two is that an LLC has one or more owners, whereas a corporation has shareholders.

Another key difference is the way the two are maintained. A corporation will generally have more formal recordkeeping and reporting requirements than an LLC.

Q: What's the difference between a C corporation and an S corporation?

When incorporating your business, you may choose to form either a C or S corporation. One of the main reasons that people choose to form an S corporation is to save money on taxes.

As a C corporation, taxes are paid twice; first, the business pays taxes on its profits, and then shareholders pay taxes on after-tax dividends. As an S-corporation, taxes are only paid once by the shareholders.

Q: Can I switch from an S corporation to a C corporation?

Yes, you can switch corporate designations. To do so, you must gain majority shareholder approval to change your corporation's status with the IRS.

Q: What is a B Corporation?

A B Corporation is a for-profit entity recognized and certified by B Lab, a nonprofit corporation that grades various business entities on social and environmental responsibility, transparency, accountability, and balance between profit and purpose. A B Corporation is not a legal business entity but rather a certification by a third party on how you conduct business. The certification is not the same as a business license.

Q: What are professional corporations?

A professional corporation, or PC, is a type of corporation that provides services by licensed professionals, such as accountants, architects, attorneys, engineers, and physicians. A professional corporation is also known as a professional service corporation (PSC) or professional association (PA).

Q: I am a sole proprietorship. How can I determine whether a C corporation or S corporation is right for me?

Before moving from a sole proprietorship to a C corp or S corp, it’s best to consult a tax professional and a small business lawyer. An attorney can show you how both a C corp and an S corp can offer you personal liability protection by keeping your personal assets separate from the corporation’s assets. Speaking with someone specializing in small business accounting can show you how a C corp exposes you to double taxation, whereas an S corp does not. A tax professional or attorney can also explain how either business structure protects your personal assets by keeping your corporation’s debts separate.

Q: What is a general business license?

General business licenses, also known as business tax receipts, business tax certificates, or business operating licenses, permit you to operate your business in a specific geographic area. It's a required document for any new business that provides services or merchandise to the public, even if your business is home-based.

Q: What are corporate formalities?

Corporate formalities refer to the operating rules and guidelines your corporation must follow to meet operational requirements. They include:

- Registering for your business permits and licenses

- Filing your doing business as (dba)

- Setting up a business bank account

- Maintaining an independent financial account for your corporation

- Holding regular and annual meetings for the board of directors

- Keeping separate records for corporate activity

Q: Can we have temporary board members?

It depends on what your bylaws call for as to whether you can have a temporary board member serve. You cannot violate your bylaws with a simple resolution to extend a term, even on a temporary basis or during a crisis. If you foresee an opening, it’s best to build some flexibility into your bylaws. You could:

- Define the term to coincide with the annual meeting rather than a set date so you can delay the annual meeting and delay board terms that are set to expire.

- Define soft-term limits rather than hard-term limits so you can re-elect members to an additional term.

- If you do not build in flexibility, you could ask a board member to stay on the board as a special advisor or ambassador so members can continue to advocate for your company. They would not have voting rights, but their expertise, knowledge, and participation while motions are deliberated will be invaluable.

- Check with a small business attorney to see if you have the option in your state to consider a quick bylaws amendment to add any of the above options.

Q: What is a tax election?

A tax election is your choice between whether you want to be taxed as a C corporation or an S corporation. It’s also where you choose a cash basis of accounting or an accrual basis. These are terms you will hear when working with a tax professional. Your election will have consequences related to the timing and amount of taxes you pay.

Q: How many initial directors will I need to incorporate?

Different states have different requirements. You may only need one, but you may need three or more. It’s best to check with your state or local small business attorney.

Q: Do I need to keep my initial directors after I incorporate?

No. You can replace the board with a permanent one after incorporation.

Q: What is ownership interest?

Ownership interest is any stake a person owns in a company, property, product, or other asset. If there is more than one owning party, then the ownership interest is either divided equally or by the amount invested.

Q: What are the different types of ownership interest?

There are three types:

- Sole ownership, where one person has all ownership interest

- Joint tenancy, where two or more people hold title to a property

- Tenancy-in-common, where two or more people have ownership, but the ownership may be unequal

Q: What is the corporate income tax?

The corporate income tax is the tax you pay a government entity on your company’s profits. It applies only to your company’s income, which is defined as revenue minus expenses.

Q: Why do I need to draft corporate bylaws?

While a small business owner who is a sole proprietor isn’t required to draft corporate bylaws, a business owner who chooses to be a C corp or S corp needs them to maintain a clear separation between business and personal commitments. They define the duties and responsibilities of people in your organization. Bylaws help resolve uncertainty or conflicts. You also need them to open a business bank account, obtain a business loan, set up a retirement plan, or obtain government certification as a minority-owned or woman-owned business.

Q: Can S corporations be publicly traded companies?

No. This is because S corporations are limited to 100 shareholders who must be U.S. citizens or residents, and they also do not maintain corporate formalities like C corporations. S corporations may invest in other corporations or mutual funds.

Q: Can C corporations be publicly traded?

Yes. Almost all C corporations are publicly traded companies.

Q: What are the pros and cons of being my own registered agent?

The main pros are that you won’t have to spend money on a professional registered agent and that it’s not a difficult job. The main cons are that your address becomes a public record, you must be available at the physical location during regular business hours, and you have extra paperwork. Plus, you may have filing fees should you move.

Q: What should I consider when choosing a business structure?

When choosing your business structure, you should at least consider your tax obligations. For example, a sole proprietorship is straightforward but comes with personal liability. Your business and you are the same legal entity. You should also consider your industry, as it will influence your business structure. For example, professional service providers tend to form partnerships for flexibility and ease of formation. You should also consider personal liability protection. With a C corp, S corp, and LLC, only the entity can be sued, not owners or officers.